Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Stacking the Deck<br />

Using Cycles, Pattern and<br />

Volume to Increase Your Odds<br />

By Kent Austin and Mike Endert<br />

Buying and Selling in the<br />

market is, and has always<br />

been, a game of probabilities.<br />

Investors who buy stocks and<br />

hold for years are betting on<br />

the probability that earnings per share<br />

will be higher 10-20 years later, driving<br />

the market price for their shares higher.<br />

This higher e.p.s. can be the result of a<br />

well-run business, or a consequence of<br />

our country’s growth in Gross Domestic<br />

Product. Either way, the probabilities are<br />

on the side with the 10-20 year investor,<br />

but not with the 6-month investor.<br />

Due to the recent reduction in transaction<br />

costs, a trading bonanza has erupted<br />

in the marketplace of securities. The<br />

increase in technological advances over<br />

the past 7 years have made buying and<br />

selling frequency more convenient and at<br />

a fraction of the cost. Therefore, the retail<br />

public has recently experienced unprecedented<br />

access to what had previously<br />

been considered as the “greatest game in<br />

town.” As investors continue to shop for<br />

“value”, many are replaced by the new<br />

paradigm of those who shop for volatility<br />

and liquidity. The presupposition of this<br />

article is that the game hasn’t changed<br />

much at all, despite the recent changes<br />

in technology. In order for the investor<br />

or trader to succeed in the marketplace,<br />

opportunities are taken only where the<br />

odds are stacked in favor of success. This<br />

article will address how a successful S&P<br />

daytrader stacks the deck in his/her favor<br />

each business day by:<br />

1. Eliminating a “chart’s real estate”.<br />

2. Exploiting pattern recognition.<br />

3. Riding volume’s tailwind.<br />

4. Applying effective money management.<br />

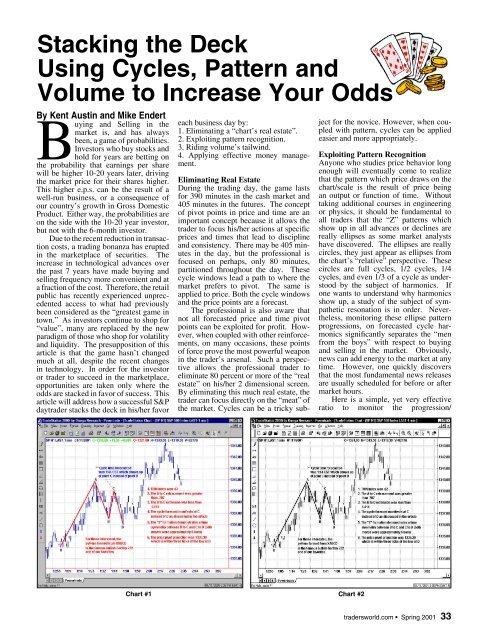

Eliminating Real Estate<br />

During the trading day, the game lasts<br />

for 390 minutes in the cash market and<br />

405 minutes in the futures. The concept<br />

of pivot points in price and time are an<br />

important concept because it allows the<br />

trader to focus his/her actions at specifi c<br />

prices and times that lead to discipline<br />

and consistency. There may be 405 minutes<br />

in the day, but the professional is<br />

focused on perhaps, only 80 minutes,<br />

partitioned throughout the day. These<br />

cycle windows lead a path to where the<br />

market prefers to pivot. The same is<br />

applied to price. Both the cycle windows<br />

and the price points are a forecast.<br />

The professional is also aware that<br />

not all forecasted price and time pivot<br />

points can be exploited for profi t. However,<br />

when coupled with other reinforcements,<br />

on many occasions, these points<br />

of force prove the most powerful weapon<br />

in the trader’s arsenal. Such a perspective<br />

allows the professional trader to<br />

eliminate 80 percent or more of the “real<br />

estate” on his/her 2 dimensional screen.<br />

By eliminating this much real estate, the<br />

trader can focus directly on the “meat” of<br />

the market. Cycles can be a tricky sub-<br />

Chart #1 Chart #2<br />

ject for the novice. However, when coupled<br />

with pattern, cycles can be applied<br />

easier and more appropriately.<br />

Exploiting Pattern Recognition<br />

Anyone who studies price behavior long<br />

enough will eventually come to realize<br />

that the pattern which price draws on the<br />

chart/scale is the result of price being<br />

an output or function of time. Without<br />

taking additional courses in engineering<br />

or physics, it should be fundamental to<br />

all traders that the “Z” patterns which<br />

show up in all advances or declines are<br />

really ellipses as some market analysts<br />

have discovered. The ellipses are really<br />

circles, they just appear as ellipses from<br />

the chart’s “relative” perspective. These<br />

circles are full cycles, 1/2 cycles, 1/4<br />

cycles, and even 1/3 of a cycle as understood<br />

by the subject of harmonics. If<br />

one wants to understand why harmonics<br />

show up, a study of the subject of sympathetic<br />

resonation is in order. Nevertheless,<br />

monitoring these ellipse pattern<br />

progressions, on forecasted cycle harmonics<br />

signifi cantly separates the “men<br />

from the boys” with respect to buying<br />

and selling in the market. Obviously,<br />

news can add energy to the market at any<br />

time. However, one quickly discovers<br />

that the most fundamental news releases<br />

are usually scheduled for before or after<br />

market hours.<br />

Here is a simple, yet very effective<br />

ratio to monitor the progression/<br />

tradersworld.com Spring 2001 33