The Finance World Magazine| Edition: December 2023

As the UAE commemorates its National Day, this edition celebrates the journey that transcends the sands, embracing the skies of global influence. It honours the UAE's growth, resilience, and significant global contributions while eagerly anticipating the promising chapters yet to unfold. The cover story highlights the narratives of Indian business leaders whose contributions have significantly contributed to the UAE's journey on the global stage. Their entrepreneurial spirit and initiatives have played a role in shaping aspects of the nation's growth and international presence. Highlighting the UAE’s visionary initiatives and strategic planning, this edition explores several aspects of the country’s progress. From the transformative journey of its energy sector and pioneering advancements in healthcare to the expanding domains of crypto and the ever-evolving landscape of real estate, each narrative illuminates pivotal moments in the UAE's narrative of success. Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

As the UAE commemorates its National Day, this edition celebrates the journey that transcends the sands, embracing the skies of global influence. It honours the UAE's growth, resilience, and significant global contributions while eagerly anticipating the promising chapters yet to unfold.

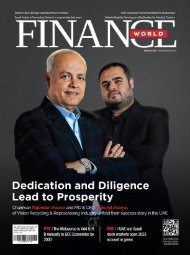

The cover story highlights the narratives of Indian business leaders whose contributions have significantly contributed to the UAE's journey on the global stage. Their entrepreneurial spirit and initiatives have played a role in shaping aspects of the nation's growth and international presence.

Highlighting the UAE’s visionary initiatives and strategic planning, this edition explores several aspects of the country’s progress. From the transformative journey of its energy sector and pioneering advancements in healthcare to the expanding domains of crypto and the ever-evolving landscape of real estate, each narrative illuminates pivotal moments in the UAE's narrative of success.

Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GROW YOUR<br />

BUSINESS<br />

We make Short / Long Term<br />

Investments in Growing Businessess<br />

www.wasayainvestments.com

Editor’s Note Note<br />

Contact:<br />

+971 58 591 8580<br />

Advertisement queries:<br />

Editorial:<br />

Press Release<br />

For News<br />

Contact:<br />

+971 58 591 8580<br />

For Partnerships Advertisement queries:<br />

com<br />

Public Relations Editorial:<br />

Press Release<br />

For Printed Copy<br />

Published By:<br />

For News<br />

For Partnerships<br />

MCFILL MEDIA &<br />

PUBLISHING GROUP<br />

Public Relations<br />

Approved and Licensed By:<br />

National Media Council,UAE<br />

com<br />

For Printed Copy<br />

<strong>The</strong> <strong>Finance</strong> <strong>World</strong> (TFW) has taken constant<br />

efforts to make sure that content is accurate as<br />

on the date of publication. <strong>The</strong> published articles,<br />

Published By:<br />

editorials, material, adverts and all other content<br />

is published in a good faith and opinions and<br />

MCFILL MEDIA &<br />

views are not necessarily those of the publishers.<br />

PUBLISHING GROUP<br />

We regret that we cannot guarantee and accept no<br />

liability for any loss or damage Approved of any and kind Licensed caused By:<br />

by this magazine and errors National and for Media the Council,UAE accuracy<br />

of claims in any forms by any advertisers or<br />

readers. We advise <strong>The</strong> the <strong>Finance</strong> readers <strong>World</strong> to seek (TFW) the has advice taken constant<br />

of specialists before efforts to acting make sure on that information content is accurate as<br />

published in the on magazine. the date of publication. <strong>The</strong> trademarks, <strong>The</strong> published articles,<br />

logos, pictures, domain editorials, names material, and adverts service and marks all other content<br />

is published in a good faith and opinions and<br />

(collectively the “Trademarks”) displayed on<br />

views are not necessarily those of the publishers.<br />

this magazine are<br />

We<br />

registered<br />

regret that we<br />

and<br />

cannot<br />

unregistered<br />

guarantee and accept no<br />

Trademarks of <strong>The</strong> liability <strong>Finance</strong> for any <strong>World</strong> loss and or damage its content of any kind caused<br />

providers. All rights by this reserved magazine and and nothing errors and can for be the accuracy<br />

partially or in whole of claims be reprinted any forms reproduced by any advertisers or<br />

or stored in a retrieval readers. system We advise or the transmitted readers to seek in the advice<br />

of specialists before acting on information<br />

any form without a written consent.<br />

published in the magazine. <strong>The</strong> trademarks,<br />

logos, pictures, domain names and service marks<br />

(collectively the “Trademarks”) displayed on<br />

Advertisers advertised in this guide magazine are included are on registered a sponsored and basis. unregistered<br />

Details are correct at the time Trademarks of going to of press, <strong>The</strong> <strong>Finance</strong> but offers <strong>World</strong> and prices and its content<br />

may change. providers. All rights reserved and nothing can be<br />

partially or in whole be reprinted or reproduced<br />

or stored in a retrieval system or transmitted in<br />

any form without a written consent.<br />

Reaching a visionary goal requires<br />

one percent vision and 99 percent alignment.<br />

As the UAE commemorates its National Day, this edition celebrates<br />

the journey that transcends the sands, embracing the skies<br />

of global influence. It honours the UAE’s growth, Editor’s resilience, Note<br />

and significant global contributions while eagerly anticipating the<br />

promising chapters yet to unfold.<br />

<strong>The</strong> cover story highlights the narratives of Indian business leaders<br />

whose contributions have significantly contributed to the UAE’s<br />

journey on the global stage. <strong>The</strong>ir entrepreneurial spirit and initiatives<br />

have played a role in shaping aspects of the nation’s growth and<br />

international presence.<br />

Highlighting the UAE’s visionary initiatives and strategic planning,<br />

this edition explores several aspects of the country’s progress.<br />

From the transformative journey of its energy sector and pioneering<br />

advancements in healthcare to the expanding domains of crypto and<br />

the ever-evolving landscape of real estate, each narrative illuminates<br />

pivotal moments in the UAE’s narrative of success.<br />

Within the news segments, you will find a condensed compendium<br />

of the most notable advancements in the field of finance. We have<br />

meticulously sifted through the latest trends and updates, spanning<br />

an array of pertinent topics such as corporate results, corporate tax,<br />

startups, banking, funding, investment, fintech, digital assets, and<br />

beyond.<br />

We aim to espouse the vision of the UAE’s wise leadership on the<br />

nation’s development path, highlighting the social, economic, and<br />

developmental aspects shaping this dynamic nation. To that end, we<br />

tirelessly curate the latest and most credible finance news for our<br />

readers, aiming to advance financial literacy and contribute to Dubai’s<br />

journey to becoming one of the world’s most pioneering economies.<br />

- Ambrish Agarwal, Editor in Chief<br />

- Ambrish Agarwal, Editor in Chief<br />

Advertisers advertised in this guide are included on a sponsored basis.<br />

Details are correct at the time of going to press, but offers and prices<br />

may change.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 5<br />

September 2022 3

Contents <strong>December</strong><br />

<strong>2023</strong><br />

PERSONAL FINANCE<br />

P8 | Budgeting Strategies for<br />

Expatriates in the UAE<br />

UAE BANKING<br />

BUSINESS<br />

P24 | Transformative Leadership<br />

Propelling Corporate Triumphs in<br />

UAE’s Business Landscape<br />

P26 | Business News<br />

COVER STORY<br />

HEALTHCARE<br />

P10 | From Cash to Contactless:<br />

Tracing the Progression of<br />

Payments in the UAE<br />

P12 | UAE Banking News<br />

UAE REFORMS<br />

P50 | Advancements,<br />

Achievements, and the Evolution<br />

of Healthcare in the UAE<br />

MERGERS AND<br />

ACQUISITIONS<br />

P16 | Adapting to Reform: 5<br />

Rules That Have Come into Effect<br />

in the UAE for <strong>2023</strong><br />

FINTECH<br />

P18 | Fintech Innovators: Reshaping<br />

the Financial Landscape of the UAE<br />

P20 | Fintech News<br />

P22 | Fintech Application<br />

P30 | Business Leader Crafting the<br />

UAE’s Global Eminence<br />

START-UP<br />

P42 | <strong>The</strong> Meteoric Ascent of<br />

UAE-born Startup Pioneers<br />

ENERGY<br />

P52 | Strategic Business Unions:<br />

Understanding the M&A Process<br />

in the UAE<br />

P54 | Mergers & Acquisitions News<br />

CRYPTOCURRENCY<br />

6 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong><br />

P44 | UAE’s Transformative<br />

Journey: From Hydrocarbons to<br />

Renewable Solutions<br />

P46 | Energy News<br />

P56 | From Trends to Business:<br />

Probing Crypto and Blockchain in<br />

the UAE

REAL ESTATE<br />

P58 | Anticipating Change as<br />

Dubai’s 2040 Vision Reshapes<br />

the Economy and Real Estate<br />

P60 | Real Estate News<br />

FUNDING & INVESTMENT<br />

P62 | Legislative Measures<br />

Shaping Venture Capital in the<br />

UAE’s Investment Realm<br />

P64 | Funding & Investment News<br />

DIGITAL ASSETS<br />

P66 | From Oil to Web3: RAK DAO’s<br />

Revolutionary Impact on UAE’s<br />

Economy<br />

STOCK MARKET<br />

P68 | <strong>The</strong> Underpinnings of UAE<br />

Stock Market: Unravelling DFM<br />

and ADX<br />

CORPORATE<br />

P70 | A Comprehensive Guide<br />

to Corporate Tax Registration<br />

Timelines in the UAE<br />

P72 | Corporate Results<br />

SPORT AS A BUSINESS<br />

P76 | Exploring the Allure of UAE’s<br />

Sports Empire, a Dynamic Player in<br />

the Global Business Landscape<br />

P78 | Sports News<br />

TOURISM<br />

P80 | Beyond Borders: GCC Unified<br />

Visa and the Future of Gulf Tourism<br />

P82 | <strong>The</strong> rise of tourism in the UAE,<br />

exploring crucial assets for potential<br />

growth<br />

GLOBAL<br />

P84 | Global News<br />

INVESTING IN ART<br />

P86 | Brushing Wealth: Companies<br />

Paving the Way for Art as Business<br />

in the UAE<br />

P96 | Local News<br />

TRAVEL<br />

P90 | T4 Visa-Free Destinations<br />

For UAE Citizens to Visit this<br />

<strong>December</strong><br />

P92 | Travel News<br />

P23 | P29 | Launch Express<br />

P40 | P48 | Wheels<br />

P28 | P95 | Tech My Money<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 7

Personal <strong>Finance</strong><br />

Budgeting Strategies for Expatriates in<br />

the UAE<br />

Living as an expatriate in the UAE offers a unique blend of cultural experiences<br />

and professional opportunities. However, navigating the financial landscape<br />

in a new country can be challenging. This article explores practical budgeting<br />

strategies tailored for expatriates in the UAE, drawing insights from various<br />

sources on effective financial planning.<br />

<strong>The</strong> UAE has made substantial efforts<br />

in making life easier for citizens as<br />

well as expats. <strong>The</strong> country offers<br />

a wide variety of facilities that cater to<br />

expatriates’ budgets, including rental<br />

homes, transportation, education, and<br />

more. It provides world-class public<br />

transport easily accessible to low-income<br />

expatriates while also offering luxury<br />

car rentals for high-income expats.<br />

Similarly, housing options range from<br />

shared rooms for as little as AED 450<br />

to high-end accommodations priced at<br />

AED 45,000.<br />

Following are some of the factors that<br />

are essential for maintaining a financially<br />

friendly lifestyle in the region.<br />

Understand Cost of Living Differences:<br />

Before crafting a budget, it’s crucial to<br />

understand the cost of living in the UAE<br />

compared to your home country. Consider<br />

housing, transportation, education, and<br />

healthcare costs. Online resources and<br />

expat forums can provide valuable insights<br />

into the local price levels.<br />

Create a Detailed Budget:<br />

Begin by outlining your monthly income<br />

and fixed expenses. Allocate funds for<br />

essentials such as rent, utilities, and<br />

groceries. Factor in discretionary spending<br />

for leisure activities, dining out, and<br />

travel. Creating a detailed budget provides<br />

a clear overview of your financial commitments<br />

and helps identify potential<br />

8 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

Establishing a budget as an expatriate in<br />

the UAE requires a thoughtful consideration<br />

of various factors to ensure a financially<br />

sustainable lifestyle.<br />

areas for savings.<br />

Account for Currency Exchange Rates:<br />

Expatriates often deal with currency<br />

fluctuations. Keep an eye on exchange<br />

rates and factor them into your budgeting.<br />

It’s essential to monitor the rates<br />

regularly to anticipate any impact on<br />

your purchasing power or savings.<br />

Emergency Fund:<br />

Establishing an emergency fund is a<br />

universal financial principle, and it holds<br />

particular importance for expatriates. Aim<br />

to set aside three to six months’ worth<br />

of living expenses in a readily accessible<br />

account. This safety net can provide peace<br />

of mind in case of unexpected events.<br />

Explore Tax Implications:<br />

Understand the tax regulations applicable<br />

to expatriates in the UAE. While<br />

the country is known for its tax-friendly<br />

environment, it’s essential to be aware<br />

of any obligations in your home country.<br />

Seek professional advice to optimise<br />

your tax position and ensure compliance.<br />

Utilise Technology for Tracking:<br />

Leverage budgeting apps and online<br />

tools to track your spending. <strong>The</strong>se tools<br />

categorise expenses, provide real-time<br />

updates, and offer insights into your<br />

financial habits. Regularly reviewing<br />

your spending patterns can help you stay<br />

within budget and identify areas where<br />

adjustments are needed.<br />

Negotiate Housing Costs:<br />

UAE is known for its luxe Housing style<br />

which is often a significant expense for<br />

expatriates. Negotiate your rental agreement,<br />

explore different neighbourhoods,<br />

and consider sharing accommodation to<br />

reduce costs. Dubai is the most expensive<br />

Emirate to live in as compared to all others<br />

while Ajman stands as the cheapest<br />

one for rental homes. Understanding the<br />

rental market dynamics can empower you<br />

to secure a suitable and cost-effective<br />

living arrangement.<br />

Benefit from Expat Packages:<br />

Many employers in the UAE offer expat<br />

packages that may include housing<br />

allowances, education subsidies, and<br />

healthcare coverage. Understand the<br />

terms of your expat package and make the<br />

most of the benefits provided. Negotiate<br />

with your employer if there’s room for<br />

adjustments or additional perks.<br />

Continuous Review and Adaptation:<br />

Regularly review and adapt your budget<br />

to accommodate changing circumstances.<br />

Life as an expatriate involves dynamic<br />

challenges, and being flexible with your<br />

financial plan allows you to navigate<br />

unexpected changes with greater ease.<br />

In the UAE, nearly half of the population<br />

considers retirement saving as an<br />

afterthought; 45 per cent of residents<br />

acknowledge that they haven’t initiated<br />

saving for retirement, and 40 per cent<br />

intend to commence saving only within<br />

the final decade leading up to their retirement.<br />

In comparison, around 75 per<br />

cent of adults in the United States have<br />

already commenced saving for their<br />

‘golden years’.<br />

Implement the 50/20/30 budgeting rule:<br />

An equally impactful strategy is the 50-<br />

20-30 budgeting rule, which proves to be<br />

among the most effective approaches for<br />

maintaining financial peace of mind once<br />

you’ve secured employment in the UAE.<br />

Allocate 50 per cent of your total<br />

income to cover essentials such as debt<br />

repayment, grocery expenses, healthcare,<br />

and so forth - these represent the buns<br />

that form the foundational structure of<br />

your financial well-being. If half of your<br />

income proves inadequate for these necessities,<br />

consider making adjustments,<br />

such as reducing reliance on taxis, opting<br />

for public transportation, or compromising<br />

on luxury aspects of your lifestyle.<br />

Balancing financial responsibility and<br />

enjoyment is key, following the 50/20/30<br />

rule. Allocate 20% for ‘luxuries’ like<br />

subscriptions, coffee treats, and social<br />

outings, and reserve 30% as the main<br />

component for long-term financial stability<br />

in this budgeting plan.<br />

By adhering to these principles, expatriates<br />

in the UAE can not only navigate<br />

their current financial landscape effectively<br />

but also build a secure foundation<br />

for their future.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 9

UAE Banking<br />

From Cash to Contactless: Tracing the<br />

Progression of Payments in the UAE<br />

<strong>The</strong> United Arab Emirates (UAE) is swiftly embracing a digital revolution in<br />

its payment landscape, witnessing a surge towards contactless and online<br />

transactions. <strong>The</strong> evolution from traditional cash transactions to the modern<br />

era of contactless payments has been remarkable, reshaping the landscape<br />

of financial transactions across the country.<br />

10 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

<strong>The</strong> advent of contactless payments<br />

has redefined how individuals<br />

conduct transactions in the UAE.<br />

This transformation gained substantial<br />

momentum, propelled further by the<br />

onset of the COVID-19 pandemic. With<br />

safety and convenience at the forefront,<br />

consumers began favouring contactless<br />

payment options, minimising physical<br />

touchpoints and embracing the speed<br />

and simplicity offered by tapping a card<br />

or mobile device to make payments.<br />

A recent report by Visa, a global<br />

leader in payments technology, unveils<br />

an astounding 87% adoption rate of<br />

digital payments among UAE consumers<br />

every week, signifying one of the<br />

highest rates globally.<br />

Notably, several banks in the UAE<br />

have played pivotal roles in this transformation,<br />

adapting their services to<br />

meet the evolving preferences of consumers.<br />

Emirates NBD led the charge<br />

in transforming contactless payments<br />

within the Central Europe, Middle East,<br />

and Africa region (CEMEA) with the<br />

launch of Emirates NBD Pay in 2016.<br />

Through the integration of Visa’s Token<br />

Service technology, the bank introduced<br />

a seamless NFC-based mobile<br />

contactless payment service.<br />

This advancement empowered Visa<br />

credit and debit cardholders to utilise<br />

NFC-enabled Android mobile devices<br />

for instantaneous in-store purchases<br />

via their upgraded mobile banking<br />

app. By incorporating NFC technology,<br />

Emirates NBD set a high standard in<br />

enhancing convenience for customers,<br />

capitalising on the swift global adoption<br />

of wireless communication protocols<br />

for contactless payments.<br />

Emirates NBD Pay, supported by Visa’s<br />

Token service technology, ensured secure<br />

transactions by replacing sensitive<br />

cardholder information with a unique<br />

digital identifier, safeguarding personal<br />

account details. This initiative not only<br />

represented a significant step towards<br />

digitising the banking experience but<br />

also signified the bank’s dedication<br />

to innovative mobile solutions for its<br />

customers, in line with evolving global<br />

trends in digital payments.<br />

Similarly, In 2020, Mashreq Bank<br />

took a pioneering stride in the Middle<br />

East & Africa region by collaborating<br />

with Mastercard to introduce a<br />

groundbreaking solution for Small and<br />

Medium Businesses (SMEs) named Tap<br />

On Phone. This innovation marked<br />

Mashreq Bank as the first in the MENA<br />

region to unveil such a service, part of<br />

their wider SME in a Box solution. This<br />

venture, supported by Mastercard’s<br />

Payment Gateway Technology, aimed<br />

to bridge the gap for local micro and<br />

small merchants, traditionally reluctant<br />

to accept digital payments due to the<br />

complexities and expenses associated<br />

with conventional point-of-sale systems.<br />

Tap On Phone emerged as a cost-effective,<br />

user-friendly digital payment<br />

technology tailored specifically for<br />

micro and small businesses, notably<br />

within the food and beverage industry<br />

and related services like food delivery<br />

and farmers markets. <strong>The</strong> solution ingeniously<br />

turned Android smartphones<br />

into secure payment acceptance devices<br />

for contactless cards, mobile wallets,<br />

and smartwatches, eliminating the<br />

need for additional hardware or setup<br />

costs. This move by Mashreq Bank,<br />

in collaboration with Mastercard,<br />

addressed the evolving needs of small<br />

businesses, emphasising the importance<br />

of adapting to new payment dynamics<br />

while offering a safer, more convenient<br />

payment avenue for customers.<br />

Another notable contributor to this<br />

shift is the Abu Dhabi Islamic Bank<br />

which achieved a significant milestone<br />

by launching the region’s inaugural tokenised,<br />

contactless payment methods<br />

under ‘ADIB PAY’, in collaboration<br />

with Tappy Technologies and Visa, in<br />

<strong>December</strong> 2022. This pioneering initiative<br />

introduced an innovative avenue<br />

for ADIB Visa cardholders to conduct<br />

contactless payments using wearable<br />

accessories like rings, bracelets, and<br />

watches, eliminating the necessity of<br />

carrying physical cards.<br />

ADIB PAY’s novel feature includes a<br />

tokenised contactless payment clasp<br />

that seamlessly transforms various<br />

wearable items into smart payment<br />

devices, initially offered to select<br />

customers. <strong>The</strong> setup process for ADIB<br />

PAY is streamlined and swift, facilitated<br />

by Tappy’s Token Enablement Services<br />

(TES) solution and a companion Universal<br />

Passive Provisioning Unit (UPPU)<br />

that automatically provisions the digital<br />

card to the embedded chip within the<br />

payment clasp. This tokenisation ensures<br />

data security by replacing sensitive<br />

card information with non-exploitable<br />

data elements, aligning with ADIB’s<br />

commitment to providing secure and<br />

intelligent payment options.<br />

Moreover, In 2020, Abu Dhabi Commercial<br />

Bank (ADCB) introduced an<br />

innovative way for businesses to accept<br />

payments without physical terminals<br />

through ADCB PACE PAY, powered<br />

by Visa. This virtual payment system<br />

operates on smartphones and tablets,<br />

eliminating the need for additional<br />

hardware. It allows businesses to<br />

receive card payments in-store by<br />

scanning cards or generating payment<br />

links for remote transactions, perfect<br />

for home deliveries.<br />

<strong>The</strong> simplicity of this solution,<br />

pre-integrated into a payment gateway,<br />

facilitates smaller merchants’ shift to<br />

online sales without complex setups.<br />

ADCB, in collaboration with Visa, aimed<br />

to support small businesses in the<br />

UAE by offering this digital payment<br />

solution at no transaction cost. <strong>The</strong><br />

initiative acknowledges the growing<br />

importance of contactless payments<br />

and seeks to address the challenges<br />

faced by businesses reliant on cash<br />

transactions. ADCB’s effort with ADCB<br />

PACE PAY signifies its commitment<br />

to aiding businesses in adapting to<br />

evolving payment preferences while<br />

embracing the shift towards a cashless<br />

economy in the UAE.<br />

<strong>The</strong> evolution of payment methods<br />

in the UAE extends beyond individual<br />

banks. <strong>The</strong> government’s initiatives,<br />

such as the introduction of the Emirates<br />

Digital Wallet, have significantly<br />

contributed to the proliferation of contactless<br />

payments. This digital platform<br />

allows users to store multiple cards<br />

and make transactions conveniently<br />

through a single application.<br />

<strong>The</strong> success and widespread adoption<br />

of contactless payments by these<br />

banks illustrate a fundamental shift in<br />

consumer behaviour. <strong>The</strong> convenience,<br />

speed, and enhanced security features<br />

offered by contactless transactions have<br />

propelled their rapid acceptance among<br />

UAE residents. <strong>The</strong> UAE’s journey from<br />

cash-dominated transactions to the<br />

widespread acceptance of contactless<br />

payments signifies a paradigm shift in<br />

the country’s financial landscape. As<br />

technology continues to evolve, the<br />

progression towards more sophisticated<br />

and secure payment methods is<br />

poised to further revolutionise the way<br />

transactions are conducted in the UAE.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 11

UAE Banking News<br />

Abu Dhabi Chamber<br />

and FAB Enhance<br />

Investment Climate<br />

with MoU<br />

<strong>The</strong> Abu Dhabi Chamber of<br />

Commerce and Industry (AD-<br />

CCI) has inked a Memorandum<br />

of Understanding (MoU)<br />

with First Abu Dhabi Bank (FAB) to<br />

enhance the investment climate and<br />

business environment in the Emirate<br />

of Abu Dhabi. This collaboration aligns<br />

with the ADCCI’s goal of supporting<br />

the private sector and bolstering its<br />

competitiveness. <strong>The</strong> agreement facilitates<br />

the sharing of information about<br />

FAB’s banking services and initiatives<br />

with the Chamber’s members and staff,<br />

streamlining the process of accessing<br />

these services. FAB will also have a<br />

more prominent presence at events<br />

organized by the Abu Dhabi Chamber,<br />

and both parties will work together<br />

to launch initiatives that promote<br />

entrepreneurship and improve the<br />

investment environment. <strong>The</strong> partnership<br />

also includes the exchange of<br />

knowledge, insights, and consultations<br />

to stimulate business and investment.<br />

Gulf Bank Initiates Capital Increase Subscription<br />

Process<br />

Gulf Bank has initiated the<br />

subscription process for its<br />

increased issued and paid-up<br />

capital of KD 26.1M, with a<br />

two-week subscription window. <strong>The</strong><br />

Central Bank of Kuwait and the Capital<br />

Markets Authority have approved the<br />

capital enhancement, which involves<br />

the issuance of 260,869,565 new ordinary<br />

shares at 230 fils per share.<br />

This includes a nominal value of 100<br />

fils per share and an issue premium<br />

of 130 fils per share, resulting in a<br />

KD 60M increase in the bank’s capital<br />

base. Shareholders listed in the<br />

bank’s Register of Shareholders as of<br />

October 26, <strong>2023</strong>, are eligible for subscription.<br />

Non-shareholders seeking<br />

to participate in the capital increase<br />

and existing shareholders looking to<br />

augment their allocated shares can do<br />

so by acquiring rights issues.<br />

UAE Central Bank mirrors the Fed, maintaining<br />

stability in interest rates<br />

<strong>The</strong> UAE Central Bank has<br />

decided to maintain its benchmark<br />

interest rate, following<br />

the lead of the US Federal<br />

Reserve, which has kept its policy<br />

rate unchanged for the third time this<br />

year. This decision is in response to a<br />

gradual decline in core inflation. <strong>The</strong><br />

US central bank has maintained the<br />

federal funds rate at a range between<br />

5.25% and 5.5%, marking the highest<br />

level since 2001. While the Fed aims to<br />

bring inflation down to its target range<br />

of 2%, the annualised US inflation fell<br />

to 3.7% in September, down from a<br />

high of 9.1% in June 2022. Despite<br />

some signs of a robust US economy,<br />

the Fed is widely expected to increase<br />

the benchmark interest rate once more<br />

this year to manage economic growth<br />

and wage increases.<br />

Dubai Islamic Bank’s 9-month income surges 47% to $3.95B<br />

<strong>The</strong> strong performance of<br />

Dubai Islamic Bank (DIB), the<br />

largest Islamic lender in the<br />

UAE, was attributed to rising<br />

core revenues, non-funded income,<br />

and lower impairment charges, as indicated<br />

in the bank’s financial results<br />

for the third quarter of <strong>2023</strong> and the<br />

first nine months of the year. Total net<br />

income for the three months ending<br />

September 30 surged to AED 4.82B<br />

($1.3B), an increase from AED 4.1B in<br />

the previous year. Over the first nine<br />

months of the year, the total income<br />

reached AED 14.5B ($3.95B), marking<br />

a remarkable 47% growth compared<br />

to the same period last year. Dubai<br />

Islamic Bank (DIB) achieved a net<br />

operating profit of AED 6.2B, reflecting<br />

a 12 percent increase compared to<br />

AED 5.6B in the same period of 2022.<br />

Net operating revenues also showed<br />

strong growth, rising by 11.7 percent<br />

year-on-year to reach AED 8,547M.<br />

12 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

Dubai and Hong Kong Partner for Economic Corridor Activation<br />

Dubai’s Department of<br />

Economy and Tourism<br />

(DET), the Financial Services<br />

and the Treasury Bureau<br />

of the Government of Hong Kong,<br />

China, have inked a Memorandum of<br />

Understanding (MoU) to nurture financial<br />

cooperation between these two economic<br />

powerhouses. <strong>The</strong> MoU was formalised<br />

during the Belt and Road Summit in Hong<br />

Kong, with Hadi Badri, CEO of the Dubai<br />

Economic Development Corporation,<br />

Dubai Department of Economy and<br />

Tourism, and Joseph Chan, Under<br />

Secretary for Financial Services and the<br />

Treasury of the Government of the Hong<br />

Kong Special Administrative Region,<br />

as signatories. This pact underscores<br />

the unwavering commitment of both<br />

governments to facilitate collaboration<br />

and knowledge sharing within their<br />

financial markets. Moreover, it serves as<br />

a testament to their shared determination<br />

to strengthen their bilateral ties, fostering<br />

mutual growth and development within<br />

their financial services sectors.<br />

Mashreq Bank Reports<br />

Remarkable 122% Jump<br />

in 9-Month <strong>2023</strong> Net<br />

Profit<br />

Mashreq, a prominent UAE<br />

banking powerhouse, has<br />

reported an astounding 122<br />

percent surge in net profit,<br />

soaring to AED 5.8B during the initial<br />

nine months of <strong>2023</strong>. Notably, the bank<br />

also disclosed a remarkable 73 percent<br />

increase in operating profit, reaching<br />

AED 5.6B, a substantial leap from the<br />

AED 3.2B recorded in the same period of<br />

2022. <strong>The</strong> bank’s return on equity (ROE)<br />

also reached a historic high, standing at<br />

32.1 percent for the January-September<br />

interval, which is double the figure from<br />

the corresponding period in 2022. This<br />

impressive growth owes much to an<br />

82 percent rise in net interest income<br />

and robust non-interest income, which<br />

reached AED 2.3B, marking an 8.1<br />

percent year-on-year growth. Mashreq<br />

attributes this success to factors such<br />

as balance sheet expansion, healthy<br />

client margins, and the prevailing highinterest<br />

rate environment.<br />

Dubai Islamic Bank profit surges 20% on<br />

increased revenue<br />

Dubai Islamic Bank, the UAE’s<br />

largest Sharia-compliant<br />

lender, reported a nearly<br />

20% increase in third-quarter<br />

net profit, reaching AED 1.64B<br />

($449M). <strong>The</strong> boost in revenue was<br />

attributed to the economic growth<br />

in the emirate. Income from Islamic<br />

financing and investment transactions<br />

for the quarter surged nearly 45% to<br />

Bank Alfalah, a prominent Pakistani<br />

commercial bank, has unveiled its<br />

international branch on Sheikh Zayed<br />

Road in Dubai, marking a strategic relocation<br />

from the Al-Khaleej Building<br />

on Zaabeel Street. This move is aimed<br />

at delivering tailor-made wholesale<br />

banking solutions to corporate clients<br />

within the vibrant city of Dubai. <strong>The</strong><br />

inauguration of this Dubai branch<br />

was a momentous occasion, with His<br />

Excellency Sheikh Nahayan Mabarak<br />

Al Nahayan, Chairman of Bank Alfalah,<br />

gracing the event. His presence<br />

underscores the bank’s commitment<br />

to expanding its services across international<br />

borders and embracing a<br />

new phase in its journey. <strong>The</strong> United<br />

Arab Emirates, known as a global<br />

financial hub, offers a promising<br />

platform for Bank Alfalah to provide<br />

AED 4.50B. <strong>The</strong> lender’s income from<br />

properties held for development and<br />

sales also saw substantial growth,<br />

reaching nearly AED 80M. Commissions,<br />

fees, and foreign exchange<br />

income jumped over 16% year-on-year<br />

to AED 385.45M. <strong>The</strong> UAE’s strong<br />

economic growth has been driven by<br />

a robust non-oil sector.<br />

Sheikh Nahayan Inaugurates Bank Alfalah<br />

Dubai Branch<br />

exemplary customer service and cement<br />

its position as a leading player<br />

in the Pakistani and international<br />

banking industry.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 13

Event<br />

CEO Clubs Network Launched Channel<br />

Partnership: Empowering Growth Together<br />

November 1, <strong>2023</strong>, Dubai – <strong>The</strong> CEO Clubs’ November Lunch Meeting, held under<br />

the theme “CEO Clubs Channel Partnership: Empowering Growth Together,”<br />

has been hailed as a resounding success, cementing the spirit of collaboration<br />

within the esteemed CEO Clubs Network.<br />

14 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

<strong>The</strong> highlight of the event was<br />

the momentous signing of the<br />

CEO Clubs Channel Partnership<br />

Memorandum of Understanding (MOU)<br />

between two distinguished organizations,<br />

Shurra Business Set-Up and<br />

Archgoke Interactive. This strategic<br />

alliance exemplifies a commitment to<br />

fostering growth through collective<br />

efforts within the dynamic business<br />

landscape.<br />

Ms. Sarah Dong, Managing Partner of<br />

CEO Clubs Network dived deep into the<br />

topic by quoting the channel partnership<br />

as “A new platform that is designed<br />

to facilitate powerful collaborations<br />

and mutual growth opportunities on a<br />

global scale”. She also explained the<br />

remarkable objectives of the channel<br />

partnership initiative such as boosted<br />

sales, expanded product/service portfolio,<br />

increased brand visibility, exclusive<br />

discount, competitive package, rewards,<br />

enhanced visibility, etc.<br />

Special recognition goes to their Exclusive<br />

Online Trading Partner, GTC-Global<br />

Trade Co. Limited, Annual Sponsors,<br />

Dubai Duty Free and Regionality Group<br />

of Companies. <strong>The</strong> Lunch Sponsor,<br />

Freehold Mediation and Information<br />

(FMI), also played a significant role in<br />

ensuring the success of the gathering<br />

<strong>The</strong> event featured insightful presentations<br />

from esteemed members of CEO<br />

Clubs Network, including Freehold<br />

Mediation and Information (FMI),<br />

GTC-Global Trade Capital Co. Limited,<br />

and the Immersion4. <strong>The</strong>ir contributions<br />

provided profound insights into their<br />

respective organizations, contributing<br />

to the wealth of knowledge shared<br />

during the occasion.<br />

CEO Clubs Network also welcomed<br />

new members, Vin Metal Synergies<br />

FZE and Ravian Shipping Line LLC,<br />

who introduced themselves and added<br />

to the vibrant and diverse community<br />

within the Network.<br />

<strong>The</strong> collaborative spirit exhibited at<br />

the CEO Clubs Channel Partnership<br />

event underscores the organization’s<br />

commitment to creating a platform<br />

where businesses can thrive through<br />

meaningful connections and shared<br />

expertise.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 15

UAE Reforms<br />

Adapting to Reform: 5 Rules That Have<br />

Come into Effect in the UAE for <strong>2023</strong><br />

<strong>The</strong> UAE continues to evolve as a global destination, constantly refining<br />

its policies to enhance convenience for residents and visitors alike. As<br />

the calendar turned to <strong>2023</strong>, several pivotal changes swept through the<br />

country, impacting tourism, residency procedures, employment rights,<br />

and visitor regulations. <strong>The</strong>se reforms, ushered in to modernise systems<br />

and improve accessibility, promising a more streamlined experience<br />

for all.<br />

16 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

Involuntary Loss of Employment<br />

(ILOE) Scheme<br />

<strong>The</strong> Involuntary Loss of Employment<br />

(ILOE) Scheme, launched on January 1,<br />

<strong>2023</strong>, marks a significant stride in social<br />

security reforms within the UAE. This<br />

scheme is designed to offer support to<br />

workers across both public and private<br />

sectors in the event of job loss.<br />

Under this scheme, employees are<br />

entitled to receive compensation for<br />

up to three months if they face involuntary<br />

unemployment. Enrollment in this<br />

scheme is mandatory for all employees,<br />

with a deadline set for October 1, <strong>2023</strong>.<br />

Non-compliance with enrollment carries<br />

penalties.<br />

<strong>The</strong> compensation provided through<br />

the ILOE Scheme amounts to as much as<br />

60 percent of the employee’s salary. This<br />

financial aid acts as a safety net during<br />

unexpected job losses, contributing to<br />

the financial stability of the workforce<br />

during transitional periods. Essentially,<br />

this initiative aims to safeguard employees’<br />

financial well-being and offer a measure<br />

of security during uncertain employment<br />

circumstances.<br />

Tourism Tax Reduction in Abu Dhabi<br />

Abu Dhabi’s Department of Culture<br />

and Tourism brought about a significant<br />

shift in government fees for the tourism<br />

sector. <strong>The</strong> adjustments made by the<br />

department involve changes in fees that<br />

visitors typically pay when they stay in<br />

hotels or explore tourism-related activities<br />

in Abu Dhabi.<br />

Before these changes, guests had to pay<br />

a six percent fee on their hotel bills as a<br />

tourism fee, along with an extra Dhs15<br />

per room per night for municipality fees.<br />

Additionally, there were charges on the<br />

hotel’s restaurants, totalling four percent.<br />

However, as of September 1, <strong>2023</strong>,<br />

there have been significant reductions.<br />

<strong>The</strong> tourism fee for guests has been decreased<br />

from six percent to four percent,<br />

providing some relief. Moreover, the<br />

extra Dhs15 per room per night for the<br />

municipality fee has been removed, as<br />

have the charges on the hotel’s restaurants.<br />

Despite these positive changes, there<br />

is still a four percent municipality fee<br />

added to the customer’s invoice value.<br />

This adjustment aims to make the overall<br />

experience more affordable and attractive<br />

for tourists visiting Abu Dhabi.<br />

<strong>The</strong> year<br />

<strong>2023</strong> marks a<br />

turning point<br />

in the UAE’s<br />

regulatory<br />

landscape,<br />

emphasising<br />

ease,<br />

accessibility,<br />

and security<br />

across various<br />

spheres.<br />

Emirates ID Update Procedures<br />

Simplified<br />

Residents in the UAE now experience<br />

enhanced convenience in updating their<br />

visa information reflected on their<br />

Emirates ID. <strong>The</strong> recent reforms have<br />

empowered individuals with the flexibility<br />

to modify personal details online. This<br />

includes alterations in name, occupation,<br />

employer, passport information, and<br />

even nationality. Notably, any changes<br />

made prompt an automatic request for a<br />

new Emirates ID card, streamlining the<br />

process significantly.<br />

This streamlined approach is facilitated<br />

through an online platform and a smart<br />

application. Additionally, designated<br />

customer centres and approved typing<br />

centres offer assistance, collectively<br />

minimising bureaucratic obstacles. <strong>The</strong>se<br />

measures aim to simplify and expedite the<br />

essential updates required for individuals,<br />

aligning with the government’s efforts to<br />

modernise and enhance accessibility to<br />

essential services.<br />

Streamlined Travel Ban Removal<br />

<strong>The</strong> recent initiative introduced by<br />

the Dubai Public Prosecution offers a<br />

digital solution for individuals encountering<br />

travel bans stemming from legal<br />

matters in Dubai. Through this newly<br />

launched digital service, individuals<br />

facing such bans can conveniently make<br />

online payments. Upon receiving court<br />

approval, the system automatically lifts<br />

the travel ban, creating a seamless and<br />

efficient process.<br />

Aligned with the government’s ‘Services<br />

360’ policy, this initiative harnesses digital<br />

technology to streamline procedures<br />

and alleviate the burden on traditional,<br />

physical service centres. By leveraging<br />

smart solutions, the aim is to expedite<br />

processes and provide individuals with<br />

a faster resolution to their travel restrictions.<br />

This approach not only simplifies<br />

the process but also demonstrates the<br />

government’s commitment to modernising<br />

services for its residents.<br />

Visa Grace Period Elimination and<br />

Extended Work Permits<br />

<strong>The</strong> recent adjustments in UAE’s visa<br />

regulations entail the elimination of the<br />

10-day grace period previously granted<br />

for Dubai visit visas after their expiration.<br />

This grace period extension, no longer<br />

available, has been replaced with fines of<br />

Dhs50 per day for individuals overstaying<br />

their visas.<br />

Additionally, a proposal by the Federal<br />

National Council (FNC) suggests extending<br />

work permits from the existing two-year<br />

duration to three years. This proposed<br />

extension aims to alleviate the financial<br />

burden associated with obtaining work<br />

permits. Though a specific timeline for<br />

the implementation of this change hasn’t<br />

been outlined, it holds the promise of<br />

offering increased stability for individuals<br />

employed in the UAE over longer periods.<br />

<strong>The</strong>se reforms signal the government’s<br />

commitment to adaptability, bringing<br />

greater efficiency and convenience for<br />

residents, workers, and visitors.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 17

Fintech<br />

Fintech Innovators: Reshaping the<br />

Financial Landscape of the UAE<br />

In recent years, the United Arab Emirates (UAE) has emerged as a hub for<br />

technological innovation, particularly in the financial sector. Fintech companies<br />

have played a pivotal role in transforming the traditional landscape of finance,<br />

introducing innovative solutions, and democratising access to financial services.<br />

<strong>The</strong> UAE has consistently embraced innovation, offering abundant opportunities<br />

for new talents to contribute and diversify the country’s financial landscape.<br />

Among the innovators in this arena, three companies stand out for their disruptive<br />

approaches and contributions, including Democrance, Brine.fi, and Zest Equity.<br />

Democrance<br />

Michele Grosso, the visionary<br />

founder and CEO of<br />

Democrance, embarked on<br />

a transformative journey in 2015.<br />

Recognising the immense potential<br />

of microinsurance in uplifting low-income<br />

communities, Grosso was astonished<br />

to find its absence in the UAE.<br />

Fueled by this realisation, he birthed<br />

Democrance, an insurtech startup<br />

dedicated to democratising insurance<br />

accessibility.<br />

Democrance operates as a Software<br />

as a Service (SaaS) insurance technology<br />

platform, facilitating insurers<br />

and insurance brokers in digitising<br />

the entire insurance value chain. Its<br />

inception in the UAE was driven by a<br />

mission to redefine insurance, making<br />

it not just accessible but also affordable.<br />

Over time, it evolved into a global<br />

force, servicing insurers and brokers<br />

in diverse insurance sectors, spanning<br />

from high-ticket to micro-insurance.<br />

From its headquarters in Dubai,<br />

Democrance has expanded its footprint,<br />

establishing offices in Saudi<br />

Arabia, Kenya, Ghana, the United<br />

Kingdom, Japan, and Pakistan. <strong>The</strong><br />

team, comprising over 30 professionals,<br />

operates seamlessly across time<br />

zones. <strong>The</strong>ir client roster includes<br />

industry giants like AIG, AXA, and<br />

MetLife, serving 16 emerging markets,<br />

from Mexico to the Philippines.<br />

Democrance’s global reach underscores<br />

its commitment to revolutionising<br />

insurance accessibility on a truly<br />

international scale.<br />

Democrance emerges as a<br />

game-changer in the insurance sphere,<br />

boasting a multifaceted suite of facilities<br />

that revolutionise how insurers,<br />

intermediaries, and customers interact<br />

within the realm of insurance. At its<br />

core, Democrance champions the integration<br />

of insurance products into<br />

diverse ecosystems through its robust<br />

APIs, enabling seamless interactions<br />

with customers via distribution partners<br />

such as Super Apps, Mobile Wallets,<br />

HR Platforms, and Governments.<br />

Moreover, Democrance’s D2C<br />

Sales Journey Builder enhances direct-to-customer<br />

sales by offering<br />

optimised, user-friendly journeys that<br />

seamlessly align with a company’s<br />

branding, transforming customer interactions<br />

into enticing and smooth<br />

“Buy Now” experiences.<br />

Additionally, the platform empowers<br />

agents, brokers, and Banca partners<br />

through a centralised Intermediaries<br />

Portal, streamlining quote management,<br />

referrals, rate adjustments,<br />

renewals, and other partner-related<br />

functionalities.<br />

Democrance’s adaptability shines<br />

through its ability to configure and<br />

distribute diverse insurance products<br />

Michele Grosso,<br />

CEO<br />

across various lines of business, covering<br />

life, health, property & casualty,<br />

personal, and commercial lines.<br />

Lastly, the platform serves as an<br />

integrated hub for leveraging external<br />

data sources, underwriting engines,<br />

and third-party services, allowing<br />

insurers to gain insights, enhance<br />

customer experiences, and boost sales<br />

by integrating payment gateways,<br />

eKYC, AI-driven analytics, and existing<br />

core systems for accounting and<br />

reinsurance.<br />

18 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

Brine.Fi<br />

Founded in 2021 by university<br />

friends Shaaran Lakshminarayanan<br />

(CEO), Bhavesh Praveen (CTO),<br />

and Ritumbhara Bhatnagar (CDO), Brine<br />

Fi disrupts the crypto trading realm<br />

as a decentralised exchange (DEX)<br />

built atop Starkware’s Layer 2 scaling<br />

solution. Unlike existing automated<br />

market maker (AMM) models, Brine<br />

Fi operates as an order book spot<br />

DEX, aiming to rectify the challenges<br />

faced by crypto traders. This design<br />

eliminates gas fees, confirmation wait<br />

times, and counterparty risks, mimicking<br />

centralised exchanges’ efficiency<br />

while maintaining decentralisation.<br />

Brine Fi marks its Beta Mainnet<br />

Launch with engaging trading competitions,<br />

stimulating participation and<br />

competitiveness among early adopters.<br />

<strong>The</strong>se competitions, coupled with a<br />

visible leaderboard showcasing top<br />

traders, cultivate a dynamic and spirited<br />

community within the platform.<br />

In a bid to appreciate community<br />

involvement, Brine Fi extends exclusive<br />

merchandise to early supporters<br />

engaged in diverse platform-related<br />

activities, from referrals to social media<br />

sharing and user experience feedback,<br />

nurturing a dedicated user base.<br />

A novel initiative within Brine’s<br />

ecosystem, the Salt Score, quantifies<br />

user engagement, determining eligibility<br />

for exclusive events, promotions, and<br />

rewards, effectively motivating and<br />

acknowledging active participants.<br />

Utilising StarkWare’s zkP (Zero<br />

Knowledge Proofs) technology, Brine<br />

Fi ensures privacy in trading positions,<br />

facilitating the seamless execution of<br />

high-volume orders. Traders enjoy feeless<br />

trading, with costs as low as 0.05%.<br />

Additionally, users stand a chance to<br />

earn rebates of up to 50% on referral<br />

trading fees at Brine Fi and can actively<br />

participate in the monthly Trading<br />

Leaderboard competition, vying for<br />

USDC rewards.<br />

Brine Fi not only overcomes the<br />

Shaaran Lakshminarayanan,<br />

CEO<br />

limitations of traditional crypto trading<br />

but also builds a committed community,<br />

emerging as a trailblazer in decentralized<br />

exchanges.<br />

Zest Equity<br />

Zest Equity, established in 2021<br />

by Rawan Baddour and Zuhair<br />

Shamma, initially began as<br />

a secondary trading marketplace.<br />

However, its swift evolution<br />

transformed it into a dynamic platform<br />

empowering ecosystem players, such<br />

as founders and venture capitalists,<br />

to conduct efficient and transparent<br />

transactions online.<br />

Traditionally, these interactions<br />

occurred offline, entailing tedious,<br />

obscure, and costly processes.<br />

Zest’s core mission revolves around<br />

democratising access to private<br />

markets and empowering investors,<br />

founders, and their enterprises within<br />

a unified platform.<br />

Founders leverage Zest Equity’s<br />

suite of tools to invite investors to<br />

fundraising rounds, facilitating actions<br />

like sharing critical information such<br />

as pitch decks and cap tables while<br />

efficiently monitoring deal processes.<br />

On the other side, investors can<br />

express their interest, observe other<br />

participating VCs in the round, and<br />

digitally sign essential documents.<br />

Moreover, Zest offers a legal<br />

infrastructure that allows investors,<br />

including angels, to form investment<br />

syndicates or special purpose vehicles,<br />

simplifying shared venture interests.<br />

This streamlined approach saves<br />

time, and administrative costs,<br />

and significantly eases investment<br />

processes, especially for angel<br />

investors.<br />

Zest Equity’s groundbreaking tools<br />

are designed to revolutionise the way<br />

startups manage secondary share<br />

trades. <strong>The</strong>se innovative solutions<br />

empower startups by providing<br />

them with the capability to establish<br />

standardised protocols for these<br />

transactions. Through these tools,<br />

startups gain the ability to define<br />

parameters for liquidity windows,<br />

oversee the intricacies of the<br />

liquidation process, and control the<br />

dissemination of shared information.<br />

By allowing startups to set specific<br />

parameters for liquidity windows, they<br />

can determine when opportunities for<br />

liquidity are accessible to investors.<br />

Simultaneously, having oversight<br />

Rawan Baddour and Zuhair Shamma,<br />

Co-Founders<br />

over the liquidation process ensures<br />

that these transactions are executed<br />

smoothly and efficiently.<br />

Looking ahead, Zest Equity has its<br />

sights set on emerging markets such as<br />

North Africa, South Asia, and Turkey,<br />

recognising similar gaps and issues<br />

in these regions, thereby aiming to<br />

extend its transformative solutions<br />

beyond its initial scope.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 19

Fintech News<br />

Raiven Capital Unveils $125M Startup Fund in Dubai<br />

Raiven Capital has unveiled its<br />

latest venture, a $125M fund<br />

established within the Dubai<br />

International Financial Centre<br />

(DIFC). This fund is strategically<br />

directed towards backing founders<br />

pioneering technology in AI, the Internet<br />

of Things, and Distributed Ledger<br />

Tech, with a strong focus on digital<br />

platforms reshaping value chains across<br />

diverse sectors like finance, energy,<br />

health, environment, and food. It aims<br />

to foster innovation among early and<br />

growth-stage tech companies in the<br />

GCC, South Asia, and North/East Africa<br />

regions, empowering them to reach<br />

leadership status by connecting them to<br />

European and North American markets<br />

through Raiven’s new Dubai hub. This<br />

initiative plays a pivotal role in bridging<br />

the growing demand for venture capital<br />

in the tech industry, which has been<br />

witnessing rapid expansion in the UAE<br />

and the wider region. MENA venture<br />

capital funding for Q3 <strong>2023</strong> recorded<br />

significant growth, with $250M raised<br />

across 78 deals, a 32 percent increase<br />

compared to the preceding quarter.<br />

Climate Tech VC: MENA and Turkey Startups Attract<br />

$651M<br />

CE-Ventures, the corporate<br />

venture capital platform of<br />

Crescent Enterprises, has<br />

collaborated with MAGNiTT<br />

to introduce ‘<strong>The</strong> State of Climate<br />

Tech Venture Capital Report.’ This<br />

comprehensive report delves into the<br />

dynamic landscape of climate tech<br />

investments in the Middle East and<br />

North Africa (MENA) and Turkey,<br />

offering valuable insights into the sector’s<br />

evolving trends, challenges, and<br />

opportunities. <strong>The</strong> report emphasises<br />

the significance of harnessing innovative<br />

technologies to combat climate<br />

change. It underlines the potential of<br />

existing technologies to mitigate 65%<br />

of emissions and highlights the need<br />

for further advancements to bridge<br />

the remaining 35% emissions gap. This<br />

report acts as a valuable resource for<br />

understanding the climate tech investment<br />

landscape in the region.<br />

CQUR Bank Chooses Finastra for Online Banking<br />

Transformation<br />

Finastra has confirmed a strategic<br />

partnership with CQUR<br />

Bank, paving the way for the<br />

bank to enhance its technology<br />

offerings. By integrating Finastra’s<br />

Trade Innovation and Corporate<br />

Channels solutions, CQUR Bank is<br />

set to introduce a cutting-edge online<br />

banking portal, ensuring a seamless<br />

user experience for its corporate<br />

clients. This initiative will also usher<br />

in new digital workflows and hostto-host<br />

integration solutions, thereby<br />

modernising and optimising the bank’s<br />

corporate client services, aligning with<br />

its technology strategy and reinforcing<br />

its commitment to providing innovative<br />

and efficient banking solutions.<br />

UAE’s Thriving Proptech<br />

Scene: 6 Fast-Growing<br />

Startups<br />

<strong>The</strong> global surge of property technology,<br />

or prop-tech, is making<br />

waves in the Middle East, offering<br />

the potential to revolutionise the<br />

real estate industry, enhancing accessibility,<br />

efficiency, and sustainability. In the<br />

Middle East, this trend is gaining momentum<br />

as home seekers, landlords, and<br />

agents increasingly embrace cutting-edge<br />

digital platforms for advanced property<br />

management tools, exploring new real<br />

estate investment prospects, and benefiting<br />

from streamlined transactions. In this<br />

burgeoning prop-tech landscape, several<br />

startups are rapidly making a mark. Notable<br />

among them are Huspy, Property<br />

Finder, Nomad Homes, Keyper, Stake,<br />

and Silkhaus. <strong>The</strong>ir recent achievements<br />

and forthcoming endeavours promise to<br />

reshape the real estate landscape in the<br />

Middle East.<br />

20 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

Saudi Arabia’s Tabby<br />

secures $200M; valued at<br />

$1.5B<br />

Tabby, the buy now, pay later<br />

start-up, has become the first<br />

fintech unicorn in the Gulf<br />

region following a successful<br />

Series D funding round that raised<br />

$200M, valuing the company at over<br />

$1.5B. Led by Wellington Management<br />

and featuring participation from growth<br />

equity investor Bluepool Capital, alongside<br />

existing investors STV, Mubadala<br />

Investment Capital, PayPal Ventures,<br />

and Arbor Ventures, this funding will<br />

further support Tabby’s mission of<br />

financing consumers and retailers.<br />

With an annualised transaction volume<br />

exceeding $6B and collaboration with<br />

over 30,000 brands, Tabby continues<br />

to expand, recently introducing Tabby<br />

Shop, a platform showcasing thousands<br />

of brands and over half a million products,<br />

offering shoppers a comprehensive<br />

and convenient shopping experience.<br />

Tabby has also achieved a user base<br />

of 10 million.<br />

UAE FinTech NOW Money Secures Funding for<br />

Remittance Revolution<br />

UAE-based FinTech NOW<br />

Money has secured substantial<br />

funding for its mission<br />

to revolutionise remittance<br />

and financial services. <strong>The</strong> investment<br />

drive, led by Dubai entrepreneurs<br />

Mark Nutter and Nicolas Andine,<br />

marks a significant milestone for the<br />

company. Nutter assumes the role of<br />

Chairman, while Andine takes the helm<br />

as the new CEO. NOW Money’s core<br />

focus is serving the underserved and<br />

underbanked immigrant population<br />

in the UAE by collaborating with employers<br />

to provide accessible payroll<br />

and banking services. <strong>The</strong>y also offer<br />

low-cost remittance and banking fees to<br />

various countries. <strong>The</strong> funding injection<br />

will propel NOW Money’s expansion,<br />

including the introduction of a unique<br />

banking subscription service tailored<br />

for the region’s migrant workers, enhancing<br />

their financial management<br />

capabilities and offering additional<br />

benefits.<br />

Qatar Islamic Bank Extends Direct Remit Service<br />

to the UK<br />

Qatar Islamic Bank (QIB) is<br />

expanding its Direct Remit<br />

service to the United Kingdom<br />

in partnership with<br />

Standard Chartered Bank. This expansion<br />

follows the successful launch<br />

of Direct Remit in several countries,<br />

including India, Pakistan, Jordan, the<br />

Philippines, and Egypt. Customers can<br />

now utilise the QIB mobile app for<br />

real-time money transfers to the UK.<br />

Users can enjoy instantaneous transactions<br />

with competitive exchange rates<br />

by logging in, selecting the destination,<br />

and providing recipient details. <strong>The</strong><br />

service also offers transaction tracking<br />

and instant SMS updates on transaction<br />

status. <strong>The</strong> addition of the UK<br />

to Direct Remit reaffirms QIB’s commitment<br />

to delivering a seamless and<br />

secure banking experience for its customers.<br />

<strong>The</strong> QIB mobile app is available<br />

for download on the App Store,<br />

Google Play, and Huawei AppGallery,<br />

enabling customers to manage their<br />

accounts, cards, and transactions remotely<br />

and even open new accounts,<br />

obtain personal financing, and apply<br />

for credit cards through the app.<br />

Dubai Chamber of Digital<br />

Economy Inks Four MoUs<br />

for Ecosystem Enhancement<br />

<strong>The</strong> Dubai Chamber of Digital<br />

Economy, operating within Dubai<br />

Chambers, has recently solidified<br />

its commitment to bolstering the<br />

emirate’s digital landscape. During the<br />

Dubai Business Forum, it signed four<br />

crucial Memorandums of Understanding<br />

(MoUs) with key players in the industry,<br />

including Mastercard, RemotePass, Tokio<br />

Marine & Nichido Fire Insurance, and<br />

Silkhaus. <strong>The</strong>se agreements are pivotal<br />

in achieving the chamber’s strategic goals<br />

of attracting global digital companies to<br />

Dubai and fortifying the emirate’s advanced<br />

digital infrastructure. <strong>The</strong> partnership<br />

with Mastercard involves the establishment<br />

of a co-branded innovation hub in<br />

Dubai, leveraging Mastercard’s extensive<br />

expertise in payment processing. This<br />

hub, known as the Innovation Centre,<br />

will be a focal point for collaboration<br />

in digital innovation and artificial intelligence<br />

technologies, aiming to attract<br />

international tech firms, startups, and<br />

digital talent to Dubai.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 21

Fintech Application<br />

ADSS: NEXT GENERATION TRADING<br />

Established in 2011, ADS Securities<br />

(ADSS) has emerged as a significant<br />

player in the global trading<br />

landscape, with its headquarters based<br />

in the United Arab Emirates (UAE).<br />

<strong>The</strong> application stands out by providing<br />

a diverse range of trading options,<br />

including forex, indices, commodities,<br />

stocks, and cryptocurrencies, catering<br />

to a wide spectrum of investor preferences.<br />

Operating through two entities,<br />

ADS Securities LLC in the UAE and<br />

ADS Securities London Limited in the<br />

UK, ADSS offers traders access to the<br />

widely utilised MetaTrader 4 platform.<br />

To cater diverse needs of its clients<br />

ADSS offers customised account options.<br />

<strong>The</strong> Classic Account serves retail<br />

traders, providing a straightforward<br />

trading experience, while the Elite<br />

Account is designed for professionals<br />

seeking advanced features. Additionally,<br />

in line with its UAE base, ADSS<br />

accommodates Islamic principles with<br />

a Sharia-compliant Islamic Account.<br />

One notable feature of ADSS is its<br />

extensive offering of indices and stocks,<br />

providing traders with a comprehensive<br />

selection of assets to trade. <strong>The</strong><br />

platform also emphasises transparency,<br />

offering detailed legal and regulatory<br />

information on its website. Regulated<br />

by both Tier 1 and Tier 2 regulators,<br />

ADSS has earned a reputation for<br />

trustworthiness and stability during<br />

its more than 10 years in operation.<br />

Despite being a private company<br />

without public trading shares or a<br />

bank parent, ADSS boasts a substantial<br />

workforce of over 500 employees,<br />

underscoring its significant presence in<br />

the market. <strong>The</strong> absence of inactivity<br />

fees further enhances the platform’s<br />

appeal, ensuring that clients won’t<br />

incur charges for dormant accounts.<br />

ADSS also invests in the education<br />

and research support of its users.<br />

Traders can access valuable resources<br />

to enhance their understanding of<br />

the markets, contributing to a more<br />

informed and empowered trading<br />

community.<br />

In summary, ADS Securities (ADSS)<br />

stands as a reliable and transparent<br />

trading platform with a decade-long<br />

track record, offering diverse account<br />

options and educational resources.<br />

Regulated by prominent authorities and<br />

with a commitment to transparency,<br />

ADSS remains a notable choice for<br />

traders navigating the complexities of<br />

the online trading landscape.<br />

Availability: Google Play Store and<br />

Apple App Store<br />

Website: www.adss.com<br />

22 www.thefinanceworld.com <strong>December</strong> <strong>2023</strong>

HUAWEI Eyewear 2<br />

Huawei’s Eyewear 2 smart glasses<br />

redefine the intersection of<br />

style and technology, bringing<br />

a cutting-edge audio experience to the<br />

UAE. Eyewear 2 delivers an exceptional<br />

wearable audio experience paired<br />

with an extended battery life. <strong>The</strong>se<br />

smart glasses boast an IP54 water and<br />

sweat-resistant rating, making them<br />

an ideal daily companion for diverse<br />

activities.<br />

Eyewear 2 comes in two distinctive<br />

styles: the Browline Eyewear frames<br />

and the Rectangle Half-Frame Eyewear<br />

frames. <strong>The</strong> Browline design, crafted<br />

from β titanium, showcases a sleek<br />

Titanium Silver hue and features an<br />

ultra-light 4.7g frame, providing a<br />

futuristic look with a levitating lens<br />

impression. <strong>The</strong> Rectangle Half-Frame<br />

Eyewear offers a vibrant and casual<br />

aesthetic, striking a perfect balance<br />

between style and utility.<br />

What sets Eyewear 2 apart is its<br />

battery life. With 11 hours of listening<br />

time, 9 hours of calling, and up to 4<br />

days of standby time on a full charge,<br />

it ensures a reliable performance<br />

throughout the day. Even when not<br />

actively in use, the glasses can last up<br />

to 4 days, and the included protective<br />

case extends the power maintenance<br />

to at least 1 month.<br />

Eyewear 2’s open acoustic design<br />

keeps users connected to their surroundings<br />

while enjoying audio, ensuring a<br />

premium experience with advanced<br />

sound systems and intelligent volume<br />

adjustment.<br />

Moreover, Eyewear 2 incorporates<br />

smart touch controls through multiple<br />

sensors on each side, facilitating seamless<br />

connectivity with smartphones<br />

and tablets. This feature is particularly<br />

convenient for users multitasking between<br />

devices at home or in the office.<br />

Priced at AED 899/-, Eyewear 2 is now<br />

available in the UAE through Huawei’s<br />

Experience Stores and e-shop, setting<br />

a new standard for wearable audio<br />

technology.<br />

<strong>December</strong> <strong>2023</strong> www.thefinanceworld.com 23

Business<br />

Transformative Leadership Propelling Corporate<br />

Triumphs in UAE’s Business Landscape<br />

<strong>The</strong> United Arab Emirates (UAE) has emerged as a global hub for<br />

innovation and economic growth. In this dynamic landscape, the role<br />

of transformative leadership stands paramount in steering corporate<br />

triumphs. Leaders who can envision change, inspire their teams, and<br />

adapt to evolving market demands have been instrumental in shaping<br />

the success stories of numerous enterprises in the region.<br />

Among various leadership styles,<br />

Transformative Leadership<br />

stands out for its emphasis on<br />

initiating significant changes within<br />

companies and in shaping business<br />

practices. <strong>The</strong> UAE’s leaders reflect<br />

this kind of leadership. It traces its<br />

roots back to the nation’s founding<br />

fathers whose visionary aspirations extended<br />

far beyond the immediate postoil<br />

era. <strong>The</strong>ir dreams encompassed a<br />

nation recognized for its innovation,<br />

harmony, and progress. This spirit has<br />

been seamlessly inherited by today’s<br />

leaders in UAE enterprises, steering<br />

them towards long-term visions over<br />

short-term gains.<br />