You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Banking stocks drag equities to negative close<br />

…As investors lost N119bn<br />

By Nkiruka Nnorom<br />

earish sentiments continued<br />

Bto pervade activities in the<br />

Nigerian Exchange Limited<br />

(NGX) following sell-off in the<br />

shares of banking stocks,<br />

resulting in N119 billion losses<br />

to investors during the week.<br />

Specifically, sell-off in banking<br />

stocks including Access<br />

Corporation formerly Access<br />

Bank Plc, (-6.2%), United Bank<br />

for Africa (UBA) Plc (-6.0%),<br />

FBN Holdings Plc (-5.7%),<br />

Union Bank of Nigeria (UBN)<br />

Plc (-4.2) and Zenith Bank Plc (-<br />

1.5%) dragged the market to a<br />

second consecutive week of<br />

losses.<br />

Consequently, the market<br />

capitalisation of all listed<br />

equities declined by N119 billion<br />

or 0.44 percent to close at<br />

N26.686 trillion from N26.805<br />

trillion in the previous week.<br />

Similarly, the NGX All Share<br />

Index (ASI) slid by 0.44 percent<br />

to close 49,475.42 points.<br />

Activity levels were weak, as<br />

trading volume and value<br />

declined by 24.3 percent and 14.1<br />

percent to close at 719.389<br />

million units and N8.004 billion<br />

from 949.819 million units and<br />

N9.329 billion respectively.<br />

Vanguard, MONDAY, SEPTEMBER 19, 2022 — 19<br />

Sectoral performance was<br />

negative as all the five sectors<br />

posted losses with the banking<br />

sector leading the pack with a 3.3<br />

percent decline.<br />

This was followed by the<br />

insurance (-2.6%), consumer<br />

goods (-0.3%), industrial goods<br />

(-0.2%) and oil & gas sector (-<br />

0.2%).<br />

In their comment, analysts at<br />

Cordros Capital said: “We expect<br />

alpha-seeking investors to rotate<br />

their portfolios towards cyclical<br />

stocks that delivered decent<br />

earnings during the Q2-22<br />

earnings season amid the yield<br />

uptick in the fixed income<br />

market.” They, however,<br />

maintained that the absence of<br />

a near-term catalyst would<br />

likely skew overall market<br />

sentiments to the negative side,<br />

particularly as the political<br />

space gets heated. They<br />

reiterated the need for<br />

positioning in fundamentally<br />

sound stocks, saying that the<br />

unimpressive macro<br />

environment remains a<br />

significant headwind for<br />

corporate earnings.<br />

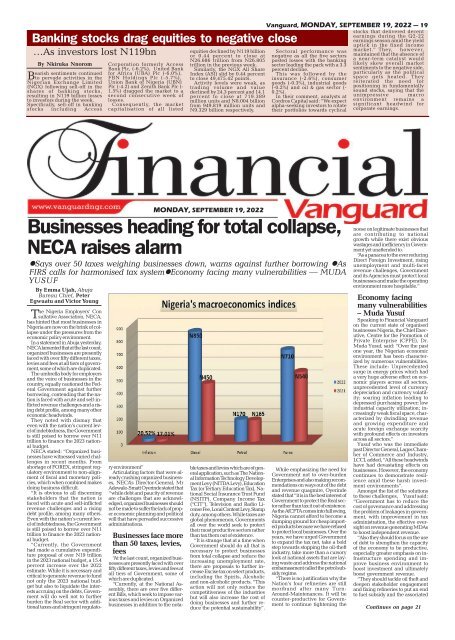

MONDAY, SEPTEMBER 19, 2022<br />

Businesses heading for total collapse,<br />

NECA raises alarm<br />

•Says over 50 taxes weighing businesses down, warns against further borrowing •As<br />

FIRS calls for harmonised tax system•Economy facing many vulnerabilities — MUDA<br />

YUSUF<br />

By Emma Ujah, Abuja<br />

Bureau Chief, Peter<br />

Egwuatu and Victor Young<br />

The Nigeria Employers’ Con<br />

sultative Association, NECA,<br />

has hinted that most businesses in<br />

Nigeria are now on the brink of collapse<br />

under the pressures from the<br />

economic policy environment.<br />

In a statement in Abuja yesterday,<br />

NECA lamented that at the last count,<br />

organized businesses are presently<br />

faced with over fifty different taxes,<br />

levies and fees at all tiers of government,<br />

some of which are duplicated.<br />

The umbrella body for employers<br />

and the voice of businesses in the<br />

country, equally cautioned the Federal<br />

Government against further<br />

borrowing, contending that the nation<br />

is faced with acute and self-inflicted<br />

revenue challenges and a rising<br />

debt profile, among many other<br />

economic headwinds.<br />

They noted with dismay that<br />

even with the nation’s current level<br />

of indebtedness, the Government<br />

is still poised to borrow over N11<br />

trillion to finance the 2023 national<br />

budget.<br />

NECA stated: “Organized businesses<br />

have witnessed varied challenges<br />

in recent months. From<br />

shortage of FOREX, stringent regulatory<br />

environment to non-alignment<br />

of fiscal and monetary policies,<br />

which when combined makes<br />

doing business difficult.<br />

“It is obvious to all discerning<br />

stakeholders that the nation is<br />

faced with acute and self-inflicted<br />

revenue challenges and a rising<br />

debt profile, among many others.<br />

Even with the nation’s current level<br />

of indebtedness, the Government<br />

is still poised to borrow over N11<br />

trillion to finance the 2023 national<br />

budget.<br />

“Currently, the Government<br />

had made a cumulative expenditure<br />

proposal of over N19 trillion<br />

in the 2023 national budget, a 15.4<br />

percent increase over the 2022<br />

estimate. While it is necessary and<br />

critical to generate revenue to fund<br />

not only the 2023 national budget<br />

but also to liquidate the interests<br />

accruing on the debts, Government<br />

will do well not to further<br />

burden the Real sector with additional<br />

taxes and stringent regulatory<br />

environment”<br />

Articulating factors that were already<br />

crushing organized businesses,<br />

NECA’s Director-General, Mr<br />

Adewale-Smatt Oyerinde stated that<br />

“while debt and paucity of revenue<br />

are challenges that are acknowledged,<br />

organized businesses should<br />

not be made to suffer the lack of proper<br />

economic planning and political<br />

will that have pervaded successive<br />

administrations.<br />

Businesses face more<br />

than 50 taxes, levies,<br />

fees<br />

“At the last count, organized businesses<br />

are presently faced with over<br />

fifty different taxes, levies and fees at<br />

all tiers of Government, some of<br />

which are duplicated.<br />

“Currently, at the National Assembly,<br />

there are over five different<br />

Bills, which seek to impose various<br />

taxes and levies on Organized<br />

businesses in addition to the notable<br />

taxes and levies which are of general<br />

application, such as The National<br />

Information Technology Development<br />

Levy (NITDA Levy), Education<br />

Tax (or Tertiary Education Tax), National<br />

Social Insurance Trust Fund<br />

(NSITF), Company Income Tax<br />

(“CIT”), Television and Radio License<br />

Fee, Local Content Levy, Stamp<br />

duty, among others. While taxes are<br />

global phenomenon, Governments<br />

all over the world seek to protect<br />

their most productive sectors rather<br />

than tax them out of existence.<br />

“It is strange that at a time when<br />

Government should do all that is<br />

necessary to protect businesses<br />

from total collapse and reduce the<br />

increasing unemployment rate,<br />

there are proposals to further increase<br />

Excise tax on select products,<br />

including the Spirits, Alcoholic<br />

and non-alcoholic products. “This<br />

action will not only reduce the<br />

competitiveness of the industries<br />

but will also increase the cost of<br />

doing businesses and further reduce<br />

the potential sustainability”.<br />

While emphasizing the need for<br />

Government not to over-burden<br />

Enterprises and also making recommendations<br />

on ways out of the debt<br />

and revenue quagmire, Oyerinde<br />

stated that “it is in the best interest of<br />

Government to protect the Real sector<br />

rather than tax it out of existence.<br />

As the AfCFTA comes into full swing,<br />

Nigeria cannot afford to become a<br />

dumping ground for cheap imported<br />

products because we have refused<br />

to protect local businesses. Over the<br />

years, we have urged Government<br />

to expand the tax net, take a bold<br />

step towards stopping the oil-theft<br />

industry, take more than a cursory<br />

look at national assets that are laying<br />

waste and address the national<br />

embarrassment called the petrol subsidy<br />

regime.<br />

“There is no justification why the<br />

Nation’s four refineries are still<br />

moribund after many Turn-<br />

Around-Maintenances. It will be<br />

counter-productive for Government<br />

to continue tightening the<br />

noose on legitimate businesses that<br />

are contributing to national<br />

growth while there exist obvious<br />

wastages and inefficiency in Government<br />

yet unattended to.<br />

“As a panacea to the ever reducing<br />

Direct Foreign Investment, rising<br />

unemployment and multi-facet<br />

revenue challenges, Government<br />

and its Agencies must protect local<br />

businesses and make the operating<br />

environment more hospitable.”<br />

Economy facing<br />

many vulnerabilities<br />

– Muda Yusuf<br />

Speaking to Financial Vanguard<br />

on the current state of organised<br />

businesses Nigeria, the Chief Executive,<br />

Centre for the Promotion of<br />

Private Enterprise (CPPE), Dr.<br />

Muda Yusuf, said: “Over the past<br />

one year, the Nigerian economic<br />

environment has been characterized<br />

by numerous vulnerabilities.<br />

These include: Unprecedented<br />

surge in energy prices which had<br />

a very huge adverse effect on economic<br />

players across all sectors,<br />

unprecedented level of currency<br />

depreciation and currency volatility;<br />

soaring inflation leading to<br />

depressed purchasing power; low<br />

industrial capacity utilization; increasingly<br />

weak fiscal space, characterized<br />

by dwindling revenue<br />

and growing expenditure and<br />

acute foreign exchange scarcity<br />

with profound effects on investors<br />

across all sectors.”<br />

Yusuf who was the immediate<br />

past Director General, Lagos Chamber<br />

of Commerce and Industry,<br />

LCCI, added, “All these headwinds<br />

have had devastating effects on<br />

businesses. However, the economy<br />

continues to demonstrate resilience<br />

amid these harsh investment<br />

environments”.<br />

Amongst the list of the solutions<br />

to these challenges, Yusuf said:<br />

“Government has to reduce the<br />

cost of governance and addressing<br />

the problem of leakages in government,<br />

with improvement in tax<br />

administration, the effective oversight<br />

on revenue generating MDAs<br />

to boost independent revenue.<br />

“Also they should focus on the use<br />

of debt to strengthen the capacity<br />

of the economy to be productive,<br />

especially greater emphasis on infrastructure<br />

spending and improve<br />

business environment to<br />

boost investment and ultimately<br />

boost government revenue.<br />

“They should tackle oil theft and<br />

deepen stakeholder engagement<br />

and fixing refineries to put an end<br />

to fuel subsidy and the associated<br />

Continues on page 21