Jeweller - October 2021

• Home advantage: Australian and New Zealand brands prove their worth • Lab-grown up: innovations and market developments in the lab-created diamond category • Christmas ready: prepare for the holiday season with exciting new products

• Home advantage: Australian and New Zealand brands prove their worth

• Lab-grown up: innovations and market developments in the lab-created diamond category

• Christmas ready: prepare for the holiday season with exciting new products

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

VOICE OF THE AUSTRALIAN JEWELLERY INDUSTRY<br />

OCTOBER <strong>2021</strong><br />

Home advantage<br />

AUSTRALIAN AND NEW ZEALAND<br />

BRANDS PROVE THEIR WORTH<br />

Lab-grown up<br />

INNOVATIONS AND MARKET DEVELOPMENTS<br />

IN THE LAB-CREATED DIAMOND CATEGORY<br />

Christmas ready<br />

PREPARE FOR THE HOLIDAY SEASON<br />

WITH EXCITING NEW PRODUCTS

AUSTRALIA'S PREMIER DIAMOND SUPPLIER<br />

IMMORTALISE<br />

EVERY<br />

SPARKLING<br />

MOMENT<br />

ACCESS TENDER STONES, SINGLE STONES & MELEE ARGYLE PINK DIAMONDS AND<br />

THE WORLD'S LARGEST INVENTORY OF CERTIFIED ARGYLE CHAMPAGNE DIAMONDS<br />

Specialist in all fancy-shapes<br />

GIA / HRD / IGI / RBC Certified stones in stock<br />

Matched fancy and unique pairs<br />

Calibrated melee in RBC and fancy shapes<br />

Quality diamond-set jewellery<br />

P +61 3 9650 2243<br />

E SALES@ADTC.COM.AU<br />

L13/227 COLLINS STREET<br />

MELBOURNE VIC 3000<br />

ADTC.COM.AU

Helping you shine<br />

yesterday, today<br />

& tomorrow.<br />

worldshiner.com

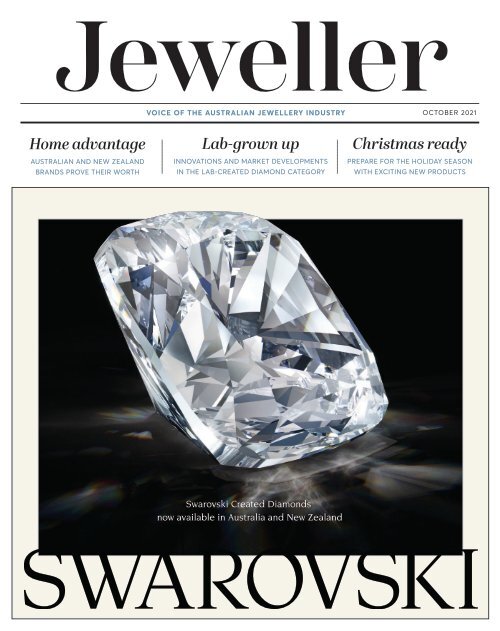

Swarovski Created Diamonds

DURAFLEX GROUP AUSTRALIA<br />

The new exclusive distributor of Swarovski Created Diamonds<br />

Australia and New Zealand<br />

Swarovski’s most astonishing innovations have always emerged from the company’s legacy of craftsmanship<br />

and technology. Swarovski Created Diamonds are no exception – a feat of master cutting and a move<br />

towards more conscious materials.<br />

100% DIAMONDS<br />

Our lab-created diamonds<br />

are crafted by simulating<br />

the natural processes that<br />

occur in the formation of<br />

mined diamonds.<br />

Just as a greenhouse-grown<br />

orchid is identical to one<br />

found in nature, a Swarovski<br />

Created Diamond faithfully<br />

reflects the growth process<br />

of mined diamonds.<br />

BREATHTAKING BRILLIANCE<br />

Swarovski Created Diamonds<br />

are perfected with master<br />

faceting for maximum light<br />

exposure. Designed in tandem<br />

with shapes dedicated to<br />

enhancing brilliance, this<br />

faceting unlocks the inner<br />

radiance found in each of our<br />

lab-grown diamonds.<br />

IGI REPORT<br />

All Swarovski Created<br />

Diamonds are hand-selected<br />

and graded according to the<br />

industry specific 4Cs (Clarity,<br />

Cut, Color and Carat) by our<br />

gemologists to ensure their<br />

brilliance, with each stone of<br />

0.70 carat and larger<br />

accompanied by a report<br />

from an independent<br />

gemological institute.<br />

RETAIL PROGRAM<br />

This unique display allows<br />

you to present the loose lab<br />

created diamonds in an<br />

exclusive way, providing at<br />

the same time education to<br />

the end consumer as well as<br />

giving them a choice of<br />

beautifully crafted Swarovski<br />

Created Diamonds.<br />

ASSORTMENT<br />

Swarovski Created Diamonds<br />

are supplied as loose stones<br />

and are offered in six classic<br />

diamond shapes and 19<br />

astonishing fancy colours.<br />

Available from DGA in a variety<br />

of colour and clarity ranges<br />

(D-I, VVS-SI) from 0.50 ct to<br />

2.50 ct; other sizes on request.<br />

CERTIFIED EXCELLENCE<br />

As proof of origin, each<br />

Swarovski Created<br />

Diamond 0.10ct/3mm and<br />

larger carries a laser<br />

engraving, visible only<br />

under strong magnification,<br />

identifying it as an<br />

authentic Swarovski jewel<br />

of extraordinary beauty.

Our Australian sapphire jewellery collection is crafted in 9ct or diamond set 18ct gold.<br />

Sapphire Dreams certifies and inscribes every sapphire greater than 0.75ct to ensure their Australian origin.<br />

Australia is enriched with amazing treasures. Sapphire Dreams pays tribute to the beauty of natural<br />

Australian sapphires, ethically sourced from the sapphire fields of inland Eastern Australia.<br />

To achieve this level of uncompromised excellence, all sapphires pass through the hands of our skilled gem<br />

cutters to become one-of-a-kind, timeless masterpieces.

Call SGA today to become an Authorised Stockist<br />

SapphireDreams.com.au 02 9290 2199

Uniting the<br />

Industry<br />

The national program to KICKSTART the future.<br />

Join us to reconnect, network and celebrate.<br />

ewellery<br />

• TRADE DAYS •<br />

MELBOURNE<br />

February 5 – 6, 2022<br />

SYDNEY<br />

February 12 – 13, 2022<br />

BRISBANE<br />

March 5 – 6, 2022<br />

PERTH<br />

March 12 – 13, 2022<br />

ADELAIDE<br />

March 20 – 21, 2022<br />

phone: +61 2 9452 7575 • email: jewelleryfair@expertiseevents.com.au<br />

Est. 1990

OCTOBER <strong>2021</strong><br />

Contents<br />

This Month<br />

Industry Facets<br />

11 Editor’s Desk<br />

12 Upfront<br />

14 News<br />

40 <strong>Jeweller</strong>s Showcase<br />

22<br />

24<br />

26<br />

29<br />

10 YEARS AGO<br />

Time Machine: <strong>October</strong> 2011<br />

NOW & THEN<br />

JM Leech <strong>Jeweller</strong>s<br />

MY STORE<br />

Harriet Kelsall Bespoke <strong>Jeweller</strong>y<br />

LEARN ABOUT GEMS<br />

Matrix & boulder opal<br />

30 LAB-CREATED DIAMOND REPORT<br />

Dazzling potential<br />

4The lab-created diamond category<br />

has seen another year of expansion and<br />

innovation, yet it is not immune to<br />

challenges, writes ARABELLA RODEN.<br />

Features<br />

30<br />

LAB-CREATED DIAMOND REPORT<br />

All that glitters<br />

84<br />

86<br />

MY BENCH<br />

Roberto Mattei<br />

SOAPBOX<br />

Joshua Zarb<br />

45<br />

70<br />

HOLIDAY STOCK SPECIAL<br />

Christmas ready<br />

LOCAL JEWELLERY BRANDS FEATURE<br />

Homegrown heroes<br />

Better Your Business<br />

45 HOLIDAY STOCK SPECIAL<br />

Special delivery<br />

4Ensure your store is well-stocked for the<br />

holiday shopping season with products and<br />

services compiled by <strong>Jeweller</strong>.<br />

78<br />

80<br />

81<br />

82<br />

83<br />

BUSINESS STRATEGY<br />

DENYSE DRUMMOND-DUNN reveals how to increase sales with segmentation.<br />

SELLING<br />

DAVID BROCK explores how managers can support sales staff effectively.<br />

MANAGEMENT<br />

There is a hidden syndrome eating away at productivity, writes DAVID BROWN.<br />

MARKETING & PR<br />

DONNA ST JEAN CONTI explains the importance of repetition in marketing.<br />

LOGGED ON<br />

GARRY GRANT provides a simple strategy for improving your SEO results.<br />

29 LEARN ABOUT<br />

Matrix &<br />

boulder opal<br />

4Natural opal takes<br />

an unusual form<br />

with unique, vibrant<br />

matrix and boulder<br />

specimens.<br />

FRONT COVER Swarovski Created<br />

Diamonds are the marriage of art and<br />

science – a true celebration of human<br />

ingenuity and creativity. They are crafted<br />

by simulating the natural processes<br />

that form diamonds, before masterful<br />

faceting unlocks the radiance in each<br />

one. All Swarovski Created Diamonds<br />

are hand-selected and graded by<br />

gemmologists, and engineered with a<br />

carbon-neutral footprint. Distributed by<br />

Duraflex Group Australia.<br />

<strong>October</strong> <strong>2021</strong> | 9

Editor’s Desk<br />

Some battles have losers, while others<br />

create two winners<br />

As the diamond war has subsided, so too has the debate around how the natural<br />

and lab-created categories can thrive in peace, writes ARABELLA RODEN.<br />

When <strong>Jeweller</strong> published the first ‘Great<br />

Diamond Debate' – natural versus labcreated<br />

– in December 2018, the battle lines<br />

had been well and truly drawn.<br />

It was the early days and representatives<br />

from each side fought on every topic, from<br />

terminology and nomenclature, to marketing,<br />

value, sustainability, and ethics.<br />

Needless to say, the industry was heavily<br />

divided with palpable tension between the<br />

natural and lab-created camps. In many<br />

ways, the animosity was understandable; few<br />

knew what the lab-created category would<br />

mean for the natural diamond industry.<br />

Would consumers – increasingly driven by<br />

sustainability concerns and enthusiastic<br />

‘greenwashed’ marketing – abandon mined<br />

gemstones altogether?<br />

Would they be hoodwinked into purchasing<br />

factory-made rocks with no real ‘value’,<br />

leading to the collapse of companies with<br />

decades of history and thousands of jobs?<br />

In a move that, at one time, seemed<br />

unfathomable, the natural side also saw a<br />

high-profile ‘defection’ – the diamond mining<br />

juggernaut De Beers joined the adversaries,<br />

and established lab-created diamond retailer<br />

Lightbox Jewelry, which now leads the very<br />

category it once stood against.<br />

Yet just a year later, when <strong>Jeweller</strong> published<br />

the second edition of the ‘Great Diamond<br />

Debate’ – fact versus fiction – tempers had<br />

cooled dramatically as a more realistic<br />

picture of the lab-created category emerged.<br />

The conversation had shifted from a conflict<br />

between righteous, venerable industry and<br />

upstart competitors, to the importance of<br />

transparency, honesty, and differentiation<br />

between two relatively equal products; a<br />

diamond is a diamond.<br />

Today, the rhetoric has softened even further,<br />

and the battlegrounds have devolved to<br />

skirmishes – tit-for-tat reporting of marketing<br />

slogans to advertising watchdogs, swiftly<br />

corrected and forgotten. The dire predictions<br />

have failed to materialise.<br />

As some prophetic industry commentators<br />

foresaw, lab-created diamonds have<br />

settled into their own niche, accounting for<br />

approximately 3 per cent of overall diamond<br />

sales, and with annual production at around<br />

5 per cent of mined stones (in 2020, the<br />

figures were 6–7 million and 111 million<br />

carats). It makes up a sizable dollar value for<br />

a market that once didn’t exist!<br />

Have lab-created diamonds become – to<br />

borrow a tech industry phrase – the ‘great<br />

disruptor’ of natural diamonds? In short, no.<br />

But perhaps they have gone one better.<br />

It is easy to forget that competition is the<br />

cornerstone of capitalism. Competitors<br />

force incumbent businesses to innovate and<br />

improve, creating better products, more<br />

choice, and value for consumers.<br />

Every headline extolling the eco-friendly<br />

benefits of lab-created diamonds is a chance<br />

for the natural diamond industry to explain<br />

that sustainability also includes human<br />

development – one of its major strengths,<br />

having helped to drag entire nations out of<br />

poverty during the 20th Century.<br />

Conservation initiatives, social programs, and<br />

jobs in developing nations are nothing to be<br />

sneered at – a salient point that was recently<br />

made in The Guardian, of all publications.<br />

Indeed, it could be argued that lab-created<br />

diamond companies have pushed mining<br />

companies to examine their impact and<br />

long-term sustainability.<br />

The reverse is also true; mining companies<br />

have consistently held lab-created diamond<br />

producers to account, calling for transparency<br />

in the supply chain and manufacturing<br />

process, and demanding they prove the<br />

generous eco claims in their advertising.<br />

With approximately 60 per cent of lab-created<br />

diamonds manufactured in China under<br />

relatively opaque conditions, the questions<br />

are not unreasonable.<br />

It is quite possible that the entire diamond<br />

trade has become all the more responsible,<br />

accountable and simply better for challenging<br />

its counterpart. As fate would have it, only<br />

diamonds can polish diamonds.<br />

Many lab-created diamond manufacturers<br />

have gladly risen to the challenge,<br />

approaching third-parties for independent<br />

certification on carbon neutrality, water<br />

use, and more. Perhaps anticipating<br />

scrutiny, Pandora Jewelry commissioned an<br />

independent assessment of its first labcreated<br />

diamond collection, Brilliance – and<br />

Have labcreated<br />

diamonds<br />

become – to<br />

borrow a<br />

tech industry<br />

phrase – the<br />

‘great disruptor’<br />

of natural<br />

diamonds? In<br />

short, no. But<br />

perhaps they<br />

have gone<br />

one better<br />

made the results publicly available at its<br />

launch this year.<br />

One must wonder whether those findings<br />

would have been made public if it went<br />

the ‘other way’ – but it is likely that the<br />

natural diamond sector would have had<br />

something to say about it, as they did when<br />

they protested that Pandora had implied it<br />

had switched to lab-created diamonds for<br />

ethical and sustainability reasons.<br />

While eco-friendly credentials are likely to<br />

remain a bone of contention, the upshot<br />

is two industries striving to create more<br />

transparent and positive products.<br />

And what does this mean for the consumer?<br />

Good things! They are the winners in market<br />

competition, gaining the benefit of choice<br />

to select products that best suit their needs<br />

and their budget.<br />

Indeed, it is the latter that appears to<br />

differentiate lab-created diamonds<br />

most plainly.<br />

A recent consumer survey, conducted by<br />

market research firm The MVEye, found that<br />

while sustainability and ‘green’ credentials<br />

are top of mind when consumers consider<br />

lab-created diamonds, the most important<br />

trigger for purchase is being able to obtain a<br />

larger diamond for less money.<br />

To those who believe that size matters,<br />

lab-created diamonds provide an affordable<br />

alternative. Lightbox Jewelry recently<br />

extended its range to include premium<br />

stones up to 2 carats; incredibly, in 2013<br />

the largest lab-created diamond in the<br />

world – manufactured by Gemesis Diamond<br />

Company – weighed just 1.29 carats.<br />

It is thrilling to consider how the technology<br />

could mature in the coming years, and how<br />

the natural diamond industry will respond,<br />

perhaps creating further value through<br />

innovative cutting and polishing, ever-more<br />

advanced and secure provenance, creative<br />

marketing campaigns, and exclusive<br />

jewellery collections – all of which have<br />

come to the fore in recent years due to<br />

competitive pressure.<br />

It is a cliché, but nonetheless true – without<br />

pressure, we would have no diamonds.<br />

Arabella Roden<br />

Editor<br />

<strong>October</strong> <strong>2021</strong> | 11

Upfront<br />

#Instagram hashtags to follow<br />

#akoyapearl<br />

79,251+ POSTS<br />

#bijoux<br />

12.1 MILLION POSTS<br />

#chocolatediamonds<br />

20,557+ POSTS<br />

#opalring<br />

251,929+ POSTS<br />

#pinktopaz<br />

19,884+ POSTS<br />

HISTORIC GEMSTONE<br />

The Arco<br />

Valley Pearl<br />

4The 575-carat Arco Valley Pearl<br />

is one of the largest natural pearls<br />

in the world. A saltwater baroque<br />

pearl, it is believed to date back to the<br />

11th Century and count Mongolian<br />

emperor Kublai Khan and Marco Polo<br />

among its previous owners.<br />

#radiantcut<br />

49,405+ POSTS<br />

#rosegoldring<br />

95,697+ POSTS<br />

#rubyearrings<br />

42,653+ POSTS<br />

#silverjewelry<br />

4.6 MILLION POSTS<br />

#tsavorite<br />

233,915+ POSTS<br />

Alpha Order<br />

Holes in the pearl suggest it was once<br />

mounted in a tiara or crown. The rest of the pearl's history is unknown, but<br />

it eventually passed into the possession of Austrian nobility, the Arco-Valley<br />

family, from which it derives its current name. The pearl was auctioned in<br />

Abu Dhabi in 2007, valued at $US8 million. The buyer of the pearl and its<br />

current whereabouts are unknown, though it is believed to be in Europe.<br />

Celebrity Style<br />

4Actress Yara Shahidi stunned on the<br />

red carpet at this year's Emmy Awards<br />

wearing a suite of Cartier jewellery<br />

from the Cactus de Cartier Collection,<br />

which is inspired by spiked succulents.<br />

The necklace is crafted in 18-carat<br />

yellow gold set with 170 emeralds<br />

and 204 brilliant-cut diamonds, while<br />

the earrings feature 12 brilliant-cut<br />

diamonds set in 18-carat yellow gold.<br />

Image credit: Getty Images<br />

Image credit: House of Gübelin<br />

Stranger Things<br />

Weird, wacky and wonderful<br />

jewellery news from around the world<br />

Mystery solved<br />

4A woman found on a remote<br />

part of an island in Croatia last<br />

month has been identified as a<br />

former celebrity jeweller. Friends<br />

recognised Slovakian-born Daniela<br />

Adamcova, who previously lived<br />

in Los Angeles and counted Diana<br />

Ross and Barbra Streisand among<br />

her customers, from police photos.<br />

Adamcova was spotted sitting<br />

on a rocky outcrop by a passing<br />

fisherman, who alerted authorities.<br />

She was rescued but had no<br />

memory, phone or identification.<br />

Spectacular specs<br />

4Two pairs of unusual 17th<br />

Century spectacles from the<br />

court of India's Mughal Empire<br />

will be auctioned by Sotheby's<br />

this month. The jewel-encrusted<br />

glasses – named the 'Halo of Light'<br />

and 'Gates of Paradise' – feature<br />

lenses believed to have been<br />

cleaved from a 200-carat diamond<br />

and a 300-carat Colombian<br />

emerald. They have been valued at<br />

£1.5–2.5 million each.<br />

Under a<br />

cryptocurrency<br />

model, customers<br />

would bear<br />

Afterpay's<br />

transaction costs.<br />

Digital Brainwave<br />

4Buy-now, pay-later service Afterpay<br />

has urged the Australian government to<br />

introduce a framework to facilitate the<br />

introduction of cryptocurrencies to its<br />

platform. Doing so would allow the company<br />

to remove many of its merchant fees by<br />

eliminating its reliance on banks.<br />

“Merchants stand to benefit considerably<br />

from the cryptocurrency model, as [debit]<br />

card network fees are entirely removed from<br />

the equation,” Afterpay representatives said<br />

in a Senate inquiry submission.<br />

Jewel Watch<br />

4The House of Gübelin has unveiled its<br />

latest jewellery creation, the Cascading<br />

Springs cocktail ring (above). Featuring<br />

an 8.68-carat emerald and 239 other<br />

gemstones, the design is inspired<br />

by the lush landscape and flowing<br />

waterfalls of the Santa Rosa de Cabal<br />

Hot Springs in Colombia. It took 350<br />

hours to complete.<br />

Keep your hair on!<br />

4Talk about an expensive hairstyle!<br />

Mexican rapper Dan Sur has<br />

taken jewellery to the next level<br />

by having gold and diamond-studded<br />

chains surgically implanted<br />

in his scalp. The performer said, "The<br />

truth is that I wanted to do something<br />

different because I see that everyone<br />

dyes their hair. I hope not everyone<br />

copies me now... This is my hair –<br />

golden hair. The first rapper to have<br />

gold hair implanted in human history."<br />

Sur reportedly underwent the<br />

procedure in April this year.<br />

VOICE OF THE AUSTRALIAN JEWELLERY INDUSTRY<br />

Published by Befindan Media Pty Ltd<br />

Locked Bag 26, South Melbourne, VIC 3205 AUSTRALIA | ABN 66 638 077 648 | Phone: +61 3 9696 7200 | Subscriptions & Enquiries: info@jewellermagazine.com<br />

Publisher Angela Han angela.han@jewellermagazine.com • Editor Arabella Roden arabella.roden@jewellermagazine.com • Production Lauren McKinnon art@befindanmedia.com<br />

Advertising Toli Podolak toli.podolak@jewellermagazine.com • Accounts Paul Blewitt finance@befindanmedia.com<br />

Copyright All material appearing in <strong>Jeweller</strong> is subject to copyright. Reproduction in whole or in part is strictly forbidden without prior written consent of the publisher. Befindan Media Pty Ltd<br />

strives to report accurately and fairly and it is our policy to correct significant errors of fact and misleading statements in the next available issue. All statements made, although based on information<br />

believed to be reliable and accurate at the time, cannot be guaranteed and no fault or liability can be accepted for error or omission. Any comment relating to subjective opinions should be addressed to<br />

the editor. Advertising The publisher reserves the right to omit or alter any advertisement to comply with Australian law and the advertiser agrees to indemnify the publisher for all damages or liabilities<br />

arising from the published material.

SINCE 1998<br />

ITALIAN MADE CHAINS<br />

9 CARAT & 18 CARAT<br />

ITALIAN MADE<br />

TENNIS MOUNTS<br />

3pt - 30pt<br />

(03) 9663 2321<br />

ATHAN.COM.AU<br />

@ATHAN_WHOLESALERS<br />

INFO@ATHAN.COM.AU<br />

602/220 COLLINS ST. MELBOURNE

News<br />

In Brief<br />

Pandora announces new<br />

Gen Z spokespeople<br />

4 Pandora Jewelry has announced a raft of<br />

new celebrity faces as part of its strategy<br />

to appeal to Gen Z and Millennial shoppers,<br />

which it estimates will constitute 60 per<br />

cent of luxury consumers by 2025. These<br />

include new Pandora 'Muses' Precious<br />

Lee, Cici Xiang, and the first male ‘Muse’,<br />

actor and skateboarder Evan Mock, and<br />

the Pandora ME Collective, including TikTok<br />

star Addison Rae and singer Charli XCX.<br />

<strong>Jeweller</strong>y ‘Stock Up & Top Up’ event gets goahead;<br />

full support from buying groups<br />

Delayed JCK Las Vegas<br />

delights attendees<br />

4 US jewellery trade fair JCK Las Vegas<br />

and its 'sister' event, JCK Luxury, had<br />

a successful return after being delayed<br />

due to the COVID-19 pandemic. Held<br />

from 24–30 August <strong>2021</strong>, organiser<br />

Reed Events said 1,200 exhibitors and<br />

more than 10,000 buyers attended. The<br />

next JCK Las Vegas – when the show<br />

will celebrate its 30th anniversary – is<br />

scheduled for 10–13 June 2022.<br />

Tech breakthrough<br />

for melee diamonds<br />

4 UK-based technology firm Opsydia<br />

has developed an ultra-precise laser<br />

marking technique that can place<br />

permanent identifying characters, such<br />

as codes or a logo, under the surface<br />

of melee diamonds. The technology has<br />

been used across diamond samples for<br />

the next phase of the Natural Diamond<br />

Council's Project Assure program, which<br />

assesses diamond detectors.<br />

New coloured gemstone<br />

grading system<br />

4Following three years of development,<br />

the Gübelin Gem Lab has announced<br />

a new rating system for coloured<br />

gemstones. Modelled after Robert<br />

Parker’s wine rating system, it assigns<br />

each specimen a numerical score from<br />

75 to 100, known as Gübelin Points,<br />

based on its gemmological qualities. The<br />

points system is based on thousands of<br />

gemstone reports analysed by Gübelin's<br />

Gemtelligence software.<br />

NSW Health has cleared Stock Up & Top Up Sydney to take place in November, with buying groups throwing their<br />

support behind the event.<br />

The NSW government’s recent announcement<br />

regarding the easing of COVID-19 restrictions<br />

has meant the pre-Christmas trade event,<br />

Stock Up & Top Up – scheduled for Sunday 7<br />

and Monday 8 November at the International<br />

Convention Centre (ICC), Darling Harbour – is<br />

approved to run.<br />

Gary Fitz-Roy, managing director of Stock<br />

Up & To Up organiser Expertise Events, said,<br />

“NSW Health has approved our event within<br />

the new orders, and we are updating our<br />

COVID plans.”<br />

Fitz-Roy added that the industry is in dire<br />

need of a trade event to reconnect, and that<br />

the current lockdown has had a very different<br />

impact on retailers than the 2020 lockdown.<br />

For those reasons, it is “even more significant<br />

that all four jewellery buying groups have<br />

announced that they will attend.”<br />

“Since announcing Stock Up & Top Up last<br />

week, it’s fantastic that Nationwide, Showcase,<br />

Independent <strong>Jeweller</strong>s Collective and Leading<br />

Edge are all supporting the event and will be<br />

there to meet their members and suppliers<br />

face-to-face to support uniting the industry at<br />

this most important time,” Fitz-Roy said.<br />

“There is such pent-up demand to reconnect<br />

and get on with our day-to-day routine and<br />

business, and it's an important time to ensure<br />

retailers have the latest stock, and enough<br />

stock, for Christmas and the New Year,”<br />

he added.<br />

Colin Pocklington, managing director of<br />

Nationwide <strong>Jeweller</strong>s, said, "Following a long<br />

lockdown period it is essential that retailers<br />

have a highly successful trading period in the<br />

lead up to Christmas.<br />

"Very buoyant trading in the states with<br />

minimal lockdown periods shows that<br />

consumers are looking to buy jewellery, just as<br />

they did following the lockdown from March to<br />

June in 2020.”<br />

Nicola Adams, chief operating officer,<br />

Showcase <strong>Jeweller</strong>s, said she was looking<br />

forward to the SUTU event.<br />

“I am sure it will be a great show for us to<br />

reconnect with our membership. Showcase<br />

is preparing for a strong Christmas once<br />

we finally re-open in many states after long<br />

lockdowns,” Adams said.<br />

Echoing Adams and Pocklington’s sentiments,<br />

Josh Zarb, CEO of Independent <strong>Jeweller</strong>s<br />

Collective, said, “The timing of Stock Up<br />

& Top Up works perfectly for us to provide<br />

our retailers the chance to see everything<br />

‘live’ and we will use the opportunity to<br />

look at as much product as possible for<br />

our 2022 season.”<br />

Claire Packett, head of category at Leading<br />

Edge Group <strong>Jeweller</strong>s, said she was “looking<br />

forward to welcoming members and suppliers<br />

to Stock Up & Top Up in November,” adding,<br />

“We also look forward to supporting and<br />

helping to bring people across the industry<br />

together, for what we hope is a strong and<br />

profitable Christmas for all.”<br />

Stock Up & Top Up will be hosted in a<br />

spacious Premier Room of the ICC Gallery,<br />

with a gift industry event in an adjacent room,<br />

and will include Christmas drinks on Sunday.<br />

Fitz-Roy explained that limited spaces would<br />

be available in order to maintain a sensible<br />

buyer-to-seller ratio, along with offering a<br />

cost-effective package.<br />

"We are all hoping that we can finish the year<br />

on a high,” he added.<br />

14 | <strong>October</strong> <strong>2021</strong>

Former Pandora executive accused of<br />

abandoning latest jewellery company<br />

Following the closure of his multi-level-marketing business JN <strong>Jeweller</strong>y, Jesper<br />

Nielsen came under fire as his fraught business history was revealed.<br />

Following the abrupt closure of his multi-level-marketing (MLM) jewellery<br />

business JN <strong>Jeweller</strong>y/JN Jewelry, many people came forward with<br />

additional information and complaints about its founder Jesper 'Kasi'<br />

Nielsen, a former Pandora Jewelry executive.<br />

While the MLM business model can offer a legitimate sales structure, the<br />

industry has been fraught with illegal operations that are, instead, pyramid<br />

schemes. Nielsen is believed to have launched JN <strong>Jeweller</strong>y in Europe in<br />

early 2020 and expanded into Australia in March <strong>2021</strong>.<br />

According to those involved, it had attracted more than 70,000 ‘ambassadors’<br />

– a buzz term used to describe salespeople recruited as paid members to<br />

sell the jewellery on a commission-only basis – at the time of its closure on<br />

10 September <strong>2021</strong>.<br />

A petition titled ‘Justice For Our Ambassadors for JN ruining their<br />

reputations’ published on the activist website Change.org says JN <strong>Jeweller</strong>y<br />

“shut down with zero warning”, claims that more 4,500 orders were still<br />

awaiting shipment, and that “thousands of ambassadors [members] haven’t<br />

even received July commissions, let alone August. Some have unspent<br />

credits they issued for their pay in their back office still.”<br />

Several former members have provided additional information about JN<br />

<strong>Jeweller</strong>y, saying that Nielsen consistently promoted – and heavily relied<br />

upon – his previous connection with Pandora to attract new members.<br />

Mary Francese, a JN <strong>Jeweller</strong>y member from the US who started the<br />

Change.org petition, explained to jewellery industry publication JCK<br />

Online that she had spent four years working in various MLM businesses,<br />

saying that she was first attracted to JN <strong>Jeweller</strong>y through Facebook<br />

advertisements.<br />

“Usually very little stands out to me. But with COVID, the kitchenware brand<br />

I was working with had a lot of supply backups. And when I saw this post,<br />

it talked about jewellery, it talked about how it involved the co-founder of<br />

Pandora,” Francese said.<br />

“I thought, it would be stupid not to pursue this. Pandora was a really<br />

successful company. The product, the compensation plan, it all seemed<br />

perfect.”<br />

Francese, a stay-at-home mother, explained to JCK that she had “spent<br />

nearly seven months selling Jesper Nielsen (JN) jewellery, eventually<br />

becoming a company ‘World Leader’ and joining its customer service team”<br />

in a paid role; however, complaints from members quickly overwhelmed her.<br />

CONTINUED ON PAGE 20

News<br />

Pandora Jewelry restructures Asia-Pacific operations<br />

Pandora is restructuring its Asia-Pacific operations, with<br />

its regional headquarters – excluding China – moving to<br />

Sydney. Image: Pandora x Disney Collection charms<br />

Just 18 months after restructuring its<br />

international operations, jewellery company<br />

Pandora has announced it will eliminate one of<br />

its 10 regional divisions, consolidating its Asia-<br />

Pacific operations in the process.<br />

The company announced the closure of<br />

three regional headquarters in March 2020<br />

– alongside the loss of 180 jobs – when it<br />

restructured the business into 10 ‘Clusters’, with<br />

the Asia-Pacific region divided into China, Pacific<br />

and Rest-of-Asia.<br />

However, the Rest-of-Asia division, including<br />

Hong Kong, Japan, and Singapore, will now be<br />

assimilated into existing Clusters.<br />

David Allen, current general manager of the<br />

Pacific Cluster – which includes Australia and<br />

New Zealand and is based in Sydney – will take<br />

control of the Japan and Singapore markets, as<br />

well as 11 other distributor-controlled markets<br />

throughout Southeast Asia and Korea.<br />

Allen told <strong>Jeweller</strong>, "The leadership team in<br />

the Pacific is reviewing the required resources,<br />

including the current organisational structure,<br />

to ensure that we are able to realise the full<br />

potential of our expanded Pacific and Greater<br />

Asia business."<br />

Meanwhile the Hong Kong, Taiwan, and Macau<br />

markets will be absorbed into the new Greater<br />

China Cluster, headquartered in Shanghai<br />

and led by current China general manager<br />

Jacques Roizen.<br />

The transition is scheduled to be completed<br />

by February 2022, at which point Rest-of-Asia<br />

general manager Alan Chan will depart<br />

the company.<br />

According to a statement from Pandora, the<br />

decision to reduce the number of regional<br />

clusters was made to “optimise our operating<br />

structure and create further commercial<br />

synergies – with the overall goal of capturing the<br />

growth opportunities that we are targeting in our<br />

new Phoenix strategy.”<br />

Phoenix is the title of Pandora’s new strategic<br />

initiative, announced at the end of Q1 <strong>2021</strong>.<br />

As part of the strategy, Pandora has announced<br />

it a DKK1 billion ($AU216 million) expansion<br />

of its southeast Asian manufacturing facilities,<br />

including a new factory in Vietnam.<br />

<strong>Jeweller</strong>y sales slump as lockdowns continue; Christmas 'rebound' predicted<br />

Extended lockdowns in NSW and Victoria<br />

have taken a heavy toll on jewellery sales<br />

during September, according to data compiled<br />

by Retail Edge Consultants from stores<br />

across Australia.<br />

Overall, Retail Edge’s latest report found that<br />

sales in dollars decreased by 25 per cent<br />

compared with September 2020, while sales in<br />

units dropped by 28 per cent.<br />

All categories of jewellery recorded double-digit<br />

declines when compared with the same period<br />

last year.<br />

However, the steepest falls were sales of<br />

diamond-set precious metal jewellery and<br />

silver and alternative metals jewellery, which<br />

fell 31 per cent and 27 per cent respectively<br />

compared with September 2020, and 19 per cent<br />

and 18 per cent compared with September 2019.<br />

Commenting on the results, the report’s<br />

authors noted, “The figures are impacted by<br />

the number of stores with limited trading in<br />

September; however, the picture shows that<br />

those stores that were able to open during the<br />

month showed a strong rebound effect.<br />

“This has been the same pattern that we have<br />

observed each time there has been a lockdown<br />

and re-open process.<br />

"We believe that pattern will continue, so if<br />

you are closed, make sure that you are fully<br />

prepared for when you are able to open.<br />

Historically, there has been pent up consumer<br />

demand for jewellery when this happens.”<br />

The report went on to recommend jewellers<br />

encourage customers to “buy early” or put<br />

items on layby given the holiday shopping<br />

season is rapidly approaching.<br />

“Australia Post said that September parcel<br />

numbers were larger than their previous largest<br />

month, December 2020.<br />

"Out-of-stocks and shipping delays will<br />

be inevitable,” the report said. “Encourage<br />

customers to adopt the early bird philosophy –<br />

‘If you like it and you see it, buy it.’”<br />

Diamond-set precious metal jewellery was the hardesthit<br />

category in September as jewellery sales fell<br />

by 25 per cent across the board, though a Christmas<br />

recovery is expected.<br />

16 | <strong>October</strong> <strong>2021</strong>

Precious metal refinery and casting house publishes sustainability report<br />

Pallion has detailed its sustainability initiatives across<br />

the FY<strong>2021</strong> in a new report, including new recycling and<br />

low-waste technology.<br />

The Pallion group of companies – which includes<br />

ABC Refinery and Palloys – has released its<br />

annual sustainability report, which details<br />

the group’s policies and performance across<br />

environmental, community, health, and industrial<br />

standards.<br />

Titled Considerate Precious Metals, the report<br />

was developed by the company’s Sustainability,<br />

Environment, Health & Safety Committee with<br />

oversight from the Pallion board of directors,<br />

and was prepared in accordance with the Global<br />

Reporting Initiative, an independent, international<br />

standards organisation.<br />

David Woodford, chief commercial officer<br />

at Pallion, said, “At Pallion, the concept<br />

of sustainability is not about lip service to<br />

the market, it’s an important part of our<br />

business model.”<br />

Andrew Cochineas, CEO Pallion, added, “This<br />

report evidences the collective efforts of Pallion,<br />

its clients and suppliers to sustainability<br />

initiatives over the <strong>2021</strong> financial year and in that<br />

regard is a true representation of our corporate<br />

ethos of partnership.<br />

“Our hope is that continued improvement will<br />

result in collective social and commercial<br />

success,” he added.<br />

Notably, Pallion introduced a number of initiatives<br />

during the FY<strong>2021</strong> financial year to improve<br />

provenance and production of precious metals.<br />

ABC Refinery doubled the size of its Acidless<br />

Separation System (ALS) to establish what<br />

it claims is the largest ALS refining capacity<br />

worldwide; ALS provides “significant advantages<br />

to traditional refining techniques including inert<br />

refining emissions and significantly reduced<br />

refining time which in turn reduces energy<br />

consumption,” according to Pallion’s report.<br />

ABC Refinery also made “significant<br />

improvements” in the recovery of metallic silver<br />

from silver chloride, a by-product of electrolytic<br />

silver refining, and improved the extraction of<br />

residual precious metals at its sweeps treatment<br />

plant by 60 per cent through the installation of<br />

new crushing and grinding mechanisms.<br />

The report also explored Pallion's workplace<br />

diversity and charity initiatives.

News<br />

New Zealand jeweller launches new precious<br />

metal alloy following decade of development<br />

Master jeweller Hugh Gillbanks has spent more than 10 years developing Starium, a high-performance alloy, for<br />

the jewellery industry. Pictured: <strong>Jeweller</strong>y crafted from Starium; Hugh Gillbanks at the bench<br />

STERLING SILVER<br />

CUBIC ZIRCONIA<br />

RRP $169 RRP $219 RRP $259<br />

RRP $289 RRP $259 RRP $299<br />

FOR STOCKIST ENQUIRIES<br />

+61 413 872 810<br />

INFO@BIANC.COM.AU<br />

@BIANC_JEWELLERY<br />

WWW.BIANC.COM.AU<br />

Following more than 10 years of development,<br />

a new metal alloy created by master jeweller<br />

Hugh Gillbanks is now available to the<br />

jewellery industry.<br />

The alloy, named Starium for its celestial<br />

lustre, polishes up to the same colour as<br />

rhodium but does not require rhodium<br />

plating, and has proven resistant to tarnish<br />

and corrosion as well as displaying superior<br />

workability, according to its inventor.<br />

Gillbanks told <strong>Jeweller</strong>, “You can roll it,<br />

fabricate it, it can be cast; it works exactly the<br />

same as any other metal you'd use.<br />

“The benefits are that it's a high-temperature<br />

metal, so it's very easy to solder and keep<br />

clean. When you're soldering it and you<br />

put it back into the acid, it takes away<br />

all the fireburn.<br />

“If you polish it first, it comes out exactly how<br />

you'd polish it after you'd worked with it,” he<br />

explained, adding, “<strong>Jeweller</strong>s will be blown<br />

away by what it does, what it's like to use, and<br />

what they can make with it. It files, bends, and<br />

sets beautifully. It seems too soft to set with at<br />

first, but it's harder than other metals."<br />

Gillbanks had begun his career in the industry<br />

at 16, later moving into luxury custom-makes,<br />

master patterns and design.<br />

He began developing the alloy more than<br />

10 years ago, when he was approached by<br />

his friend Kotin Ma – a geologist, gemstone<br />

collector, and New Zealand tourism operator –<br />

to create metallic beads from a meteorite.<br />

“He is a very spiritual person and I had<br />

made a lot of jewellery for him and his<br />

customers overseas, using a variety of<br />

different gemstones.<br />

"He asked me if I could make beads from<br />

a meteorite, and I said no, nobody could!<br />

Instead, I suggested we create a new precious<br />

metal that could be used for anything,”<br />

Gillbanks recalled.<br />

Ma – now Gillbanks' business partner – also<br />

wanted to develop a metal that wouldn't cause<br />

an allergic reaction, as his wife's wedding ring<br />

did while on their honeymoon.<br />

"That was the first and last time she wore her<br />

original ring!" Ma told <strong>Jeweller</strong>. "I wouldn't<br />

want any other couples to go through what we<br />

did that day. She could not wear any jewellery<br />

that wasn't platinum or high-carat gold – until<br />

we developed our metal."<br />

Gillbanks said it had taken six years to bring<br />

Starium up to industry standards.<br />

"It can do anything that every other metal on<br />

the market can do,” he told <strong>Jeweller</strong>, adding<br />

that friends and family – including Ma and his<br />

wife – have worn Starium jewellery for years.<br />

In 2010, a prototype of the metal was assessed<br />

by Professor Milo Kral from the University of<br />

Canterbury in Christchurch, New Zealand.<br />

However, while the metal was patented in both<br />

New Zealand and Australia, progress was<br />

halted by the devastating 2011 Christchurch<br />

Earthquake when samples were lost before<br />

they could be tested.<br />

Following a protracted rebuilding phase,<br />

Starium is "finally ready to go out to the market<br />

and everything is in place", with Gillbanks –<br />

now based in Queensland – partnering with an<br />

Australian factory to manufacture Starium at<br />

scale for the jewellery industry.

Buying group announces pre-Christmas 'expo'<br />

Nationwide <strong>Jeweller</strong>s, Australasia’s largest<br />

jewellery buying group, has announced<br />

its Pre-Christmas Expo virtual event will<br />

return for a second year to assist retailers in<br />

stocking up ahead of the holiday season.<br />

Colin Pocklington, managing director,<br />

Nationwide, praised the Expo format, saying,<br />

“Our 2020 Expo was a huge success with<br />

our participating suppliers achieving<br />

substantial orders. There was also great<br />

participation from members in the webinar<br />

program that we ran over the two-week Expo<br />

period,” he added.<br />

This year’s Expo will take place from<br />

Monday 25 <strong>October</strong> to Friday 5 November,<br />

with more than 70 of Nationwide’s preferred<br />

suppliers taking part.<br />

The virtual Expo platform features three<br />

supplier ‘pavilions’ – Australia, New Zealand<br />

and International – and each supplier ‘stand’<br />

comprises a video message, Expo special<br />

offer, and list of best-selling products.<br />

Members will be able to order from the<br />

‘stand’ or by contacting the supplier directly.<br />

Each Nationwide member will be allocated<br />

up to $60,000 in ‘Expo Dollars’ – depending<br />

on their Member Reward Scheme level – to<br />

pay over six months, interest-free.<br />

In order to provide flexibility to retailers in<br />

different states, Nationwide has“made our<br />

Expo Dollars available over an extended<br />

period from early <strong>October</strong> to mid-November,”<br />

Pocklington explained.<br />

In addition to special offers from suppliers,<br />

the Expo will also include a keynote address<br />

from Pocklington. daily online workshops<br />

focused on business management, and a<br />

specialist question-and-answer panel.<br />

Plus, a number of social events are set<br />

to take place, including a Melbourne<br />

Cup-themed virtual session on Tuesday 2<br />

November and a concluding Happy Hour on<br />

Friday 5 November, where Nationwide’s <strong>2021</strong><br />

Apprentice of the Year and <strong>2021</strong> Members<br />

and Suppliers of the Year for Australia and<br />

New Zealand will be announced.<br />

Hollywood star returns for natural<br />

diamond advertising campaign<br />

Chinese markets last year. David Kellie, CEO<br />

of the NDC, said, “Diamond jewellery sales<br />

have seen record-breaking growth as we<br />

emerge from the pandemic.<br />

"We're thrilled to have Ana de Armas back<br />

with us for another year to share the magic of<br />

natural diamonds with a global audience."<br />

The Natural Diamond Council has released its<br />

second campaign with actress Ana de Armas.<br />

Image credit: Natural Diamond Council<br />

The Natural Diamond Council (NDC) –<br />

formerly known as the Diamond Producers<br />

Association – has revealed its second<br />

large-scale advertising campaign starring<br />

actress Ana de Armas.<br />

De Armas, who is set to star in the upcoming<br />

James Bond film No Time To Die and is<br />

best-known for roles in Knives Out and<br />

Blade Runner 2049, was named the NDC’s<br />

international ‘face’ in 2020.<br />

Her previous campaign for the organisation<br />

was distributed across the US, UK, Indian and<br />

The new campaign, named ‘Love Life’,<br />

features De Armas wearing a custom-made<br />

11-piece diamond jewellery collection by<br />

jewellery designer Malyia McNaughton, who<br />

was part of the NDC’s Emerging Designers<br />

Diamond Initiative earlier this year.<br />

De Armas emphasises the “joy and hope”<br />

of the campaign, saying, “It was an amazing<br />

experience working with this incredible team<br />

and I couldn't be happier to be working again<br />

with the Natural Diamond Council.”<br />

Notably, McNaughton’s collection – which<br />

features current trends including “gender<br />

fluidity, heavy metal chains, and the<br />

marquise cut” – has been made available<br />

to international retailers to either stock or<br />

manufacture for the holiday season.

News<br />

In Brief<br />

International watch and<br />

jewellery sales slow<br />

4 Market analysis firm The Mercury<br />

Project has published its latest report into<br />

international watch and jewellery sales.<br />

Following a strong recovery in the first<br />

half of the year, the report notes "pent up<br />

demand" has "softened" with July showing<br />

a 23.9 per cent rise compared with 2020,<br />

versus 150.9 per cent in May. However, its<br />

overall sales index for the first seven months<br />

of the year is 8.8 per cent above 2019.<br />

E-commerce jewellery<br />

company goes public<br />

4 Brilliant Earth, which manufactures<br />

and retails personalised bridal<br />

jewellery, has successfully launched<br />

its initial public offering (IPO) on the<br />

NASDAQ in New York, with its share<br />

price rising by 43 per cent, from $US12<br />

to $US17.16, on its first day of trading.<br />

According to Forbes, Brilliant Earth's<br />

sales increased 25 per cent in 2020,<br />

reaching $US251.8 million.<br />

Ellendale Mine owner<br />

purchases yellow stones<br />

4 Burgundy Diamond Mines, which<br />

took control of Western Australia's<br />

Ellendale Mine in March, has announced<br />

the purchase of $US1 million in Fancy<br />

Vivid and Fancy Intense yellow diamonds<br />

from the Ekati Mine in Canada. The<br />

stones will be cut and polished at<br />

Burgundy's specialist facility in Perth,<br />

before being marketed as the company's<br />

"first branded diamond product".<br />

Omega gets royal<br />

seal of approval<br />

4Watch brand Omega, part of the<br />

Swatch Group, can count HRH Prince<br />

William among its fans. Observers noted<br />

the royal wearing an Omega Seamaster<br />

Diver to the premiere of the James<br />

Bond film No Time To Die – of which<br />

Omega is a sponsor, adorning the wrist<br />

of the iconic fictional spy. However, the<br />

prince's timepiece is in fact his everyday<br />

watch of choice, gifted to him by his late<br />

mother Princess Diana.<br />

Former Pandora executive accused of<br />

abandoning latest jewellery company<br />

CONTINUED FROM PAGE 15<br />

Another member, who contacted <strong>Jeweller</strong>,<br />

said Nielsen “planted seeds of dreams in over<br />

76,000 people, he got them to spend money<br />

for higher commissions... Creating urgency to<br />

purchase at discounted rates, but it became<br />

clear when his sales never stopped and his<br />

‘newly’ named products arrived branded with<br />

Endless [Jewelry] and Amazing [Jewelry], that<br />

something was seriously not right.”<br />

One member told <strong>Jeweller</strong> she had joined<br />

the business just four weeks before it closed<br />

and like many others, was out-of-pocket for<br />

product inventory.<br />

Describing the unexpected closure of<br />

the business, the member said, “On 10<br />

September we were told JN had gone into<br />

administration.<br />

"When we tried to contact customer<br />

service and Jesper via Facebook for further<br />

information, all points of contact and Jesper’s<br />

social media accounts had been closed."<br />

“We have searched for a point of contact for<br />

Jesper but he has vanished off the face of the<br />

Earth,” she added.<br />

Nielsen was initially a European Pandora<br />

distributor and a member of its management<br />

team, before resigning as president of its<br />

Central Western Europe subsidiary in 2011.<br />

He was bound by a non-compete clause until<br />

1 June 2013, whereby he immediately founded<br />

Endless Jewelry.<br />

Despite experiencing a rapid expansion,<br />

Nielsen left Endless Jewelry in February<br />

2016; the company declared bankruptcy in<br />

November that year.<br />

In June 2016, Nielsen opened the first<br />

Amazing Jewelry store in Copenhagen. It<br />

operated on a franchise business model<br />

and reportedly reached a store count of 60.<br />

However, media reports in August 2018 stated<br />

that five German stores were closed amid<br />

insolvency proceedings.<br />

The last remaining store – the Copenhagen<br />

flagship – was closed by Nielsen in February<br />

<strong>2021</strong>, one month after Nielsen’s company<br />

Kasi Brands went into bankruptcy. According<br />

to Danish media, Nielsen was declared<br />

personally bankrupt on 17 November 2020<br />

and currently lives “for rent” in Majorca, Spain.<br />

Nielsen has also been embroiled in legal<br />

disputes with Pandora since leaving the<br />

company a decade ago.<br />

In 2017, Denmark’s Maritime and Commercial<br />

High Court ruled that Nielsen had unlawfully<br />

used the Pandora trademark to promote<br />

Amazing Jewelry.<br />

He had been warned against using the<br />

Pandora name before, with a Danish website<br />

covering trademark law reporting that<br />

Pandora had "found reason to voice their<br />

concern towards Mr Nielsen’s continuous<br />

use of Pandora again in the spring of<br />

2015, and in June 2016 Pandora obtained<br />

a default judgment.”<br />

“It became clear when his sales never<br />

stopped and his ‘newly’ named products<br />

arrived branded with Endless [Jewelry]<br />

and Amazing [Jewelry], that something<br />

was seriously not right”<br />

FORMER JN JEWELLERY MEMBER<br />

Three years after his departure from Pandora,<br />

Nielsen also self-published a book entitled<br />

Inside Pandora, and which was promoted as:<br />

“A simple and unconventional approach to<br />

business by one of the key players behind the<br />

billion-dollar global enterprise.”<br />

At the time of Nielsen’s resignation from the<br />

Pandora board, his company Kasi ApS – also<br />

known as Kasi Group – sold its shares in the<br />

business for an initial payment of DKK385<br />

million ($AU83.5 million) with a second<br />

payment promised based on future earnings.<br />

In 2015, Nielsen contended that Pandora<br />

had not honoured this second payment and<br />

insisted that he was owed DKK753 million<br />

($AU164 million) – later increased to more<br />

than DKK2 billion ($AU430 million).<br />

Pandora has consistently denied Nielsen’s<br />

claim. The case has since moved into<br />

arbitration; however, Kasi ApS was fined<br />

DKK5 million ($AU1.09 million) in 2020 due to<br />

Nielsen's breach of a confidentiality clause.<br />

According to a Finans.dk report, the fine was<br />

not paid, forcing Kasi ApS into bankruptcy.<br />

During more recent court proceedings,<br />

Nielsen is reported as saying: “It is expensive<br />

to be Jesper Nielsen, and I am good at<br />

making money."<br />

The future for his reported 76,000 JN<br />

<strong>Jeweller</strong>y ‘ambassadors’ is unknown – as<br />

are any monies owed to them.<br />

<strong>Jeweller</strong> has attempted to contact Jesper<br />

Nielsen. His personal website jespernielsen.<br />

com is non-functioning and various emails to<br />

the business have ‘bounced’.<br />

20 | <strong>October</strong> <strong>2021</strong>

Sky-high sales for fashion jewellery chain Lovisa amid COVID expansion<br />

Lovisa has announced positive financial results for<br />

FY21, following its acquisition of German jewellery and<br />

accessories retail firm Beeline Group.<br />

Fashion jewellery retailer Lovisa has announced<br />

a $42.7 million profit to 20 June <strong>2021</strong>, a 39.4 per<br />

cent increase compared to the previous year. Total<br />

sales reached $288 million – an increase of 18.9<br />

per cent over FY20 ($243 million).<br />

Despite the global pandemic, same-store sales<br />

increased by 8 per cent over FY20, while one of<br />

the largest growth sectors was the company’s<br />

e-commerce strategy, which delivered 178 per<br />

cent growth in FY21.<br />

Gross margin was up 77 per cent, while gross<br />

profit increased 18 per cent to $221 million.<br />

The fashion jewellery chain started in Australia<br />

more than a decade ago, however 72 per cent<br />

of its current 544-store network is now located<br />

outside<br />

of Australia. Lovisa is owned by the ASX-listed<br />

BB Retail Capital, founded by retail entrepreneur<br />

Brett Blundy.<br />

Lovisa’s store count dramatically increased in<br />

December last year when it acquired German<br />

retail firm Beeline Group, which operated 114<br />

fashion jewellery and accessories stores across<br />

Germany, Switzerland, the Netherlands, Belgium,<br />

Austria, Luxembourg, and France, under the<br />

brands Six and I Am.<br />

Along with 22 new stores, 87 of the 114 Six and<br />

I Am outlets were converted to Lovisa, with the<br />

“remainder exited at or around the time of the<br />

handover”, the company stated.<br />

As previously reported by <strong>Jeweller</strong>, the Beeline<br />

acquisition was for a nominal €70 ($AU113), with<br />

Lovisa taking over €3 million in bank guarantees<br />

associated with the leases on the Beeline Group<br />

stores. Lovisa is obliged to pay Beeline Group<br />

an additional €3 million from its existing credit<br />

facilities before 31 March 2022.<br />

Lovisa's US store count increased from 48 in<br />

FY20 to 63 by June <strong>2021</strong>. It has been reported<br />

that Lovisa received about $12 million in<br />

JobKeeper and other wage subsidies for stooddown<br />

staff while, at the same time, did not pay<br />

rent while stores were closed.<br />

Lovisa was listed on the ASX at $2 per share in<br />

December 2014 and at the time of publication was<br />

trading at $18.83.<br />

International trade show makes successful return in India<br />

Following the cancellation of its 2020 edition due<br />

to the COVID-19 pandemic, the India International<br />

<strong>Jeweller</strong>y Show (IIJS) Premiere made a triumphant<br />

return last month.<br />

The show – held from 15–19 September in the<br />

city of Bengaluru – recorded approximately<br />

1,300 exhibitors and 21,000 visitors, including<br />

more than 300 international buyers, according<br />

to organiser the Gem & <strong>Jeweller</strong>y Export<br />

Promotion Council (GJEPC).<br />

Prior to the pandemic, IIJS Premiere would attract<br />

35,000–40,000 visitors, of which more than 1,000<br />

were international buyers.<br />

The GJEPC claims it is the first large-scale,<br />

international, and entirely physical jewellery<br />

trade show to be held since the pandemic began.<br />

Notably, the <strong>2021</strong> event was held outside Mumbai<br />

for the first time in the show’s history due to<br />

COVID-19 restrictions in the city.<br />

According to a GJEPC statement, the show<br />

generated “business worth $US6.75 billion”<br />

($AU9.4 billion).<br />

“The success of IIJS Premiere <strong>2021</strong> is a clear<br />

indication that the gem and jewellery industry<br />

has shrugged off the pandemic’s effects on the<br />

sector and the economy at large,” the statement<br />

continued.<br />

Colin Shah, chairman of the GJEPC, said, “We are<br />

delighted that IIJS Premiere has generated an<br />

estimated $US6.75 billion worth of business. We<br />

are already witnessing a surge in exports and are<br />

confident that the industry will achieve the export<br />

target of $US43.75 billion this year.”<br />

Shah also thanked the Karnataka State<br />

Government and the show’s venue, the Bangalore<br />

International Exhibition Centre, which was subject<br />

to rigorous safety regulations including an on-site<br />

COVID-19 testing centre, ambulance, quarantine<br />

room, and on-call doctor.<br />

Attendees were required to have at least one<br />

dose of a COVID-19 vaccine, as well as produce a<br />

negative test within 48 hours prior to attendance.<br />

The GJPEC statement noted international<br />

buyers from Bangladesh, the UK, USA, Thailand,<br />

Singapore, Australia, the United Arab Emirates,<br />

and Nepal had placed orders at the show.<br />

The India International <strong>Jeweller</strong>y Show (IIJS) Premiere<br />

<strong>2021</strong> was held in Bengaluru in September, attracting<br />

21,000 visitors. Image: Dignitaries launch the IIJS<br />

Premiere <strong>2021</strong><br />

<strong>October</strong> <strong>2021</strong> | 21

10 Years Ago<br />

Time Machine: <strong>October</strong> 2011<br />

A snapshot of the industry events making headlines this time 10 years ago in <strong>Jeweller</strong>.<br />

Historic Headlines<br />

4 Five more years for Expertise Events<br />

4 Michael Hill profits<br />

4 Big win for Queensland jewellers<br />

4 Georgini heads overseas<br />

4 Celebrity launches diamond collection<br />

Diamond investment fund<br />

Australian investors will have the chance to<br />

contribute to the Australian arm of a new $US250<br />

million diamond asset fund.<br />

The Diamond Asset Fund (DAF 1) is a joint<br />

venture between Canadian retailer Harry Winston<br />

Diamonds and Zürich-based advisor, Diamond<br />

Asset Advisors (DAA) and involves Harry Winston<br />

sourcing diamonds which will then be consigned<br />

to it by the fund; when sold, Harry Winston will pay<br />

the fund the prevailing market price as determined<br />

by its cost to replace the diamond.<br />

Formed in May this year, the partnership is<br />

raising funds from institutional investors. It will be<br />

managed locally by Melbourne-based investment<br />

advisor Bristow Shaw & Company, which aims to<br />

raise $30 million from "institutions" and "high networth<br />

parties".<br />

Young jewellers meet in Sydney<br />

The Young <strong>Jeweller</strong>s Group (YJG) met for the first<br />

time at the Sydney fair in August for cocktails and<br />

conversation.<br />

Hosted by <strong>Jeweller</strong> editor Coleby Nicholson, the<br />

function was attended by about 30 people including<br />

some senior members of the industry, who offered<br />

help and guidance.<br />

Nicholson, who instigated the meeting, said that<br />

<strong>Jeweller</strong> magazine was essentially a conduit for<br />

encouraging the group to form ideas and network<br />

together, in order to enhance their future.<br />

NSW-based young jeweller Ewen Ryley has been<br />

managing the group's Facebook page and urged<br />

fellow young jewellers to get on board. Young<br />

jewellers from New Zealand have also joined the<br />

YJG, including Naeem Alhaseny from Marqueez<br />

<strong>Jeweller</strong>y, who said she was eager to network with<br />

other jewellers.<br />

<strong>October</strong> 2011<br />

ON THE COVER Storch & Co.<br />

Editor’s Desk<br />

4Look In The Mirror First:“While<br />

I sympathise with jewellers' concerns<br />

about how the industry has changed,<br />

longing for the 'good ol' days' won't<br />

change a thing.<br />

"Ridiculing successful brands for their<br />

popularity with consumers or agitating<br />

for government protection of traditional<br />

business models is misguided to say the<br />

least. If your business is struggling, the<br />

first place to look is in the mirror, rather<br />

than across the road!"<br />

Soapbox<br />

4The Importance of Trade Fairs<br />

“The core reason for trade fairs is<br />

obvious; for buyers to meet with<br />

existing, and new, sellers. But what<br />

is often overlooked is that fairs also<br />

provide a way for those in the industry<br />

to network and help each other.<br />

"Many people seem to think a<br />

successful fair is just about getting<br />

numbers through the door – I<br />

disagree. It's the quality of the<br />

audience that's important, not<br />

the quantity."<br />

– Gary Fitz-Roy, managing director,<br />

Expertise Events<br />

STILL RELEVANT 10 YEARS ON<br />

Child's Play:<br />

No longer content to be told what to wear<br />

by mum or dad, these chic kids often<br />

dictate what purchases are to be made.<br />

Influenced by peers, celebrities, and a<br />

greater exposure to what's available via<br />

the internet and social media, these kids<br />

know what they want and once they<br />

arexposed to a product, hopefully remain<br />

loyal in the long-term.<br />

Ayres acquires competitor<br />

Melbourne-based company Kenneth Ayres<br />

has acquired its competitor, Davies Ferguson,<br />

which will cease operations on 31 August 2011<br />

after 30 years in business.<br />

Kenneth Ayres has acquired the business<br />

assets in the form of stock, plant and<br />

equipment, but not the 'Davies Ferguson'<br />

trading name. Paul Chaston, Ayres national<br />

sales manager, said: "We knew they wanted<br />

to move on. Our relationship has always been<br />

respectful, despite being competitors, and it<br />

has been an amicable transition."<br />

Chaston believes the combination of both Ayres<br />

and Davies Ferguson gives customers a greater<br />

level of choice.<br />

US jewellery sales expert<br />

in Australia<br />

US based sales expert Shane Decker was in<br />

Australia recently to head a series of seminars<br />

on jewellery retailing.<br />

Visiting for the first time, Decker inspired<br />

audiences with his charistmatic speech and<br />

proactive approach to retailing.<br />

The first seminar, entitled, 'Anatomy of a<br />

diamond sale', saw Decker deliver practical<br />

tools encompassing everything from the<br />

importance of showing diamonds on a<br />

daily basis to the consistency of excellent<br />

customer service.<br />

Decker also conducted one-hour seminars on<br />

customer loyalty and customer service, noting<br />

Australian retailers "lack accountability".<br />

READ ALL HEADLINES IN FULL ON<br />

JEWELLERMAGAZINE.COM<br />

22 | <strong>October</strong> <strong>2021</strong>

SUPPORT SERVICES FOR<br />

INDEPENDENT JEWELLERS<br />

“We guarantee that you will be financially better with Nationwide.”<br />

Colin Pocklington, Managing Director<br />

• Marketing • Sales Training • Business Planning<br />

• STAY 100% INDEPENDENT•<br />

• NETWORKING • COST SAVINGS • INDUSTRY SUPPORT<br />

the largest network with over 450 jewellery stores<br />

P: +61 2 9418 0000 E: info@jgbs.com www.jgbs.com

INSIDE<br />

Now & Then<br />

JM Leech <strong>Jeweller</strong>s<br />

Celebrating 93 Years • BENDIGO, CASTLEMAINE, ECHUCA, AND MARYBOROUGH, VIC • A moment with Adam Tuohy, director<br />

MILESTONES<br />

L to R: Jessie Leech's sister Connie with Johnstone Melmore Leech outside the original JM Leech <strong>Jeweller</strong>s<br />

Bendigo store, circa 1932; an historic newspaper advertisement for the business<br />

JM Leech <strong>Jeweller</strong>s was founded by my<br />

grandfather and grandmother more than<br />

90 years ago and today, is the oldest<br />

jewellery store in Bendigo.<br />

My grandmother, Jessie, used to work for<br />

a department store and my grandfather<br />

Johnstone Melmore Leech fancied her, so he<br />

had his brother take a note to her and ask if<br />

she would come and work for him instead!<br />

They ended up getting together and started<br />

JM Leech <strong>Jeweller</strong>s in 1928.<br />

In 1930, when the business was only two<br />

years old, the Great Depression really began<br />

to hit Australia; then, a few years later,<br />

Johnstone went off to World War II.<br />

There have been so many obstacles over the<br />

years; there were times when they couldn't<br />

get stock – if you wanted an engagement<br />

ring in the 1930s, you had a choice of two!<br />

From wars to depressions and recessions, I<br />

take my hat off to them. I know we are going<br />

through tough times now, but I think if we<br />

were to take our minds back to what the<br />

previous generations went through, we'd<br />

have a bit more appreciation for how tough<br />

times really were back then!<br />

My grandparents had personal struggles<br />

too; their daughter was born in 1937 and<br />

tragically died when she was two.<br />

They had my mother, Faith, in 1941 and<br />

were told she would be in a wheelchair by<br />

the time she was 30 as she had a double<br />

curvature of the spine.<br />

To help with her condition, they got her into<br />

swimming when she was five; by the time<br />

she was 12 years old, she was the fastest<br />

female swimmer for her age on the planet.<br />

She ended up going to the Olympics,<br />

winning a gold medal and bronze medal<br />

in 1956 as one of the Golden Girls alongside<br />

Dawn Fraser. She also worked in the<br />

family business until the mid ’90s, when<br />

she retired.<br />

My grandfather and grandmother were very<br />

determined – they built up an extremely good<br />

business over the years. We struggled a bit in<br />

the ’70s and early ’80s, but since then we've<br />

gone from strength to strength.<br />

I purchased half the business from my<br />

grandmother and the other half from my<br />

mother in the 1990s; it wasn't handed to me,<br />

I wanted to buy it. That's how it worked.<br />

When my grandparents started the business,<br />

jewellery stores were different than they are<br />

today; they were a bit of a 'jack of all trades'.<br />

Alongside jewellery and watches, we stocked<br />

Royal Doulton, Royal Albert, Limoges<br />

porcelain, Belleek pottery, Delft Blue<br />

giftware, stainless steel cookware, cutlery<br />

sets, pens, paintings – you name it!<br />

We phased out giftware from the early ’90s<br />

and over a period of 15 years, became purely<br />

a jewellery and timepieces store, which we<br />

remain to this day.<br />

My wife Anna joined the business in 2001 and<br />

this proved a game-changer for our growth.<br />

She has strengths I don’t, and vice versa.<br />

Anna has a business background and her<br />

eye for market trends and selecting fastselling<br />

stock is something to be seen!<br />

Anna’s involvement has allowed me to<br />

work ‘on the business’ rather than ‘in it’<br />

which is a primary reason for our expansion<br />

to date.<br />

1928<br />

Johnstone Melmore<br />

Leech and wife Jessie<br />

establish JM Leech<br />

<strong>Jeweller</strong>s in Bendigo<br />

1930<br />

The Great Depression<br />

begins, severely limiting<br />

JM Leech <strong>Jeweller</strong>s’ stock<br />

1941<br />

Johnstone and Jessie<br />

welcome their second<br />

daughter, Faith, after<br />

losing their first-born<br />

1942<br />

Johnstone serves in<br />

World War II; Jessie<br />

continues to run the store<br />

while he is away<br />

1956<br />

Faith Leech wins gold<br />

and bronze medals at<br />

the Melbourne Olympics,<br />

then joins the family<br />

business<br />

1973<br />

A major renovation of the<br />

store is completed<br />

1986<br />

Faith’s son Adam Tuohy<br />

begins working in the<br />

business and starts<br />

phasing out giftware<br />

to focus solely on fine<br />

jewellery and timepieces<br />

1993-1999<br />

Adam purchases the<br />

business from Jessie<br />

and Faith<br />

1998<br />

The store is completely<br />

demolished and rebuilt,<br />

using the original<br />

leadlight but with an<br />

award-winning, modern,<br />

shopper-friendly design<br />

2001<br />

Adam marries Anna, who<br />

also joins the business<br />

2005<br />

A second location opens<br />

in Castlemaine, followed<br />

three years later by a<br />

third store in Echuca<br />

2012<br />

The original Bendigo<br />

location is given a fresh<br />

new look<br />

2016<br />

The fourth store opens<br />

in Maryborough<br />

Above: Adam and Anna Tuohy outside the<br />

Bendigo store in 2018<br />

When you boil it all down, if you look<br />

after the customer the rest takes care of<br />

itself. If you're honest and do what you<br />

say you're going to do, you earn repeat<br />

business and referrals.<br />

We're in an industry where the lifetime<br />

value of a customer is massive; they<br />

start with kids' jewellery and the first<br />