You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Counting on the<br />

10 Year Cycle<br />

By Ken Turkin<br />

The importance of cycles are<br />

talked about all through W.D.<br />

Gann’s courses. Great emphasis<br />

is placed on time as the<br />

constant foundation. Therefore,<br />

to be accurate in forecasting the<br />

future, we must know the major cycles,<br />

the larger trends. How cycles can be<br />

constructed shows that the most money<br />

could be made when fast moves occur<br />

at the end of major cycles. Much effort<br />

is put in describing the different ways<br />

that the 10 year cycle appears physically.<br />

This makes it the most interesting and<br />

crucial to our understanding.<br />

In the unpublished “Forecasting”<br />

course of 1935, Gann identifi es the Great<br />

Cycle, the Master Time period, the most<br />

important, to be the 60 year cycle. There<br />

is also the discussion of the 10 year cycle,<br />

the Bull and Bear Calendar<br />

Years of the Decades. These revealing<br />

parts were later edited out in future<br />

courses. From the 1931 unpublished<br />

“Method for Forecasting the Stock<br />

Market”, the most important time cycle<br />

is the 20 year cycle. Gann states that this<br />

is broken down into two cycles approximately<br />

ten years in length which will<br />

produce fl uctuations of a similar nature<br />

and extreme highs and lows. The 10 year<br />

is also hinted to be tied to the 20 year<br />

cycle, by the comment of “stocks come<br />

out remarkably close on each even 10<br />

year cycle.”<br />

Here are some of the rules describing<br />

the 10 year cycle and it’s components<br />

from various written sections:<br />

1. It is 1/2 of the 20 year cycle and<br />

1/6th of the 60 year cycle.<br />

2. It is 1/3 of the 30 year cycle and<br />

120 months is 1/3 of a circle.<br />

3. The stock market moves in 10 year<br />

cycles, which is worked out in a 5 year<br />

cycle up and a 5 year cycle down.<br />

4. The smallest complete cycle or<br />

38 Spring 2001 tradersworld.com<br />

workout is 5 years.<br />

5. A Bull campaign runs 5 years: 2<br />

years up, 1 down then 2 years up.<br />

6. A Bear campaign runs 5 years: 2<br />

years down, 1 up then 2 years down.<br />

7. Adding 5 years to a bottom will<br />

give you a top.<br />

8. Adding 5 years to a top will give<br />

you a bottom.<br />

7. From a completed bottom (or top)<br />

add 3 years to get the next one, then add<br />

4 years to get the fi nal one of the 7<br />

year cycle.<br />

Gann’s concepts were simply profound,<br />

but this becomes very confusing.<br />

How can the same thing be counted in so<br />

many different ways and perspectives ?<br />

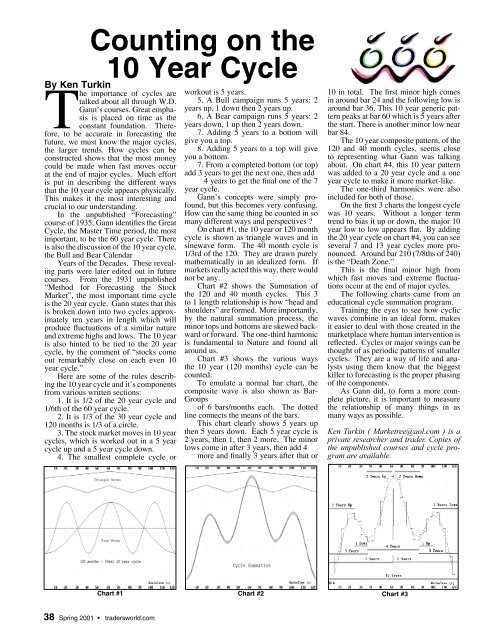

On chart #1, the 10 year or 120 month<br />

cycle is shown as triangle waves and in<br />

sinewave form. The 40 month cycle is<br />

1/3rd of the 120. They are drawn purely<br />

mathematically in an idealized form. If<br />

markets really acted this way, there would<br />

not be any.<br />

Chart #2 shows the Summation of<br />

the 120 and 40 month cycles. This 3<br />

to 1 length relationship is how “head and<br />

shoulders” are formed. More importantly,<br />

by the natural summation process, the<br />

minor tops and bottoms are skewed backward<br />

or forward. The one-third harmonic<br />

is fundamental to Nature and found all<br />

around us.<br />

Chart #3 shows the various ways<br />

the 10 year (120 months) cycle can be<br />

counted.<br />

To emulate a normal bar chart, the<br />

composite wave is also shown as Bar-<br />

Groups<br />

of 6 bars/months each. The dotted<br />

line connects the means of the bars.<br />

This chart clearly shows 5 years up<br />

then 5 years down. Each 5 year cycle is<br />

2 years, then 1, then 2 more. The minor<br />

lows come in after 3 years, then add 4<br />

more and fi nally 3 years after that or<br />

10 in total. The fi rst minor high comes<br />

in around bar 24 and the following low is<br />

around bar 36. This 10 year generic pattern<br />

peaks at bar 60 which is 5 years after<br />

the start. There is another minor low near<br />

bar 84.<br />

The 10 year composite pattern, of the<br />

120 and 40 month cycles, seems close<br />

to representing what Gann was talking<br />

about. On chart #4, this 10 year pattern<br />

was added to a 20 year cycle and a one<br />

year cycle to make it more market-like.<br />

The one-third harmonics were also<br />

included for both of those.<br />

On the fi rst 3 charts the longest cycle<br />

was 10 years. Without a longer term<br />

trend to bias it up or down, the major 10<br />

year low to low appears fl at. By adding<br />

the 20 year cycle on chart #4, you can see<br />

several 7 and 13 year cycles more pronounced.<br />

Around bar 210 (7/8ths of 240)<br />

is the “Death Zone.”<br />

This is the fi nal minor high from<br />

which fast moves and extreme fl uctuations<br />

occur at the end of major cycles.<br />

The following charts came from an<br />

educational cycle summation program.<br />

Training the eyes to see how cyclic<br />

waves combine in an ideal form, makes<br />

it easier to deal with those created in the<br />

marketplace where human intervention is<br />

refl ected. Cycles or major swings can be<br />

thought of as periodic patterns of smaller<br />

cycles. They are a way of life and analysts<br />

using them know that the biggest<br />

killer to forecasting is the proper phasing<br />

of the components.<br />

As Gann did, to form a more complete<br />

picture, it is important to measure<br />

the relationship of many things in as<br />

many ways as possible.<br />

Ken Turkin ( Marketree@aol.com ) is a<br />

private researcher and trader. Copies of<br />

the unpublished courses and cycle program<br />

are available.<br />

Chart #1 Chart #2 Chart #3