22042019 - ACUTE HUNGER: Outrage as IDP children feed on onion leaves

Vanguard Newspaper 22 April 2019

Vanguard Newspaper 22 April 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FINANCIAL<br />

Credit to ec<strong>on</strong>omy rises to N30.5trn<br />

C<strong>on</strong>tinues from page 19<br />

(net) to N12.74 trilli<strong>on</strong>.<br />

“Further breakdown of<br />

the NDC showed a 11.42<br />

percent m-o-m incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in<br />

Credit to the Government<br />

to N6.35 trilli<strong>on</strong> and an<br />

incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e of 5.37 percent in<br />

Credit to the Private sector<br />

to N24.16 trilli<strong>on</strong>.<br />

“On the liabilities side,<br />

3.22 percent m-o-m rise in<br />

Broad M<strong>on</strong>ey Supply w<str<strong>on</strong>g>as</str<strong>on</strong>g><br />

chiefly driven by 18.83<br />

percent m-o-m incre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in<br />

tre<str<strong>on</strong>g>as</str<strong>on</strong>g>ury bills held by<br />

m<strong>on</strong>ey holding sector to<br />

N8.23 trilli<strong>on</strong> but w<str<strong>on</strong>g>as</str<strong>on</strong>g> offset<br />

by 0.98 percent m-o-m<br />

decre<str<strong>on</strong>g>as</str<strong>on</strong>g>e in Narrow<br />

M<strong>on</strong>ey to N11.03 trilli<strong>on</strong><br />

(<str<strong>on</strong>g>as</str<strong>on</strong>g> Demand Deposits<br />

which fell by 2.22 percent<br />

to N9.19 trilli<strong>on</strong> offset the<br />

effect of currency outside<br />

banks which rose by 5.70<br />

percent to N1.84 trilli<strong>on</strong>)<br />

and a 0.74 percent m-o-m<br />

moderati<strong>on</strong> in Qu<str<strong>on</strong>g>as</str<strong>on</strong>g>i<br />

M<strong>on</strong>ey (near maturing<br />

short term financial<br />

instruments) to N15.50<br />

trilli<strong>on</strong>.<br />

“Reserve M<strong>on</strong>ey (B<str<strong>on</strong>g>as</str<strong>on</strong>g>e<br />

M<strong>on</strong>ey) decre<str<strong>on</strong>g>as</str<strong>on</strong>g>ed m-o-m<br />

by 4.30 percent to N7.17<br />

trilli<strong>on</strong> <str<strong>on</strong>g>as</str<strong>on</strong>g> Bank reserves<br />

declined m-o-m by 8.47<br />

percent to N4.58 trilli<strong>on</strong><br />

despite a 4.75 percent m-<br />

o-m rise in currency in<br />

circulati<strong>on</strong> to N4.46<br />

trilli<strong>on</strong>.”<br />

DMO to offer<br />

N100bn FGN b<strong>on</strong>d<br />

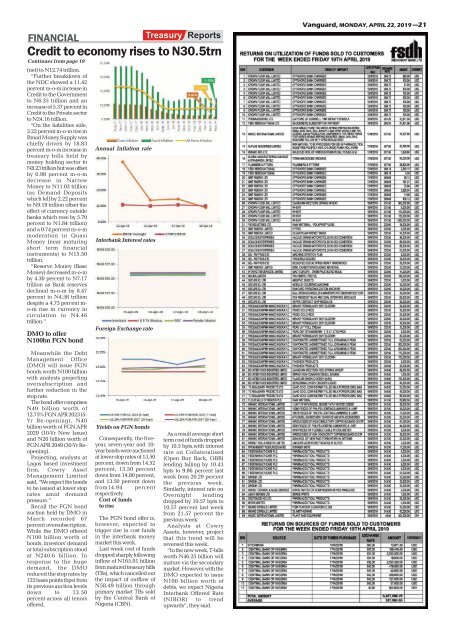

Annual Inflati<strong>on</strong> rate<br />

Interbank Interest rates<br />

Foreign Exchange rate<br />

Vanguard, MONDAY, APRIL 22, 2019 —21<br />

Meanwhile the Debt<br />

Management Office<br />

(DMO) will issue FGN<br />

b<strong>on</strong>ds worth N100 billi<strong>on</strong><br />

with analysts projecting<br />

oversubscripti<strong>on</strong> and<br />

further reducti<strong>on</strong> in the<br />

stop rate.<br />

The b<strong>on</strong>d offer comprises<br />

N40 billi<strong>on</strong> worth of<br />

12.75% FGN APR 2023 (5-<br />

Yr Re-opening), N40<br />

billi<strong>on</strong> worth of FGN APR<br />

2029 (10-Yr New Issue)<br />

and N20 billi<strong>on</strong> worth of<br />

FGN APR 2049 (30-Yr Reopening).<br />

Projecting, analysts at<br />

Lagos b<str<strong>on</strong>g>as</str<strong>on</strong>g>ed investment<br />

firm, Cowry Asset<br />

Management Limited<br />

said, “We expect the b<strong>on</strong>ds<br />

to be issued at lower stop<br />

rates amid demand<br />

pressure.”<br />

Recall the FGN b<strong>on</strong>d<br />

aucti<strong>on</strong> held by DMO in<br />

March recorded 67<br />

percent oversubscripti<strong>on</strong>.<br />

While the DMO offered<br />

N100 billi<strong>on</strong> worth of<br />

b<strong>on</strong>ds, investors’ demand<br />

or total subscripti<strong>on</strong> stood<br />

at N240.6 billi<strong>on</strong>. In<br />

resp<strong>on</strong>se to the huge<br />

demand, the DMO<br />

reduced the stop rates by<br />

125 b<str<strong>on</strong>g>as</str<strong>on</strong>g>is points (bps) from<br />

its previous aucti<strong>on</strong> levels<br />

down to 13.50<br />

percent across all tenors<br />

offered.<br />

Yields <strong>on</strong> FGN b<strong>on</strong>ds<br />

C<strong>on</strong>sequently, the fiveyear,<br />

seven-year and 10-<br />

year b<strong>on</strong>ds were aucti<strong>on</strong>ed<br />

at lower stop rates of 13.50<br />

percent, down from 14.52<br />

percent, 13.50 percent<br />

down from 14.80 percent,<br />

and 13.50 percent down<br />

from14.94 percent<br />

respectively.<br />

Cost of funds<br />

to rise<br />

The FGN b<strong>on</strong>d offer is,<br />

however, expected to<br />

trigger rise in cost funds<br />

in the interbank m<strong>on</strong>ey<br />

market this week.<br />

L<str<strong>on</strong>g>as</str<strong>on</strong>g>t week cost of funds<br />

dropped sharply following<br />

inflow of N165.91 billi<strong>on</strong><br />

from matured tre<str<strong>on</strong>g>as</str<strong>on</strong>g>ury bills<br />

(TBs), which cancelled out<br />

the impact of outflow of<br />

N58.49 billi<strong>on</strong> through<br />

primary market TBs sold<br />

by the Central Bank of<br />

Nigeria (CBN).<br />

As a result average short<br />

term cost of funds dropped<br />

by 10.5 bpts,with interest<br />

rate <strong>on</strong> Collateralised<br />

(Open Buy Back, OBB)<br />

lending falling by 10.43<br />

bpts to 9.86 percent l<str<strong>on</strong>g>as</str<strong>on</strong>g>t<br />

week from 20.29 percent<br />

the previous week.<br />

Similarly, interest rate <strong>on</strong><br />

Overnight lending<br />

dropped by 10.57 bpts to<br />

10.57 percent l<str<strong>on</strong>g>as</str<strong>on</strong>g>t week<br />

from 21.57 percent the<br />

previous week.<br />

Analysts at Cowry<br />

Assets, however, project<br />

that this trend will be<br />

reversed this week.<br />

“In the new week, T-bills<br />

worth N46.25 billi<strong>on</strong> will<br />

mature via the sec<strong>on</strong>dary<br />

market. However, with the<br />

DMO expected to issue<br />

N100 billi<strong>on</strong> worth of<br />

debts, we expect Nigeria<br />

Interbank Offered Rate<br />

(NIBOR) to trend<br />

upwards”, they said.