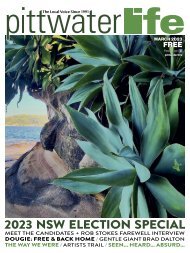

Pittwater Life April 2023 Issue

NEW DAWN FOR PITTWATER SALLY MAYMAN SNAPSHOT / OUR WINDFOILING STAR ON RISE PLASTIC RECYCLING / MCCARRS CREEK BOAT SHED NIGHTMARE SEEN... HEARD... ABSURD / ANZAC DAY / THE WAY WE WERE

NEW DAWN FOR PITTWATER

SALLY MAYMAN SNAPSHOT / OUR WINDFOILING STAR ON RISE

PLASTIC RECYCLING / MCCARRS CREEK BOAT SHED NIGHTMARE

SEEN... HEARD... ABSURD / ANZAC DAY / THE WAY WE WERE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

know how much you have in<br />

super, in total, are you, your<br />

accountant (via the ATO portal)<br />

and the ATO. Your superfund<br />

doesn’t know if you have<br />

another fund. For the Government<br />

to tax those with over $3<br />

million in super it must have<br />

access to consolidated data, in<br />

this case from the ATO. (You<br />

can find your TSB via MyGov<br />

and the ATO links in there.)<br />

This new tax proposes<br />

to tax ‘earnings’ which are<br />

defined as your TSB at the<br />

end of the financial year less<br />

your TSB at the end of the<br />

previous financial year plus<br />

your withdrawals less your net<br />

contributions. The proportion<br />

of earnings that are taxable<br />

is that proportion of your account<br />

over $3 million and the<br />

tax on that is 15%.<br />

This is not how we have<br />

traditionally approached<br />

taxation within super, or, in<br />

general. The main concern is<br />

that changes to capital values<br />

are now subject to being<br />

taxed – not sold items but<br />

items that have simply gone<br />

up in value. As well, capital<br />

gains tax concessions normally<br />

available inside super are also<br />

disregarded. Consider if your<br />

fund invested in a volatile asset<br />

– bitcoin, tech shares or even<br />

property that has risen in value<br />

one year and fallen in value in<br />

the next and being taxed in<br />

these circumstances under this<br />

proposal which contains no<br />

provision for refunds.<br />

If you want a more detailed<br />

look at this issue beyond the<br />

limited space I have here I’d<br />

suggest you Google Graham<br />

Hand’s very good article on<br />

Firstlinks from 8 March. In it<br />

he considers 10 revelations<br />

about the new tax.<br />

On of the issues examined<br />

by Hand in the article was<br />

modelling from the Financial<br />

Services Council (FSC) attacking<br />

the Government’s position<br />

on not indexing the $3 million<br />

cap. The FSC notes that by not<br />

indexing the threshold some<br />

500,000 taxpayers will breach<br />

it in their lifetimes; leaving<br />

the amount at $3 million<br />

means that in today’s dollars<br />

a 30-year-old will have a real<br />

cap of $1 million in super,<br />

calling into question the intergenerational<br />

fairness of not<br />

indexing.<br />

The FSC also pointed out<br />

that given the start date of the<br />

The Local Voice Since 1991<br />

legislation being 1 July 2025<br />

and the first measurement<br />

date being 30 June 2026 –<br />

three years from now, the real<br />

threshold is nearer to $2.5<br />

million in today’s dollars not<br />

$3 million after allowing for<br />

current rates of inflation.<br />

While the proposal is directed<br />

at individual member<br />

accounts over $3 million, there<br />

are quite a few funds that total<br />

$3 million (or $2.5 million if<br />

you take the FSC’s point about<br />

indexing), mostly mums and<br />

dads, who could find themselves<br />

affected by the proposal<br />

on the death of a partner.<br />

So what planning steps can<br />

be taken now in anticipation<br />

of the legislation?<br />

The most obvious is to work<br />

towards equalising balances<br />

between spouses where material<br />

differences exist and one<br />

spouse is caught and the other<br />

isn’t. A recontribution strategy<br />

is likely the most effective<br />

pathway but the Hand article<br />

went so far as to suggest<br />

some may choose super splitting<br />

via divorce although it is<br />

likely this would be caught under<br />

anti-avoidance provisions<br />

of the tax legislation.<br />

Investment bonds have been<br />

suggested for some time as<br />

an alternative to superannuation,<br />

earnings within these are<br />

taxed at the company rate<br />

while maintained and the proceeds<br />

tax free after 10 years.<br />

People likely to be affected<br />

by the rule changes will start<br />

to reassess their choice of<br />

holding vehicle – super versus<br />

trust versus company. The<br />

issue comes down to the final<br />

tax rate, in super you may be<br />

taxed at up to 30%, however,<br />

company profits and trust<br />

distributions can be made to<br />

those on lower rates of tax.<br />

Brian Hrnjak B Bus CPA (FPS) is<br />

a Director of GHR Accounting<br />

Group Pty Ltd, Certified<br />

Practising Accountants. Offices<br />

at: Suite 12, Ground Floor,<br />

20 Bungan Street Mona Vale<br />

NSW 2103 and Shop 8, 9 – 15<br />

Central Ave Manly NSW 2095,<br />

Telephone: 02 9979-4300,<br />

Webs: www.ghr.com.au and<br />

www.altre.com.au Email:<br />

brian@ghr.com.au<br />

These comments are of a<br />

general nature only and are<br />

not intended as a substitute<br />

for professional advice.<br />

APRIL <strong>2023</strong> 57<br />

Business <strong>Life</strong>