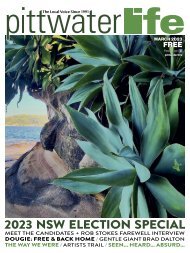

Pittwater Life April 2023 Issue

NEW DAWN FOR PITTWATER SALLY MAYMAN SNAPSHOT / OUR WINDFOILING STAR ON RISE PLASTIC RECYCLING / MCCARRS CREEK BOAT SHED NIGHTMARE SEEN... HEARD... ABSURD / ANZAC DAY / THE WAY WE WERE

NEW DAWN FOR PITTWATER

SALLY MAYMAN SNAPSHOT / OUR WINDFOILING STAR ON RISE

PLASTIC RECYCLING / MCCARRS CREEK BOAT SHED NIGHTMARE

SEEN... HEARD... ABSURD / ANZAC DAY / THE WAY WE WERE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Business <strong>Life</strong>: Money<br />

with Brian Hrnjak<br />

Business <strong>Life</strong><br />

New Super tax: where does<br />

the Government’s net widen?<br />

This month we take a<br />

look at the Federal<br />

Government’s recently<br />

announced changes to superannuation<br />

taxation… at first<br />

glance you might think these<br />

the changes may never apply<br />

to you but there are few situations<br />

that could materially<br />

widen the net of those affected.<br />

Firstly, what has been<br />

proposed: a change to the<br />

taxation of superannuation<br />

balances will come in from<br />

1 July 2025, imposing an additional<br />

tax of 15% on those<br />

individuals with a total superannuation<br />

balance (TSB) over<br />

$3 million measured at the<br />

end of 30 June 2026.<br />

So, it’s not really a tax<br />

rate of 30% as some have<br />

described it or a doubling of<br />

superannuation taxes; rather,<br />

it is an additional tax on that<br />

portion of your member balance<br />

above a threshold much<br />

like Division 293 tax that<br />

applies to the contributions<br />

of those on adjusted taxable<br />

incomes over $250,000.<br />

There is no mention of retrospectivity,<br />

thank goodness<br />

for that. Individuals subject<br />

to the tax will likely have the<br />

option of paying the tax themselves<br />

or releasing the amount<br />

from super, again, like Division<br />

293 taxes. The changes<br />

will also apply to defined<br />

benefit funds, but how that is<br />

going to work will need to be<br />

subject to a fair amount of industry<br />

consultation as defined<br />

benefit members don’t usually<br />

have TSBs.<br />

The most contentious element<br />

(so far) of this new tax<br />

is how they intend to calculate<br />

what is to be taxed. In regular<br />

situations, if a person has<br />

property or shares and they<br />

earn rent or dividends or perhaps<br />

they sell their property<br />

or some shares, those items<br />

are generally the factors we<br />

include in the calculation of<br />

taxation liability.<br />

This new tax changes that<br />

process quite dramatically.<br />

When I was introducing the tax<br />

change earlier, I used the term<br />

‘total superannuation balance’<br />

or TSB. The only people that<br />

56 APRIL <strong>2023</strong><br />

The Local Voice Since 1991