Panels & Furniture Asia September/October 2020

Panels & Furniture Asia (PFA) is a leading regional trade magazine dedicated to the woodbased panel, furniture and flooring processing industry. Published bi-monthly since 2000, PFA delivers authentic journalism to cover the latest news, technology, machinery, projects, products and trade events throughout the sector. With a hardcopy and digital readership comprising manufacturers, designers and specifiers, among others, PFA is the platform of choice for connecting brands across the global woodworking landscape.

Panels & Furniture Asia (PFA) is a leading regional trade magazine dedicated to the woodbased panel, furniture and flooring processing industry. Published bi-monthly since 2000, PFA delivers authentic journalism to cover the latest news, technology, machinery, projects, products and trade events throughout the sector. With a hardcopy and digital readership comprising manufacturers, designers and specifiers, among others, PFA is the platform of choice for connecting brands across the global woodworking landscape.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

20 | MARKET REPORT<br />

<strong>September</strong> / <strong>October</strong> <strong>2020</strong>, Issue 5 | <strong>Panels</strong> & <strong>Furniture</strong> <strong>Asia</strong><br />

US HARDWOOD SUPPLIES:<br />

ADAPTING TO A NEW NORM<br />

By: Judd Johnson Managing Editor, Hardwood Market Report<br />

If it is agreed that change is persistent, then it is agreed there<br />

is always a new norm. On rare occasions, change can be lifealtering<br />

and even historic. COVID-19 created such change.<br />

US hardwood sawmill production dropped to record low levels<br />

in the second quarter of <strong>2020</strong> as a direct result of market<br />

impacts from COVID-19. Unlike effects from the China/US trade<br />

war or cyclical events that disrupt business within individual<br />

market sectors, government regulations aimed at mitigating<br />

the spread of COVID-19 affected the entire marketplace for US<br />

hardwood lumber.<br />

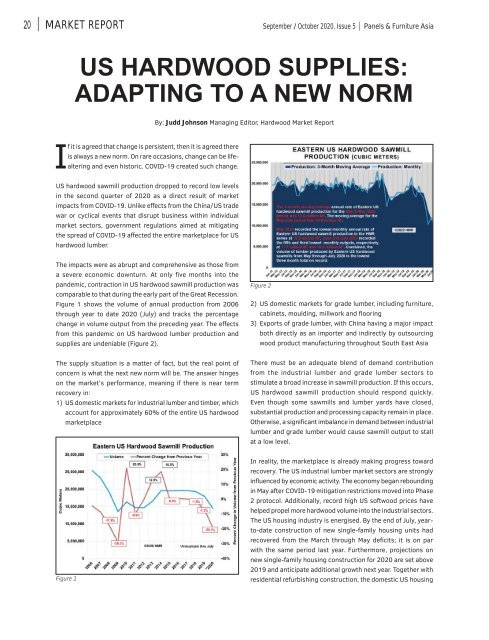

The impacts were as abrupt and comprehensive as those from<br />

a severe economic downturn. At only five months into the<br />

pandemic, contraction in US hardwood sawmill production was<br />

comparable to that during the early part of the Great Recession.<br />

Figure 1 shows the volume of annual production from 2006<br />

through year to date <strong>2020</strong> (July) and tracks the percentage<br />

change in volume output from the preceding year. The effects<br />

from this pandemic on US hardwood lumber production and<br />

supplies are undeniable (Figure 2).<br />

Figure 2<br />

2) US domestic markets for grade lumber, including furniture,<br />

cabinets, moulding, millwork and flooring<br />

3) Exports of grade lumber, with China having a major impact<br />

both directly as an importer and indirectly by outsourcing<br />

wood product manufacturing throughout South East <strong>Asia</strong><br />

The supply situation is a matter of fact, but the real point of<br />

concern is what the next new norm will be. The answer hinges<br />

on the market’s performance, meaning if there is near term<br />

recovery in:<br />

1) US domestic markets for industrial lumber and timber, which<br />

account for approximately 60% of the entire US hardwood<br />

marketplace<br />

There must be an adequate blend of demand contribution<br />

from the industrial lumber and grade lumber sectors to<br />

stimulate a broad increase in sawmill production. If this occurs,<br />

US hardwood sawmill production should respond quickly.<br />

Even though some sawmills and lumber yards have closed,<br />

substantial production and processing capacity remain in place.<br />

Otherwise, a significant imbalance in demand between industrial<br />

lumber and grade lumber would cause sawmill output to stall<br />

at a low level.<br />

Figure 1<br />

In reality, the marketplace is already making progress toward<br />

recovery. The US industrial lumber market sectors are strongly<br />

influenced by economic activity. The economy began rebounding<br />

in May after COVID-19 mitigation restrictions moved into Phase<br />

2 protocol. Additionally, record high US softwood prices have<br />

helped propel more hardwood volume into the industrial sectors.<br />

The US housing industry is energised. By the end of July, yearto-date<br />

construction of new single-family housing units had<br />

recovered from the March through May deficits; it is on par<br />

with the same period last year. Furthermore, projections on<br />

new single-family housing construction for <strong>2020</strong> are set above<br />

2019 and anticipate additional growth next year. Together with<br />

residential refurbishing construction, the domestic US housing