Member Information Booklet - REI Super

Member Information Booklet - REI Super

Member Information Booklet - REI Super

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

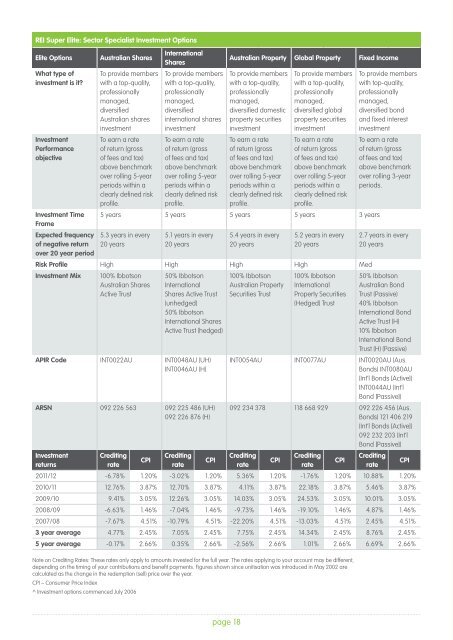

ei <strong>Super</strong> elite: Sector Specialist investment options<br />

elite options Australian Shares<br />

what type of<br />

investment is it?<br />

investment<br />

Performance<br />

objective<br />

investment time<br />

frame<br />

expected frequency<br />

of negative return<br />

over 20 year period<br />

To provide members<br />

with a top-quality,<br />

professionally<br />

managed,<br />

diversified<br />

Australian shares<br />

investment<br />

To earn a rate<br />

of return (gross<br />

of fees and tax)<br />

above benchmark<br />

over rolling 5-year<br />

periods within a<br />

clearly defined risk<br />

profile.<br />

international<br />

Shares<br />

To provide members<br />

with a top-quality,<br />

professionally<br />

managed,<br />

diversified<br />

international shares<br />

investment<br />

To earn a rate<br />

of return (gross<br />

of fees and tax)<br />

above benchmark<br />

over rolling 5-year<br />

periods within a<br />

clearly defined risk<br />

profile.<br />

page 18<br />

Australian Property global Property fixed income<br />

To provide members<br />

with a top-quality,<br />

professionally<br />

managed,<br />

diversified domestic<br />

property securities<br />

investment<br />

To earn a rate<br />

of return (gross<br />

of fees and tax)<br />

above benchmark<br />

over rolling 5-year<br />

periods within a<br />

clearly defined risk<br />

profile.<br />

To provide members<br />

with a top-quality,<br />

professionally<br />

managed,<br />

diversified global<br />

property securities<br />

investment<br />

To earn a rate<br />

of return (gross<br />

of fees and tax)<br />

above benchmark<br />

over rolling 5-year<br />

periods within a<br />

clearly defined risk<br />

profile.<br />

5 years 5 years 5 years 5 years 3 years<br />

5.3 years in every<br />

20 years<br />

5.1 years in every<br />

20 years<br />

5.4 years in every<br />

20 years<br />

5.2 years in every<br />

20 years<br />

risk Profile High High High High Med<br />

investment mix 100% Ibbotson<br />

Australian Shares<br />

Active Trust<br />

50% Ibbotson<br />

International<br />

Shares Active Trust<br />

(unhedged)<br />

50% Ibbotson<br />

International Shares<br />

Active Trust (hedged)<br />

APir Code INT0022AU INT0048AU (UH)<br />

INT0046AU (H)<br />

ArSn 092 226 563 092 225 486 (UH)<br />

092 226 876 (H)<br />

investment<br />

returns<br />

Crediting<br />

rate<br />

CPi<br />

Crediting<br />

rate<br />

CPi<br />

100% Ibbotson<br />

Australian Property<br />

Securities Trust<br />

100% Ibbotson<br />

International<br />

Property Securities<br />

(Hedged) Trust<br />

To provide members<br />

with top-quality,<br />

professionally<br />

managed,<br />

diversified bond<br />

and fixed interest<br />

investment<br />

To earn a rate<br />

of return (gross<br />

of fees and tax)<br />

above benchmark<br />

over rolling 3-year<br />

periods.<br />

2.7 years in every<br />

20 years<br />

50% Ibbotson<br />

Australian Bond<br />

Trust (Passive)<br />

40% Ibbotson<br />

International Bond<br />

Active Trust (H)<br />

10% Ibbotson<br />

International Bond<br />

Trust (H) (Passive)<br />

INT0054AU INT0077AU INT0020AU (Aus.<br />

Bonds) INT0080AU<br />

(Int’l Bonds [Active])<br />

INT0044AU (Int’l<br />

Bond [Passive])<br />

092 234 378 118 668 929 092 226 456 (Aus.<br />

Bonds) 121 406 219<br />

(Int’l Bonds [Active])<br />

092 232 203 (Int’l<br />

Bond [Passive])<br />

Crediting<br />

rate<br />

CPi<br />

Crediting<br />

rate<br />

CPi<br />

Crediting<br />

rate<br />

2011/12 -6.78% 1.20% -3.02% 1.20% 5.36% 1.20% -1.76% 1.20% 10.88% 1.20%<br />

2010/11 12.76% 3.87% 12.70% 3.87% 4.11% 3.87% 22.18% 3.87% 5.46% 3.87%<br />

2009/10 9.41% 3.05% 12.26% 3.05% 14.03% 3.05% 24.53% 3.05% 10.01% 3.05%<br />

2008/09 -6.63% 1.46% -7.04% 1.46% -9.73% 1.46% -19.10% 1.46% 4.87% 1.46%<br />

2007/08 -7.67% 4.51% -10.79% 4.51% -22.20% 4.51% -13.03% 4.51% 2.45% 4.51%<br />

3 year average 4.77% 2.45% 7.05% 2.45% 7.75% 2.45% 14.34% 2.45% 8.76% 2.45%<br />

5 year average -0.17% 2.66% 0.35% 2.66% -2.56% 2.66% 1.01% 2.66% 6.69% 2.66%<br />

Note on Crediting Rates: These rates only apply to amounts invested for the full year. The rates applying to your account may be different,<br />

depending on the timing of your contributions and benefit payments. Figures shown since unitisation was introduced in May 2002 are<br />

calculated as the change in the redemption (sell) price over the year.<br />

CPI – Consumer Price Index<br />

^ Investment options commenced July 2006<br />

CPi