The Finance World Magazine| Edition: May 2023

The May edition of The Finance World Magazine (TFW) is out now. Our cover story highlights this development of the fintech industry in the UAE and the Middle East, presenting an exclusive interview with Mohammad Alblooshi, the Head of DIFC Innovation Hub & FinTech Hive, whose insights into this exciting field provide valuable knowledge for industry stakeholders. The UAE has emerged as a preeminent global financial hub and a coveted destination for international investors. In light of this, our focus in this edition is directed towards the rapidly evolving domain of asset management. Through a meticulous screening process, we have identified 15 UAE-based asset management companies that have demonstrated notable proficiency and excellence in this arena. Our compilation furnishes valuable insights into the investment strategies and approaches employed by these firms and sheds light on the factors that have contributed to their resounding success. Focusing on Investment in the UAE as this edition’s main theme, our articles provide insights on the various investment options offered by the UAE’s different sectors, such as the UAE cryptocurrency market promising exciting investment opportunities, different investment options in the UAE’s sports industry, investing in emerging artists and the importance of risk management, investment opportunities and advantages in Dubai real estate market, UAE corporate tax creating new investment opportunities, and many more articles that offer critical analysis and insights on current trends and issues in the business and investment domains. Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

The May edition of The Finance World Magazine (TFW) is out now. Our cover story highlights this development of the fintech industry in the UAE and the Middle East, presenting an exclusive interview with Mohammad Alblooshi, the Head of DIFC Innovation Hub & FinTech Hive, whose insights into this exciting field provide valuable knowledge for industry stakeholders.

The UAE has emerged as a preeminent global financial hub and a coveted destination for international investors. In light of this, our focus in this edition is directed towards the rapidly evolving domain of asset management. Through a meticulous screening process, we have identified 15 UAE-based asset management companies that have demonstrated notable proficiency and excellence in this arena. Our compilation furnishes valuable insights into the investment strategies and approaches employed by these firms and sheds light on the factors that have contributed to their resounding success.

Focusing on Investment in the UAE as this edition’s main theme, our articles provide insights on the various investment options offered by the UAE’s different sectors, such as the UAE cryptocurrency market promising exciting investment opportunities, different investment options in the UAE’s sports industry, investing in emerging artists and the importance of risk management, investment opportunities and advantages in Dubai real estate market, UAE corporate tax creating new investment opportunities, and many more articles that offer critical analysis and insights on current trends and issues in the business and investment domains.

Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

M&A Activity in GCC Expects a Spike Amid Global Caution<br />

Abu Dhabi Boosts Business Tourism with Public-Private Partnerships<br />

<strong>The</strong> UAE Reinforces Its Business-Friendly Environment with Global Partnerships Promising Investment Opportunities in the UAE Stock Market<br />

<strong>May</strong> <strong>2023</strong><br />

UAE Fintech Arena: A Huge<br />

Untapped Market to Leverage<br />

Mohammad Alblooshi, Head of DIFC Innovation Hub & FinTech Hive<br />

UAE - AED 30 | USA - USD 16.5 KSA - SR<br />

61 | Qatar - QAR 60 Oman - OMR 6.3 |<br />

Bahrain - BD 6.2 Kuwait - KWD 5 | UK -<br />

£12 | EU - €14<br />

P72 | <strong>The</strong> UAE Expands<br />

Economic and Trade Relations to<br />

Boost Investment Opportunities<br />

P82 | <strong>The</strong> UAE Corporate Tax to<br />

Create New Investment<br />

Opportunities<br />

STAY CONNECTED<br />

WITH OUR LATEST<br />

BUSINESS NEWS

GROW YOUR<br />

BUSINESS<br />

We make Short / Long Term<br />

Investments in Growing Businessess<br />

www.wasayainvestments.com

SUBSCRI B E<br />

N O W<br />

APRIL <strong>2023</strong> MARCH <strong>2023</strong><br />

MAY <strong>2023</strong><br />

FEBRUARY <strong>2023</strong><br />

JANUARY <strong>2023</strong><br />

Contact us at:<br />

+971 58 591 8580<br />

www.thefinanceworld.com<br />

subscribe@thefinanceworld.com

Editor’s Note Note<br />

Contact:<br />

+971 58 591 8580<br />

Advertisement queries:<br />

Editorial:<br />

Press Release<br />

For News<br />

Contact:<br />

For Partnerships +971 58 591 8580<br />

com<br />

Advertisement queries:<br />

Public Relations<br />

For Printed Copy<br />

Press Release<br />

Published By:<br />

Editorial:<br />

For News<br />

MCFILL MEDIA &<br />

PUBLISHING GROUP<br />

For Partnerships<br />

Approved and Licensed By:<br />

National Media Council,UAE<br />

Public Relations<br />

com<br />

<strong>The</strong> <strong>Finance</strong> <strong>World</strong> (TFW) has taken constant<br />

efforts to make sure that content For Printed is accurate Copyas<br />

on the date of publication. <strong>The</strong> published articles,<br />

editorials, material, adverts and all other content<br />

is published in a good faith and opinions and<br />

views are not necessarily those of Published the publishers. By:<br />

We regret that we cannot guarantee and accept no<br />

liability for any loss or damage of any kind<br />

MCFILL<br />

caused<br />

MEDIA &<br />

PUBLISHING GROUP<br />

by this magazine and errors and for the accuracy<br />

of claims in any forms Approved by any and advertisers Licensed or By:<br />

readers. We advise the readers National to Media seek Council,UAE<br />

the advice<br />

of specialists before acting on information<br />

published in the magazine. <strong>The</strong> trademarks,<br />

<strong>The</strong> <strong>Finance</strong> <strong>World</strong> (TFW) has taken constant<br />

logos, pictures, domain efforts names to make and sure service that content marks is accurate as<br />

(collectively the on “Trademarks”) the date of publication. displayed <strong>The</strong> published on articles,<br />

this magazine are editorials, registered material, and adverts unregistered and all other content<br />

Trademarks of <strong>The</strong> is <strong>Finance</strong> published <strong>World</strong> in a good and its faith content and opinions and<br />

views are not necessarily those of the publishers.<br />

providers. All rights reserved and nothing can be<br />

We regret that we cannot guarantee and accept no<br />

partially or in whole<br />

liability<br />

be reprinted<br />

for any loss<br />

or<br />

or damage<br />

reproduced<br />

of any kind caused<br />

or stored in a retrieval by this system magazine or and transmitted errors and for in the accuracy<br />

any form without a of written claims in consent. any forms by any advertisers or<br />

readers. We advise the readers to seek the advice<br />

of specialists before acting on information<br />

published in the magazine. <strong>The</strong> trademarks,<br />

Advertisers advertised in this guide are included on a sponsored basis.<br />

logos, pictures, domain names and service marks<br />

Details are correct at the time of going to press, but offers and prices<br />

(collectively the “Trademarks”) displayed on<br />

may change.<br />

this magazine are registered and unregistered<br />

Trademarks of <strong>The</strong> <strong>Finance</strong> <strong>World</strong> and its content<br />

providers. All rights reserved and nothing can be<br />

partially or in whole be reprinted or reproduced<br />

or stored in a retrieval system or transmitted in<br />

any form without a written consent.<br />

Advertisers advertised in this guide are included on a sponsored basis.<br />

Details are correct at the time of going to press, but offers and prices<br />

may change.<br />

Reaching a visionary goal requires<br />

one percent vision and 99 percent alignment.<br />

<strong>The</strong> fintech industry in the UAE and the Middle East is undergoing<br />

rapid expansion, signaling the possibility of a substantial<br />

transformation in the financial landscape of the region. This<br />

issue’s cover story highlights this development and presents<br />

an exclusive interview with Mohammad Alblooshi, the Head Editor’s of Note DIFC<br />

Innovation Hub & FinTech Hive, whose insights into this exciting field<br />

provide valuable knowledge for industry stakeholders.<br />

<strong>The</strong> UAE has emerged as a preeminent global financial hub and a<br />

coveted destination for international investors. In light of this, our<br />

focus in this edition is directed towards the rapidly evolving domain<br />

of asset management. Through a meticulous screening process, we<br />

have identified 15 UAE-based asset management companies that have<br />

demonstrated notable proficiency and excellence in this arena. Our<br />

compilation furnishes valuable insights into the investment strategies<br />

and approaches employed by these firms and sheds light on the factors<br />

that have contributed to their resounding success.<br />

Focusing on Investment in the UAE as this edition’s main theme, our<br />

articles provide insights on the various investment options offered by<br />

the UAE’s different sectors, such as the UAE cryptocurrency market<br />

promising exciting investment opportunities, different investment<br />

options in the UAE’s sports industry, investing in emerging artists<br />

and the importance of risk management, investment opportunities<br />

and advantages in Dubai real estate market, UAE corporate tax<br />

creating new investment opportunities, and many more articles that<br />

offer critical analysis and insights on current trends and issues in the<br />

business and investment domains.<br />

Within the news segments, you will find a condensed compendium<br />

of the most notable advancements in the field of finance. We have<br />

meticulously sifted through the latest trends and updates, spanning<br />

an array of pertinent topics such as corporate results, corporate tax,<br />

startups, banking, funding, investment, fintech, digital assets, and<br />

beyond.<br />

We aim to espouse the vision of the UAE’s wise leadership on the<br />

nation’s development path, highlighting the social, economic, and<br />

developmental aspects shaping this dynamic nation. To that end, we<br />

tirelessly curate the latest and most credible finance news for our<br />

readers, with the aim of advancing financial literacy and contributing<br />

to Dubai’s journey to becoming one of the world’s most pioneering<br />

economies.<br />

- Ambrish Agarwal, Editor in Chief<br />

- Ambrish Agarwal, Editor in Chief<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 7<br />

September 2022 3

Contents <strong>May</strong><br />

<strong>2023</strong><br />

PERSONAL FINANCE<br />

P10 | 10 Things You Should Know<br />

Before Getting a Mortgage<br />

UAE BANKING<br />

P12 | AED 245.5B Saving Deposits<br />

in UAE Banks by End of January<br />

<strong>2023</strong><br />

P14 | UAE Banking News<br />

UAE REFORMS<br />

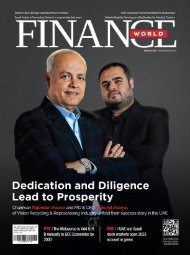

COVER STORY<br />

P26 | UAE’s Fintech Ecosystem<br />

and the upcoming Dubai Fintech<br />

Summit <strong>2023</strong>: Mohammad<br />

Alblooshi, Head of DIFC Innovation<br />

Hub & FinTech Hive<br />

START-UP<br />

P50 | Three Promising Investment<br />

Management Startups in the<br />

Middle East<br />

ENERGY<br />

P52 | Investment Opportunities<br />

in the UAE’s Sustainability and<br />

Energy Sector<br />

HEALTHCARE<br />

P56 | UAE’s Booming Healthcare<br />

Industry Offers Lucrative<br />

Investment Prospects<br />

MERGERS AND<br />

ACQUISITIONS<br />

P16 | <strong>The</strong> Central Bank of UAE<br />

Launches CBDC strategy<br />

FINTECH<br />

P18 | Three UAE-Based Fintechs<br />

Attracting Investors’ Attention<br />

P20 | Fintech News<br />

P22 | Fintech Application<br />

P24 | Business News<br />

P58 | M&A Activity in GCC Expects<br />

a Spike amid Global Caution<br />

P60 | Mergers & Acquisitions News<br />

CRYPTOCURRENCY<br />

P62 | <strong>The</strong> UAE Cryptocurrency<br />

Market Promises Exciting<br />

Investment Opportunities<br />

8 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong><br />

P31 | Meet the Top 15 UAE-Based<br />

Asset Managers

REAL ESTATE<br />

CORPORATE TAX<br />

TOURISM<br />

P66 | Investment Opportunities<br />

and Advantages in Dubai Real<br />

Estate Market<br />

P68 | Real Estate News<br />

FUNDING & INVESTMENT<br />

P80 | UAE Corporate Tax to Create<br />

New Investment Opportunities<br />

P82 | Corporate Results<br />

TRAVEL<br />

P90 | Abu Dhabi Boosts Business<br />

Tourism with Public-Private<br />

Partnerships<br />

INVESTING IN ART<br />

P70 | <strong>The</strong> UAE Expands Economic and<br />

Trade Relations to Boost Investment<br />

Opportunities<br />

P72 | Funding & Investment News<br />

DIGITAL ASSETS<br />

P74 | UAE’s Digital Asset<br />

Investment Landscape Gaining<br />

Momentum<br />

STOCK MARKET<br />

P76 | Promising Investment<br />

Opportunities in the UAE Stock<br />

Market<br />

P84 | 4 Destinations to Visit in<br />

<strong>May</strong> <strong>2023</strong> and Rejuvenate Yourself<br />

from Work<br />

SPORT AS A BUSINESS<br />

P86 | Different Investment Options<br />

in the UAE’s Sports Industry<br />

P88 | Sports News<br />

P92 | Investing in Emerging<br />

Artists and the Importance of Risk<br />

Management<br />

INVESTING IN TOURISM<br />

P98 | Ras Al Khaimah’s Las-Vegas<br />

Resort Offers Great Options for<br />

Investors<br />

P94 | Global News<br />

P100 | Local News<br />

P23 | 64-65 | Launch Express<br />

P48 | P54 | P78 | P96 | Wheels<br />

P30 | P47 | Tech My Money<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 9

Personal <strong>Finance</strong><br />

10 Things You Should Know Before<br />

Getting a Mortgage<br />

Ensuring the long-term sustainability and feasibility of homeownership<br />

necessitates prudent and informed decision-making regarding housing<br />

finance, be it for a new property acquisition or an existing property refinance.<br />

Thoroughly evaluating and deliberating mortgage options in advance enables<br />

individuals to realize significant cost savings and fortify their financial<br />

resilience against unanticipated adversities. This article elucidates crucial<br />

aspects that individuals should be cognizant of before pursuing a mortgage.<br />

Several measures can be implemented<br />

to augment the probability of<br />

being granted a mortgage. It is<br />

imperative to comprehend the<br />

determinants influencing your eligibility<br />

for a mortgage, such as your credit<br />

rating, present liabilities, status as a selfemployed<br />

individual, and the magnitude<br />

of your down payment. To optimize your<br />

likelihood of success in acquiring your<br />

desired mortgage, consider adhering to<br />

the following 10 recommendations.<br />

Your Credit Report:<br />

Individuals with inferior credit ratings<br />

are subjected to exorbitant interest<br />

rates, culminating in inflated mortgage<br />

expenditures over time. Furthermore,<br />

those possessing a credit score lower<br />

than 620 may encounter difficulties<br />

securing a loan. A superior credit score<br />

amplifies the prospects of obtaining a<br />

low-interest mortgage. It is expedient<br />

to procure a copy of one’s credit report,<br />

ensuring its accuracy and rectifying<br />

any discrepancies before submitting a<br />

mortgage application.<br />

Set Your Budget:<br />

Create a budget before seeking a<br />

mortgage, ensuring that the loan amount<br />

is sufficient to cover the property’s price<br />

and associated expenses. Our guide on<br />

calculating the cost of buying your first<br />

home may be beneficial. <strong>The</strong> monthly<br />

mortgage payments are determined by<br />

the loan amount, the duration, and the<br />

interest rate.<br />

Reducing debts<br />

pre-mortgage<br />

application shows<br />

responsible<br />

financial<br />

management<br />

and enhances<br />

the chance of<br />

approval.<br />

10 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

Employment Stability:<br />

To secure a mortgage, lenders generally<br />

require evidence of long-term employment<br />

with the same employer. If considering<br />

a job switch, it’s advisable to wait until<br />

after securing the mortgage. A minimum<br />

of three to six months of tenure with the<br />

current employer is typically recommended<br />

before applying.<br />

Reduce Your Debt:<br />

When applying for a mortgage, having<br />

substantial credit card debt or unpaid<br />

loans is unfavourable to potential lenders.<br />

Reducing existing debts before submitting<br />

a mortgage application demonstrates<br />

responsible money management, increases<br />

the likelihood of a successful mortgage<br />

application, and potentially enables<br />

borrowing more in the lender’s affordability<br />

evaluation.<br />

Proof of Income:<br />

Lenders typically require evidence<br />

of income, which is provided annually<br />

by the employer and details the salary<br />

and tax deductions. Additionally, three<br />

months’ worth of bank statements and<br />

payslips are commonly requested to<br />

assess the borrower’s incoming and<br />

outgoing expenses.<br />

<strong>The</strong> Larger Your Downpayment, the<br />

High interest<br />

rates increase<br />

the borrower’s<br />

financial<br />

burden,<br />

resulting in<br />

an augmented<br />

future monthly<br />

payment<br />

obligation.<br />

Better:<br />

Experts recommend a 20% down<br />

payment to reduce mortgage size and<br />

interest paid over time. However, with<br />

FHA and VA loans offering lower down<br />

payments, some buyers question the<br />

need for 20%. A down payment under<br />

20% on a conventional loan requires<br />

PMI, adding 1% of the outstanding loan<br />

balance yearly to the monthly mortgage<br />

payment. Lower down payments can also<br />

lead to a higher interest rate, ultimately<br />

costing more.<br />

Consider a Co-buyer:<br />

If saving for a deposit on your own<br />

is difficult, consider buying a property<br />

with someone else. This may increase<br />

your chances of getting a good mortgage,<br />

especially if the other person has a high<br />

income and an excellent credit score.<br />

However, keep in mind that buying with<br />

someone else is a significant commitment.<br />

You’ll need to discuss with your co-buyer<br />

what will happen if one of you wants to<br />

sell the property in the future.<br />

Get Some Help:<br />

If you’re having difficulty locating<br />

the appropriate mortgage plan or don’t<br />

know what mortgage options you’re<br />

eligible for, employing the services of<br />

a mortgage broker could be beneficial.<br />

<strong>The</strong>y can conduct market research on<br />

your behalf and guide you through the<br />

application process, sparing you the<br />

trouble of completing everything on<br />

your own.<br />

Set Your Target:<br />

Bear in mind that applying for a<br />

mortgage or any other loan will result<br />

in a “hard inquiry” on your credit report,<br />

which can temporarily lower your score.<br />

If you apply for multiple mortgages within<br />

a two-week period, it will only count as<br />

one inquiry. However, if you spread out<br />

your applications over a longer period<br />

and apply to numerous lenders, your<br />

score may suffer, and you may end up<br />

with a higher interest rate than expected.<br />

Be Careful with Your Application:<br />

It is advisable not to alter the figures<br />

on your mortgage application once it has<br />

been submitted as it can delay the property<br />

purchase process. Any modifications to<br />

the application will require reassessment,<br />

which could result in additional delays.<br />

In conclusion, obtaining a mortgage<br />

requires careful consideration and<br />

planning. Before seeking a mortgage,<br />

it is crucial to assess your eligibility,<br />

set a budget, reduce debt, and secure<br />

stable employment. Having a co-buyer or<br />

enlisting the services of a mortgage broker<br />

can increase your chances of securing a<br />

favourable mortgage plan. By following<br />

these 10 recommendations, individuals<br />

can optimize their chances of obtaining<br />

a mortgage that suits their needs and<br />

fortify their financial resilience against<br />

unanticipated adversities.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 11

UAE Banking<br />

AED 245.5B Saving Deposits in UAE Banks<br />

by End of January <strong>2023</strong><br />

Saving deposits in the UAE<br />

banking system, excluding<br />

interbank deposits, increased<br />

to AED 245.537B by the end<br />

of January <strong>2023</strong>, a YoY growth of<br />

approximately AED 2.023B, or 0.92%,<br />

from about AED 243.31B in January<br />

2022, statistics by the Central Bank<br />

of the UAE revealed.<br />

Savings deposits in the UAE banks<br />

have grown remarkably over the recent<br />

years, from AED 152B at the close of<br />

2018 to AED 172.2B in 2019 and to<br />

AE 215.2B in 2020; and AED 241.8B<br />

in 2021, according to the statistics of<br />

the apex bank.<br />

Demand deposits grew to AED<br />

914.74B by the end of January <strong>2023</strong>, a<br />

YoY growth of 5.6% from AED 866.16B<br />

in January 2022, added the bank’s<br />

statistics. Term deposits surged to AED<br />

611.69B by the end of last January, a<br />

YoY growth of 19.5% from AED 512.04B<br />

in January 2022.<br />

Earlier, the Central Bank of UAE<br />

declared that deposits of ‘above AED<br />

20M’ in UAE banks until December<br />

2022 reached AED 1.31T. Large deposits<br />

(greater than AED 20M) made up 59%<br />

the total deposits held by the banks<br />

based in the UAE that totalled AED<br />

2.222T until the end of 2022, data from<br />

the Central Bank of the UAE revealed.<br />

Deposits of greater than AED 20M<br />

surged to AED 1.31T by the end of<br />

December, a growth of 11.4% from<br />

roughly AED 1.175T by the end of<br />

December 2021. Deposit accounts of<br />

more than AED 5M up to AED 20M<br />

accounted for roughly AED 269.24B, or<br />

12.1% of all deposits, an 11% increase<br />

from AED 242.46B in December 2021.<br />

Deposits from AED 1.00M up to AED<br />

5.00M made up roughly 13% of the total<br />

at the end of last December, up 15.2%<br />

from AED 250.63B in December 2021.<br />

Deposits of more than AED 500,000 and<br />

up to AED 1M totalled AED 108.5B,<br />

or 4.9% of all deposits, a rise of 13.5%<br />

from approximately AED 95.6B in<br />

December 2021.<br />

Deposits between AED 250.000 to<br />

AED 500,000 totalled AED 84.26B, down<br />

from AED 87.4B in December 2021.<br />

Deposits of up to AED 250,000 amounted<br />

to about 7.2% or the equivalent of AED<br />

160.8B at the end of last December, an<br />

increase of 11.3% compared to about<br />

AED 144.47B in December 2021.<br />

12 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

ADCB, Al Hilal Bank Partner with Bank of<br />

London and the Middle East<br />

ADCB and its Shari’ah compliant<br />

digital banking subsidiary Al<br />

Hilal Bank have announced an<br />

innovative new partnership<br />

with Bank of London and the Middle<br />

East (BLME) to bring digital UK banking<br />

to UAE nationals and residents through<br />

Nomo.<br />

Customers in the UAE can now open<br />

UK-based multi-currency current and<br />

savings accounts, as well as apply<br />

for UK home financing, from their<br />

smartphones using the newly launched<br />

ADCB-Nomo and Al Hilal-Nomo banking<br />

apps. This unique proposition, which<br />

gives UAE consumers a quick and simple<br />

way to bank in the UK from the UAE,<br />

demonstrates ADCB Group’s agility and<br />

commitment to consistently provide<br />

market-leading customer experience.<br />

Nomo is part of BLME, a subsidiary<br />

of Boubyan Bank, one of the leading<br />

financial institutions in the Middle<br />

East. Nomo was established to bring<br />

high-quality, Shari’ah-compliant digital<br />

banking to non-UK residents in the<br />

Middle East.<br />

Ala’a Eraiqat, ADCB Group CEO,<br />

and Al Hilal Bank Chairman, said,<br />

“ADCB’s partnership with Nomo is part<br />

of our strategy to drive digital-enabled<br />

growth. We are focused on maintaining<br />

ADCB’s leadership position in customer<br />

experience and are committed to<br />

providing customers with innovative<br />

digital banking solutions and an<br />

unparalleled banking experience. <strong>The</strong><br />

ADCB-Nomo and Al Hilal-Nomo apps<br />

will simplify international banking and<br />

unlock new financing opportunities for<br />

our customers with interests in the UK.”<br />

<strong>The</strong> ADCB-Nomo and Al Hilal-<br />

Nomo apps will give customers the<br />

ability to spend fee-free globally in<br />

six currencies (GBP, USD, AED, EUR,<br />

KWD and SAR), send money fee-free<br />

to UK bank accounts, and save in UKbased<br />

Fixed Term Deposits in GBP<br />

and USD. Customers will also have<br />

the opportunity to get finance to help<br />

them buy properties in the UK as an<br />

investment or as a second home.<br />

Adel Abdul Wahab Al-Majed, Vice-<br />

Chairman and Group Chief Executive<br />

Officer, Boubyan Group, added, “ADCB<br />

is a market leader in GCC banking<br />

when it comes to excellence, security<br />

and innovation, and it’s a hugely<br />

exciting prospect to be partnering<br />

with them. Our collective mission is<br />

to give customers in the UAE unique<br />

opportunities to invest and manage<br />

their wealth internationally, simplifying<br />

complicated banking processes and<br />

avoiding high cross-border fees. <strong>The</strong><br />

ADCB-Nomo and Al Hilal Nomo apps<br />

will make this a reality.” A fully mobile<br />

service, the ADCB-Nomo and Al Hilal-<br />

Nomo apps are available on iOS and<br />

Android operating systems.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 13

UAE Banking News<br />

UAE Banks Federation<br />

hosted lecture by Global<br />

Risk Management Expert<br />

<strong>The</strong> lecture by Professor Edward<br />

Altman, recently organised by<br />

the UAE Banks Federation,<br />

was a valuable opportunity for<br />

executives and staff from UBF member<br />

banks and financial institutions to<br />

learn from a global expert in the<br />

field of risk management. Professor<br />

Altman discussed the phenomenon<br />

of ghost companies, which manage<br />

to continue operating despite their<br />

inability to make profits or meet their<br />

obligations. He also spoke about credit<br />

risk management models and how<br />

they can be applied to counter these<br />

companies. In addition, Professor<br />

Altman provided an overview of the<br />

ZValue model, which has been used<br />

by banks in more than 20 countries.<br />

He also highlighted the evolution of<br />

resilient capabilities by companies and<br />

economic institutions in the current<br />

credit cycle, and the factors that<br />

contribute to determining the phases<br />

of the credit cycle.<br />

CBUAE cancels Abu Dhabi license of Russia’s<br />

MTS Bank<br />

On 31 March, <strong>2023</strong>, the<br />

Central Bank of the UAE has<br />

announced the cancellation<br />

of MTS Bank’s Abu Dhabi<br />

branch license, a Russian bank that<br />

had obtained a license to operate<br />

in the UAE in 2022. <strong>The</strong> bank’s Abu<br />

Dhabi operations will be wound down<br />

within six months of the decision. <strong>The</strong><br />

decision was made after considering<br />

the risks of sanctions associated with<br />

the bank after its designation by the US,<br />

UK and EU. During the winding down<br />

period, the branch will be prohibited<br />

from opening new accounts and<br />

conducting transactions, except for<br />

clearing prior obligations. <strong>The</strong> bank’s<br />

use of Central Bank’s payment systems<br />

will be restricted to this purpose only.<br />

UAE issues new AED 1,000 banknote for circulation<br />

<strong>The</strong> UAE Central Bank has<br />

launched a new AED 1,000<br />

banknote, made from ecofriendly<br />

polymer material.<br />

<strong>The</strong> banknote features cultural and<br />

development symbols that represent the<br />

UAE’s global achievements, reflecting its<br />

position as a leader among developed<br />

countries. <strong>The</strong> design also highlights<br />

the UAE’s achievements in space<br />

exploration, embodying its forwardlooking<br />

vision and ambitions. <strong>The</strong><br />

banknote will be available at banks and<br />

exchange houses, in alignment with the<br />

UAE’s declaration of <strong>2023</strong> as the year of<br />

sustainability. Khaled Mohamed Balama,<br />

Governor of the UAE Central Bank, said<br />

the banknote represents the new phase<br />

of the UAE’s developmental journey and<br />

ambitious future.<br />

UAE set to be a leader in digital finance with CBDC<br />

<strong>The</strong> UAE’s leadership has a strong<br />

vision for digital transformation<br />

and non-oil production. To<br />

further diversify its economy,<br />

the central bank is planning a Central<br />

Bank Digital Currency (CBDC) - a digital<br />

version of the UAE’s fiat currency, issued<br />

and backed by the central bank. Unlike<br />

decentralized cryptocurrencies, CBDCs<br />

are created and maintained by a central<br />

bank, responding to the rise of cashless<br />

payments and providing greater access to<br />

financial services. However, challenges<br />

remain, such as ensuring cybersecurity<br />

and data privacy, regulatory compliance,<br />

and bridging the digital divide for<br />

underserved populations. CBDCs would<br />

allow for instant, secure transactions<br />

without intermediaries.<br />

14 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

Blockchain adoption to be driven by central bank digital currencies and<br />

gaming industry<br />

Blockchain is a database<br />

technology that links digital<br />

transactions using cryptography<br />

to create a secure and efficient<br />

ledger, which is behind cryptocurrencies<br />

like Bitcoin. <strong>The</strong> Emirates Blockchain<br />

Strategy 2021, launched by the UAE<br />

in 2018, aims to shift nearly 50% of<br />

government transactions to blockchain<br />

within three years, potentially saving<br />

AED 11B ($2.99B) in costs and 398<br />

million printed documents annually.<br />

<strong>The</strong> Middle East, Africa, and Asia Crypto<br />

and Blockchain Association, launched<br />

in Abu Dhabi, aims to integrate digital<br />

assets into key economic sectors and<br />

address challenges facing the industry.<br />

<strong>The</strong> UAE Central Bank has also started<br />

implementing its digital currency<br />

strategy, Digital Dirham, with the help<br />

of infrastructure provider G42 Cloud<br />

and technology provider R3.<br />

GCC Banks well-equipped<br />

to withstand Turkish risks<br />

with ample buffers<br />

According to Fitch Ratings, GCC<br />

banks that have subsidiaries<br />

in Turkey have enough capital<br />

and profitability buffers to<br />

withstand any financial risks stemming<br />

from their operations in Turkey. Even<br />

in the event of a full write-down of<br />

the subsidiaries and before factoring<br />

in pre-impairment operating profit<br />

buffers, banks’ regulatory capital<br />

ratios would remain above minimum<br />

requirements. <strong>The</strong> banks’ Viability<br />

Ratings (VRs) already reflect the<br />

risks from Turkish operations, and a<br />

downgrade of Turkey would be unlikely<br />

to trigger VR downgrades due to the<br />

banks’ strong buffers and declining<br />

Turkish exposures. ENBD and KFH were<br />

the most affected, with above-average<br />

Turkish exposure and a decline in their<br />

operating profit/risk-weighted assets<br />

(RWA) ratio by about 60bp when net<br />

monetary losses were included.<br />

Dubai Police and Banks join forces to tackle<br />

Financial Crime<br />

Dubai Police’s General<br />

Department of Criminal<br />

Investigation has teamed up<br />

with ten banks and financial<br />

institutions to combat financial<br />

crime. <strong>The</strong> signed Memorandums<br />

of Understanding (MoUs) aim to<br />

enhance security and cooperation<br />

between the parties in investigating and<br />

predicting future economic crimes. <strong>The</strong><br />

collaboration seeks to create predictive<br />

frameworks that improve performance<br />

levels and promote preventive planning<br />

in line with global economic, criminal,<br />

and technological changes. As Dubai<br />

is a global economic and investment<br />

destination, the partnership aims<br />

to intensify efforts in cooperation<br />

with internal and external partners<br />

to strengthen the security system and<br />

prevent financial crimes in the region.<br />

Saudi National Bank Chairman steps down following<br />

Credit Suisse acquisition<br />

Saudi National Bank’s Chairman,<br />

Abdul Wahed Al Khudairy, has<br />

resigned for personal reasons<br />

and has been replaced by<br />

Chief Executive Saeed Mohammed Al<br />

Ghamdi. <strong>The</strong> bank has also appointed<br />

Talal Ahmed Al Khereiji as acting CEO.<br />

<strong>The</strong> bank, which acquired almost<br />

9.9% of Credit Suisse for $1.46B last<br />

November, suffered an 80% loss on its<br />

investment after UBS forced a takeover<br />

of the Swiss bank for $3.2B. However,<br />

the Saudi lender stated that the drop<br />

in investment value did not impact<br />

its growth plans and forward-looking<br />

guidance for <strong>2023</strong>. <strong>The</strong> announcement<br />

of new appointments followed after<br />

Abdul Wahed Al Khudairy, the former<br />

Chairman of Saudi National Bank, that<br />

the bank, which is the largest in the<br />

country in terms of assets, would not<br />

be able to purchase more shares in<br />

Credit Suisse due to regulatory reasons.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 15

UAE Reforms<br />

<strong>The</strong> Central Bank of UAE Launches CBDC<br />

strategy<br />

<strong>The</strong> Central Bank of UAE<br />

(CBUAE) jointly held a signing<br />

ceremony with G42 Cloud and<br />

R3 to mark the implementation<br />

of the CBUAE Central Bank Digital<br />

Currency (CBDC) Strategy, one of<br />

the nine initiatives of the CBUAE’s<br />

Financial Infrastructure Transformation<br />

(FIT) Programme. <strong>The</strong> CBUAE has<br />

engaged with G42 Cloud and R3 as<br />

the infrastructure and technology<br />

providers respectively for its CBDC<br />

implementation.<br />

Following several successful CBDC<br />

initiatives including Project “Aber”<br />

with the Saudi Central Bank in 2020,<br />

which confirmed the possibility of<br />

using a digital currency issued by two<br />

central banks to settle cross borders<br />

payments and was awarded the Global<br />

Impact Award by Central Banking<br />

Magazine, in addition to the first realvalue<br />

cross-border CBDC pilot under<br />

the “mBridge” Project with the Hong<br />

Kong Monetary Authority, the Bank of<br />

Thailand, the Digital Currency Institute<br />

of the People’s Bank of China and the<br />

Bank for International Settlements<br />

in 2022, the CBUAE is now ready for<br />

entering into the next major milestone<br />

of the CBDC journey and implementing<br />

its CBDC Strategy.<br />

<strong>The</strong> first phase of CBUAE’s CBDC<br />

Strategy, which is expected to complete<br />

over the next 12 to 15 months; comprises<br />

three major pillars, the soft launch<br />

of mBridge to facilitate real-value<br />

cross-border CBDC transactions for<br />

international trade settlement, proofof-concept<br />

work for bilateral CBDC<br />

bridges with India, one of the UAE’s<br />

top trading partners and finally, proofof-concept<br />

work for domestic CBDC<br />

issuance covering wholesale and retail<br />

usage.<br />

CBDC is a risk-free form of digital<br />

money issued and guaranteed by the<br />

central bank and serves as a secure,<br />

cost-effective and efficient form of<br />

payment and a store of value. As part<br />

of the UAE’s digital transformation,<br />

CBDC will help address the pain points<br />

of domestic and cross-border payments,<br />

enhance financial inclusion and the<br />

move towards a cashless society.<br />

It will further strengthen the UAE’s<br />

payment infrastructure, providing<br />

additional robust payment channels<br />

and ensuring a resilient and reliable<br />

financial system. More importantly, the<br />

CBUAE aims to ensure the readiness<br />

of the UAE to integrate the payment<br />

infrastructures with the future potential<br />

tokenisation world, the tokenisation of<br />

financial and non-financial activities.<br />

Khaled Mohamed Balama, the<br />

Governor of the CBUAE, said, “CBDC<br />

is one of the initiatives as part of the<br />

CBUAE’s FIT programme, which will<br />

further position and solidify the UAE<br />

as a leading global financial hub. <strong>The</strong><br />

launch of our CBDC strategy marks a<br />

key step in the evolution of money and<br />

payments in the country. CBDC will<br />

accelerate our digitalisation journey and<br />

promote financial inclusion. We look<br />

forward to exploring the opportunities<br />

that CBDC will bring to the wider<br />

economy and society.”<br />

16 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

MoF Issues Decision on Small Business<br />

Relief for Corporate Tax Purposes<br />

<strong>The</strong> Ministry of <strong>Finance</strong><br />

(MoF) has issued Ministerial<br />

Decision No. 73 of <strong>2023</strong> on<br />

Small Business Relief for the<br />

purposes of Federal Decree-Law No. 47<br />

of 2022 on the Taxation of Corporations<br />

and Businesses (Corporate Tax Law).<br />

<strong>The</strong> decision is issued in accordance<br />

with Article 21 of the Corporate Tax<br />

Law, which treats the taxable person as<br />

not having derived any taxable income<br />

in a given tax period where the revenue<br />

did not exceed a certain threshold.<br />

Small Business Relief is intended<br />

to support start-ups and other small<br />

or micro businesses by reducing their<br />

Corporate Tax burden and compliance<br />

costs. <strong>The</strong> Ministerial Decision on Small<br />

Business Relief specifies the revenue<br />

threshold and conditions for a taxable<br />

person to elect for Small Business<br />

Relief and clarifies the provisions of<br />

the carried forward Tax Losses and<br />

disallowed Net Interest Expenditure<br />

under the Small Business Relief scheme.<br />

<strong>The</strong> Ministerial Decision on Small<br />

Business Relief stipulates the<br />

following:<br />

1. Taxable persons that are resident<br />

persons can claim Small Business<br />

Relief where their revenue in the<br />

relevant tax period and previous tax<br />

periods is below AED 3M for each<br />

tax period. This means that once a<br />

taxable person exceeds the AED 3M<br />

revenue threshold in any tax period,<br />

then the Small Business Relief will<br />

no longer be available.<br />

2. <strong>The</strong> AED 3M revenue threshold will<br />

apply to tax periods starting on or<br />

after 1st June <strong>2023</strong> and will only<br />

continue to apply to subsequent tax<br />

periods that end before or on 31st<br />

December 2026.<br />

3. Revenue can be determined based on<br />

the applicable accounting standards<br />

accepted in the UAE.<br />

4. Small Business Relief will not be<br />

available to Qualifying Free Zone<br />

Persons or members of Multinational<br />

Enterprises Groups (MNE Groups) as<br />

defined in Cabinet Decision No. 44 of<br />

2020 on Organising Reports Submitted<br />

by Multinational Companies. MNE<br />

Groups are groups of companies<br />

with operations in more than one<br />

country that have consolidated group<br />

revenues of more than AED 3.15B.<br />

5. In tax periods defined in the decision<br />

where businesses do not elect to apply<br />

for Small Business Relief, they will<br />

be able to carry forward any incurred<br />

Tax Losses and any disallowed Net<br />

Interest Expenditure from such tax<br />

periods, for use in future tax periods<br />

in which the Small Business Relief<br />

is not elected.<br />

6. With regard to the artificial separation<br />

of business, the Ministerial Decision<br />

specifies that where the Federal Tax<br />

Authority (FTA) establishes that<br />

taxable persons have artificially<br />

separated their business or business<br />

activity and the total revenue of the<br />

entire business or business activity<br />

exceeds AED 3M in any tax period and<br />

such persons have elected to apply for<br />

Small Business Relief, this would be<br />

considered an arrangement to obtain<br />

a Corporate Tax advantage under<br />

Clause (1) of Article 50 regarding<br />

the general anti-abuse rules of the<br />

Corporate Tax Law.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 17

Fintech<br />

Three UAE-Based Fintechs Attracting<br />

Investors’ Attention<br />

Fintech startups are on the rise in the UAE, with several companies<br />

making waves in the payments and digital banking space. In this article,<br />

we shed light on Postpay, YAP, and Pyypl, three promising fintechs<br />

attracting attention from investors and customers alike. With their<br />

innovative payment solutions, strong funding, impressive user bases,<br />

and innovative approaches to payment solutions, these three fintechs<br />

are well-positioned for continued growth and success in the years to<br />

come.<br />

Postpay<br />

Postpay is a fintech startup that<br />

provides payment solutions for<br />

customers through its buy now<br />

pay later (BNPL) service. Founded<br />

in 2019 by Tariq Sheikh and Dani Molina<br />

Carmona, Postpay has quickly become<br />

a leading payment solutions provider<br />

in the Middle East. Headquartered in<br />

the UAE, Postpay has a team of 51-200<br />

employees dedicated to providing topnotch<br />

payment services. <strong>The</strong> company<br />

has received a total funding of $63.5M<br />

from investors such as Afterpay, Touch<br />

Ventures Ltd, IMPACT46, and others.<br />

Postpay’s specialties include BNPL,<br />

fintech, AI, finance, UI excellence,<br />

payments, and ecommerce. Its innovative<br />

payment solutions have earned it a loyal<br />

customer base of over a million active<br />

users. <strong>The</strong> company has partnered<br />

with more than 1,500 brands, including<br />

regional merchants such as Ounass,<br />

Namshi, and Alshaya.<br />

In 2021, Postpay handled over $500M<br />

in transactions, demonstrating its strong<br />

foothold in the payments industry.<br />

<strong>The</strong> company’s app has also been<br />

successful, with 400,000 downloads<br />

as of July 2022. Postpay operates<br />

across the GCC, including in the UAE<br />

and Saudi Arabia, where it has gained<br />

a reputation as a reliable and userfriendly<br />

payment solutions provider.<br />

With its commitment to innovation<br />

and excellence, Postpay is poised for<br />

continued growth and success in the<br />

years to come.<br />

18 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

YAP<br />

YAP is a financial super app that<br />

offers a range of digital banking<br />

services to both individuals and<br />

businesses. Founded in 2021<br />

by Marwan Hachem and Anas Zaidan,<br />

YAP has quickly established itself as<br />

a leading player in the digital banking<br />

space. Since its establishment, YAP<br />

has secured a total of $45M in funding<br />

from angels and family offices. With a<br />

current team size of 11-50 employees,<br />

YAP has been able to offer a range of<br />

innovative digital banking solutions<br />

to its customers.<br />

<strong>The</strong> company’s headquarters is located<br />

in the UAE. YAP’s consumer debit<br />

cards, virtual cards with Apple Pay<br />

and Samsung Pay, spending analytics,<br />

money transfers, bill payments, and<br />

real-time notifications of purchases<br />

have been well-received by users.<br />

In the UAE, YAP has partnered with<br />

RAKBANK for consumers and the<br />

Emirates Development Bank for SMEs.<br />

This has enabled the company to<br />

onboard over 190,000 users and 8,000<br />

SME partners.<br />

In July 2022, YAP raised $41M in<br />

funding to fuel its expansion plans<br />

in Saudi Arabia, Egypt, Pakistan, and<br />

Ghana. <strong>The</strong> company has already<br />

partnered with Bank AlJazira to launch<br />

its consumer and business banking<br />

platforms in Saudi Arabia in <strong>2023</strong>.<br />

YAP’s innovative approach to digital<br />

banking has made it a standout company<br />

in the fintech space. With its strong<br />

partnerships, impressive user base,<br />

and funding, YAP is well-positioned<br />

to continue its growth and expansion<br />

in the years to come.<br />

Pyypl<br />

Pyypl is a mobile-led financial services<br />

app that specializes in fintech, mobile<br />

payments, mobile technology, blockchain,<br />

and financial inclusion. Founded in 2017<br />

by Antti Arponen and Phil Reynolds,<br />

Pyypl has quickly gained traction<br />

as a leading provider of innovative<br />

digital payment solutions. With a team<br />

size of 51-200 employees, Pyypl has<br />

been able to offer a range of virtual<br />

and physical prepaid cards, instant<br />

domestic and international user-touser<br />

transfers, and remittances to 38<br />

currency destinations. <strong>The</strong> company’s<br />

headquarters are located in the UAE,<br />

and it currently operates in the UAE,<br />

Bahrain, Kenya, Mozambique, Sierra<br />

Leone, and Kazakhstan.<br />

Pyypl has secured a total of $40M in<br />

funding from undisclosed investors. In<br />

November 2022, the company raised<br />

$20M in a Series B fundraising round to<br />

expand the reach of its digital payments<br />

and financial services across the Middle<br />

East and Africa. Pyypl claims that its<br />

user numbers, transaction volumes,<br />

and revenues have grown over four<br />

times since its Series A funding round<br />

in 2021.<br />

Pyypl’s commitment to financial<br />

inclusion and innovation has made it a<br />

standout company in the fintech space.<br />

<strong>The</strong> company aims to be fully operational<br />

in more than 20 countries in the next<br />

five years. Its focus on expanding its<br />

reach to underserved populations has<br />

set it apart from its competitors. With<br />

its strong financial backing, impressive<br />

growth, and innovative products,<br />

Pyypl is well-positioned to continue<br />

its expansion and make a significant<br />

impact in the digital payments space.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 19

Fintech News<br />

Qatar Financial Centre<br />

and R3 join forces to<br />

enhance fintech growth<br />

<strong>The</strong> Qatar Financial Centre<br />

Authority (QFCA) has signed an<br />

MoU with R3, a global provider<br />

of enterprise distributed ledger<br />

technology (DLT) and services, to bolster<br />

the growth of the fintech industry in Qatar.<br />

Under the partnership, QFCA and R3 will<br />

work to establish a lab environment for<br />

commercial banks and fintechs in Qatar,<br />

promote education and training on asset<br />

digitisation and the use of DLT, and create<br />

working groups to observe emerging<br />

regulatory paradigms. <strong>The</strong> agreement also<br />

supports QFCA’s deployment of DLT on<br />

a national level. <strong>The</strong> QFC’s CEO, Yousuf<br />

Mohamed Al Jaida, said the collaboration<br />

aims to foster innovation and support<br />

fintech growth in Qatar.<br />

Saudi Arabian Fintech Hakbah closes $2M funding<br />

Saudi Arabia’s Hakbah, a fintech<br />

savings platform, has secured<br />

$2M in a pre-Series A funding<br />

round following regulatory<br />

approval from the Saudi Central Bank.<br />

<strong>The</strong> round was led by Global Ventures,<br />

a MENA-based venture capital firm, and<br />

Aditum Investment Management, based<br />

in the Dubai International Financial<br />

Centre, which provided Hakbah with its<br />

first institutional capital. <strong>The</strong> funds will<br />

be used to expand Hakbah’s presence<br />

in Saudi Arabia, improve the user<br />

journey, and enhance its savings engine<br />

algorithm. <strong>The</strong> firm offers an automated<br />

savings platform that invests user<br />

Zero Two, a digital assets<br />

infrastructure company, has<br />

launched operations in Abu<br />

Dhabi, aiming to benefit from<br />

the emirate’s growing interest in Web3<br />

technology and ecosystem. <strong>The</strong> company<br />

offers a comprehensive range of digital<br />

asset infrastructure solutions, including<br />

power infrastructure development, latestgeneration<br />

technology sourcing and testing,<br />

data centre building and operation, and<br />

digital assets management services. Zero<br />

Two’s goal is to become a trusted partner<br />

for companies seeking to benefit from the<br />

transformative potential of digital assets.<br />

funds in Sharia-compliant fixed-income<br />

instruments, providing users with a<br />

profit-sharing ratio.<br />

Digital assets firm Zero Two launches operations<br />

in Abu Dhabi<br />

<strong>The</strong> company will also play a critical role<br />

in supporting the stability of Abu Dhabi’s<br />

power grid while contributing to the UAE’s<br />

Net Zero commitments and transition to<br />

a sustainable and decarbonized economy.<br />

MBME becomes first family-owned fintech to go public on ADX Growth<br />

Market<br />

MBME Group, the operator<br />

of the UAE’s largest online<br />

payment platforms for utility<br />

and government services, has<br />

become the first fintech company to list<br />

on the Abu Dhabi Securities Exchange’s<br />

(ADX) Growth Market. MBME, which<br />

is a family-owned business, saw its<br />

stock open at AED 12.000 and close at<br />

AED 12.300 on its debut day, under the<br />

trading symbol MBME. Listing on the<br />

ADX Growth Market allows MBME to<br />

expand and develop its digital payment<br />

solutions at a faster pace and promote<br />

adoption in the region, with more than<br />

90 million transactions involving over<br />

3.2 million clients, 650 APIs, and 4,000<br />

touchpoints across the UAE.<br />

20 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

Abu Dhabi’s RemotePass introduces physical debit<br />

card for remote workers<br />

RemotePass, a leading remote<br />

work platform based in<br />

Abu Dhabi, has launched a<br />

physical debit card to facilitate<br />

instant payments for remote teams<br />

in emerging markets, with no fees<br />

and bypassing international transfer<br />

delays and Swift fees. <strong>The</strong> new service<br />

also allows global remote workers<br />

to hold funds in USD, granting them<br />

greater control over their finances.<br />

<strong>The</strong> RemotePass card is equipped<br />

with 3D Secure for enhanced online<br />

transaction authentication, and offline<br />

transactions require a PIN for added<br />

security. RemotePass’s co-founder<br />

and CEO, Kamal Reggad, expressed<br />

excitement about delivering on<br />

the company’s vision of providing<br />

benefits and financial services to<br />

underserved workers in emerging<br />

markets, particularly in the UAE<br />

where Dubai is ranked as the thirdbest<br />

city for digital nomads to reside<br />

according to Savills.<br />

UAE’s Alaan partners with OpenAI to provide<br />

live expense insights<br />

UAE-based fintech Alaan has<br />

partnered with OpenAI to<br />

integrate advanced artificial<br />

intelligence technology onto<br />

its platform to offer real-time insights<br />

on corporate spend and improve<br />

expense management experience for<br />

its users. Alaan, which participated in<br />

the latest batch of startup accelerator<br />

Y Combinator and was given early<br />

access to ChatGPT-4, can now use<br />

OpenAI’s natural language processing<br />

capabilities to provide more intelligent,<br />

intuitive, and efficient expense<br />

management for its users. <strong>The</strong> AIpowered<br />

system enables users to type<br />

queries about spending activities and<br />

receive personalised, context-aware<br />

responses within seconds, while also<br />

categorising and analysing expenses in<br />

real time, detecting spending behaviour<br />

patterns and trends, and alerting users<br />

of unusual activities.<br />

MyFatoorah receives<br />

license from Qatar<br />

Central Bank for<br />

digital payments<br />

<strong>The</strong> Qatar Central Bank<br />

(QCB) has granted a license<br />

to MyFatoorah Company<br />

to provide digital payment<br />

services, making it the seventh company<br />

in the financial technology sector<br />

to come under QCB’s supervision.<br />

<strong>The</strong> move is part of QCB’s efforts<br />

to develop and reinforce the fintech<br />

sector in the country. MyFatoorah is<br />

a Kuwait-based fintech company that<br />

provides electronic payment solutions<br />

to businesses and individuals in the<br />

Gulf region. <strong>The</strong> company’s services<br />

include online payment gateway,<br />

e-invoicing, and mobile payment<br />

solutions. MyFatoorah’s expansion<br />

into Qatar is expected to boost digital<br />

payment services in the country.<br />

ADCB & Al Hilal Bank Partner with BLME for UAE-UK Banking<br />

ADCB and its Shari’ah-compliant<br />

digital banking subsidiary, Al<br />

Hilal Bank, have teamed up<br />

with Bank of London and the<br />

Middle East (BLME) to launch Nomo,<br />

a digital UK banking service for UAE<br />

residents and nationals. Customers<br />

can now open multi-currency current<br />

and savings accounts and apply for UK<br />

home financing using ADCB-Nomo and<br />

Al Hilal-Nomo mobile banking apps. This<br />

unique offering showcases ADCB Group’s<br />

flexibility and dedication to providing<br />

excellent customer experiences. Nomo is<br />

a subsidiary of Boubyan Bank, a leading<br />

financial institution in the Middle East,<br />

and is designed to provide high-quality,<br />

Shari’ah-compliant digital banking to<br />

non-UK residents in the Middle East.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 21

Fintech Application<br />

BEAM WALLET<br />

About<br />

Beam Wallet is a mobile payment<br />

and rewards app that allows<br />

users to make purchases, earn<br />

rewards, and redeem them at<br />

participating merchants in the UAE.<br />

Users can link their credit or debit<br />

cards to the app to make payments,<br />

and they can also earn rewards for<br />

every transaction they make.<br />

Review<br />

Beam Wallet is a popular mobile<br />

payment and rewards app in the UAE<br />

that provides its users with a variety<br />

of features and benefits. One of the<br />

key features of the app is its mobile<br />

payment functionality, which allows<br />

users to make payments at participating<br />

merchants in the UAE using their<br />

mobile phones. This feature is not<br />

only convenient but also secure, as the<br />

app uses state-of-the-art encryption<br />

technology to protect users’ payment<br />

information.<br />

In addition to its mobile payment<br />

feature, Beam Wallet also offers a<br />

comprehensive rewards program that<br />

allows users to earn points for every<br />

transaction they make using the app.<br />

<strong>The</strong>se points can then be redeemed for<br />

discounts, vouchers, and other rewards<br />

at participating merchants in the UAE,<br />

giving users even more incentive to use<br />

the app for their everyday transactions.<br />

To make the app even more appealing<br />

to users, Beam Wallet also offers a<br />

wide range of deals and discounts at<br />

participating merchants in the UAE.<br />

Users can find these deals on the app<br />

and use them to save money on their<br />

purchases, which is a valuable feature<br />

for many users who are looking to<br />

make their money go further. Beam<br />

Wallet’s user interface is also one of its<br />

key strengths. <strong>The</strong> app is designed to<br />

be user-friendly and easy to navigate,<br />

with a clean and intuitive interface<br />

that makes it easy for users to find<br />

merchants, make payments, and manage<br />

their rewards and discounts through<br />

the app. <strong>The</strong> app is available in both<br />

English and Arabic, which is a helpful<br />

feature for users who prefer to use the<br />

app in their native language.<br />

Beam Wallet is a comprehensive<br />

and convenient mobile payment and<br />

rewards app that provides its users<br />

with a variety of features and benefits.<br />

Whether you are looking to make secure<br />

mobile payments, earn rewards for<br />

your transactions, or save money on<br />

your purchases, Beam Wallet is worth<br />

considering.<br />

Availability: Google Play Store and<br />

Apple App Store<br />

Website: https://beamwallet.com/<br />

22 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

<strong>The</strong> Sonos Era 300 Speaker<br />

<strong>The</strong> Sonos Era 300 Speaker is a<br />

high-quality wireless speaker<br />

that delivers an immersive<br />

sound and is easy to use.<br />

This speaker boasts impressive<br />

features, including WiFi and Bluetooth®<br />

connectivity, the ability to stream content<br />

from all your favorite services and devices,<br />

and an auxiliary cable for connecting a<br />

turntable or other audio source. What<br />

sets the Sonos Era 300 apart is its<br />

ability to deliver mind-bending realistic<br />

surround sound when paired with Arc<br />

and streaming spatial audio with Dolby<br />

Atmos. This makes it ideal for movie and<br />

TV enthusiasts who want to experience<br />

immersive sound like never before.<br />

Setting up the Sonos Era 300 is incredibly<br />

easy, and controlling it is even easier with<br />

the Sonos app, next-generation touch<br />

controls, and your voice. You can use<br />

your voice to play and control music,<br />

change the volume, skip tracks, and more<br />

without using your hands.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 23

Business News<br />

UAE Joins G20 <strong>Finance</strong> Track’s 2nd IFA WG Meeting for <strong>2023</strong><br />

<strong>The</strong> International Financial<br />

Architecture Working Group<br />

(IFA WG) within the Gp20<br />

<strong>Finance</strong> Track for <strong>2023</strong> met in<br />

Paris, France, on March 30th and 31st.<br />

Attendees, including G20 members, invited<br />

countries, and international organizations,<br />

discussed progress made on the <strong>2023</strong> IFA<br />

WG work plan. <strong>The</strong> meeting focused on<br />

addressing the sustainability of sovereign<br />

debt, proposing solutions to support<br />

vulnerable countries, implementing<br />

recommendations on multinational<br />

development banks’ capital adequacy<br />

frameworks, and strengthening these<br />

banks to tackle global challenges.<br />

Members also discussed the effects<br />

of climate change-related policies on<br />

capital flows. <strong>The</strong> UAE team stressed<br />

the need for collaboration with regional<br />

organizations to promote global debt<br />

sustainability and encouraged incentives<br />

for debt transparency.<br />

Yahsat to invest<br />

$17.5M in IoT network<br />

operator<br />

Yahsat, a satellite communications<br />

firm based in Abu Dhabi, has<br />

revealed that its subsidiary will<br />

invest $17.5M in Astrocast, a<br />

network operator focused on IoT and low<br />

Earth orbit. Thuraya Telecommunications,<br />

which provides mobile satellite services,<br />

will provide the investment as a convertible<br />

loan, marking its initial investment in a LEO<br />

satellite constellation. <strong>The</strong> companies will<br />

also extend their technical cooperation<br />

agreement, which was first established<br />

between Thuraya and Astrocast in 2019,<br />

for an additional four years. Astrocast<br />

operates IoT networks using nanosatellites<br />

on a global scale and aims to provide low<br />

power wide area connectivity solutions.<br />

UAE Tops Kearney’s Emerging Market Index for<br />

MENA Region<br />

<strong>The</strong> UAE has been ranked as the<br />

third most appealing emerging<br />

market globally for investors,<br />

and the top one in the Middle<br />

East and North Africa (MENA) region,<br />

according to Kearney’s Global Emerging<br />

Markets Index. China and India secured<br />

the first two positions globally. <strong>The</strong><br />

UAE’s business-friendly policies and<br />

reforms, as well as its initiatives to<br />

attract talent, have made it an attractive<br />

H.E. Abdullah bin Touq Al Marri,<br />

the Minister of Economy in<br />

the UAE, announced that<br />

the country had reached an<br />

impressive milestone of 557,000 small<br />

and medium-sized enterprises (SMEs)<br />

by the end of 2022. This achievement is<br />

in line with the UAE’s ambitious plan to<br />

increase the number of SMEs to 1 million<br />

by the end of 2030. Al Marri emphasised<br />

the significant role that SMEs play in<br />

the non-oil GDP, accounting for 63.5<br />

percent of it. <strong>The</strong> ministry’s vision is<br />

to establish a globally competitive<br />

knowledge-based economy, led by UAE<br />

nationals, by creating an investment<br />

environment that supports citizens<br />

who own SMEs. <strong>The</strong> ministry also aims<br />

to protect consumer rights, increase<br />

foreign direct investment (FDI), and<br />

destination for investors. <strong>The</strong> country is<br />

expected to receive a significant chunk<br />

of the $66B potential foreign direct<br />

investment (FDI) inflows into MENA<br />

and Pakistan this year, after logging<br />

around $22B in FDI inflows in 2022.<br />

However, investors have expressed<br />

concerns about commodity price<br />

increases, heightened geopolitical<br />

tensions, and political instability in<br />

emerging markets.<br />

Minister of Economy: 557,000 SMEs operated in<br />

UAE at end of 2022<br />

promote an entrepreneurial culture<br />

among future generations.<br />

24 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

UAE, Vietnam sign mutual declaration of intent to begin CEPA talks<br />

<strong>The</strong> UAE and Vietnam have<br />

signed a mutual declaration<br />

of intent to begin negotiations<br />

for a comprehensive economic<br />

partnership agreement (CEPA). <strong>The</strong><br />

document was signed by the Minister<br />

of State for Foreign Trade, H.E. Dr.<br />

Thani bin Ahmed Al Zeyoudi, and the<br />

Vietnamese Minister of Industry and Trade,<br />

Nguyen Hong Dien. <strong>The</strong> UAE is Vietnam’s<br />

leading trade partner in the Arab region,<br />

accounting for 39 percent of Vietnamese<br />

trade with the region. <strong>The</strong> two sides<br />

discussed ways to strengthen cooperation<br />

in areas including trade, investment, the<br />

new economy, industry, energy, logistics,<br />

agriculture, and infrastructure.<br />

AD Ports Group secures<br />

$2B corporate facility<br />

with syndicate of 13<br />

banks<br />

AD Ports Group has signed a<br />

General Corporate Facility<br />

agreement with a syndicate of<br />

13 regional and international<br />

banks, including First Abu Dhabi Bank,<br />

Citibank, Mizuho Bank, and Société<br />

Générale. <strong>The</strong> multi-currency facility is<br />

worth around $2B and includes three<br />

tranches with a tenure of up to 2.5 years.<br />

<strong>The</strong> demand for the facility was overwhelming,<br />

with commitments of $7.4B<br />

in total from participating banks. AD<br />

Ports Group managed to improve pricing<br />

compared to the $1B RCF secured in<br />

2021. <strong>The</strong> successful funding reaffirms<br />

AD Ports Group’s strong financial position<br />

and supports its ambitious strategic<br />

development plans.<br />

Abu Dhabi Islamic Bank’s SME financing totalled<br />

$272.2M in 2022<br />

Abu Dhabi Islamic Bank (ADIB)<br />

has released its second<br />

Environmental, Social, and<br />

Governance (ESG) report,<br />

highlighting its progress towards<br />

ESG goals and commitments for the<br />

year 2022. <strong>The</strong> report also introduces<br />

a new three-year ESG strategy that<br />

integrates ESG risk considerations<br />

<strong>The</strong> UAE’s trade with the rest<br />

of the world surpassed $1T in<br />

2022, with exports growing by<br />

41% and imports accounting for<br />

22% of the total amount, according to<br />

the <strong>World</strong> Trade Organisation. Higher<br />

crude oil prices were cited as the main<br />

driver of growth. His Highness Sheikh<br />

Mohammed bin Rashid Al Maktoum,<br />

Vice President and Prime Minister of the<br />

UAE and Ruler of Dubai, said that the<br />

figures will continue to increase in the<br />

year ahead. His Highness emphasised<br />

into the banking framework to support<br />

the UAE’s transition towards a more<br />

sustainable economy. <strong>The</strong> bank invested<br />

AED 23M in community development<br />

initiatives and provided AED1 billion<br />

in SME financing, maintaining a stable<br />

financial position with 60 percent of<br />

the bank’s funding portfolio meeting<br />

low or medium ESG risk standards.<br />

UAE’s trade surpasses $1Tin 2022 and eyes further<br />

growth<br />

the UAE’s economic priorities and its<br />

commitment to developing its economy<br />

through international trade. <strong>The</strong><br />

country’s exports accounted for 2.4% of<br />

the global merchandise exports share.<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 25

Cover Story<br />

<strong>The</strong> region<br />

promises a<br />

lot of growth<br />

opportunities,<br />

and it is the<br />

right region<br />

for any fintech<br />

company.<br />

Mohammad Alblooshi<br />

Head of DIFC Innovation Hub & FinTech Hive<br />

26 www.thefinanceworld.com <strong>May</strong> <strong>2023</strong>

UAE’s Fintech Ecosystem and the upcoming<br />

Dubai Fintech Summit <strong>2023</strong><br />

Mohammed Alblooshi is a specialist in FinTech & innovation. He contributes to the<br />

growth of Dubai International Financial Centre (DIFC) by developing and managing<br />

its FinTech & Innovation functions in line with the Dubai Vision of a global business<br />

hub for tech.<br />

Exclusive to the <strong>Finance</strong> <strong>World</strong> Magazine<br />

Q. Could you give us a brief<br />

introduction of your experience<br />

at the DIFC Innovation Hub and<br />

FinTech Hive?<br />

I am Mohammad Alblooshi, and my<br />

role is to lead the DIFC Innovation<br />

Hub, responsible for advancing its<br />

innovation agenda. This includes<br />

overseeing a physical ecosystem that<br />

is home to around 650 fintech and<br />

innovation companies, as well as our<br />

accelerators and a strong network of<br />

venture capitalists. <strong>The</strong> ecosystem<br />

provides a comprehensive platform<br />

for startups and fintech companies to<br />

drive the evolution of finance within<br />

the financial center. Prior to this role, I<br />

worked in the banking industry, which<br />

has given me a background in finance.<br />

Now, my focus is on unlocking the<br />

potential of innovation and fintech<br />

companies and the future of finance<br />

sectors within DIFC.<br />

Q. What is your outlook on the<br />

current fintech arena in the UAE<br />

and the Middle East?<br />

I think it’s probably at a very<br />

interesting point because; if you are to<br />

<strong>May</strong> <strong>2023</strong> www.thefinanceworld.com 27

Cover Story<br />

compare us now to the fintech outlook<br />

globally, our market is still very<br />

nascent and developing very rapidly.<br />

We are yet to see the real potential and<br />

real growth, and I think there’s a huge<br />

opportunity for growth. If you compare<br />

other markets, I would say a lot of<br />

them are mature and stagnated, while<br />