GV January Newsletter

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GOVERNMENT<br />

MAKING A difference<br />

2021 BUDGET<br />

WHAT DOES THE<br />

BUDGET SAY ABOUT<br />

THE VILLAGE’S<br />

FINANCIAL CONDITION?<br />

This past December, City Council<br />

adopted the 2021 Annual Operating<br />

and Capital Improvement Budget.<br />

The primary purpose of the Village’s<br />

budget and budgetary process is to<br />

develop, adopt and implement a<br />

fiscally sound and sustainable plan to<br />

accomplish the established goals of<br />

the upcoming year, while remaining<br />

consistent with the long-term vision<br />

of the community. Despite the<br />

economic challenges presented by the<br />

pandemic, the 2021 budget maintains<br />

the high-quality services residents<br />

expect, provides for reinvestment in<br />

the community’s infrastructure, and<br />

does so without the imposition of<br />

new taxes or the use of debt.<br />

WHERE DOES THE<br />

MONEY COME FROM?<br />

The Village receives revenue from<br />

several sources. Taxes and assessments<br />

represent the largest category,<br />

accounting for more than 80% of all<br />

Village revenue. Other sources<br />

include intergovernmental revenues<br />

comprised of sources which are<br />

collected and shared with the Village<br />

by other governments, as well as<br />

federal, state and/or county grants,<br />

the sale of various licenses and<br />

permits, user charges and fees<br />

intended to offset certain costs,<br />

punitive fines and forfeitures for the<br />

commission of minor crimes, and<br />

lastly, investment earnings and<br />

miscellaneous revenues. For 2021,<br />

the above sources are expected to<br />

continued on page 7<br />

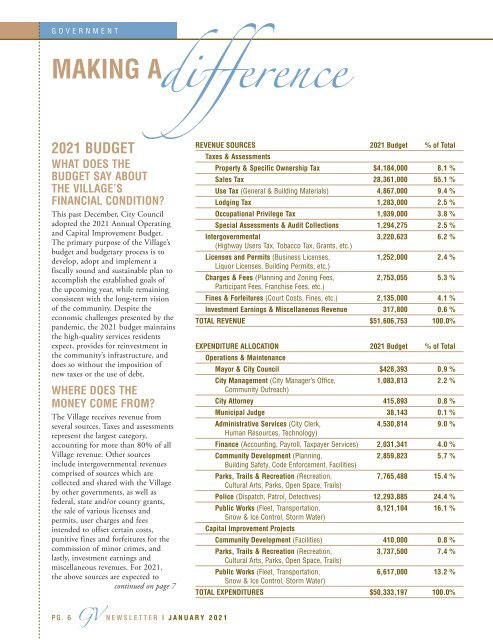

REVENUE SOURCES 2021 Budget % of Total<br />

Taxes & Assessments<br />

Property & Specific Ownership Tax $4,184,000 8.1 %<br />

Sales Tax 28,361,000 55.1 %<br />

Use Tax (General & Building Materials) 4,867,000 9.4 %<br />

Lodging Tax 1,283,000 2.5 %<br />

Occupational Privilege Tax 1,939,000 3.8 %<br />

Special Assessments & Audit Collections 1,294,275 2.5 %<br />

Intergovernmental 3,220,623 6.2 %<br />

(Highway Users Tax, Tobacco Tax, Grants, etc.)<br />

Licenses and Permits (Business Licenses, 1,252,000 2.4 %<br />

Liquor Licenses, Building Permits, etc.)<br />

Charges & Fees (Planning and Zoning Fees, 2,753,055 5.3 %<br />

Participant Fees, Franchise Fees, etc.)<br />

Fines & Forfeitures (Court Costs, Fines, etc.) 2,135,000 4.1 %<br />

Investment Earnings & Miscellaneous Revenue 317,800 0.6 %<br />

TOTAL REVENUE $51,606,753 100.0%<br />

EXPENDITURE ALLOCATION 2021 Budget % of Total<br />

Operations & Maintenance<br />

Mayor & City Council $428,393 0.9 %<br />

City Management (City Manager’s Office, 1,083,813 2.2 %<br />

Community Outreach)<br />

City Attorney 415,893 0.8 %<br />

Municipal Judge 38,143 0.1 %<br />

Administrative Services (City Clerk, 4,530,814 9.0 %<br />

Human Resources, Technology)<br />

Finance (Accounting, Payroll, Taxpayer Services) 2,031,341 4.0 %<br />

Community Development (Planning, 2,859,823 5.7 %<br />

Building Safety, Code Enforcement, Facilities)<br />

Parks, Trails & Recreation (Recreation, 7,765,488 15.4 %<br />

Cultural Arts, Parks, Open Space, Trails)<br />

Police (Dispatch, Patrol, Detectives) 12,293,885 24.4 %<br />

Public Works (Fleet, Transportation, 8,121,104 16.1 %<br />

Snow & Ice Control, Storm Water)<br />

Capital Improvement Projects<br />

Community Development (Facilities) 410,000 0.8 %<br />

Parks, Trails & Recreation (Recreation, 3,737,500 7.4 %<br />

Cultural Arts, Parks, Open Space, Trails)<br />

Public Works (Fleet, Transportation, 6,617,000 13.2 %<br />

Snow & Ice Control, Storm Water)<br />

TOTAL EXPENDITURES $50,333,197 100.0%<br />

PG. 6 <strong>GV</strong> NEWSLETTER | JANUARY 2021