22042019 - ACUTE HUNGER: Outrage as IDP children feed on onion leaves

Vanguard Newspaper 22 April 2019

Vanguard Newspaper 22 April 2019

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

20 — Vanguard, MONDAY, APRIL 22, 2019<br />

FINANCIAL VANGUARD<br />

COVER<br />

How low yield, high NPL took toll <strong>on</strong> tier-1 banks’ performance<br />

C<strong>on</strong>tinues from page 19<br />

2018 (Q4’18), while average<br />

NPL in 2018 w<str<strong>on</strong>g>as</str<strong>on</strong>g> 15.02 percent.<br />

According to Mr. Johns<strong>on</strong><br />

Chukwu, Managing Director/<br />

CEO, Cowry Asset<br />

Management, a Lagos-b<str<strong>on</strong>g>as</str<strong>on</strong>g>ed<br />

investment banking firm,<br />

decline in yield curve led to<br />

loss of major income sources for<br />

the banks during the year.<br />

He, however, said that the<br />

tier-1 banks showed resilience<br />

c<strong>on</strong>sidering the challenges in<br />

the business envir<strong>on</strong>ment.<br />

Zenith Bank in mixed<br />

results<br />

Financial Vanguard’s<br />

analysis showed that Zenith<br />

Bank Plc topped the earning<br />

spot in absolute figures though<br />

it recorded a huge 15.4 percent<br />

decline in its earning.<br />

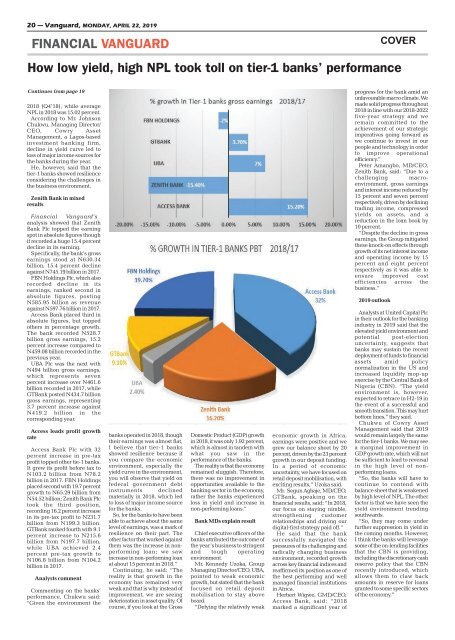

Specifically, the bank’s gross<br />

earnings stood at N630.34<br />

billi<strong>on</strong>, 15.4 percent decline<br />

against N745.19 billi<strong>on</strong> in 2017.<br />

FBN Holdings Plc, which also<br />

recorded decline in its<br />

earnings, ranked sec<strong>on</strong>d in<br />

absolute figures, posting<br />

N585.95 billi<strong>on</strong> <str<strong>on</strong>g>as</str<strong>on</strong>g> revenue<br />

against N597.76 billi<strong>on</strong> in 2017.<br />

Access Bank placed third in<br />

absolute figures, but topped<br />

others in percentage growth.<br />

The bank recorded N528.7<br />

billi<strong>on</strong> gross earnings, 15.2<br />

percent incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e compared to<br />

N459.08 billi<strong>on</strong> recorded in the<br />

previous year.<br />

UBA Plc w<str<strong>on</strong>g>as</str<strong>on</strong>g> the next with<br />

N494 billi<strong>on</strong> gross earnings,<br />

which represents seven<br />

percent incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e over N461.6<br />

billi<strong>on</strong> recorded in 2017, while<br />

GTBank posted N434.7 billi<strong>on</strong><br />

gross earnings, representing<br />

3.7 percent incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e against<br />

N419.2 billi<strong>on</strong> in the<br />

corresp<strong>on</strong>ding year.<br />

Access leads profit growth<br />

rate<br />

Access Bank Plc with 32<br />

percent incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in pre-tax<br />

profit topped other tie-1 banks.<br />

It grew its profit before tax to<br />

N103.2 billi<strong>on</strong> from N78.2<br />

billi<strong>on</strong> in 2017. FBN Holdings<br />

placed sec<strong>on</strong>d with 19.7 percent<br />

growth to N65.29 billi<strong>on</strong> from<br />

N54.52 billi<strong>on</strong>; Zenith Bank Plc<br />

took the third positi<strong>on</strong>,<br />

recording 16.2 percent incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e<br />

in its pre-tax profit to N231.7<br />

billi<strong>on</strong> from N199.3 billi<strong>on</strong>.<br />

GTBank ranked fourth with 9.1<br />

percent incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e to N215.6<br />

billi<strong>on</strong> from N197.7 billi<strong>on</strong>,<br />

while UBA achieved 2.4<br />

percent pre-tax growth to<br />

N106.8 billi<strong>on</strong> from N104.2<br />

billi<strong>on</strong> in 2017.<br />

Analysts comment<br />

Commenting <strong>on</strong> the banks’<br />

performance, Chukwu said:<br />

“Given the envir<strong>on</strong>ment the<br />

banks operated in 2018, though<br />

their earnings w<str<strong>on</strong>g>as</str<strong>on</strong>g> almost flat,<br />

I believe that tier-1 banks<br />

showed resilience because if<br />

you compare the ec<strong>on</strong>omic<br />

envir<strong>on</strong>ment, especially the<br />

yield curve in the envir<strong>on</strong>ment,<br />

you will observe that yield <strong>on</strong><br />

federal government debt<br />

instruments declined<br />

materially in 2018, which led<br />

to loss of major income source<br />

for the banks.<br />

So, for the banks to have been<br />

able to achieve about the same<br />

level of earnings, w<str<strong>on</strong>g>as</str<strong>on</strong>g> a mark of<br />

resilience <strong>on</strong> their part. The<br />

other factor that worked against<br />

them w<str<strong>on</strong>g>as</str<strong>on</strong>g> the incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in n<strong>on</strong>performing<br />

loan; we saw<br />

incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in n<strong>on</strong>-performing loan<br />

at about 15 percent in 2018.”<br />

C<strong>on</strong>tinuing, he said: “The<br />

reality is that growth in the<br />

ec<strong>on</strong>omy h<str<strong>on</strong>g>as</str<strong>on</strong>g> remained very<br />

weak and that is why instead of<br />

improvement, we are seeing<br />

deteriorati<strong>on</strong> in <str<strong>on</strong>g>as</str<strong>on</strong>g>set quality. Of<br />

course, if you look at the Gross<br />

Domestic Product (GDP) growth<br />

in 2018, it w<str<strong>on</strong>g>as</str<strong>on</strong>g> <strong>on</strong>ly 1.92 percent,<br />

which is almost in tandem with<br />

what you saw in the<br />

performance of the banks.<br />

The reality is that the ec<strong>on</strong>omy<br />

remained sluggish. Therefore,<br />

there w<str<strong>on</strong>g>as</str<strong>on</strong>g> no improvement in<br />

opportunities available to the<br />

banking sector in the ec<strong>on</strong>omy,<br />

rather the banks experienced<br />

loss in yield and incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in<br />

n<strong>on</strong>-performing loans.”<br />

Bank MDs explain result<br />

Chief executive officers of the<br />

banks attributed the outcome of<br />

the year’s business to stringent<br />

and tough operating<br />

envir<strong>on</strong>ment.<br />

Mr. Kennedy Uzoka, Group<br />

Managing Director/CEO, UBA,<br />

pointed to weak ec<strong>on</strong>omic<br />

growth, but stated that the bank<br />

focused <strong>on</strong> retail deposit<br />

mobilisati<strong>on</strong> to stay above<br />

board.<br />

“Defying the relatively weak<br />

ec<strong>on</strong>omic growth in Africa,<br />

earnings were positive and we<br />

grew our balance sheet by 20<br />

percent, driven by the 23 percent<br />

growth in our deposit funding.<br />

In a period of ec<strong>on</strong>omic<br />

uncertainty, we have focused <strong>on</strong><br />

retail deposit mobilisati<strong>on</strong>, with<br />

exciting results,” Uzoka said.<br />

Mr. Segun Agbaje, MD/CEO,<br />

GTBank, speaking <strong>on</strong> the<br />

financial results, said: “In 2018,<br />

our focus <strong>on</strong> staying nimble,<br />

strengthening customer<br />

relati<strong>on</strong>ships and driving our<br />

digital-first strategy paid off.”<br />

He said that the bank<br />

successfully navigated the<br />

pressures of its challenging and<br />

radically changing business<br />

envir<strong>on</strong>ment, recorded growth<br />

across key financial indices and<br />

reaffirmed its positi<strong>on</strong> <str<strong>on</strong>g>as</str<strong>on</strong>g> <strong>on</strong>e of<br />

the best performing and well<br />

managed financial instituti<strong>on</strong>s<br />

in Africa.<br />

Herbert Wigwe, GMD/CEO,<br />

Access Bank, said: “2018<br />

marked a significant year of<br />

progress for the bank amid an<br />

unfavourable macro climate. We<br />

made solid progress throughout<br />

2018 in line with our 2018-2022<br />

five-year strategy and we<br />

remain committed to the<br />

achievement of our strategic<br />

imperatives going forward <str<strong>on</strong>g>as</str<strong>on</strong>g><br />

we c<strong>on</strong>tinue to invest in our<br />

people and technology in order<br />

to improve operati<strong>on</strong>al<br />

efficiency.”<br />

Peter Amangbo, MD/CEO,<br />

Zenith Bank, said: “Due to a<br />

challenging macroenvir<strong>on</strong>ment,<br />

gross earnings<br />

and interest income reduced by<br />

15 percent and seven percent<br />

respectively, driven by declining<br />

trading income, compressed<br />

yields <strong>on</strong> <str<strong>on</strong>g>as</str<strong>on</strong>g>sets, and a<br />

reducti<strong>on</strong> in the loan book by<br />

10 percent.<br />

“Despite the decline in gross<br />

earnings, the Group mitigated<br />

these knock-<strong>on</strong> effects through<br />

growth of its net interest income<br />

and operating income by 15<br />

percent and eight percent<br />

respectively <str<strong>on</strong>g>as</str<strong>on</strong>g> it w<str<strong>on</strong>g>as</str<strong>on</strong>g> able to<br />

ensure improved cost<br />

efficiencies across the<br />

business.”<br />

2019 outlook<br />

Analysts at United Capital Plc<br />

in their outlook for the banking<br />

industry in 2019 said that the<br />

elevated yield envir<strong>on</strong>ment and<br />

potential post-electi<strong>on</strong><br />

uncertainty, suggests that<br />

banks may sustain the recent<br />

deployment of funds to financial<br />

<str<strong>on</strong>g>as</str<strong>on</strong>g>sets amid policy<br />

normalizati<strong>on</strong> in the US and<br />

incre<str<strong>on</strong>g>as</str<strong>on</strong>g>ed liquidity mop-up<br />

exercise by the Central Bank of<br />

Nigeria (CBN). “The yield<br />

envir<strong>on</strong>ment is, however,<br />

expected to retrace in H2-19 in<br />

the event of a successful and<br />

smooth transiti<strong>on</strong>. This may hurt<br />

bottom lines,” they said.<br />

Chukwu of Cowry Asset<br />

Management said that 2019<br />

would remain largely the same<br />

for the tier-1 banks. We may see<br />

a marginal improvement in<br />

GDP growth rate, which will not<br />

be sufficient to lead to reversal<br />

in the high level of n<strong>on</strong>performing<br />

loans.<br />

“So, the banks will have to<br />

c<strong>on</strong>tinue to c<strong>on</strong>tend with<br />

balance sheet that is weakened<br />

by high level of NPL. The other<br />

factor is that we have seen the<br />

yield envir<strong>on</strong>ment trending<br />

southwards.<br />

“So, they may come under<br />

further suppressi<strong>on</strong> in yield in<br />

the coming m<strong>on</strong>ths. However,<br />

I think the banks will leverage<br />

some of the <strong>on</strong>-lending facilities<br />

that the CBN is providing,<br />

including the discreti<strong>on</strong>ary c<str<strong>on</strong>g>as</str<strong>on</strong>g>h<br />

reserve policy that the CBN<br />

recently introduced, which<br />

allows them to claw back<br />

amounts in reserve for loans<br />

granted to some specific sectors<br />

of the ec<strong>on</strong>omy.”