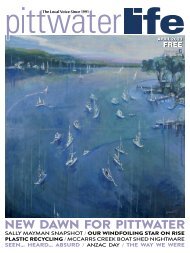

Pittwater Life March 2023 Issue

2023 NSW ELECTION SPECIAL MEET THE CANDIDATES + ROB STOKES FAREWELL INTERVIEW DOUGIE: FREE & BACK HOME / GENTLE GIANT BRAD DALTON THE WAY WE WERE / ARTISTS TRAIL / SEEN... HEARD... ABSURD...

2023 NSW ELECTION SPECIAL

MEET THE CANDIDATES + ROB STOKES FAREWELL INTERVIEW

DOUGIE: FREE & BACK HOME / GENTLE GIANT BRAD DALTON

THE WAY WE WERE / ARTISTS TRAIL / SEEN... HEARD... ABSURD...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

tions in tax are passed on<br />

more slowly due to the lagging<br />

effects of averaging. This is the<br />

situation we have now but it’s<br />

not the whole problem.<br />

The rest of the problem<br />

relates to the determination<br />

of valuations. My understanding<br />

is the VG undertakes<br />

broad-brush, desktop-based<br />

valuations to come up with<br />

numbers that have little<br />

resemblance to what you or I<br />

may equate to the value of a<br />

property when advertised for<br />

sale by a real estate agent, the<br />

percentage changes between<br />

the years however should be<br />

roughly in line with that of<br />

property markets.<br />

Over the past few weeks<br />

we have seen a steady stream<br />

of clients call to enquire how<br />

their land tax notices could<br />

have jumped so dramatically,<br />

in some cases by more<br />

than 300%. In all cases the<br />

valuation uplifts have been<br />

breathtaking.<br />

A couple of examples<br />

include: a townhouse at Warriewood<br />

rising 28% between<br />

July 2020 and July 2021 and<br />

23% between July 2021 and<br />

July 2022. A commercial property<br />

at Mona Vale showing<br />

growth of 13% between 2020<br />

and 2021 and 36% between<br />

2021 and 2022; a south coast<br />

clifftop property rising 68%<br />

from 2020 to 2021 and 46%<br />

from 2021 to 2022.<br />

In the Warriewood example<br />

our property database shows<br />

the change in Warriewood properties<br />

to be a reduction of 6% in<br />

median prices for houses and<br />

2.6% for units between calendar<br />

years 2021 and 2022 on sales<br />

volume that is approximately<br />

40% down on the prior year.<br />

In the South Coast example,<br />

the percentages roughly line<br />

up with the database: 65.5%<br />

for 2020 to 2021 and 31.9%<br />

for 2021 to 2022; the sales<br />

volume however is less than a<br />

third of normal. The inclusion<br />

of only one or two high sales<br />

will drag the averages up and<br />

will impact any broad-brush<br />

valuations.<br />

What do you if you disagree<br />

with your valuation? Here is<br />

where this has the potential<br />

to become another robo-debt<br />

problem. There is an objection<br />

mechanism but it doesn’t<br />

involve speaking to a person.<br />

You still need to pay the notice<br />

sent to you (or interest ap-<br />

The Local Voice Since 1991<br />

plies) and the objection needs<br />

to be undertaken within 60<br />

days of the receipt of the land<br />

tax notice – these have been<br />

mailed out since mid-January<br />

with a few still reaching clients<br />

in mid-February.<br />

The VG’s website outlines<br />

how to go about the objection<br />

process but you can<br />

also engage your own valuer<br />

to prepare a case on your<br />

behalf – and it may be a good<br />

investment. Referring back<br />

to the earlier South Coast<br />

example, there were only 12<br />

property sales in that calendar<br />

year, a weak sample size to<br />

justify such a material price<br />

uplift. The subject property<br />

was clifftop but without direct<br />

beach access and it was valued<br />

equivalently to one that<br />

had better views, no adjoining<br />

neighbour and direct access<br />

to the beach. A property may<br />

have a range of topographical<br />

features or limitations that<br />

may impact UCV that are not<br />

obvious to someone undertaking<br />

a desk top valuation.<br />

It would be my guess that<br />

the VG is going to have many,<br />

many objections to process.<br />

The other thing investors<br />

should check for themselves<br />

is whether their property has<br />

now become subject to land<br />

tax for the first time. The valuation<br />

changes in our local area<br />

and in some typical holiday<br />

areas are well in excess of the<br />

18% increase in the general<br />

land tax threshold – a good<br />

example of bracket creep. The<br />

Office of State Revenue<br />

doesn’t typically work through<br />

tax agents as the ATO does<br />

and your accountant may not<br />

be in position to judge the<br />

UCV of the rental property<br />

included in your annual tax<br />

return.<br />

Brian Hrnjak B Bus CPA (FPS) is<br />

a Director of GHR Accounting<br />

Group Pty Ltd, Certified<br />

Practising Accountants. Offices<br />

at: Suite 12, Ground Floor,<br />

20 Bungan Street Mona Vale<br />

NSW 2103 and Shop 8, 9 – 15<br />

Central Ave Manly NSW 2095,<br />

Telephone: 02 9979-4300,<br />

Webs: www.ghr.com.au and<br />

www.altre.com.au Email:<br />

brian@ghr.com.au<br />

These comments are of a<br />

general nature only and are<br />

not intended as a substitute<br />

for professional advice.<br />

MARCH <strong>2023</strong> 65<br />

Business <strong>Life</strong>