Organic Farmer October/November 2019

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

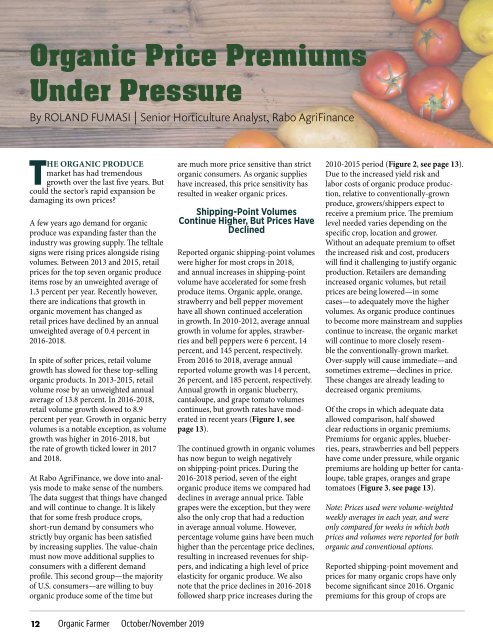

<strong>Organic</strong> Price Premiums<br />

Under Pressure<br />

By ROLAND FUMASI | Senior Horticulture Analyst, Rabo AgriFinance<br />

THE ORGANIC PRODUCE<br />

market has had tremendous<br />

growth over the last five years. But<br />

could the sector’s rapid expansion be<br />

damaging its own prices?<br />

A few years ago demand for organic<br />

produce was expanding faster than the<br />

industry was growing supply. The telltale<br />

signs were rising prices alongside rising<br />

volumes. Between 2013 and 2015, retail<br />

prices for the top seven organic produce<br />

items rose by an unweighted average of<br />

1.3 percent per year. Recently however,<br />

there are indications that growth in<br />

organic movement has changed as<br />

retail prices have declined by an annual<br />

unweighted average of 0.4 percent in<br />

2016-2018.<br />

In spite of softer prices, retail volume<br />

growth has slowed for these top-selling<br />

organic products. In 2013-2015, retail<br />

volume rose by an unweighted annual<br />

average of 13.8 percent. In 2016-2018,<br />

retail volume growth slowed to 8.9<br />

percent per year. Growth in organic berry<br />

volumes is a notable exception, as volume<br />

growth was higher in 2016-2018, but<br />

the rate of growth ticked lower in 2017<br />

and 2018.<br />

At Rabo AgriFinance, we dove into analysis<br />

mode to make sense of the numbers.<br />

The data suggest that things have changed<br />

and will continue to change. It is likely<br />

that for some fresh produce crops,<br />

short-run demand by consumers who<br />

strictly buy organic has been satisfied<br />

by increasing supplies. The value-chain<br />

must now move additional supplies to<br />

consumers with a different demand<br />

profile. This second group—the majority<br />

of U.S. consumers—are willing to buy<br />

organic produce some of the time but<br />

are much more price sensitive than strict<br />

organic consumers. As organic supplies<br />

have increased, this price sensitivity has<br />

resulted in weaker organic prices.<br />

Shipping-Point Volumes<br />

Continue Higher, But Prices Have<br />

Declined<br />

Reported organic shipping-point volumes<br />

were higher for most crops in 2018,<br />

and annual increases in shipping-point<br />

volume have accelerated for some fresh<br />

produce items. <strong>Organic</strong> apple, orange,<br />

strawberry and bell pepper movement<br />

have all shown continued acceleration<br />

in growth. In 2010-2012, average annual<br />

growth in volume for apples, strawberries<br />

and bell peppers were 6 percent, 14<br />

percent, and 145 percent, respectively.<br />

From 2016 to 2018, average annual<br />

reported volume growth was 14 percent,<br />

26 percent, and 185 percent, respectively.<br />

Annual growth in organic blueberry,<br />

cantaloupe, and grape tomato volumes<br />

continues, but growth rates have moderated<br />

in recent years (Figure 1, see<br />

page 13).<br />

The continued growth in organic volumes<br />

has now begun to weigh negatively<br />

on shipping-point prices. During the<br />

2016-2018 period, seven of the eight<br />

organic produce items we compared had<br />

declines in average annual price. Table<br />

grapes were the exception, but they were<br />

also the only crop that had a reduction<br />

in average annual volume. However,<br />

percentage volume gains have been much<br />

higher than the percentage price declines,<br />

resulting in increased revenues for shippers,<br />

and indicating a high level of price<br />

elasticity for organic produce. We also<br />

note that the price declines in 2016-2018<br />

followed sharp price increases during the<br />

2010-2015 period (Figure 2, see page 13).<br />

Due to the increased yield risk and<br />

labor costs of organic produce production,<br />

relative to conventionally-grown<br />

produce, growers/shippers expect to<br />

receive a premium price. The premium<br />

level needed varies depending on the<br />

specific crop, location and grower.<br />

Without an adequate premium to offset<br />

the increased risk and cost, producers<br />

will find it challenging to justify organic<br />

production. Retailers are demanding<br />

increased organic volumes, but retail<br />

prices are being lowered—in some<br />

cases—to adequately move the higher<br />

volumes. As organic produce continues<br />

to become more mainstream and supplies<br />

continue to increase, the organic market<br />

will continue to more closely resemble<br />

the conventionally-grown market.<br />

Over-supply will cause immediate—and<br />

sometimes extreme—declines in price.<br />

These changes are already leading to<br />

decreased organic premiums.<br />

Of the crops in which adequate data<br />

allowed comparison, half showed<br />

clear reductions in organic premiums.<br />

Premiums for organic apples, blueberries,<br />

pears, strawberries and bell peppers<br />

have come under pressure, while organic<br />

premiums are holding up better for cantaloupe,<br />

table grapes, oranges and grape<br />

tomatoes (Figure 3, see page 13).<br />

Note: Prices used were volume-weighted<br />

weekly averages in each year, and were<br />

only compared for weeks in which both<br />

prices and volumes were reported for both<br />

organic and conventional options.<br />

Reported shipping-point movement and<br />

prices for many organic crops have only<br />

become significant since 2016. <strong>Organic</strong><br />

premiums for this group of crops are<br />

12<br />

<strong>Organic</strong> <strong>Farmer</strong> <strong>October</strong>/<strong>November</strong> <strong>2019</strong>