Finance World Magazine| Edition: February 2024

This edition of Finance World magazine delves into the intricate tapestry of family businesses that form the backbone of the UAE's economic landscape. While the world marvels at the skyscrapers that adorn the horizon, it is the stories of resilience, tradition, and financial acumen within these family enterprises that define the nation's economic fabric. The cover story highlights some of the influential family businesses that traverse diverse sectors within the UAE, weaving together a narrative that profoundly influences the nation's economic trajectory. Furthermore, articles such as 'Exploring The AlMulla Brothers' Visionary Approach to Healthcare' and 'Innovation in Elevation: Al Habtoor Real Estate's Landmark Projects of 2023' navigate the influential role of family businesses in driving growth within diverse sectors. Moreover, the magazine explores regulatory initiatives taken by the UAE to boost family businesses within the country and their consequential impact on the economy. Articles including, 'The Economic Significance of Family Businesses in the UAE' and 'UAE's Unified Registry Launch: Strengthening Family Business Governance' provide insights into these regulatory measures. Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

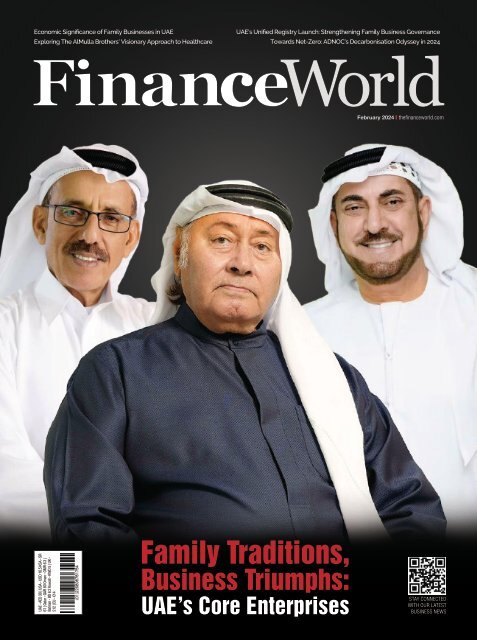

This edition of Finance World magazine delves into the intricate tapestry of family businesses that form the backbone of the UAE's economic landscape. While the world marvels at the skyscrapers that adorn the horizon, it is the stories of resilience, tradition, and financial acumen within these family enterprises that define the nation's economic fabric.

The cover story highlights some of the influential family businesses that traverse diverse sectors within the UAE, weaving together a narrative that profoundly influences the nation's economic trajectory. Furthermore, articles such as 'Exploring The AlMulla Brothers' Visionary Approach to Healthcare' and 'Innovation in Elevation: Al Habtoor Real Estate's Landmark Projects of 2023' navigate the influential role of family businesses in driving growth within diverse sectors.

Moreover, the magazine explores regulatory initiatives taken by the UAE to boost family businesses within the country and their consequential impact on the economy. Articles including, 'The Economic Significance of Family Businesses in the UAE' and 'UAE's Unified Registry Launch: Strengthening Family Business Governance' provide insights into these regulatory measures.

Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Economic Significance of Family Businesses in UAE<br />

Exploring The AlMulla Brothers' Visionary Approach to Healthcare<br />

UAE's Unified Registry Launch: Strengthening Family Business Governance<br />

Towards Net-Zero: ADNOC’s Decarbonisation Odyssey in <strong>2024</strong><br />

<strong>February</strong> <strong>2024</strong><br />

UAE - AED 30 | USA - USD 16.5 KSA - SR<br />

61 | Qatar - QAR 60 Oman - OMR 6.3 |<br />

Bahrain - BD 6.2 Kuwait - KWD 5 | UK -<br />

£12 | EU - €14<br />

Business Triumphs:<br />

Family Traditions,<br />

UAE’s Core Enterprises<br />

STAY CONNECTED<br />

WITH OUR LATEST<br />

BUSINESS NEWS

GROW YOUR<br />

BUSINESS<br />

We make Short / Long Term<br />

Investments in Growing Businesses<br />

www.wasayainvestments.com

Editor’s Editor’s Note Note<br />

Contact:<br />

+971 58 591 8580<br />

Advertisement queries:<br />

Editorial:<br />

Press Release<br />

Contact:<br />

For News +971 58 591 8580<br />

Advertisement queries:<br />

For Partnerships<br />

com<br />

Editorial:<br />

Public Relations<br />

Press Release<br />

For Printed Copy<br />

For News<br />

Published By: For Partnerships<br />

MCFILL MEDIA &<br />

PUBLISHING GROUP<br />

Public Relations<br />

Approved and Licensed By:<br />

National Media Council,UAE For Printed Copy<br />

com<br />

<strong>Finance</strong> <strong>World</strong> (FW) has taken constant efforts to<br />

Published By:<br />

make sure that content is accurate as on the date of<br />

publication. The published articles, editorials,<br />

MCFILL MEDIA &<br />

material, adverts and all other content is PUBLISHING published GROUP<br />

in a good faith and opinions and views are not<br />

necessarily those of the publishers. Approved and We Licensed regret that By:<br />

we cannot guarantee and National accept no Media liability Council,UAE for any<br />

loss or damage of any kind caused by this magazine<br />

and errors and for the accuracy of claims in any<br />

<strong>Finance</strong> <strong>World</strong> (FW) has taken constant efforts to<br />

forms by any advertisers or readers. We advise the<br />

make sure that content is accurate as on the date of<br />

readers to seek the publication. advice The of specialists published articles, before editorials,<br />

acting on information material, published adverts and in all the other magazine. content is published<br />

The trademarks, logos, in a good pictures, faith and domain opinions names and and views are not<br />

service marks (collectively necessarily those the of the "Trademarks")<br />

publishers. We regret that<br />

we cannot guarantee and accept no liability for any<br />

displayed on this magazine are registered and<br />

loss or damage of any kind caused by this magazine<br />

unregistered Trademarks and errors of and The for <strong>Finance</strong> the accuracy <strong>World</strong> of and claims in any<br />

its content providers. forms by All any advertisers rights reserved or readers. and We advise the<br />

nothing can be partially readers or to in seek whole the be advice reprinted of specialists or before<br />

reproduced or stored acting on in information a retrieval published system in or the magazine.<br />

transmitted in any The form trademarks, without logos, a written pictures, consent. domain names and<br />

service marks (collectively the "Trademarks")<br />

displayed on this magazine are registered and<br />

unregistered Trademarks of The <strong>Finance</strong> <strong>World</strong> and<br />

its content providers. All rights reserved and<br />

Advertisers advertised in this guide are included on a sponsored basis.<br />

nothing can be partially or in whole be reprinted or<br />

Details are correct at the time of going to press, but offers and prices<br />

reproduced or stored in a retrieval system or<br />

may change.<br />

transmitted in any form without a written consent.<br />

Reaching a visionary goal requires<br />

one percent vision and 99 percent alignment.<br />

This edition of <strong>Finance</strong> <strong>World</strong> magazine delves into the intricate<br />

tapestry of family businesses that form the backbone Editor’s Note of the<br />

UAE’s economic landscape. While the world marvels at the<br />

skyscrapers that adorn the horizon, it is the stories of resilience,<br />

tradition, and financial acumen within these family enterprises that<br />

define the nation’s economic fabric.<br />

The cover story highlights some of the influential family businesses<br />

that traverse diverse sectors within the UAE, weaving together a<br />

narrative that profoundly influences the nation’s economic trajectory.<br />

Furthermore, articles such as ‘Exploring The AlMulla Brothers’ Visionary<br />

Approach to Healthcare’ and ‘Innovation in Elevation: Al Habtoor Real<br />

Estate’s Landmark Projects of 2023’ navigate the influential role of<br />

family businesses in driving growth within diverse sectors.<br />

Moreover, the magazine explores regulatory initiatives taken by<br />

the UAE to boost family businesses within the country and their<br />

consequential impact on the economy. Articles including, ‘The<br />

Economic Significance of Family Businesses in the UAE’ and ‘UAE’s<br />

Unified Registry Launch: Strengthening Family Business Governance’<br />

provide insights into these regulatory measures.<br />

Within the news segments, you will find a condensed compendium<br />

of the most notable advancements in the field of finance. We have<br />

meticulously sifted through the latest trends and updates, spanning an<br />

array of pertinent topics such as corporate results, startups, banking,<br />

funding, investment, fintech, digital assets, economy, and beyond.<br />

We aim to espouse the vision of the UAE’s wise leadership on the<br />

nation’s development path, highlighting the social, economic, and<br />

developmental aspects shaping this dynamic nation. To that end, we<br />

tirelessly curate the latest and most credible finance news for our<br />

readers, aiming to advance financial literacy and contribute to Dubai’s<br />

journey to becoming one of the world’s most pioneering economies.<br />

- Ambrish Agarwal, Editor in Chief<br />

- Ambrish Agarwal, Editor in Chief<br />

Advertisers advertised in this guide are included on a sponsored basis.<br />

Details are correct at the time of going to press, but offers and prices<br />

may change.<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 5<br />

September 2022 3

STAY CONNECTED<br />

WITH OUR LATEST<br />

BUSINESS NEWS<br />

Contents <strong>February</strong><br />

<strong>2024</strong><br />

PERSONAL FINANCE<br />

P8 | Integrating Family-Owned<br />

Business with Personal <strong>Finance</strong>: A<br />

Comprehensive Guide<br />

UAE BANKING<br />

P10 | Exploring LGT’s Family-<br />

Centric Business Model and<br />

Long-Term Vision<br />

P12 | UAE Banking News<br />

UAE REFORMS<br />

P14 | UAE’s Unified Registry<br />

Reforms: Strengthening Family<br />

Business Governance<br />

FINTECH<br />

P16 | Cash Infusion: FinTech<br />

Funding Highlights from the<br />

Middle East<br />

P18 | Fintech News<br />

P20 | Fintech Application<br />

BUSINESS<br />

P22 | Innovative Solutions,<br />

Enduring Wealth: Exploring the<br />

DIFC Family Wealth Centre<br />

P24 | Business News<br />

COVER STORY<br />

Economic Significance of Family Businesses in UAE<br />

Exploring The AlMulla Brothers' Visionary Approach to Healthcare<br />

UAE - AED 30 | USA - USD 16.5 KSA - SR<br />

61 | Qatar - QAR 60 Oman - OMR 6.3 |<br />

Bahrain - BD 6.2 Kuwait - KWD 5 | UK -<br />

£12 | EU - €14<br />

P28 | Family Traditions, Business<br />

Triumphs: UAE’s Core Enterprises<br />

START-UP<br />

P38 | How Dubai’s Startups Are<br />

Attracting Significant Foreign<br />

Investments<br />

ENERGY<br />

P40 | Towards Net-Zero: ADNOC’s<br />

Decarbonisation Odyssey in <strong>2024</strong><br />

P42 | Energy News<br />

UAE's Unified Registry Launch: Strengthening Family Business Governance<br />

Towards Net-Zero: ADNOC’s Decarbonisation Odyssey in <strong>2024</strong><br />

Family Traditions,<br />

Business Triumphs:<br />

UAE’s Core Enterprises<br />

<strong>February</strong> <strong>2024</strong><br />

HEALTHCARE<br />

P46 | Mohamed & Obaid AlMulla<br />

Groups’ Visionary Approach to<br />

Healthcare<br />

MERGERS AND<br />

ACQUISITIONS<br />

P52 | Key Reasons Why Due<br />

Diligence is Essential for<br />

Mergers & Acquisitions in UAE<br />

P54 | Mergers & Acquisitions News<br />

REAL ESTATE<br />

P56 | Innovation in Elevation: Al<br />

Habtoor Real Estate’s Landmark<br />

Projects of 2023<br />

P60 | Real Estate News<br />

6 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

FUNDING & INVESTMENT<br />

P62 | HB Investments: Nurturing<br />

Global Brands Through Strategic<br />

Investments<br />

P64 | Funding & Investment News<br />

DIGITAL ASSETS<br />

CORPORATE<br />

P70 | Corporate Results<br />

SPORT AS A BUSINESS<br />

P72 | Scoreboard Economics: The<br />

Influence of Sports Investments on<br />

the Global Stage<br />

P74 | Sports News<br />

TOURISM<br />

TRAVEL<br />

P84 | Top Picks for Family<br />

Getaways this <strong>February</strong><br />

P86 | Travel News<br />

P27 | P89 | Launch Express<br />

P38 | P44 | Wheels<br />

P26 | P88 | Tech My Money<br />

P66 | Navigating the Top<br />

Blockchain Companies and<br />

Developers in Dubai<br />

ECONOMY<br />

P76 | Charting Success: A Step-by-<br />

Step Guide to Tourism Licensing in<br />

Dubai<br />

GLOBAL<br />

P78 | Global News<br />

INVESTING IN ART<br />

P68 | The Economic Significance<br />

of Family Businesses in the UAE<br />

P80 | Navigating Legal Aspects<br />

of Art Investment: Contracts and<br />

Ownership<br />

P82 | Local News<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 7

Personal <strong>Finance</strong><br />

source: freepik.com<br />

Family businesses see largest growth increase in 15 years, pwc.<br />

Integrating Family-<br />

Owned Business with<br />

Personal <strong>Finance</strong>: A<br />

Comprehensive Guide<br />

Family-run companies may slightly lag during<br />

economic booms but excel in recession<br />

resilience. - Harvard Business Review<br />

Embarking on the journey of integrating<br />

family-owned businesses with personal<br />

finance demands a nuanced understanding<br />

of the intricate dynamics involved. In<br />

an era where financial success is pivotal<br />

for both individual prosperity and the<br />

longevity of family enterprises, a comprehensive<br />

guide becomes indispensable.<br />

Recent research sheds light on the encouraging<br />

fact that 71% of family businesses<br />

witnessed growth in their latest financial<br />

year, marking a significant uptick in performance.<br />

Even more striking, 43% of<br />

these businesses reported double-digit<br />

growth, demonstrating a robust and resilient<br />

sector. As we delve into the intricacies<br />

of integrating family-owned businesses<br />

with personal finance, these statistics<br />

underscore the potential for prosperity<br />

and provide a compelling backdrop for<br />

our comprehensive guide.<br />

8 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

Family-owned businesses bring a<br />

unique set of dynamics to the table,<br />

intertwining the success of the<br />

enterprise with the financial well-being<br />

of family members. Balancing personal<br />

financial goals with the demands and<br />

opportunities of a family business requires<br />

a thoughtful and strategic approach. In<br />

this comprehensive guide, we delve into<br />

key considerations and strategies for<br />

seamlessly integrating family-owned<br />

businesses with personal finance.<br />

Compensation Harmony:<br />

It is the art of fairly and competitively<br />

remunerating family members involved<br />

in a family-owned business. This process<br />

ensures that each member receives<br />

compensation commensurate with their<br />

roles and contributions, aligning personal<br />

financial interests with the success of the<br />

business. By establishing a transparent<br />

and structured compensation plan, the<br />

distinction between personal income<br />

and business profits becomes clear.<br />

This clarity not only fosters a shared<br />

commitment to the business’s prosperity<br />

but also aids family members in making<br />

informed decisions for their financial<br />

planning, creating a harmonious relationship<br />

between familial and business<br />

financial objectives.<br />

Wealth Building through<br />

Business Ownership:<br />

It involves recognising the interconnected<br />

nature of owning a family<br />

business and personal wealth. This<br />

concept emphasises understanding the<br />

symbiotic relationship between the<br />

family’s ownership of the business and<br />

the accumulation of personal wealth. As<br />

the family business experiences growth<br />

or diversification, it directly influences<br />

personal financial goals. By exploring<br />

how the family business impacts personal<br />

financial objectives, individuals<br />

can leverage the business’s success to<br />

contribute to long-term wealth building.<br />

Succession Planning Integration:<br />

It goes beyond securing the future of<br />

the family business; it is an essential<br />

aspect of personal financial planning.<br />

This concept emphasises the need to align<br />

personal goals with a carefully crafted<br />

succession plan, recognising that the two<br />

are intricately connected. Succession<br />

planning ensures a smooth transition of<br />

leadership and ownership, contributing<br />

The fusion of<br />

family values<br />

and financial<br />

wisdom crafts a<br />

legacy of enduring<br />

prosperity of<br />

business.”<br />

to the continuity of financial stability for<br />

the entire family. This approach fosters<br />

a strategic alignment where the family’s<br />

aspirations and the business’s long-term<br />

sustainability complement each other,<br />

resulting in a seamless and prosperous<br />

transition for generations to come.<br />

Tax Planning Synergy:<br />

Family-owned businesses, like any other<br />

business, require tax planning. However,<br />

when considering the synergy of personal<br />

finance with the business, it becomes<br />

crucial to explore optimal options. Tax<br />

planning synergy involves strategically<br />

leveraging tax planning strategies that<br />

account for both personal and business<br />

taxes. By exploring tax-efficient methods<br />

for transferring wealth between family<br />

members and the business, individuals<br />

can optimise financial outcomes, ensuring<br />

a harmonious integration of tax planning<br />

strategies for the benefit of both entities.<br />

Retirement Goals Aligned:<br />

Integrate comprehensive retirement<br />

planning aligning family members with<br />

business retirement plans. Develop a<br />

strategic transition plan for business<br />

ownership upon retirement, ensuring a<br />

harmonious balance between personal<br />

retirement goals and the ongoing needs<br />

of the family business.<br />

Financial Education Across the Board:<br />

A family business is a fusion of collective<br />

efforts and unity, with varying<br />

levels of financial literacy among its<br />

members. To ensure the long-term health<br />

of the family business, it is crucial to<br />

promote financial literacy among all<br />

family members. Fostering a shared<br />

understanding of both the dynamics of<br />

the family business and personal financial<br />

matters cultivates responsible financial<br />

practices and informed decision-making.<br />

Emergency Funds and<br />

Contingency:<br />

Being prepared for the worst is always<br />

preferable to being helpless, especially<br />

in family businesses where losses affect<br />

everyone. Establishing emergency funds<br />

at both personal and business levels is<br />

essential to navigate unforeseen financial<br />

challenges. Develop contingency plans<br />

that carefully consider the financial<br />

stability of both family members and<br />

the business.<br />

Distinguishing Business<br />

and Personal Debt:<br />

Maintain financial clarity by clearly<br />

distinguishing between business and<br />

personal debts. Recognize how business<br />

debt may impact personal credit and<br />

financial standing, and manage these<br />

aspects separately.<br />

Family Council Meetings:<br />

Transparency is fundamental for a<br />

successful business. Utilising regular<br />

family council meetings as a platform<br />

facilitates discussions on both business<br />

and personal financial matters. Open<br />

communication is pivotal in addressing<br />

concerns and aligning financial goals<br />

across all family members, fostering<br />

a cohesive and informed approach to<br />

managing both aspects of the family’s<br />

financial landscape.<br />

Professional Advisor<br />

Collaboration:<br />

Engage professional advisors who<br />

specialise in both family business and<br />

personal finance. Ensure coordination<br />

among legal, financial, and business<br />

advisors to create holistic strategies that<br />

align with overall goals.<br />

The integration of family-owned businesses<br />

with personal finance is a delicate<br />

dance requiring strategic planning, open<br />

communication, and a deep understanding<br />

of the interconnected nature of these<br />

financial spheres. When approached<br />

thoughtfully, the synergy between family<br />

and business can create a legacy of financial<br />

success for generations to come.<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 9

UAE Banking<br />

source: Pexels.com<br />

Designated Non-Financial Businesses and Professions Regulations safeguards business integrity.<br />

Exploring LGT’s<br />

Family-Centric<br />

Business Model and<br />

Long-Term Vision<br />

Offering a comprehensive suite, including Princely<br />

strategy, co-investments, wealth planning, and<br />

sustainable investments, LGT stands as a steward of<br />

generational wealth.<br />

In the realm of family businesses, one<br />

that demands our attention is the exemplary<br />

model of the LGT group. It is one<br />

of the largest royal family-owned private<br />

banking and asset management groups in<br />

the world with over 25 locations across<br />

the globe. The ownership of LGT has a<br />

deep-rooted connection to Liechtenstein<br />

since the era of Prince Karl I (1569 to<br />

1627), the first Prince of Liechtenstein,<br />

establishing a historical tie that persists<br />

to this day in one of the world’s most<br />

economically prosperous states. Initially<br />

centred around land acquisition and management,<br />

the family evolved its business<br />

across diverse sectors, demonstrating skill,<br />

innovation, and a long-term perspective.<br />

Through strategic diversification, the family<br />

navigated crises, preserving wealth<br />

over generations, with current holdings<br />

spanning agriculture, forestry, alternative<br />

energy production, and thriving financial<br />

institutions.<br />

10 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

The Princely Family, spanning 900<br />

years and 26 generations, has<br />

maintained its entrepreneurial<br />

legacy by embracing a sustainable and<br />

innovative approach. Initially rooted<br />

in agriculture and forestry, the family’s<br />

success factors expanded beyond<br />

these sectors with the incorporation of<br />

diverse businesses, including banking<br />

and asset management, into its portfolio.<br />

Throughout this evolution, the core principles<br />

of sustainability and continuous<br />

innovation remained unchanged. LGT,<br />

as a family-owned entity, embodies this<br />

centuries-old entrepreneurial character,<br />

allowing for independent decision-making<br />

aligned with long-term goals, a privilege<br />

not afforded to publicly traded companies<br />

on stock exchanges.<br />

For over a century, LGT, a family-run<br />

private bank, has been at the helm of<br />

managing assets for families and corporations<br />

globally. Delving into the annals<br />

of LGT’s history, its roots intertwine with<br />

traditional values, systematic investment<br />

processes, and modern portfolio theories,<br />

earning the trust of clients worldwide.<br />

LGT’s enduring principles echo a<br />

commitment to long-term thinking<br />

and sustainable practices. In a rapidly<br />

changing world, LGT, as one of the last<br />

family-run private banks, has navigated<br />

substantial growth while keeping its sights<br />

on sustainability. From Europe to Asia<br />

and the Middle East, LGT has become<br />

a prominent figure for high-net-worth<br />

individuals and families, prioritising<br />

sustainable growth over fleeting profits.<br />

Understanding the distinct nature of<br />

each client’s financial journey, LGT’s advisors<br />

craft personalised solutions. Clients<br />

gain direct access to expert insights, with<br />

investment processes rooted in modern<br />

portfolio theories and meticulous financial<br />

analyses. Whether aligning with the<br />

Princely Family’s strategy or venturing<br />

into private equity and impact funds,<br />

LGT opens doors to diverse investment<br />

opportunities.<br />

Built on the bedrock of the Princely<br />

Family’s traditional values, LGT’s corporate<br />

culture exudes respect, friendliness,<br />

and an entrepreneurial spirit. Mutual<br />

trust serves as the cornerstone of LGT’s<br />

relationships, fostering sustainability in<br />

both private and business connections.<br />

Families entrust LGT with their assets<br />

for generations, drawn by a commitment<br />

to client interests and a robust financial<br />

foundation.<br />

We believe<br />

that integrating<br />

sustainability<br />

enhances longterm<br />

risk-adjusted<br />

returns.”<br />

Christopher Greenwald, Head of<br />

Sustainable Investing, LGT.<br />

LGT’s investment expertise revolves<br />

around personalised advice, conflict-free<br />

practices, and systematic, disciplined<br />

processes. The aim is to optimise returns,<br />

manage risks, and ensure investments<br />

positively impact society and the environment.<br />

Offering a comprehensive suite,<br />

including Princely strategy, co-investments,<br />

wealth planning, and sustainable<br />

investments, LGT stands as a steward of<br />

generational wealth.<br />

The group, housing Private Banking<br />

and Asset Management divisions operates<br />

independently with streamlined structures.<br />

The Foundation Board, chaired by H.S.H<br />

Prince Max von und zu Liechtenstein,<br />

oversees LGT Group, ensuring efficient<br />

decision-making. This organisational<br />

efficiency establishes LGT as a steadfast,<br />

long-term partner for clients, emphasising<br />

stability and solidity in the face of<br />

market fluctuations.<br />

LGT works closely with many families<br />

and family offices across the Middle East,<br />

where their businesses have grown into<br />

significant players in the regional economy<br />

over the past few decades. These<br />

enterprises, once small, have transformed<br />

into global conglomerates, becoming<br />

essential pillars in their respective local<br />

economies.<br />

Drawing the Princely Family’s entrepreneurial<br />

history brings valuable insights<br />

and interactions with business families<br />

in the region. Conversations about family<br />

governance, succession planning, and<br />

wealth preservation mirror challenges<br />

that owners have successfully tackled<br />

across generations. This shared experience<br />

resonates well with clients and is<br />

genuinely appreciated.<br />

LGT’s commitment to independence<br />

and long-term vision is evident in its<br />

international expansion. Over the past<br />

two decades, the company has consistently<br />

grown, demonstrating resilience<br />

even during economic downturns. The<br />

establishment of LGT’s DIFC entity a<br />

decade ago marked the beginning of<br />

its expansion into India and Australia.<br />

This strategic growth aligns with the<br />

company’s enduring approach, reflected<br />

in the significant number of long-tenured<br />

employees and a sustained presence in<br />

the jurisdictions it enters. LGT’s dedication<br />

to stability and longevity extends<br />

beyond financial strategies, shaping its<br />

corporate culture and global footprint.<br />

This steadfast commitment positions LGT<br />

as a reliable partner, distinguishing it in<br />

a landscape often marked by short-term<br />

perspectives.<br />

Clients choose LGT due to its unparalleled<br />

grasp of wealth management,<br />

dedication to family values, impressive<br />

track record, commitment to sustainability,<br />

and personalised approach. Rooted<br />

in the Princely Family of Liechtenstein’s<br />

values, their culture centres on a holistic<br />

wealth management approach, ensuring<br />

LGT maintains a long-term perspective<br />

aligned with clients’ best interests. This<br />

foundation cultivates trust and confidence,<br />

which are crucial for enduring<br />

relationships.<br />

Moreover, LGT’s strong focus on<br />

sustainability and impact investing, a<br />

sustained priority for years, attracts<br />

clients seeking investments aligned with<br />

their values. In an era where many wish<br />

to contribute positively to society and the<br />

environment through their investments,<br />

LGT provides the expertise and support<br />

to help clients realise this aspiration.<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 11

UAE Banking News<br />

Saudi Arabia’s PIF<br />

Investments Surge in<br />

2023<br />

In 2023, Saudi Arabia’s sovereign<br />

wealth fund, the Public Investment<br />

Fund (PIF), demonstrated<br />

its significant influence by<br />

contributing a noteworthy $31.5B,<br />

roughly a quarter of the total $124B<br />

spent globally by sovereign wealth<br />

funds. PIF’s active participation extended<br />

across US public and private<br />

markets, along with diverse global<br />

sectors. Detailed in documents related<br />

to the LIV Golf-PGA merger, PIF’s top<br />

holdings encompassed shares in Lucid,<br />

Electronic Arts, Uber, Take-Two, and<br />

Live Nation. Beyond mere financial<br />

stakes, PIF showcased a strategic focus<br />

on experiential sectors, spanning<br />

gaming to in-person entertainment.<br />

This underscores PIF’s dynamic and<br />

diversified investment strategy, positioning<br />

itself as a key player on the<br />

global financial stage.<br />

Emirates NBD Business Banking Unveils ‘Foreign<br />

Exchange and Trade’ Promotion<br />

Emirates NBD has launched a<br />

major Foreign Exchange and<br />

Trade customer promotion,<br />

offering prizes exceeding<br />

AED 3M. Running until March 31, <strong>2024</strong>,<br />

the initiative rewards 120 Business<br />

Banking customers with monthly<br />

prizes of up to AED 10,000 each for<br />

engaging in trade or foreign exchange<br />

transactions. Additionally, participants<br />

have the chance to win a grand prize<br />

of AED 1M, two prizes of AED 250,000<br />

each, and five prizes of AED 100,000<br />

each. Rohit Garg, Group Head of<br />

Business Banking at Emirates NBD,<br />

emphasises the bank’s commitment<br />

to recognizing the crucial role of business<br />

transactions in driving economic<br />

prosperity and invites customers to<br />

participate in this rewarding initiative.<br />

UBF and HKAB Ink Deal to Boost Cooperation in UAE<br />

The UAE Banks Federation<br />

(UBF) and Hong Kong Association<br />

of Banks (HKAB) recently<br />

inked a Memorandum<br />

of Understanding (MoU) to bolster<br />

collaboration and knowledge exchange<br />

within the banking and financial realm.<br />

The agreement, sealed by Jamal Saleh,<br />

UBF’s Director General, and Stephen<br />

Chan, HKAB’s Acting Chairman, aims<br />

to foster cooperation among the two<br />

entities, their member banks, and the<br />

broader financial sector. This strategic<br />

alliance, overseen by the Central<br />

Bank of the UAE and the Hong Kong<br />

Monetary Authority (HKMA), emphasises<br />

sharing expertise, organising<br />

workshops, and ensuring adherence<br />

to international regulations. Key focus<br />

areas include governance, transparency,<br />

and sustainability, showcasing a<br />

commitment to harmonising practices<br />

on a global scale.<br />

UAE Central Bank Introduces Regulations for Short-Term Credit Services<br />

The UAE Central Bank has<br />

rolled out a revised <strong>Finance</strong><br />

Companies Regulation to supervise<br />

firms providing shortterm<br />

credit and buy-now-pay-later<br />

services. The updated rules authorise<br />

entities, acting as agents for licensed<br />

banks or finance companies, to offer<br />

short-term credit upon approval from<br />

the banking regulator. Furthermore,<br />

the Central Bank has the authority to<br />

issue licences to entities as restricted<br />

licence finance companies for these<br />

activities. Unlicensed entities involved<br />

in short-term credit must either seek<br />

a restricted licence or partner with a<br />

licensed finance company or bank.<br />

This regulatory step responds to the<br />

burgeoning sector fueled by the increasing<br />

popularity of buy-now-pay-later<br />

models, aiming to ensure oversight<br />

and stability in financial services.<br />

12 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

Union Properties in Debt Repayment Deal with Leading UAE Bank<br />

Union Properties in Dubai has<br />

secured a debt repayment<br />

agreement with a prominent<br />

UAE bank, marking its second<br />

significant transaction. The Board of<br />

Directors has greenlit a payment plan<br />

ranging from AED 825M to AED 875M, to<br />

be fulfilled within nine months through<br />

four instalments. This initiative is part<br />

of Union Properties’ proactive approach<br />

to managing debt exposure, following<br />

a settlement with its ex-chairman for<br />

AED 620M under a structured instalment<br />

plan. The company is strategically<br />

addressing legacy issues, aiming to<br />

fortify its operational focus and enhance<br />

future cash flow generation. The board’s<br />

approval underscores Union Properties’<br />

commitment to navigating financial<br />

challenges through strategic measures.<br />

Saudi Arabia Unveils<br />

First Financial Center<br />

with Unified Policies<br />

Saudi Arabia is poised to<br />

inaugurate its inaugural<br />

financial centre, incorporating<br />

a unified system of standards<br />

and policies at the national level.<br />

Abdul Aziz Al-Furaih, Chairman of the<br />

Steering Committee at the Ministry of<br />

<strong>Finance</strong>, emphasised the significance<br />

of this initiative at the Leadership<br />

Forum in Riyadh. The move towards<br />

accrual accounting is anticipated<br />

to optimise government financial<br />

and accounting efficiency, furnishing<br />

precise information for decisionmaking,<br />

performance assessment, and<br />

accountability. Al-Furaih highlighted<br />

the transformation’s achievements,<br />

underscoring its role in advancing<br />

sustainability and augmenting gains—<br />

an essential stride in Saudi Arabia’s<br />

commitment to modernise financial<br />

practices for comprehensive and<br />

improved governance.<br />

UAE Insurance Sector Expands with $36B in<br />

Assets<br />

The UAE insurance sector<br />

demonstrates robust growth,<br />

reaching AED 131.6B ($35.8B)<br />

in assets by Q3 2023, a 9.6%<br />

surge in the initial nine months, marking<br />

an AED 11.5B ($3.1B) increase<br />

from year-end 2022. Quarterly, assets<br />

climb 3.05% to AED 127.7B ($34.8B)<br />

from Q2 to Q3 2023. Leading in Arab<br />

insurance, the UAE rises to 37th<br />

Proshot Holding is set to revolutionise<br />

the banking landscape in<br />

the Middle East and North Africa<br />

(MENA) with an innovative digital<br />

banking platform launched in the UAE.<br />

Founded by Iman Khatibzadeh, the<br />

vision is to address the unique needs<br />

and challenges of the rapidly evolving<br />

MENA market. The platform aspires<br />

to offer a seamless, secure, and user-friendly<br />

digital banking experience<br />

catering to diverse customers, from<br />

individuals to large enterprises. Iman<br />

Khatibzadeh underscores the goal of<br />

bridging the gap in digital financial services,<br />

providing accessible, efficient,<br />

and secure banking solutions to meet<br />

the dynamic needs of customers in<br />

the region. The initiative represents a<br />

significant step towards modernising<br />

and enhancing the financial landscape<br />

in the MENA region.<br />

globally in 2021, underscoring its<br />

resilience and dynamism. These figures<br />

solidify the UAE’s status as a<br />

regional powerhouse and global player,<br />

emphasising consistent growth and a<br />

fortified position in the international<br />

financial arena. The sector’s performance<br />

highlights its adaptability and<br />

enduring strength in the face of economic<br />

dynamics.<br />

New Digital Banking Launch Anticipated in UAE<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 13

UAE Reforms<br />

source: freepik.com<br />

The ministry’s unified registry aligns with Cabinet Resolution No. 109 for family business registration.<br />

UAE’s Unified<br />

Registry Reforms:<br />

Strengthening Family<br />

Business Governance<br />

The evolving policies and frameworks showcase a<br />

commitment to fostering an environment for longterm<br />

success among family businesses in the UAE.<br />

The United Arab Emirates (UAE) has<br />

embarked on a transformative journey<br />

to fortify the governance and sustainability<br />

of family businesses, signalling a pivotal<br />

shift in its economic landscape. With the<br />

Ministry of Economy unveiling a unified<br />

registry and enacting four resolutions,<br />

the UAE is redefining the framework for<br />

family enterprises. These reforms, aimed<br />

at bolstering governance and competitiveness,<br />

underscore the nation’s commitment<br />

to fostering an environment where local,<br />

regional, and global family companies<br />

thrive. The article explores the registration,<br />

deregistration, and governance<br />

procedures of family businesses in the<br />

UAE, as stipulated by the new unified<br />

registry law, emphasising transparency<br />

and compliance within this regulatory<br />

framework.<br />

14 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

The cornerstone of this transformation<br />

lies in recognising the pivotal role<br />

of family businesses in shaping<br />

economies worldwide. H.E. Abdulla bin<br />

Touq Al Marri, Minister of Economy,<br />

emphasised their significance, highlighting<br />

their substantial contribution to the global<br />

private sector, workforce, and GDP. In the<br />

UAE, where these businesses constitute<br />

a significant portion of the national<br />

GDP and private companies, their role<br />

is paramount in realising the country’s<br />

ambitious economic goals outlined in<br />

the ‘We the UAE 2031’ vision.<br />

Central to these reforms is the introduction<br />

of the Family Business Law Decree<br />

and the subsequent establishment<br />

of a unified registry. This registry<br />

serves as a comprehensive database,<br />

streamlining the registration process for<br />

family companies. It mandates specific<br />

criteria for registration, ensuring that<br />

only eligible family businesses become<br />

part of this centralised system. This<br />

process, spanning five distinct steps,<br />

ensures transparency and compliance<br />

while facilitating smoother operations<br />

for family enterprises.<br />

Firstly, the majority shareholders of<br />

the family-owned enterprise initiate<br />

the registration by applying through<br />

the relevant authority in each emirate.<br />

This authority, encompassing free zones<br />

as well, meticulously verifies the family<br />

company’s compliance with all specified<br />

regulations and prerequisites. Following<br />

this, the authority manages the data<br />

and ensures seamless communication<br />

between the family-owned company<br />

and relevant parties, with any updates<br />

promptly shared with the Ministry of<br />

Economy. Subsequently, the Department<br />

of the Unified Registry at the Ministry<br />

takes charge, overseeing the registration<br />

process upon receiving the necessary<br />

documentation and data, ultimately issuing<br />

the certification for the family company.<br />

In cases where digital connectivity is<br />

absent between the Ministry and the<br />

relevant authority, alternate coordinated<br />

methods are utilised to share the data<br />

within three working days to ensure a<br />

streamlined registration process.<br />

Moreover, the establishment of<br />

deregistration procedures is crucial to<br />

uphold the credibility and accuracy of the<br />

unified registry for family businesses in<br />

the UAE. These procedures are designed<br />

within a robust framework that ensures<br />

stringent checks and balances. They serve<br />

as safeguards against any inaccuracies or<br />

deviations from the specified ownership<br />

structures outlined during the registration<br />

process.<br />

By delineating a clear process for<br />

deregistration, the framework empowers<br />

authorities to thoroughly review and<br />

assess the reasons behind a family<br />

business’s potential removal from the<br />

registry. This could occur if there are<br />

substantial deviations from the initially<br />

provided information regarding ownership,<br />

which might compromise the integrity<br />

of the registry.<br />

Additionally, these measures help<br />

prevent any unauthorised or misleading<br />

information from being associated with<br />

registered family businesses, thereby<br />

maintaining the trustworthiness and<br />

reliability of the information stored within<br />

the unified registry. The credibility of the<br />

registered family businesses is thereby<br />

reinforced, ensuring that the registry<br />

remains a comprehensive and accurate<br />

database of eligible family enterprises<br />

within the UAE.<br />

The integration of the Family Charter into<br />

the unified registry stands as a testament<br />

to the commitment to sustainability<br />

and succession planning within family<br />

enterprises. This charter sets out ownership<br />

rules, values, and mechanisms, crucial<br />

for the continuity and long-term viability<br />

of these businesses across generations.<br />

Facilitating share purchase mechanisms<br />

and outlining guidelines for issuing<br />

multiple share classes further enhances<br />

the adaptability and growth prospects<br />

of family businesses. These resolutions<br />

provide a structured approach, allowing for<br />

strategic decision-making and flexibility<br />

in adapting to evolving market demands.<br />

H.E. Al Saleh detailed Cabinet Decision<br />

No. 107 of 2021, aligning with Article<br />

No. 11 of the Family Businesses Law,<br />

outlining a structured procedure for<br />

family companies to purchase their<br />

shares. This mechanism mandates several<br />

key steps: the initial approval from the<br />

family company’s general assembly,<br />

empowering the board of directors or<br />

the company manager to proceed with<br />

the purchase. Subsequently, the family<br />

company seeks approval from the<br />

relevant authority, committing to adhere<br />

to specified obligations and obtaining<br />

the necessary consent from government<br />

bodies if applicable. The commitment<br />

includes executing the purchase process<br />

within a stipulated time frame set by the<br />

competent authority. The final decision on<br />

the approval or rejection of the purchase<br />

request is made by the relevant authority<br />

within 15 business days, contingent upon<br />

the submission of all required data and<br />

documents.<br />

Cabinet Decision No. 108 of 2023<br />

introduces stringent controls governing<br />

the issuance of multiple share categories<br />

within family companies, emphasising the<br />

importance of clarity in the allocation of<br />

rights and privileges for each category.<br />

These controls, delineated within the<br />

company’s articles of association or<br />

bylaws, ensure that shares of the same<br />

category possess equal rights and privileges.<br />

Moreover, the resolution grants the<br />

family company the authority to modify<br />

or revoke share categories or associated<br />

rights, allowing for the establishment of<br />

specific rules within the founding contract<br />

or bylaws to facilitate such changes<br />

when necessary. Notably, if procedures<br />

for altering or revoking share categories<br />

aren’t defined, a 75% or more majority<br />

vote from partners with voting rights,<br />

as specified in the founding contract or<br />

bylaws, is mandated to authorise such<br />

modifications.<br />

H.E. Al Saleh emphasised that these<br />

resolutions mark a significant milestone,<br />

providing increased flexibility for the<br />

operations of family businesses across<br />

diverse sectors within the UAE. These<br />

measures are aligned with the nation’s<br />

ongoing efforts to enhance its appeal<br />

for family businesses, supporting their<br />

expansion and fostering an environment<br />

conducive to their sustained growth. These<br />

initiatives are in line with the country’s<br />

long-term objectives, ensuring a thriving<br />

ecosystem for family enterprises over<br />

the coming decades.<br />

These reforms underscore the UAE’s<br />

commitment to nurturing an ecosystem<br />

where family businesses thrive, contributing<br />

significantly to the nation’s economic<br />

landscape. By aligning legislative<br />

advancements with visionary programs,<br />

the UAE stands poised to elevate its<br />

position as a global destination for family<br />

companies.<br />

The unveiling of these resolutions marks<br />

a pivotal moment in the UAE’s economic<br />

narrative. As the country looks towards<br />

the next fifty years, these reforms pave<br />

the way for sustained growth, innovation,<br />

and global leadership within the realm<br />

of family enterprises.<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 15

Fintech<br />

source: freepik.com<br />

UAE’s investment spiked by 92%, fueled by fintech-friendly regulations. CNBC<br />

Cash Infusion:<br />

FinTech Funding<br />

Highlights from the<br />

Middle East<br />

Fintech thrives on innovation, where funding is<br />

the spark that ignites a revolution in reshaping and<br />

redefining the future of finance.<br />

Fintech, short for financial technology,<br />

encompasses the delivery of financial<br />

services utilising IT and internet solutions.<br />

Key subcategories include digital<br />

payments, mobile banking, money<br />

transfer services, and cryptocurrency.<br />

Projections for <strong>2024</strong> indicate that the<br />

global fintech sector’s total revenue is<br />

expected to reach 188 billion U.S. dollars.<br />

In the Middle East, fintech services play a<br />

crucial role within the financial industries,<br />

with numerous startups emerging in this<br />

sector. Entrepreneurs swiftly grasped the<br />

value within the fintech industry, securing<br />

noteworthy funding mere years after their<br />

inception. This article spotlights some of<br />

these fintech ventures that have garnered<br />

substantial funding due to their innovative<br />

approaches and robust ideas.<br />

16 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

“To date, KARTY has garnered significant<br />

direct funding from local and international<br />

investors”, Mohammed Suleiman.<br />

KARTY<br />

In the ever-expanding landscape of<br />

FinTech in the Middle East, KARTY has<br />

emerged as a standout player, founded<br />

in 2021 by Mohammed Suleiman and<br />

Abdulaziz Al-Marri. The recent success<br />

of KARTY, a Qatari fintech, lies in its<br />

completion of a substantial seed funding<br />

round, securing an impressive $2 million.<br />

The infusion of capital stems from a<br />

diverse consortium of local investors,<br />

as reported by IBS Intelligence. This<br />

influx of funds is strategically earmarked<br />

for the imminent launch and scaling of<br />

KARTY’s cutting-edge e-wallet and financial<br />

resource management application.<br />

The platform, designed with user-friendly<br />

features, offers instant peer-to-peer<br />

money transfers, meticulous oversight<br />

of daily spending, and insightful tracking<br />

of spending patterns through interactive<br />

charts. Amidst the thriving FinTech<br />

funding landscape in the Middle East,<br />

KARTY is a standout contender.<br />

This investment propels our<br />

global AI-driven retail customer<br />

engagement revolution, Omar Ebeid.<br />

Zeal<br />

Established in 2019 by Omar Ebeid,<br />

Bellal Mohamed, and Amr Mohamed,<br />

Zeal has carved its niche in the fintech<br />

landscape, offering a unique blend of<br />

payment solutions and customer loyalty<br />

programs. Users can seamlessly link<br />

various payment methods to their Zeal<br />

accounts, making in-store payments with<br />

a QR code scan, facilitated by Zeal-provided<br />

scanners.<br />

Zeal’s innovative approach replaces<br />

traditional loyalty cards, allowing users<br />

to accumulate points with each transaction<br />

that can be redeemed for rewards<br />

at partner outlets. Recently securing a<br />

substantial $4 million in funding led by<br />

Raed Ventures and Cur8 Capital, along<br />

with strategic angel investors, Zeal is<br />

set to expand its technological footprint<br />

across the EMEA region. Having already<br />

made strides in the UK market, Zeal aims<br />

to stand out by providing Value Added<br />

Service solutions for payment acquirers<br />

and merchants globally, solidifying its<br />

position as a noteworthy player in the<br />

Middle East’s FinTech funding landscape.<br />

At Takadao, we create user-owned<br />

financial services, fostering community<br />

empowerment, Sharene Lee.<br />

Takadao<br />

Established in 2022 by Sharene Lee<br />

and Morrad Irsane, Takadao stands out<br />

in the FinTech funding landscape with<br />

its Shariah-compliant blockchain-based<br />

services, offering users savings, loans, and<br />

cooperative life insurance. As a pioneer<br />

in creating the infrastructure for community-based<br />

financing and insurance,<br />

Takadao represents a significant stride<br />

towards inclusive, transparent financial<br />

solutions.<br />

The Saudi Arabia-based fintech recently<br />

garnered attention by raising a<br />

substantial $1.6 million in a pre-Seed<br />

round in June 2023, led by prominent<br />

investor Tim Draper, along with BIM,<br />

Core Vision Ventures, and Prince Sultan<br />

bin Fahad bin Salman Al Saud.<br />

Notably, Takadao secured additional<br />

undisclosed investment in January <strong>2024</strong><br />

from Adaverse, a Cardano ecosystem<br />

accelerator and seed fund, focusing on<br />

Web3 solutions. This new funding will<br />

propel the launch of Takadao’s flagship<br />

product, Takasure, in June <strong>2024</strong>, marking<br />

a noteworthy development in the FinTech<br />

funding landscape of the Middle East.<br />

What we offer can be vital for small<br />

business owners, Idriss Al Rifai.<br />

Flow48<br />

Established in 2022 by Idriss Al Rifai,<br />

Flow48 is making waves in the Middle<br />

East’s FinTech landscape by providing<br />

SMEs in the UAE with innovative revenue-based<br />

financing solutions. Recently<br />

securing an impressive $25 million in a<br />

pre-Series A funding round, featuring a<br />

blend of equity and debt funding, Flow48<br />

is poised for expansion.<br />

The platform, which seamlessly integrates<br />

with ERP providers, payment<br />

gateways, and e-commerce platforms,<br />

utilises a proprietary risk engine for<br />

precise and efficient credit assessments.<br />

With plans to expand its horizons, Flow48<br />

is actively considering South Africa,<br />

acknowledging the robust SME lending<br />

market and advanced fintech ecosystem<br />

in the region.<br />

Backed by investors like Speedinvest,<br />

Daphni, Blockchain Founders Fund, and<br />

more, this funding aligns with Flow48’s<br />

commitment to data-driven, real-time<br />

lending solutions, emphasising its dedication<br />

to empowering SMEs across<br />

emerging markets globally.<br />

The journey of Flow48 continues, driven<br />

by a vision to empower SMEs across<br />

emerging markets on a truly global scale.<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 17

Fintech News<br />

Maalexi’s Pre-Series A Funding Hits $3M for UAE Agri-Trade Fintech<br />

Maalexi, in the global agritrade<br />

sector, triumphs with<br />

a $3M pre-Series A funding<br />

round, proudly announced<br />

by the company. Spearheaded by Global<br />

Ventures, the leading MENA venture<br />

capital firm, this round sees collaboration<br />

with existing investors Rockstart<br />

(Amsterdam) and Ankurit Capital (New<br />

Delhi). The infusion of funds is strategically<br />

earmarked for Maalexi’s tech<br />

advancement, focusing on fortifying its<br />

full-stack platform. This move aims to<br />

empower SME agri-buyers to procure<br />

swiftly, cost-effectively, and securely<br />

from SME sellers across the globe. Additionally,<br />

the funds will be instrumental<br />

in expanding Maalexi’s customer base,<br />

targeting increased buyers in the UAE<br />

and Saudi Arabia and welcoming sellers<br />

from more than 50 origin countries.<br />

Maalexi’s cutting-edge technology,<br />

featuring digital contracts, AI-enhanced<br />

inspections, and blockchain-verified<br />

documentation, addresses trade risks<br />

and financial constraints faced by small<br />

agri-businesses.<br />

Tabby Raises $700M in Debt Financing, Extends<br />

Series D to $250M<br />

Saudi Arabia’s prominent shopping<br />

and financial services<br />

app, Tabby, has secured a<br />

substantial boost with up to<br />

$700M in receivables securitisation<br />

from J.P. Morgan, marking the largest<br />

asset-backed facility attained by a<br />

fintech company in the MENA region.<br />

Simultaneously, Tabby has extended its<br />

Series D financing, reaching a total of<br />

$250M. The extended round includes<br />

investment from Hassana Investment<br />

Company, Soros Capital Management<br />

from the US, and Saudi Venture Capital<br />

(SVC). This financial infusion fortifies<br />

Tabby’s balance sheet, meeting the surging<br />

demand for its buy now, pay later<br />

platform. The capital will facilitate the<br />

expansion of Tabby’s financial services<br />

and shopping products, catering to its<br />

extensive user base of 10M consumers<br />

and 30,000 retailers. This positions<br />

Tabby for continued innovation and<br />

market leadership.<br />

Qashio Teams Up With Emirates Skywards for UAE<br />

Business Expense Solutions<br />

In a strategic alliance with Emirates<br />

Skywards, the acclaimed<br />

loyalty programme of Emirates<br />

and flydubai, Qashio, the UAE’s<br />

premier business expense solution,<br />

introduces a rewarding collaboration.<br />

Through this partnership, customers<br />

can seamlessly convert Qashio Points,<br />

earned via Qashio’s business expense<br />

cards, into coveted Skywards Miles.<br />

This unlocks a plethora of exclusive<br />

benefits offered by Emirates Skywards,<br />

renowned globally. As business travel is<br />

projected to rebound to pre-pandemic<br />

levels by <strong>2024</strong>, Qashio aims to enhance<br />

its customers’ travel experiences. This<br />

significant milestone provides Qashio’s<br />

clientele with unparalleled travel advantages,<br />

including flight rewards and<br />

upgrades, with Emirates, the world’s<br />

largest international airline.<br />

CBUAE Unveils<br />

Regulatory Framework<br />

for BNPL Services<br />

Addressing the rising demand<br />

for “Buy-Now, Pay-Later”<br />

and similar credit offerings,<br />

the Central Bank of the UAE<br />

(CBUAE) introduces an amended <strong>Finance</strong><br />

Companies Regulation. The new<br />

framework permits entities to provide<br />

short-term credit as agents of licensed<br />

Banks or <strong>Finance</strong> Companies, subject to<br />

CBUAE approval. Alternatively, entities<br />

can engage in this activity by obtaining<br />

a licence as Restricted Licence <strong>Finance</strong><br />

Companies from CBUAE. Unlicensed<br />

entities involved in short-term credit<br />

activities must either seek to licence as<br />

Restricted Licence <strong>Finance</strong> Companies<br />

from CBUAE or collaborate with a licenced<br />

<strong>Finance</strong> Company or Bank to continue<br />

such operations. This initiative aims to<br />

regulate and streamline the growing market<br />

for these financial services in the UAE.<br />

18 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

Fintech Saudi Partners<br />

With Kyndryl to Empower<br />

Saudi Arabian Fintechs<br />

Fintech Saudi and Kyndryl, the<br />

world’s largest IT infrastructure<br />

services firm, have inked a<br />

memorandum of understanding<br />

(MoU) to support fintech entrepreneurs<br />

and startups in Saudi Arabia. This<br />

collaboration, part of the Fintechs Enablement<br />

Programme (Makken), aligns<br />

with the kingdom’s fintech strategy<br />

under Saudi Vision 2030. Makken, which<br />

means “to enable” in Arabic, aims to<br />

expedite the market entry of fintech<br />

startups efficiently. Kyndryl, under the<br />

MoU, will provide a secure, cloud-based<br />

incubation platform to aid startups in<br />

developing prototypes before seeking<br />

funding. The partnership also involves<br />

co-hosting seminars and workshops to<br />

foster knowledge sharing, networking,<br />

and the advancement of modernisation<br />

within the Saudi fintech community.<br />

Tameed Platform Secures $15M in Series A<br />

Funding for Saudi Digital Lending<br />

Saudi-based Tameed Digital<br />

Lending Platform, specialising in<br />

shariah-compliant Government<br />

Purchase Orders Financing for<br />

SMEs, has successfully concluded a<br />

Series A funding round, securing SAR<br />

56.75M ($15M). Alromaih Investments<br />

led the investment. Tameed plans to<br />

utilise the funds to fuel its expansion,<br />

catering to the rising demand for its<br />

innovative Digital Lending products<br />

in sync with Saudi Arabia’s economic<br />

growth. Benefiting from an operating<br />

licence from the Saudi Central Bank<br />

since January 2023, Tameed has already<br />

facilitated over SAR 400M in funding<br />

to SMEs, achieved a growth rate exceeding<br />

400%, and garnered 50K downloads<br />

for its mobile app. The recently<br />

launched Auto-Invest product allows<br />

investors to participate in short-term<br />

funding opportunities aligned with their<br />

pre-configured preferences.<br />

Islamic Banks in UAE Embrace Digital Innovation<br />

Islamic banks in the UAE are<br />

rapidly embracing digital innovations,<br />

leveraging technologies<br />

such as artificial intelligence (AI),<br />

e-learning, and blockchain, according<br />

to a recent report by the Central Bank<br />

of the UAE (CBUAE). Released on<br />

December 20, 2023, the UAE Islamic<br />

<strong>Finance</strong> Report 2023 assesses the global<br />

and local performance of various<br />

Islamic finance sectors, emphasising<br />

sustainability. The report highlights<br />

the swift adoption of digital initiatives<br />

by Islamic banks in the UAE, encompassing<br />

online finance, contactless<br />

payments, chat support, dedicated<br />

applications, and upgraded ATMs and<br />

CDMs. This digital transition has led to<br />

increased online and mobile transactions,<br />

expanded customer bases, and<br />

higher mobile wallet adoption. Additionally,<br />

AI and robotics are employed<br />

for facial recognition in account openings,<br />

while e-learning and blockchain<br />

enhance employee training and trade<br />

finance transparency.<br />

Dubai establishes<br />

itself as a fintech and<br />

investment hub<br />

Dubai and the broader Middle<br />

East and North Africa (ME-<br />

NA) region have emerged<br />

as pivotal hubs for fintech<br />

and online trading, witnessing a surge<br />

in investment, startups, and venture<br />

capital in <strong>2024</strong>. MENA has become<br />

an attractive destination for various<br />

industry players, including brokers,<br />

service providers, and fintech firms,<br />

seeking to establish a market presence<br />

and expand operations. Global interest<br />

in the region is evident through major<br />

events like the upcoming iFX EXPO<br />

Dubai <strong>2024</strong>. With over 465 fintechs operating<br />

in MENA, the region is poised<br />

for significant growth, reflecting a<br />

strategic shift toward high-potential<br />

markets amid strong competition,<br />

scalability, and notable challenges in<br />

the fintech and online trading spheres.<br />

According to various estimates, several<br />

local retail trading markets in the<br />

MENA region have outpaced their<br />

counterparts, showcasing the region’s<br />

robust growth and attractiveness for<br />

those operating in the online trading<br />

sector.<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 19

Fintech Application<br />

ENBD X<br />

ENBD X, the latest iteration of<br />

Emirates NBD’s mobile banking<br />

app, heralds a new era in streamlined<br />

and efficient banking experiences.<br />

This comprehensive revamp has been<br />

engineered to cater to diverse financial<br />

needs, setting a higher benchmark in<br />

user-centric digital banking solutions.<br />

The app redesign emphasises speed<br />

and usability, offering an enriched user<br />

interface that ensures faster navigation<br />

and access to a vast array of banking<br />

services. With over 150 services available<br />

at your fingertips, the majority of<br />

transactions are processed instantly in<br />

real-time, eliminating unnecessary steps<br />

and enhancing convenience for users.<br />

One of the defining features of ENBD<br />

X is its personalised dashboard, allowing<br />

users to tailor their app according to<br />

their preferences and lifestyle. Whether<br />

managing profiles, notifications,<br />

or security preferences, users have<br />

complete control, ensuring a banking<br />

experience that aligns seamlessly with<br />

their needs.<br />

The app’s capabilities extend far<br />

beyond everyday banking functionalities.<br />

It empowers users to manage<br />

their wealth effortlessly, facilitating<br />

instant account openings on the app<br />

with enticing rewards of up to AED<br />

1,000. Additionally, users can venture<br />

into investment portfolios and trade in<br />

global and local equities across various<br />

markets, enhancing accessibility to<br />

stock trading.<br />

ENBD X doesn’t just simplify local<br />

transfers; it revolutionises global transactions.<br />

From international transfers<br />

via SWIFT to rapid 60-second transfers<br />

to select countries like the UK, India,<br />

Pakistan, Philippines, Sri Lanka, and<br />

Egypt, the app ensures efficient and<br />

secure money transfers.<br />

Moreover, the app introduces innovative<br />

features like cardless withdrawals,<br />

allowing users to send money to any<br />

Emirates NBD ATM for withdrawal<br />

by themselves or their recipients, irrespective<br />

of their banking affiliation.<br />

For added convenience, users can<br />

swiftly make utility, telecommunications,<br />

and other bill payments, set up<br />

auto payments, and perform secure<br />

money transfers between contacts<br />

using UAE mobile numbers.<br />

The app’s enhanced functionality<br />

spans from managing finances and<br />

card payments to handling service<br />

requests, accessing dedicated rewards,<br />

and exploring simplified financial services<br />

like loan applications, instalment<br />

plans, and more.<br />

ENBD X redefines mobile banking,<br />

empowering users with unparalleled<br />

control, efficiency, and an extensive<br />

suite of features designed to elevate<br />

their banking experience to new heights.<br />

Availability<br />

Google Play, App Store, App Gallery<br />

source: Paytabs.com<br />

20 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

Fintech Application<br />

BANKIOM<br />

Bankiom stands out as a transformative<br />

super money app,<br />

reshaping the digital banking<br />

landscape across the GCC countries.<br />

With a focus on enhancing the user’s<br />

relationship with money, Bankiom introduces<br />

a novel and intelligent digital<br />

banking experience.<br />

The standout feature of Bankiom is<br />

its promise of a hassle-free account<br />

setup that takes a mere three minutes.<br />

Users can swiftly access their payment<br />

card directly on their phones,<br />

providing unparalleled convenience.<br />

Additionally, the app allows users to<br />

connect and manage all their bank<br />

accounts seamlessly, consolidating<br />

financial management into a single,<br />

user-friendly platform.<br />

One of the key attractions of Bankiom<br />

is its provision of a free-to-use virtual<br />

card, obtained effortlessly in just three<br />

simple steps. This virtual card comes<br />

with a significant advantage—no exchange<br />

fees. Users can shop from<br />

their favourite online merchants in<br />

their local AED currency without the<br />

burden of exorbitant exchange charges,<br />

contributing to a more cost-effective<br />

and user-friendly experience.<br />

Bankiom empowers users with full<br />

control over their financial transactions.<br />

The app allows users to freeze or<br />

unfreeze cards, manage transactions,<br />

and gain valuable insights into their<br />

spending patterns. With an emphasis<br />

on security, Bankiom incorporates 3D<br />

Secure payments, ensuring that online<br />

transactions are safe and protected,<br />

reducing the risk of exposing primary<br />

bank card details.<br />

Money transfers are made quick,<br />

efficient, and enjoyable through Bankiom.<br />

Users can leverage the app to pay<br />

friends or family within seconds, and<br />

the Tap and Pay feature facilitates<br />

swift requests or transfers with just<br />

a button tap.<br />

Bankiom positions itself as a centralised<br />

hub for all financial activities.<br />

Users can connect multiple bank accounts,<br />

providing a comprehensive<br />

dashboard to view transactions, spending<br />

trends, and other insights for a<br />

holistic financial overview. The app’s<br />

detailed transfer logs and insightful<br />

reports simplify the task of tracking<br />

payments, ensuring transparency and<br />

accountability in financial transactions.<br />

Recently, Bankiom introduced a range<br />

of enhancements. The newly launched<br />

Bankiom virtual card, available for<br />

free, signifies a commitment to providing<br />

enhanced online freedom. Back<br />

top-ups, an improved user interface,<br />

increased card limits, and upgraded<br />

bank connectivity for improved categorisation<br />

demonstrate Bankiom’s<br />

dedication to continuous innovation,<br />

ensuring a better user experience for<br />

its growing user base.<br />

Availability<br />

Google Play, App Store<br />

<strong>February</strong> <strong>2024</strong> www.thefinanceworld.com 21

Business<br />

Image Supplied<br />

Innovative Solutions,<br />

Enduring Wealth:<br />

Exploring the DIFC<br />

Family Wealth Centre<br />

“As the next generation takes on the responsibility for<br />

growing their family wealth, DIFC’s experience and<br />

expertise will enhance their ability to achieve their future<br />

ambitions”. H.H. Sheikh Maktoum bin Mohammed<br />

Family businesses anchor the UAE’s economy, constituting almost 90% of private companies.<br />

In the compelling narrative of Dubai’s<br />

remarkable economic growth, family<br />

enterprises emerge as key drivers of<br />

progress and innovators contributing to<br />

value creation. Constituting over 40% of<br />

the emirate’s GDP, this sector epitomises<br />

Dubai’s entrepreneurial spirit. As Dubai<br />

endeavours to usher in a new era of robust<br />

economic expansion, the government<br />

is implementing a series of initiatives<br />

aimed at fortifying family businesses and<br />

ensuring their resilience. Over the past<br />

year, Dubai has introduced fresh legislative<br />

measures and support systems, addressing<br />

the challenges and opportunities arising<br />

from a world economy in flux. One such<br />

initiative is the inauguration of the DIFC<br />

Family Wealth Centre which aims to<br />

maximise the growth and potential of<br />

family businesses.<br />

22 www.thefinanceworld.com <strong>February</strong> <strong>2024</strong>

Family businesses form the cornerstone<br />

of the UAE’s economic<br />

landscape, with an astonishing 90%<br />

of private companies in the country being<br />

family-owned, according to a report by the<br />

UAE Ministry of Economy. Additionally,<br />

they play a significant role as employers,<br />

supporting over 70% of the private sector<br />

workforce. Dubai’s economic diversification<br />

has been spearheaded by family<br />

enterprises, showcasing a substantial<br />

presence across crucial sectors such as<br />

real estate, construction, retail, wholesale<br />

trade, hospitality, tourism, manufacturing,<br />

financial services, healthcare, education,<br />

and technology.<br />

Dubai’s strategic location and its status<br />

as one of the world’s most interconnected<br />

cities make it an ideal global hub for<br />

family businesses aiming to access highgrowth<br />