Panels & Furniture Asia September/October 2022

Panels & Furniture Asia (PFA) is a leading regional trade magazine dedicated to the woodbased panel, furniture and flooring processing industry. Published bi-monthly since 2000, PFA delivers authentic journalism to cover the latest news, technology, machinery, projects, products and trade events throughout the sector. With a hardcopy and digital readership comprising manufacturers, designers and specifiers, among others, PFA is the platform of choice for connecting brands across the global woodworking landscape.

Panels & Furniture Asia (PFA) is a leading regional trade magazine dedicated to the woodbased panel, furniture and flooring processing industry. Published bi-monthly since 2000, PFA delivers authentic journalism to cover the latest news, technology, machinery, projects, products and trade events throughout the sector. With a hardcopy and digital readership comprising manufacturers, designers and specifiers, among others, PFA is the platform of choice for connecting brands across the global woodworking landscape.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MARKET REPORT<br />

have otherwise. Neither of these<br />

developments was foreseen, but each<br />

one held back the recovery in eastern US<br />

hardwood sawmill production.<br />

But life and the world around us do<br />

not remain still. Here is where business<br />

conditions now stand:<br />

25000000<br />

23000000<br />

21000000<br />

19000000<br />

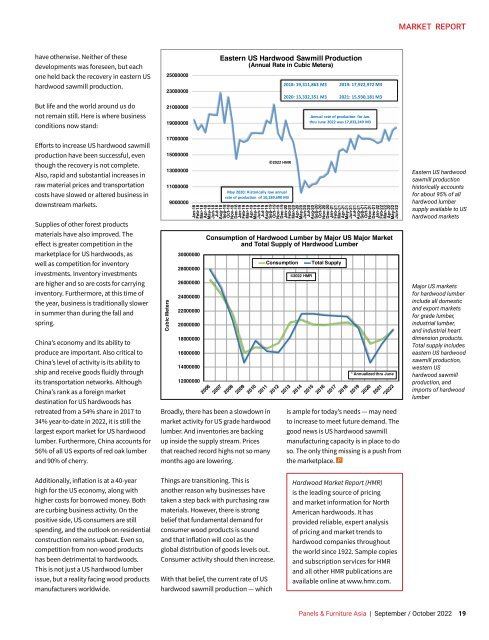

Eastern US Hardwood Sawmill Production<br />

(Annual Rate in Cubic Meters)<br />

2018: 19,311,863 M3 2019: 17,922,972 M3<br />

2020: 13,332,351 M3 2021: 15,930,181 M3<br />

Annual rate of produciton for Jan.<br />

thru June <strong>2022</strong> was 17,033,249 M3<br />

Efforts to increase US hardwood sawmill<br />

production have been successful, even<br />

though the recovery is not complete.<br />

Also, rapid and substantial increases in<br />

raw material prices and transportation<br />

costs have slowed or altered business in<br />

downstream markets.<br />

Supplies of other forest products<br />

materials have also improved. The<br />

effect is greater competition in the<br />

marketplace for US hardwoods, as<br />

well as competition for inventory<br />

investments. Inventory investments<br />

are higher and so are costs for carrying<br />

inventory. Furthermore, at this time of<br />

the year, business is traditionally slower<br />

in summer than during the fall and<br />

spring.<br />

China’s economy and its ability to<br />

produce are important. Also critical to<br />

China’s level of activity is its ability to<br />

ship and receive goods fluidly through<br />

its transportation networks. Although<br />

China’s rank as a foreign market<br />

destination for US hardwoods has<br />

retreated from a 54% share in 2017 to<br />

34% year-to-date in <strong>2022</strong>, it is still the<br />

largest export market for US hardwood<br />

lumber. Furthermore, China accounts for<br />

56% of all US exports of red oak lumber<br />

and 90% of cherry.<br />

Cubic Meters<br />

17000000<br />

15000000<br />

13000000<br />

11000000<br />

9000000<br />

30000000<br />

28000000<br />

26000000<br />

24000000<br />

22000000<br />

20000000<br />

18000000<br />

16000000<br />

14000000<br />

12000000<br />

Jan-18<br />

Feb-18<br />

Mar-18<br />

Apr-18<br />

May-18<br />

Jun-18<br />

Jul-18<br />

Aug-18<br />

Sep-18<br />

Oct-18<br />

Nov-18<br />

Dec-18<br />

Jan-19<br />

Feb-19<br />

Mar-19<br />

Apr-19<br />

May-19<br />

Jun-19<br />

Jul-19<br />

Aug-19<br />

Sep-19<br />

Oct-19<br />

Nov-19<br />

Dec-19<br />

Jan-20<br />

Feb-20<br />

Mar-20<br />

Apr-20<br />

May-20<br />

Jun-20<br />

Jul-20<br />

Aug-20<br />

Sep-20<br />

Oct-20<br />

Nov-20<br />

Dec-20<br />

Jan-21<br />

Feb-21<br />

Mar-21<br />

Apr-21<br />

May-21<br />

Jun-21<br />

Jul-21<br />

Aug-21<br />

Sep-21<br />

Oct-21<br />

Nov-21<br />

Dec-21<br />

Jan-22<br />

Feb-22<br />

Mar-22<br />

Apr-22<br />

May-22<br />

Jun-22<br />

Broadly, there has been a slowdown in<br />

market activity for US grade hardwood<br />

lumber. And inventories are backing<br />

up inside the supply stream. Prices<br />

that reached record highs not so many<br />

months ago are lowering.<br />

©<strong>2022</strong> HMR<br />

May 2020: Historically low annual<br />

rate of production of 10,189,690 M3<br />

Consumption of Hardwood Lumber by Major US Major Market<br />

and Total Supply of Hardwood Lumber<br />

Consumption<br />

©<strong>2022</strong> HMR<br />

2006<br />

2007<br />

2008<br />

2009<br />

2010<br />

2011<br />

2012<br />

2013<br />

2014<br />

Total Supply<br />

* Annualized thru June<br />

2015<br />

2016<br />

2017<br />

2018<br />

2019<br />

2020<br />

2021<br />

*<strong>2022</strong><br />

is ample for today’s needs — may need<br />

to increase to meet future demand. The<br />

good news is US hardwood sawmill<br />

manufacturing capacity is in place to do<br />

so. The only thing missing is a push from<br />

the marketplace. P<br />

Eastern US hardwood<br />

sawmill production<br />

historically accounts<br />

for about 95% of all<br />

hardwood lumber<br />

supply available to US<br />

hardwood markets<br />

Major US markets<br />

for hardwood lumber<br />

include all domestic<br />

and export markets<br />

for grade lumber,<br />

industrial lumber,<br />

and industrial heart<br />

dimension products.<br />

Total supply includes<br />

eastern US hardwood<br />

sawmill production,<br />

western US<br />

hardwood sawmill<br />

production, and<br />

imports of hardwood<br />

lumber<br />

Additionally, inflation is at a 40-year<br />

high for the US economy, along with<br />

higher costs for borrowed money. Both<br />

are curbing business activity. On the<br />

positive side, US consumers are still<br />

spending, and the outlook on residential<br />

construction remains upbeat. Even so,<br />

competition from non-wood products<br />

has been detrimental to hardwoods.<br />

This is not just a US hardwood lumber<br />

issue, but a reality facing wood products<br />

manufacturers worldwide.<br />

Things are transitioning. This is<br />

another reason why businesses have<br />

taken a step back with purchasing raw<br />

materials. However, there is strong<br />

belief that fundamental demand for<br />

consumer wood products is sound<br />

and that inflation will cool as the<br />

global distribution of goods levels out.<br />

Consumer activity should then increase.<br />

With that belief, the current rate of US<br />

hardwood sawmill production — which<br />

Hardwood Market Report (HMR)<br />

is the leading source of pricing<br />

and market information for North<br />

American hardwoods. It has<br />

provided reliable, expert analysis<br />

of pricing and market trends to<br />

hardwood companies throughout<br />

the world since 1922. Sample copies<br />

and subscription services for HMR<br />

and all other HMR publications are<br />

available online at www.hmr.com.<br />

<strong>Panels</strong> & <strong>Furniture</strong> <strong>Asia</strong> | <strong>September</strong> / <strong>October</strong> <strong>2022</strong> 19