221JANAP_web

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

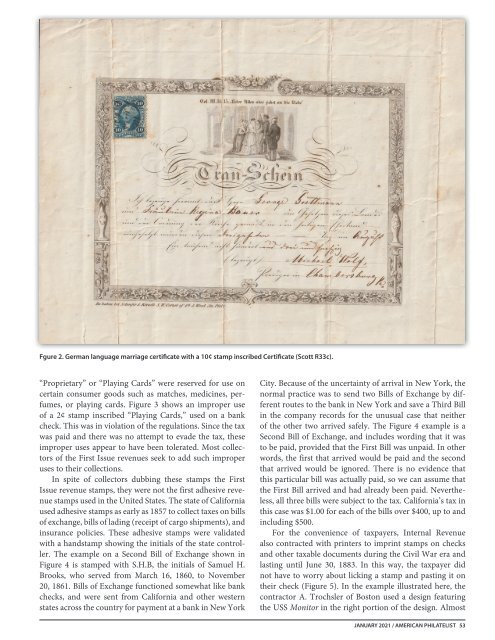

Fgure 2. German language marriage certificate with a 10¢ stamp inscribed Certificate (Scott R33c).<br />

“Proprietary” or “Playing Cards” were reserved for use on<br />

certain consumer goods such as matches, medicines, perfumes,<br />

or playing cards. Figure 3 shows an improper use<br />

of a 2¢ stamp inscribed “Playing Cards,” used on a bank<br />

check. This was in violation of the regulations. Since the tax<br />

was paid and there was no attempt to evade the tax, these<br />

improper uses appear to have been tolerated. Most collectors<br />

of the First Issue revenues seek to add such improper<br />

uses to their collections.<br />

In spite of collectors dubbing these stamps the First<br />

Issue revenue stamps, they were not the first adhesive revenue<br />

stamps used in the United States. The state of California<br />

used adhesive stamps as early as 1857 to collect taxes on bills<br />

of exchange, bills of lading (receipt of cargo shipments), and<br />

insurance policies. These adhesive stamps were validated<br />

with a handstamp showing the initials of the state controller.<br />

The example on a Second Bill of Exchange shown in<br />

Figure 4 is stamped with S.H.B, the initials of Samuel H.<br />

Brooks, who served from March 16, 1860, to November<br />

20, 1861. Bills of Exchange functioned somewhat like bank<br />

checks, and were sent from California and other western<br />

states across the country for payment at a bank in New York<br />

City. Because of the uncertainty of arrival in New York, the<br />

normal practice was to send two Bills of Exchange by different<br />

routes to the bank in New York and save a Third Bill<br />

in the company records for the unusual case that neither<br />

of the other two arrived safely. The Figure 4 example is a<br />

Second Bill of Exchange, and includes wording that it was<br />

to be paid, provided that the First Bill was unpaid. In other<br />

words, the first that arrived would be paid and the second<br />

that arrived would be ignored. There is no evidence that<br />

this particular bill was actually paid, so we can assume that<br />

the First Bill arrived and had already been paid. Nevertheless,<br />

all three bills were subject to the tax. California’s tax in<br />

this case was $1.00 for each of the bills over $400, up to and<br />

including $500.<br />

For the convenience of taxpayers, Internal Revenue<br />

also contracted with printers to imprint stamps on checks<br />

and other taxable documents during the Civil War era and<br />

lasting until June 30, 1883. In this way, the taxpayer did<br />

not have to worry about licking a stamp and pasting it on<br />

their check (Figure 5). In the example illustrated here, the<br />

contractor A. Trochsler of Boston used a design featuring<br />

the USS Monitor in the right portion of the design. Almost<br />

JANUARY 2021 / AMERICAN PHILATELIST 53