Deals on Wheels #460

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

DEALS Data<br />

moving <strong>on</strong> up<br />

All sizes indicate it may well be time for new<br />

truck sales to break free of pandemic slump<br />

In racing terms, October might represent the start of the last<br />

lap, with Truck Industry Council (TIC) T-Mark commercial<br />

vehicle sales figures c<strong>on</strong>firming likely placings.<br />

Some, such as Isuzu’s perennial fr<strong>on</strong>t-running form, leads to a<br />

foreg<strong>on</strong>e c<strong>on</strong>clusi<strong>on</strong> in total numbers and medium- and light-duty<br />

segments, with the battle for minor placings perhaps pointing to<br />

where momentum might lie.<br />

Elsewhere, makes are looking for something akin to pers<strong>on</strong>al bests<br />

in the struggle for higher ground.<br />

And then there is the big picture for the whole sector, with hope<br />

that a return to some sort of normality will come when an ec<strong>on</strong>omic<br />

rebound starts, well, now.<br />

So, 10 m<strong>on</strong>ths down the track, the numbers show a mixed bag.<br />

Total year-to-date (YTD) sales are at 27,842 after October’s 3,011.<br />

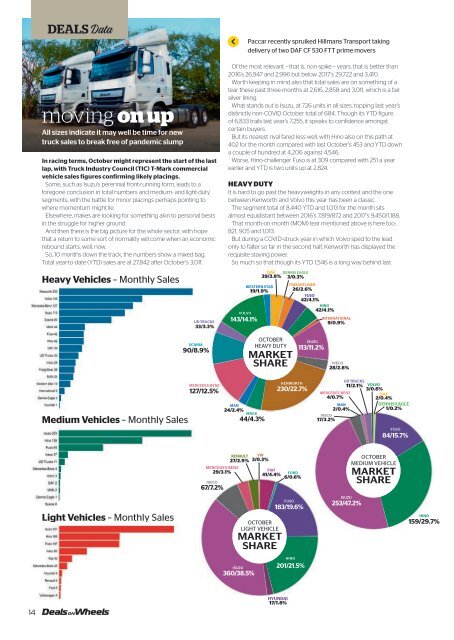

Heavy Vehicles – M<strong>on</strong>thly Sales<br />

UD TRUCKS<br />

33/3.3%<br />

Paccar recently spruiked Hillmans Transport taking<br />

delivery of two DAF CF 530 FTT prime movers<br />

Of the most relevant – that is, n<strong>on</strong>-spike – years, that is better than<br />

2016’s 26,947 and 2,996 but below 2017’s 29,722 and 3,410.<br />

Worth keeping in mind also that total sales are <strong>on</strong> something of a<br />

tear these past three m<strong>on</strong>ths at 2,616, 2,858 and 3,011, which is a fair<br />

silver lining.<br />

What stands out is Isuzu, at 726 units in all sizes, topping last year’s<br />

distinctly n<strong>on</strong>-COVID October total of 684. Though its YTD figure<br />

of 6,833 trails last year’s 7,255, it speaks to c<strong>on</strong>fidence am<strong>on</strong>gst<br />

certain buyers.<br />

But its nearest rival fared less well, with Hino also <strong>on</strong> this path at<br />

402 for the m<strong>on</strong>th compared with last October’s 453 and YTD down<br />

a couple of hundred at 4,206 against 4,546.<br />

Worse, Hino-challenger Fuso is at 309 compared with 251 a year<br />

earlier and YTD is two units up at 2,824.<br />

HEAVY DUTY<br />

It is hard to go past the heavyweights in any c<strong>on</strong>test and the <strong>on</strong>e<br />

between Kenworth and Volvo this year has been a classic.<br />

The segment total of 8,440 YTD and 1,013 for the m<strong>on</strong>th sits<br />

almost equidistant between 2016’s 7,819/872 and 2017’s 9,450/1,188.<br />

That m<strong>on</strong>th-<strong>on</strong>-m<strong>on</strong>th (MOM) tear menti<strong>on</strong>ed above is here too:<br />

821, 905 and 1,013.<br />

But during a COVID-struck year in which Volvo sped to the lead<br />

<strong>on</strong>ly to falter so far in the sec<strong>on</strong>d half, Kenworth has displayed the<br />

requisite staying power.<br />

So much so that though its YTD 1,546 is a l<strong>on</strong>g way behind last<br />

DAF DENNIS EAGLE<br />

39/3.8% 3/0.3%<br />

FREIGHTLINER<br />

WESTERN STAR<br />

19/1.9%<br />

26/2.6%<br />

FUSO<br />

42/4.1%<br />

HINO<br />

42/4.1%<br />

VOLVO<br />

INTERNATIONAL<br />

9/0.9%<br />

143/14.1%<br />

SCANIA<br />

90/8.9%<br />

OCTOBER<br />

HEAVY DUTY<br />

MARKET<br />

SHARE<br />

ISUZU<br />

113/11.2%<br />

IVECO<br />

28/2.8%<br />

Medium Vehicles – M<strong>on</strong>thly Sales<br />

MERCEDES-BENZ<br />

127/12.5%<br />

MAN<br />

24/2.4%<br />

MACK<br />

44/4.3%<br />

KENWORTH<br />

230/22.7%<br />

UD TRUCKS<br />

11/2.1% VOLVO<br />

3/0.6%<br />

MERCEDES-BENZ<br />

DAF<br />

4/0.7% 2/0.4%<br />

MAN<br />

DENNIS EAGLE<br />

2/0.4%<br />

1/0.2%<br />

IVECO<br />

17/3.2%<br />

FUSO<br />

84/15.7%<br />

27/2.9%<br />

MERCEDES-BENZ<br />

29/3.1%<br />

IVECO<br />

67/7.2%<br />

RENAULT VW<br />

3/0.3%<br />

FIAT<br />

41/4.4%<br />

FORD<br />

6/0.6%<br />

OCTOBER<br />

MEDIUM VEHICLE<br />

MARKET<br />

SHARE<br />

Light Vehicles – M<strong>on</strong>thly Sales<br />

OCTOBER<br />

LIGHT VEHICLE<br />

MARKET<br />

SHARE<br />

FUSO<br />

183/19.6%<br />

ISUZU<br />

253/47.2%<br />

HINO<br />

159/29.7%<br />

ISUZU<br />

360/38.5%<br />

HINO<br />

201/21.5%<br />

14<br />

HYUNDAI<br />

17/1.8%