Download annual report 2010 - Port of Rotterdam

Download annual report 2010 - Port of Rotterdam

Download annual report 2010 - Port of Rotterdam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Provision for guarantees allegedly<br />

furnished<br />

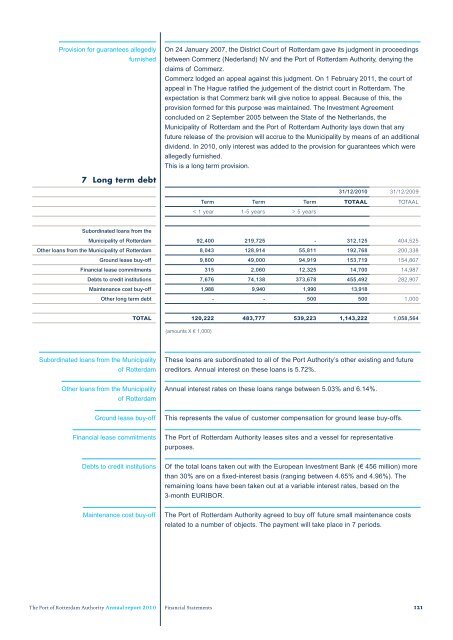

7 Long term debt<br />

Subordinated loans from the<br />

Subordinated loans from the Municipality<br />

<strong>of</strong> <strong>Rotterdam</strong><br />

Other loans from the Municipality<br />

<strong>of</strong> <strong>Rotterdam</strong><br />

Ground lease buy-<strong>of</strong>f<br />

Financial lease commitments<br />

Debts to credit institutions<br />

Maintenance cost buy-<strong>of</strong>f<br />

On 24 January 2007, the District Court <strong>of</strong> <strong>Rotterdam</strong> gave its judgment in proceedings<br />

between Commerz (Nederland) NV and the <strong>Port</strong> <strong>of</strong> <strong>Rotterdam</strong> Authority, denying the<br />

claims <strong>of</strong> Commerz.<br />

Commerz lodged an appeal against this judgment. On 1 February 2011, the court <strong>of</strong><br />

appeal in The Hague ratified the judgement <strong>of</strong> the district court in <strong>Rotterdam</strong>. The<br />

expectation is that Commerz bank will give notice to appeal. Because <strong>of</strong> this, the<br />

provision formed for this purpose was maintained. The Investment Agreement<br />

concluded on 2 September 2005 between the State <strong>of</strong> the Netherlands, the<br />

Municipality <strong>of</strong> <strong>Rotterdam</strong> and the <strong>Port</strong> <strong>of</strong> <strong>Rotterdam</strong> Authority lays down that any<br />

future release <strong>of</strong> the provision will accrue to the Municipality by means <strong>of</strong> an additional<br />

dividend. In <strong>2010</strong>, only interest was added to the provision for guarantees which were<br />

allegedly furnished.<br />

This is a long term provision.<br />

(amounts X € 1,000)<br />

These loans are subordinated to all <strong>of</strong> the <strong>Port</strong> Authority’s other existing and future<br />

creditors. Annual interest on these loans is 5.72%.<br />

Annual interest rates on these loans range between 5.03% and 6.14%.<br />

31/12/<strong>2010</strong> 31/12/2009<br />

Term Term Term TOTAAL TOTAAl<br />

< 1 year 1-5 years > 5 years<br />

Municipality <strong>of</strong> <strong>Rotterdam</strong> 92,400 219,725 - 312,125 404,525<br />

Other loans from the Municipality <strong>of</strong> <strong>Rotterdam</strong> 8,043 128,914 55,811 192,768 200,338<br />

Ground lease buy-<strong>of</strong>f 9,800 49,000 94,919 153,719 154,807<br />

Financial lease commitments 315 2,060 12,325 14,700 14,987<br />

Debts to credit institutions 7,676 74,138 373,678 455,492 282,907<br />

Maintenance cost buy-<strong>of</strong>f 1,988 9,940 1,990 13,918<br />

Other long term debt - - 500 500 1,000<br />

TOTAL 120,222 483,777 539,223 1,143,222 1,058,564<br />

This represents the value <strong>of</strong> customer compensation for ground lease buy-<strong>of</strong>fs.<br />

The <strong>Port</strong> <strong>of</strong> <strong>Rotterdam</strong> Authority leases sites and a vessel for representative<br />

purposes.<br />

Of the total loans taken out with the European Investment Bank (€ 456 million) more<br />

than 30% are on a fixed-interest basis (ranging between 4.65% and 4.96%). The<br />

remaining loans have been taken out at a variable interest rates, based on the<br />

3-month EURIBOR.<br />

The <strong>Port</strong> <strong>of</strong> <strong>Rotterdam</strong> Authority agreed to buy <strong>of</strong>f future small maintenance costs<br />

related to a number <strong>of</strong> objects. The payment will take place in 7 periods.<br />

The <strong>Port</strong> <strong>of</strong> <strong>Rotterdam</strong> Authority Annual <strong>report</strong> <strong>2010</strong> Financial Statements<br />

121