SOWBO Magazine 4TH edition

About Our Magazine SOWBO Magazine is the publication and news extension of our organization. The magazine uses a holistic focus (mind, body, spiritual, and financial) to reach women worldwide. We wish to share your business with other women entrepreneurs. Additionally, we want to hear your business journey of success and share it to help motivate and encourage other entrepreneurs and future entrepreneurs.

About Our Magazine

SOWBO Magazine is the publication and news extension of our organization. The magazine uses a holistic focus (mind, body, spiritual, and financial) to reach women worldwide.

We wish to share your business with other women entrepreneurs. Additionally, we want to hear your business journey of success and share it to help motivate and encourage other entrepreneurs and future entrepreneurs.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

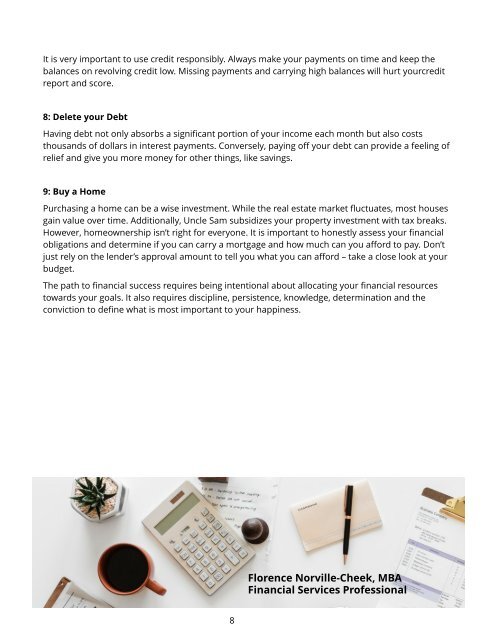

It is very important to use credit responsibly. Always make your payments on time and keep the<br />

balances on revolving credit low. Missing payments and carrying high balances will hurt yourcredit<br />

report and score.<br />

8: Delet e your Debt<br />

Having debt not only absorbs a significant portion of your income each month but also costs<br />

thousands of dollars in interest payments. Conversely, paying off your debt can provide a feeling of<br />

relief and give you more money for other things, like savings.<br />

9: Buy a Hom e<br />

Purchasing a home can be a wise investment. While the real estate market fluctuates, most houses<br />

gain value over time. Additionally, Uncle Sam subsidizes your property investment with tax breaks.<br />

However, homeownership isn?t right for everyone. It is important to honestly assess your financial<br />

obligations and determine if you can carry a mortgage and how much can you afford to pay. Don?t<br />

just rely on the lender?s approval amount to tell you what you can afford ? take a close look at your<br />

budget.<br />

The path to financial success requires being intentional about allocating your financial resources<br />

towards your goals. It also requires discipline, persistence, knowledge, determination and the<br />

conviction to define what is most important to your happiness.<br />

Florence Norville-Cheek, MBA<br />

Financial Services Professional<br />

8