The Finance World Magazine| Edition: November 2023

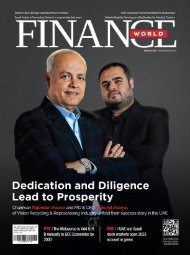

As COP28 unfolds, finance takes the spotlight, intricately linked to Climate Transition and Adaptation. This edition of The Finance World Magazine explores the finance-sustainability connection and the growing trend in the MENA region. In this edition, the focus lies on influential leaders from the UAE who are leaving a significant mark on sustainability. Employing a rigorous selection process, the cover story of this magazine highlights 10 UAE leaders who have substantially participated in sustainability efforts. Notable figures include Sultan Al Jaber, the president-designate of COP28, and Emirati Visionaries Razan Al Mubarak and Shamma Al Mazrui, who are appointed as ambassadors for COP28. Centred around sustainability and finance, this edition highlights different aspects of green initiatives surging in the Middle East, including the ESG revolutions in the fintech sector, green investments in luxury real estate across UAE, and the rise of sustainable tourism throughout the region. It also encompasses informative articles on "Leveraging Digital Assets and Blockchain for Achieving ESG Objectives," "Balancing Profit and Protection: Investing in Wildlife Sanctuaries," and much more. Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

As COP28 unfolds, finance takes the spotlight, intricately linked to Climate Transition and Adaptation. This edition of The Finance World Magazine explores the finance-sustainability connection and the growing trend in the MENA region.

In this edition, the focus lies on influential leaders from the UAE who are leaving a significant mark on sustainability. Employing a rigorous selection process, the cover story of this magazine highlights 10 UAE leaders who have substantially participated in sustainability efforts. Notable figures include Sultan Al Jaber, the president-designate of COP28, and Emirati Visionaries Razan Al Mubarak and Shamma Al Mazrui, who are appointed as ambassadors for COP28.

Centred around sustainability and finance, this edition highlights different aspects of green initiatives surging in the Middle East, including the ESG revolutions in the fintech sector, green investments in luxury real estate across UAE, and the rise of sustainable tourism throughout the region. It also encompasses informative articles on "Leveraging Digital Assets and Blockchain for Achieving ESG Objectives," "Balancing Profit and Protection: Investing in Wildlife Sanctuaries," and much more.

Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GROW YOUR<br />

BUSINESS<br />

We make Short / Long Term<br />

Investments in Growing Businessess<br />

www.wasayainvestments.com

Editor’s Note Note<br />

Contact:<br />

+971 58 591 8580<br />

Advertisement queries:<br />

Editorial:<br />

Press Release<br />

For News<br />

Contact:<br />

For Partnerships +971 58 591 8580<br />

com<br />

Advertisement queries:<br />

Public Relations<br />

For Printed Copy<br />

Press Release<br />

Published By:<br />

Editorial:<br />

For News<br />

MCFILL MEDIA &<br />

PUBLISHING GROUP<br />

For Partnerships<br />

Approved and Licensed By:<br />

National Media Council,UAE Public Relations<br />

com<br />

<strong>The</strong> <strong>Finance</strong> <strong>World</strong> (TFW) has taken constant<br />

efforts to make sure that content For Printed is accurate Copyas<br />

on the date of publication. <strong>The</strong> published articles,<br />

editorials, material, adverts and all other content<br />

is published in a good faith and Published opinions By: and<br />

views are not necessarily those of the publishers.<br />

We regret that we cannot guarantee and accept<br />

MCFILL MEDIA<br />

no<br />

&<br />

liability for any loss or damage of any kind PUBLISHING caused GROUP<br />

by this magazine and errors and for the accuracy<br />

of claims in any forms Approved by any and advertisers Licensed or By:<br />

readers. We advise the readers National to Media seek Council,UAE<br />

the advice<br />

of specialists before acting on information<br />

published in the <strong>The</strong> magazine. <strong>Finance</strong> <strong>World</strong> <strong>The</strong> (TFW) trademarks, has taken constant<br />

logos, pictures, domain efforts names to make and sure service that content marks is accurate as<br />

on the date of publication. <strong>The</strong> published articles,<br />

(collectively the “Trademarks”) displayed on<br />

editorials, material, adverts and all other content<br />

this magazine are is registered published in and a good unregistered<br />

faith and opinions and<br />

Trademarks of <strong>The</strong> views <strong>Finance</strong> are not <strong>World</strong> necessarily and its those content of the publishers.<br />

providers. All rights We reserved regret that and we cannot nothing guarantee can be and accept no<br />

partially or in whole liability be reprinted for any loss or damage reproduced of any kind caused<br />

or stored in a retrieval by this system magazine or and transmitted errors and for in the accuracy<br />

of claims in any forms by any advertisers or<br />

any form without a written consent.<br />

readers. We advise the readers to seek the advice<br />

of specialists before acting on information<br />

published in the magazine. <strong>The</strong> trademarks,<br />

Advertisers advertised in this logos, guide pictures, are included domain on a sponsored names and basis. service marks<br />

Details are correct at the time (collectively of going to press, the “Trademarks”) but offers and prices displayed on<br />

may change. this magazine are registered and unregistered<br />

Trademarks of <strong>The</strong> <strong>Finance</strong> <strong>World</strong> and its content<br />

providers. All rights reserved and nothing can be<br />

partially or in whole be reprinted or reproduced<br />

or stored in a retrieval system or transmitted in<br />

any form without a written consent.<br />

Advertisers advertised in this guide are included on a sponsored basis.<br />

Details are correct at the time of going to press, but offers and prices<br />

may change.<br />

Reaching a visionary goal requires<br />

one percent vision and 99 percent alignment.<br />

As COP28 unfolds, finance takes the spotlight, intricately linked<br />

to Climate Transition and Adaptation. This edition of <strong>The</strong><br />

<strong>Finance</strong> <strong>World</strong> Magazine explores the finance-sustainability<br />

connection and the growing trend in the MENA region.<br />

Editor’s Note<br />

In this edition, the focus lies on influential leaders from the UAE who<br />

are leaving a significant mark on sustainability. Employing a rigorous<br />

selection process, the cover story of this magazine highlights 10 UAE<br />

leaders who have substantially participated in sustainability efforts.<br />

Notable figures include Sultan Al Jaber, the president-designate of<br />

COP28, and Emirati Visionaries Razan Al Mubarak and Shamma Al<br />

Mazrui, who are appointed as ambassadors for COP28.<br />

Centred around sustainability and finance, this edition highlights<br />

different aspects of green initiatives surging in the Middle East,<br />

including the ESG revolutions in the fintech sector, green investments<br />

in luxury real estate across UAE, and the rise of sustainable tourism<br />

throughout the region. It also encompasses informative articles<br />

on “Leveraging Digital Assets and Blockchain for Achieving ESG<br />

Objectives,” “Balancing Profit and Protection: Investing in Wildlife<br />

Sanctuaries,” and much more.<br />

This edition features exclusive interviews that provide unique<br />

perspectives on the financial world. Aniket Sunil Talati, President of<br />

<strong>The</strong> Institute of Chartered Accountants of India (ICAI), shares insights<br />

into the impact of Chartered Accountants. Additionally, gain valuable<br />

insights into sustainability initiatives as Chris Hamilton, Resident<br />

Manager, and Head of Sustainability at Shangri-La Group, discusses<br />

Shangri-La Dubai’s commitment to sustainability.<br />

Within the news segments, you will find a condensed compendium<br />

of the most notable advancements in the field of finance. We have<br />

meticulously sifted through the latest trends and updates, spanning<br />

an array of pertinent topics such as corporate results, corporate tax,<br />

startups, banking, funding, investment, fintech, digital assets, and<br />

beyond.<br />

We aim to espouse the vision of the UAE’s wise leadership on the<br />

nation’s development path, highlighting the social, economic, and<br />

developmental aspects shaping this dynamic nation. To that end, we<br />

tirelessly curate the latest and most credible finance news for our<br />

readers, aiming to advance financial literacy and contribute to Dubai’s<br />

journey to becoming one of the world’s most pioneering economies.<br />

- Ambrish Agarwal, Editor in Chief<br />

- Ambrish Agarwal, Editor in Chief<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 5<br />

September 2022 3

Contents <strong>November</strong><br />

<strong>2023</strong><br />

PERSONAL FINANCE<br />

P8 | Building Wealth for the<br />

Future: <strong>The</strong> Power of Long-Term<br />

Investment<br />

UAE BANKING<br />

BUSINESS<br />

P22 | <strong>The</strong> Future of <strong>Finance</strong>:<br />

Climate Business and Generational<br />

Security<br />

P24 | Business News<br />

COVER STORY<br />

HEALTHCARE<br />

P10 | Salary Guide for In-Demand<br />

Banking and <strong>Finance</strong> Careers in<br />

the UAE<br />

P12 | UAE Banking News<br />

UAE REFORMS<br />

P50 | COP28 to centralise<br />

Healthcare at first-ever Health Day<br />

MERGERS AND<br />

ACQUISITIONS<br />

P14 | UAE Reforms Arbitration<br />

Law<br />

P15 | UAE’s New Consumer<br />

Protection Framework<br />

FINTECH<br />

P16 | Fintech for ESG: Revolutionising<br />

Responsible Investing<br />

P18 | Fintech News<br />

P20 | Fintech Application<br />

6 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong><br />

P30 | 10 UAE Leaders Influencing<br />

Sustainable Development<br />

START-UP<br />

P42 | Startups Addressing Climate<br />

Change in UAE<br />

ENERGY<br />

P44 | Masdar City: <strong>The</strong> $22B Zero<br />

Carbon ProjectAmidst the Arabian<br />

Desert<br />

P46 | Energy News<br />

P52 | Innovating M&A Strategies<br />

for Resilience and Forward<br />

Momentum<br />

P54 | Mergers & Acquisitions News<br />

CRYPTOCURRENCY<br />

P56 | UAE’s Crypto Revolution:<br />

Regulatory Insights from Dubai

REAL ESTATE<br />

P58 | Luxury Real Estate in the<br />

UAE Goes Green<br />

P60 | Real Estate News<br />

FUNDING & INVESTMENT<br />

INTERVIEW<br />

P68 | Aniket Sunil Talati, President<br />

of <strong>The</strong>Institute of Chartered<br />

Accountants of India (ICAI)<br />

P84 | Chris Hamilton, Resident<br />

Manager and Head of<br />

Sustainability at Shangri-La Group<br />

STOCK MARKET<br />

TOURISM<br />

P86 | Sustainable Tourism Initiatives<br />

on the Rise in the Middle East<br />

P88 | Balancing Profit and Protection:<br />

Investing in Wildlife Sanctuaries<br />

GLOBAL<br />

P90 | Historic Moment as Burj CEO<br />

Awards <strong>2023</strong> Awardees Light Up<br />

Times Square Billboard<br />

P92 | Global News<br />

INVESTING IN ART<br />

P62 | <strong>The</strong> Evolution of ESG<br />

investments in the United Arab<br />

Emirates<br />

P64 | Funding & Investment News<br />

DIGITAL ASSETS<br />

P66 | ALeveraging Digital Assets<br />

and Blockchain for ESG Objectives<br />

P72 | <strong>The</strong> UAE Takes the Lead in<br />

Middle East IPOs, Driving Market<br />

Expansion<br />

CORPORATE<br />

P74 | UAE Tax Insights: What You<br />

Need to Know About Corporate<br />

Taxation<br />

P76 | Corporate Results<br />

SPORT AS A BUSINESS<br />

P80 | Future-Proofing Sports Business:<br />

<strong>The</strong> Rise of Sustainability<br />

P82 | Sports News<br />

P94 | <strong>The</strong> Growing Appeal: High-<br />

Net-Worth Investors Flocking to Art<br />

P96 | Local News<br />

TRAVEL<br />

P98 | Top 4 Places to Visit this<br />

<strong>November</strong><br />

P100 | Travel News<br />

P21 | P27 | Launch Express<br />

P40 | P48 | Wheels<br />

P26 | P103 | Tech My Money<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 7

Personal <strong>Finance</strong><br />

Anticipatory Insurance in the Age of<br />

Climate Change: Building Financial<br />

Resilience<br />

In an era marked by unpredictable weather patterns, rising sea levels, and<br />

extreme climate events, the need for innovative solutions to address the<br />

challenges of a changing world has never been greater. Anticipatory insurance,<br />

a cutting-edge approach, has emerged as a promising solution to mitigate the<br />

impacts of climate change. By combining the power of insurance with personal<br />

finance, anticipatory insurance is pioneering climate aid for individuals in<br />

our changing world. This article explores how incorporating anticipatory<br />

insurance into personal finance can help build financial resilience and prepare<br />

for an uncertain future.<br />

8 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

Anticipatory insurance represents<br />

a paradigm shift from traditional,<br />

primarily reactive insurance<br />

models. Instead, it embraces a proactive<br />

approach that leverages advanced data<br />

analytics, artificial intelligence, and climate<br />

modelling to predict, prepare for,<br />

and mitigate the financial consequences<br />

of climate-related events.<br />

Forecast-Based Financing (FbF),<br />

Forecast-Based Action (FbA), Early<br />

Warning Early Action (EWEA), and<br />

other proactive response strategies are<br />

gaining momentum among donors, humanitarian<br />

organisations, and disaster<br />

risk managers. <strong>The</strong>y serve as effective<br />

mechanisms to offer vital assistance to<br />

vulnerable communities before the onset<br />

of disasters. <strong>The</strong> primary goal of these<br />

anticipatory measures, which consider<br />

humanitarian and financial factors, is to<br />

minimise the consequences of disasters<br />

and bolster recovery efforts by utilising<br />

forecasts or warnings of impending<br />

shocks or stressors.<br />

Incorporating anticipatory insurance<br />

into personal finance has emerged as a<br />

powerful strategy for fortifying financial<br />

resilience. Following are some ways to<br />

interconnect anticipatory insurance with<br />

personal finances:<br />

Tailored Coverage:<br />

Individuals can purchase anticipatory<br />

insurance policies customised to their<br />

specific needs and locations. This allows<br />

them to protect their personal finances<br />

against climate-related risks such as<br />

flooding, wildfires, and hurricanes. Insurance<br />

providers can use advanced data<br />

analytics to offer personalised coverage<br />

based on the policyholder’s geographical<br />

location and the associated climate risks.<br />

Risk Assessment and Planning: Insurance<br />

providers can offer policyholders<br />

tools and resources for assessing their<br />

vulnerability to climate risks and help<br />

them create financial plans to mitigate<br />

them. By understanding the potential<br />

impact of climate events on their finances,<br />

individuals can make informed decisions<br />

about coverage and investment in disaster<br />

preparedness measures.<br />

Discounts for Risk Mitigation:<br />

Insurance companies can incentivise<br />

policyholders to invest in risk reduction<br />

measures by offering discounts<br />

on premiums. For instance, individuals<br />

who implement climate-resilient home<br />

improvements or follow environmentally<br />

responsible practices can receive reduced<br />

insurance rates, thus encouraging<br />

responsible personal finance decisions.<br />

Early Payouts and Emergency Funds:<br />

Anticipatory insurance can be designed<br />

to provide early payouts or activate emergency<br />

funds in the event of impending<br />

climate disasters. This ensures individuals<br />

have immediate financial resources to<br />

cover evacuation, temporary lodging,<br />

or emergency repairs, allowing them to<br />

secure their personal finances during<br />

a crisis.<br />

Preemptive Budgeting:<br />

Just as these anticipatory actions<br />

proactively allocate resources before a<br />

disaster occurs, individuals can adopt a<br />

preemptive budgeting approach. <strong>The</strong>y can<br />

allocate funds in advance for potential<br />

emergencies, including those related to<br />

climate change, such as flood-proofing<br />

a home, creating an emergency fund, or<br />

investing in resilient infrastructure. This<br />

financial preparation ensures individuals<br />

have the necessary resources to mitigate<br />

damage and recover swiftly in the event<br />

of a disaster.<br />

Investment in Climate-Resilient<br />

Assets:<br />

Individuals can consider climate-resilient<br />

investments as part of their personal<br />

finance strategy. <strong>The</strong>se could include green<br />

infrastructure, sustainable housing, or<br />

investments in companies and industries<br />

focusing on climate adaptation. Anticipatory<br />

insurance can complement these<br />

investments by providing a safety net<br />

against climate-related financial losses.<br />

Integration with Financial Planning<br />

Services:<br />

Financial advisors can incorporate<br />

anticipatory insurance into their services,<br />

helping individuals assess their climate<br />

risk exposure and create comprehensive<br />

financial plans that consider climate adaptation<br />

strategies, including insurance.<br />

Collaboration with Financial Institutions:<br />

Individuals can work closely with<br />

banks, credit unions, and financial advisors<br />

to develop anticipatory financial<br />

strategies. Financial institutions can guide<br />

on creating climate-resilient financial<br />

plans and offer products that align with<br />

anticipatory actions, such as insurance<br />

<strong>The</strong> synergy<br />

of anticipatory<br />

insurance<br />

and personal<br />

finance<br />

empowers<br />

individuals<br />

to address<br />

climate<br />

change<br />

challenges<br />

while securing<br />

their financial<br />

future.<br />

bundles tailored to climate risks.<br />

By adopting these anticipatory concepts<br />

into personal finance, individuals<br />

can proactively protect their financial<br />

stability in the face of climate change.<br />

<strong>The</strong> essence of these strategies lies<br />

in planning, reducing risks, and being<br />

prepared for potential challenges, which<br />

are fundamental principles in both anticipatory<br />

actions and responsible personal<br />

finance management.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 9

UAE Banking<br />

Salary Guide for In-Demand Banking<br />

and <strong>Finance</strong> Careers in the UAE<br />

In the thriving financial landscape of the United Arab Emirates (UAE),<br />

professionals in the banking and finance sector are handsomely rewarded<br />

for their expertise and contributions. <strong>The</strong> salary structures in various<br />

subfields within this industry reflect the demand for skilled individuals and<br />

the importance of their roles in driving the UAE’s economic engine. This<br />

article closely examines the well-compensated and sought-after banking<br />

and finance careers in the UAE, drawing insights from Michael Page’s UAE<br />

Salary Guide and the Hays Salary Guide.<br />

10 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

<strong>The</strong> banking and finance sector<br />

in the United Arab Emirates<br />

(UAE) is experiencing a significant<br />

increase in the demand<br />

for skilled professionals. This surge<br />

can be attributed to various factors,<br />

notably the progressive visa reforms<br />

and the expanded golden visa program.<br />

<strong>The</strong>se initiatives are drawing in an<br />

increasing number of job seekers and<br />

investors, establishing the Emirates as<br />

an exceptionally appealing destination<br />

with promising career opportunities.<br />

Notably, private equity and advisory<br />

firms are aggressively bolstering their<br />

workforce, spanning junior, middle,<br />

and senior roles. According to Hays,<br />

the region’s increase in initial public<br />

offerings (IPOs) is the driving force<br />

behind recruitment in corporate banks,<br />

particularly within the dynamic capital<br />

market sector.<br />

Amidst the multitude of job openings<br />

within the banking sector, it is<br />

essential to identify the roles that are<br />

currently in high demand in the UAE.<br />

According to the report by Michael<br />

Page, pivotal positions such as Chief<br />

Financial Officer, Compliance Officer,<br />

Fund Accountant, Investor Relations,<br />

<strong>Finance</strong> Investment Manager, Market<br />

Risk Manager, and Operations roles<br />

within middle offices (encompassing<br />

private equities, listed equities, and<br />

hedge funds) stand out as some of the<br />

most coveted positions in the industry.<br />

<strong>The</strong> average salaries of these jobs are<br />

detailed further:<br />

Chief Financial Officer (CFO):<br />

Average Salary: In the UAE, a Chief<br />

Financial Officer (CFO) can expect<br />

an average annual salary ranging from<br />

AED 75,000 to AED 250,000. However,<br />

this figure can vary based on an individual’s<br />

experience and qualifications.<br />

As a crucial figure in an organisation’s<br />

financial landscape, CFOs bear significant<br />

responsibility for the financial<br />

well-being and strategic direction of their<br />

respective companies. <strong>The</strong>ir expertise<br />

and leadership are highly regarded in<br />

the UAE’s dynamic financial sector,<br />

making them instrumental in shaping<br />

the industry’s success and growth.<br />

Compliance Officer:<br />

Average Salary: For Compliance Officers<br />

in the UAE, the average annual<br />

salary typically falls within the range of<br />

AED 50,000 to AED 110,000. However,<br />

High-demand<br />

roles offer<br />

generous<br />

compensation,<br />

making the<br />

sector attractive<br />

for career<br />

prospects.<br />

this figure can vary based on an individual’s<br />

experience and qualifications.<br />

Compliance Officers play a vital role<br />

in ensuring organisations adhere to<br />

regulations and ethical standards. <strong>The</strong>ir<br />

responsibilities involve implementing<br />

and overseeing compliance programs<br />

and policies to maintain the integrity<br />

and legal standing of the organisations.<br />

Fund Accountant:<br />

Average Salary: In the UAE, Fund<br />

Accountants earn an average annual<br />

salary ranging from AED 30,000 to AED<br />

75,000. However, this figure can vary<br />

based on an individual’s experience<br />

and qualifications. Fund Accountants<br />

are integral to the finance sector and<br />

responsible for managing financial records<br />

and transactions within investment<br />

funds. <strong>The</strong>ir expertise ensures accurate<br />

reporting and financial stability.<br />

Investor Relations Specialist:<br />

Average Salary: Investor Relations<br />

Specialists in the UAE typically receive<br />

an average annual salary ranging from<br />

AED 40,000 to AED 100,000, depending<br />

on experience and qualifications. <strong>The</strong>se<br />

professionals are essential for maintaining<br />

and enhancing relationships between<br />

organisations and their investors. <strong>The</strong>y<br />

play a key role in communication,<br />

financial reporting, and ensuring transparency<br />

to foster investor confidence.<br />

<strong>Finance</strong> Investment Managers:<br />

Average Salary: <strong>Finance</strong> Investment<br />

Managers in the UAE earn an average<br />

annual salary spanning from AED 35,000<br />

to AED 90,000, with variations based<br />

on experience and qualifications. <strong>The</strong>se<br />

experts are responsible for managing<br />

investment portfolios, making strategic<br />

financial decisions, and maximising<br />

returns for clients. <strong>The</strong>ir role is pivotal<br />

in the financial industry, where sound<br />

investment strategies are essential.<br />

Market Risk Manager:<br />

Average Salary: Market Risk Managers<br />

in the UAE receive an average annual<br />

salary ranging from AED 45,000 to AED<br />

105,000, contingent on their experience<br />

and qualifications. <strong>The</strong>se professionals<br />

are instrumental in identifying, assessing,<br />

and mitigating risks associated<br />

with financial market activities. <strong>The</strong>ir<br />

expertise helps organisations navigate<br />

the complex world of market fluctuations<br />

and make informed decisions.<br />

Operations roles in Middle Offices<br />

(Private Equities, Listed Equities,<br />

and Hedge Funds):<br />

Average Salary: Individuals in Operations<br />

roles within Middle Offices<br />

in the UAE typically earn an average<br />

annual salary of AED 25,000 to AED<br />

70,000, depending on their experience<br />

and qualifications. <strong>The</strong>se roles involve<br />

managing and supporting the operational<br />

aspects of financial activities, ensuring<br />

efficiency and accuracy within the<br />

financial operations of organisations.<br />

In the dynamic landscape of the UAE’s<br />

banking and finance sector, success is<br />

intricately tied to possessing the right<br />

skill set. According to Michael Page’s<br />

salary guide, proficiency in financial<br />

modelling, senior strategic finance,<br />

compliance, and investor relations<br />

emerges as fundamental skills crucial<br />

for establishing and advancing one’s<br />

career. To maximise earnings and unlock<br />

the full potential of opportunities in<br />

the banking and finance sector, these<br />

skills are not just desirable; they are<br />

indispensable.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 11

UAE Banking News<br />

Global Islamic<br />

Banking Assets Surge<br />

to $4T and Poised for<br />

Growth<br />

Global Islamic banking assets<br />

have surged to a substantial<br />

$4T, as reported by the<br />

Al Huda Centre of Islamic<br />

Banking and Economics. This growth<br />

comes at a time when ethical and<br />

sustainable finance is taking center<br />

stage in the global financial landscape,<br />

and the Islamic banking and finance<br />

sector is increasingly recognized for its<br />

responsible financial practices. Major<br />

financial markets are acknowledging<br />

the potential of Islamic finance in<br />

addressing the challenges of eradicating<br />

extreme poverty and fostering<br />

shared prosperity. <strong>The</strong> industry’s<br />

assets reached the $4T mark in <strong>2023</strong>,<br />

and it is expected to maintain a compound<br />

annual growth rate (CAGR) of<br />

10 percent in the forecast period.<br />

Emirates NBD Unveils Digital Wealth Platform for<br />

Securities and ETF Trading<br />

Emirates NBD, Dubai’s largest<br />

bank, has introduced a<br />

digital wealth platform enabling<br />

customers to engage<br />

in securities and exchange-traded<br />

fund (ETF) trading across both local<br />

and global exchanges. <strong>The</strong> platform<br />

offers access to a diverse portfolio<br />

of over 11,000 global equities and 150<br />

regional equities, facilitating trading<br />

on domestic exchanges like the Dubai<br />

Financial Market, Abu Dhabi Securities<br />

Exchange, and Nasdaq Dubai, as well<br />

as international markets, including<br />

the New York Stock Exchange, Nasdaq,<br />

and London Stock Exchange.<br />

Integrated into the ENBD X mobile<br />

application, this initiative aligns with<br />

Emirates NBD’s mobile-first strategy,<br />

leveraging advanced cloud technologies<br />

to ensure user safety and security.<br />

Saudi Fund for Development Inks MoU with Asian<br />

Development Bank<br />

<strong>The</strong> Saudi Fund for Development<br />

(SFD) Chief Executive<br />

Officer, H.E. Sultan Al-Marshad,<br />

signed an essential<br />

Memorandum of Understanding (MoU)<br />

with the President of the Asian Development<br />

Bank (ADB), H.E. Masatsugu<br />

Asakawa. This MoU, signed on the<br />

sidelines of the <strong>2023</strong> <strong>World</strong> Bank<br />

Group - IMF Annual Meetings in Marrakech,<br />

Morocco, marks a significant<br />

stride in their strategic partnership.<br />

Its objective is to promote collaborative<br />

initiatives that advance social<br />

and economic development in ADB<br />

member countries in Asia and the<br />

Pacific. <strong>The</strong> agreement underscores<br />

their joint commitment to supporting<br />

sustainable development aligned with<br />

the UN Sustainable Development<br />

Goals and enhancing the global development<br />

system. <strong>The</strong> MoU focuses<br />

on development activities in Asia<br />

and the Pacific, strengthening capacities<br />

to meet international needs,<br />

and facilitating knowledge-sharing to<br />

maximize institutional efficiency and<br />

development impact.<br />

UAE Engages in <strong>World</strong> Bank and IMF Meetings in Marrakech<br />

<strong>The</strong> United Arab Emirates,<br />

represented by the Ministry<br />

of <strong>Finance</strong>, has announced<br />

its active participation in the<br />

Annual Meetings of the International<br />

Monetary Fund (IMF) and the <strong>World</strong><br />

Bank Group (WBG) scheduled to take<br />

place in Marrakech, Kingdom of Morocco,<br />

from October 9 to 15, <strong>2023</strong>. His<br />

Excellency Mohamed bin Hadi Al Hussaini,<br />

Minister of State for Financial<br />

Affairs, will lead the UAE delegation,<br />

which comprises prominent officials<br />

such as His Excellency Younis Haji Al<br />

Khoori, Undersecretary of the Ministry<br />

of <strong>Finance</strong>, and His Excellency<br />

Ebrahim Al Zaabi, Assistant Governor<br />

for Monetary Policy and Financial<br />

Stability at the Central Bank of the<br />

UAE, along with several experts from<br />

the Ministry of <strong>Finance</strong> and the Central<br />

Bank of the UAE. <strong>The</strong> UAE delegation’s<br />

agenda includes participation in<br />

key meetings and committees such as<br />

the <strong>World</strong> Bank Group Development<br />

Committee, the G20 <strong>Finance</strong> Ministers<br />

and Central Bank Governors meeting,<br />

the Annual General Meetings, and<br />

interactions with regional and international<br />

financial institutions.<br />

12 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

UAE Banks Outshine GCC Peers with Profit Boost Amid Economic Growth<br />

UAE banks have demonstrated<br />

superior profitability compared<br />

to their GCC counterparts,<br />

especially in Saudi Arabia and<br />

Qatar, with this trend expected to continue<br />

due to a robust operating environment, as<br />

stated by Fitch Ratings. Factors such as<br />

elevated oil prices, controlled inflation,<br />

and increasing interest rates have all<br />

contributed to the positive performance<br />

of these financial institutions, according<br />

to the New York-based ratings agency’s<br />

recent report. Fitch noted that UAE<br />

banks’ profitability has seen significant<br />

improvement, and they anticipate this<br />

trend to persist. Along with other robust<br />

financial metrics, this could potentially<br />

lead to positive rating actions on the<br />

viability ratings of certain UAE banks.<br />

Furthermore, Fitch analysts highlighted<br />

that banks in the primary GCC markets,<br />

including Saudi Arabia, the UAE, and<br />

Qatar, are well-positioned to benefit from<br />

rising interest rates.<br />

Al Salam Bank Initiates<br />

AI Bootcamp in Bahrain<br />

Al Salam Bank has initiated<br />

a two-day AI Bootcamp in<br />

Bahrain, providing students<br />

with a platform to showcase<br />

their AI-driven creativity and innovation<br />

in designing business branding<br />

campaigns. <strong>The</strong> participants will present<br />

their campaigns to a judging panel<br />

comprised of Al Salam Bank members,<br />

including Mahmood Qannati, Head of<br />

Marketing and Communications and<br />

ESG Officer, Muna Al Balooshi, Head of<br />

Human Resources and Administration,<br />

Mohammed Al Shehabi, Head of<br />

Innovation, and Ahmed bin Jamal,<br />

AVP of Marketing and Communications.<br />

Ten winners will receive BD100 cash<br />

prizes, and the top five participants<br />

will have the opportunity to join the<br />

bank’s marketing and communications<br />

department. <strong>The</strong> AI Bootcamp requires<br />

participants to have a background in<br />

AI applications, demonstrate creativity<br />

and innovation, possess a passion for<br />

branding and marketing, and be capable<br />

of working both independently and as<br />

part of a team.<br />

Successful Bond Issue by Commercial Bank of<br />

Kuwait<br />

<strong>The</strong> Commercial Bank of Kuwait<br />

(AlTijari) and Kuwait Financial<br />

Centre “Markaz” have<br />

successfully issued bonds<br />

with a nominal value of KWD 50M<br />

($161.748M) for a ten-year tenure,<br />

callable after five years. This first<br />

tranche is part of the subordinated<br />

Tier 2 capital bonds programme, which<br />

was initially issued for a maximum of<br />

KWD 100M and represents the first<br />

bond issuance of its kind denominated<br />

Dubai’s Department of Economy<br />

and Tourism (DET)<br />

and the Financial Services<br />

and the Treasury Bureau of<br />

the Government of Hong Kong, China,<br />

have inked a Memorandum of Understanding<br />

(MoU) intending to enhance<br />

financial cooperation between the two<br />

regions. <strong>The</strong> agreement was formalized<br />

during the Belt and Road Summit in<br />

Hong Kong, with Hadi Badri, CEO of<br />

the Dubai Economic Development Corporation,<br />

Dubai Department of Economy<br />

and Tourism, and Joseph Chan,<br />

Under Secretary for Financial Services<br />

and the Treasury of the Government of<br />

the Hong Kong Special Administrative<br />

Region, as the signatories. This MoU<br />

underscores the commitment of both<br />

in Kuwaiti dinar. <strong>The</strong> private placement<br />

to qualified investors was fully<br />

subscribed, reflecting investor confidence<br />

in the quality of the issuance,<br />

bolstering the bank’s position, and<br />

highlighting the competence of the<br />

lead manager. <strong>The</strong> bonds offer attractive<br />

returns, with a floating interest<br />

rate of 3.0% above the Central Bank of<br />

Kuwait’s discount rate and a minimum<br />

annual interest rate of 5.0%, payable<br />

semi-annually.<br />

Dubai and Hong Kong Collaborate for Economic<br />

Corridor via Financial Services<br />

governments to promoting collaboration<br />

and knowledge exchange within<br />

their financial markets. It also signals<br />

their determination to deepen their<br />

bilateral relationship, fostering mutual<br />

growth and development in the financial<br />

services sectors of both cities.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 13

UAE Reforms<br />

UAE Reforms Arbitration Law<br />

<strong>The</strong> UAE has recently enacted<br />

Federal Law No. 15 of <strong>2023</strong>, which<br />

has brought about revisions to<br />

Articles 10, 23, 28, and 33 of Federal<br />

Law No. 6 of 2018, collectively referred<br />

to as the “Amendments.” <strong>The</strong>se changes<br />

have been introduced with the primary<br />

goal of enhancing the efficiency and<br />

adaptability of arbitration proceedings<br />

within the UAE.<br />

<strong>The</strong> changes in UAE arbitration law<br />

took effect on September 16, <strong>2023</strong>, and<br />

are discussed further below.<br />

Arbitrators’ Qualifications (Article 10)<br />

Article 10 of the Amendments has<br />

undergone modifications to reinforce<br />

arbitrators’ independence and integrity.<br />

Arbitrators are now explicitly required<br />

to have no prior affiliations with any<br />

involved parties that could compromise<br />

their impartiality or independence. Significantly,<br />

Article 10 no longer includes<br />

the previous prohibition that barred<br />

parties from appointing individuals who<br />

are members of the Board of Trustees,<br />

Executive Management, or Administrative<br />

Bodies of the arbitral institution overseeing<br />

the arbitration process. However, it also<br />

places the onus on arbitral institutions<br />

to establish specific governance policies<br />

and mechanisms that ensure the ongoing<br />

impartiality and independence of the<br />

selected arbitrators.<br />

Applicable Proceedings (Article 23)<br />

Article 23 of the Amendments reiterates<br />

the significance of party autonomy<br />

in arbitral proceedings. <strong>The</strong> revised text<br />

explicitly excludes the prior reference to<br />

Article 10.2, which previously restricted<br />

arbitrators associated with arbitral institutions<br />

overseeing the arbitration from<br />

being nominated. Instead, it emphasises<br />

that arbitrators must adhere to the<br />

procedural framework mutually agreed<br />

upon by the parties while respecting the<br />

arbitration rules of the relevant arbitral<br />

institution. In instances where the parties<br />

fail to reach a consensus on the arbitration<br />

procedure, the arbitral tribunal is<br />

empowered to determine an appropriate<br />

procedure. This determination must align<br />

with the litigation standards and international<br />

agreements to which the UAE<br />

is a signatory, ensuring that arbitration<br />

proceedings remain just, efficient, and<br />

consistent with international norms.<br />

Remote Hearings and Use of Technology<br />

(Article 28)<br />

Article 28 of the Amendments now<br />

mandates that arbitral institutions must<br />

provide the essential technological infrastructure<br />

to facilitate remote hearings.<br />

This amendment necessitates that both<br />

the involved parties and arbitral institutions<br />

exercise diligence in selecting the<br />

appropriate technology and configuring<br />

the technical setup to uphold the integrity<br />

and security of the proceedings.<br />

Hearings and Evidence (Article 33)<br />

Article 33 of the Amendments bestows<br />

arbitrators with the authority to determine<br />

proceedings on a “document-only” basis.<br />

This provision empowers arbitrators to<br />

decide whether oral evidentiary hearings<br />

are necessary or whether the proceedings<br />

can rely solely on written documentation.<br />

This change offers arbitration tribunals<br />

greater flexibility in managing proceedings,<br />

which, in turn, enhances efficiency and<br />

is likely to contribute to cost savings in<br />

the arbitration process.<br />

<strong>The</strong>se amendments signify a significant<br />

step toward the UAE’s ambitions<br />

of establishing itself as a global centre<br />

for international arbitration.<br />

14 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

UAE’s New Consumer Protection<br />

Framework<br />

<strong>The</strong> United Arab Emirates (UAE) has<br />

undergone a significant transformation<br />

in its consumer protection<br />

framework, aiming to enhance consumer<br />

rights and promote responsible business<br />

practices. <strong>The</strong> culmination of these efforts<br />

is the implementation of Federal<br />

Law No. 15 of 2020 (CP Law) and its<br />

corresponding executive regulations<br />

(the Regulations), officially approved<br />

in July <strong>2023</strong> and set to take effect on<br />

October 14, <strong>2023</strong>. This comprehensive<br />

legislation replaces the outdated consumer<br />

protection law dating back to<br />

2006, signalling the UAE’s commitment<br />

to modernising its legal framework to<br />

meet the evolving needs of consumers in<br />

a dynamic marketplace. <strong>The</strong> Law operates<br />

under a broad definition of “Supplier,”<br />

covering manufacturers, distributors,<br />

service providers, and e-commerce entities<br />

registered in the UAE. Notably, it<br />

addresses various aspects of consumer<br />

protection, including minimum content<br />

requirements for transaction documents,<br />

regulations against unfair practices and<br />

misleading information dissemination,<br />

and detailed rules governing warranties<br />

and remedies.<br />

Several key provisions within this legislation<br />

stand out, such as the inclusive<br />

definition of a consumer that extends to<br />

juristic persons, the mandate for most<br />

consumer information to be presented in<br />

Arabic, and specific regulations related<br />

to e-commerce. Notably, the law places<br />

responsibility on e-commerce marketplaces<br />

for defective products offered by third<br />

parties on their platforms, which could<br />

significantly impact online businesses.<br />

Additionally, it requires suppliers to<br />

provide warranties for services based<br />

on the nature of the service or agreements<br />

with consumers, and it outlines<br />

a framework for product recalls and<br />

maintenance of spare parts. Suppliers<br />

must maintain stocks of spare parts in<br />

line with consumer demand and provide<br />

written policies in Arabic and other chosen<br />

languages. Advertisements that may<br />

mislead consumers are prohibited, and<br />

suppliers cannot impose unreasonable<br />

contract terms or engage in monopolistic<br />

practices.<br />

<strong>The</strong> legislation is further reinforced<br />

by a range of administrative sanctions<br />

and financial penalties for suppliers that<br />

violate its provisions, with a graduated<br />

approach that includes issuing notices,<br />

imposing fines, temporary closures,<br />

suspension of activities, and licence<br />

revocation. It also includes criminal<br />

sanctions for breaches of various articles,<br />

although the conditions under which<br />

these criminal sanctions would apply<br />

remain to be clarified.<br />

In sum, the UAE’s new consumer<br />

protection laws and Regulations offer<br />

a robust framework to ensure product<br />

quality, transparent business practices,<br />

and adherence to language requirements.<br />

Businesses operating in the UAE must<br />

prepare to align with these regulations,<br />

consider adjustments to their processes,<br />

and uphold consumer trust as the country<br />

enters a new era of consumer protection<br />

and legal compliance.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 15

Fintech<br />

Fintech for ESG: Revolutionising<br />

Responsible Investing<br />

<strong>The</strong> United Arab Emirates (UAE) is experiencing a growing interest in<br />

responsible investing, driven by the global emphasis on ESG (Environmental,<br />

Social, and Governance) criteria. Fintech companies have emerged as key<br />

players in this movement, using cutting-edge technology to revolutionise the way<br />

investments are made with a focus on sustainability. This article will spotlight<br />

three international Fintech companies operating in the UAE, each contributing<br />

to the nation’s evolving ESG landscape. As the UAE continues to make strides in<br />

this arena, the influence of these Fintech pioneers highlights the transformative<br />

potential of responsible investing, setting a global example for financial markets.<br />

EMEX<br />

Emex is a Dublin-based fintech<br />

firm dedicated to delivering<br />

sustainability reporting and<br />

data solutions across various sectors,<br />

including Mining, Transportation and<br />

Logistics, Governments, Materials,<br />

Retail, and Energy. It operates internationally<br />

in the US, UK, Ireland, UAE<br />

(Dubai) and Ukraine.<br />

At the core of Emex’s mission is the<br />

commitment to empower businesses<br />

to achieve their sustainability goals<br />

while ensuring the well-being of the<br />

environment and their stakeholders.<br />

<strong>The</strong>y achieve this through an innovative<br />

data-driven approach that offers<br />

accurate, timely insights, ultimately<br />

advancing ESG initiatives.<br />

Emex’s comprehensive suite of<br />

solutions covers a wide range of critical<br />

areas within the ESG ecosystem.<br />

This encompasses health and safety,<br />

ESG impact reporting, carbon management,<br />

risk assessments, and third-party<br />

screening and due diligence. By<br />

providing an all-encompassing platform,<br />

Emex simplifies the intricate<br />

landscape of sustainable finance for<br />

businesses, not only within the UAE<br />

but also globally.<br />

Emex’s decade-long journey signifies<br />

its global prominence, serving<br />

more than 100,000 users across 80+<br />

countries and offering support in<br />

16 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong><br />

over 30 languages. This extensive<br />

global presence underlines Emex’s<br />

commitment to promoting responsible<br />

investing on a worldwide scale. <strong>The</strong>y<br />

achieve this through the adept use<br />

of technology, expert insights, and a<br />

versatile platform designed to leverage<br />

high-quality data.<br />

Emex understands that sustainability<br />

is not a fixed destination but<br />

an ongoing journey of continuous<br />

improvement. <strong>The</strong>ir platform empowers<br />

businesses to translate their<br />

sustainability aspirations into tangible<br />

actions. By utilising advanced IoT<br />

technology and expert input, Emex<br />

collects and communicates crucial<br />

health, safety, and environmental data<br />

at the source. This comprehensive<br />

approach empowers UAE-based businesses<br />

to measure, track, and advance<br />

toward their sustainability goals while<br />

realising measurable returns on their<br />

investments in sustainability.<br />

Emex’s pivotal role in the UAE’s<br />

sustainable finance and ESG transformation<br />

underscores its commitment<br />

to transparency and innovation. In a<br />

world where the demand for sustainability,<br />

from achieving net-zero emissions<br />

to enhancing employee safety,<br />

continues to grow, Emex serves as a<br />

trusted partner for businesses seeking<br />

to navigate the intricate terrain of<br />

Simon Kelly,<br />

Co-Founder<br />

responsible investing.<br />

Emex’s presence in the UAE is a<br />

reflection of the nation’s dedication<br />

to sustainability and aligns seamlessly<br />

with the global movement to<br />

integrate ESG criteria into financial<br />

decision-making. Bridging the divide<br />

between sustainability intentions and<br />

meaningful actions, Emex exemplifies<br />

the transformative power of fintech in<br />

propelling responsible investing within<br />

the UAE and across borders.

Quantexa<br />

Quantexa is an England-based<br />

fintech firm, revolutionising the<br />

way organisations make informed<br />

operational decisions by imbuing data<br />

with meaning. Leveraging the latest<br />

advancements in big data and artificial<br />

intelligence (AI), Quantexa’s platform<br />

uncovers hidden risks and untapped<br />

opportunities, offering a contextual,<br />

connected view of internal and external<br />

data in a single, accessible platform. It<br />

operates globally with offices located<br />

in the UK, Canada, the US, Australia,<br />

Singapore, Brussels, and UAE.<br />

Quantexa’s impact extends across<br />

a multitude of domains, from data<br />

management and Know Your Customer<br />

(KYC) processes to customer intelligence,<br />

financial crime detection, risk management,<br />

and fraud prevention. <strong>The</strong>ir innovative<br />

solutions play a pivotal role in enhancing<br />

security throughout the customer lifecycle.<br />

With these capabilities, Quantexa not<br />

only addresses the complexities of<br />

modern finance but also empowers<br />

organisations to operate more efficiently<br />

and securely, both within the UAE and<br />

on a global scale.<br />

In an era marked by an amplified<br />

focus on Environmental, Social, and<br />

Governance (ESG) considerations, the<br />

business community has recognised<br />

the profound influence these factors<br />

can exert on a company’s performance.<br />

ESG presents both tangible risks and<br />

significant opportunities, and Quantexa<br />

has embraced the importance of this aspect<br />

within its operational framework. <strong>The</strong><br />

company has seamlessly integrated ESG<br />

analysis into its investment processes,<br />

recognising that sustainability and ESG<br />

risk factors contribute significantly to<br />

the evaluation of risks in the global<br />

economy, financial markets, and various<br />

industries.<br />

Quantexa’s versatile services cater<br />

to a diverse array of sectors, including<br />

banking, insurance, telecommunications,<br />

and government. By providing tailormade<br />

solutions, they assist these<br />

Vishal Marria,<br />

CEO and Founder<br />

sectors in navigating the complex world<br />

of ESG considerations, aligning their<br />

operations with sustainability goals,<br />

and effectively managing risk in an<br />

ever-changing financial landscape.<br />

TietoEVRY<br />

TietoEVRY is a West Mallingbased<br />

fintech company that<br />

provides a diverse range of<br />

products and services spanning the insurance<br />

and wealth sectors. Central to<br />

their portfolio is the ESG and Climate<br />

Risk Assessment tool, a groundbreaking<br />

solution for financial institutions<br />

and companies seeking to evaluate<br />

their ESG and climate-related risks.<br />

It operates in Europe, India, South<br />

Africa, the US, Canada, Singapore,<br />

Japan, Australia, New Zealand, UAE,<br />

and Japan.<br />

TietoEVRY’s comprehensive suite<br />

of products and services, spanning<br />

back-office, advisory, and digital channels,<br />

caters to the insurance and<br />

wealth sectors. <strong>The</strong>ir Enterprise IT<br />

modernisation, next-gen application<br />

services, and advisory and innovation<br />

services provide an array of innovative<br />

solutions, all designed to elevate<br />

financial operations and align them<br />

with ESG principles.<br />

TietoEVRY’s ESG and Climate Risk<br />

Assessment tool is designed as a<br />

standalone module that addresses<br />

the evolving landscape of credit risk<br />

assessment. ESG and climate considerations<br />

have become integral in<br />

gauging credit risk, and traditional<br />

spreadsheet-based assessments have<br />

become less efficient. TietoEVRY<br />

recognised the need for a more systematic<br />

approach and a solution that<br />

seamlessly integrates with existing<br />

credit-granting systems.<br />

This innovative tool empowers both<br />

financial institutions and non-financial<br />

companies in the UAE to assess their<br />

customers’ ESG and climate risk exposure<br />

with precision. By employing<br />

a rating system that spans from high<br />

to low risk, the tool utilises a comprehensive<br />

set of questions. <strong>The</strong>se<br />

questions cover everything from industry-specific<br />

inherent risks to individual<br />

sustainability strategies. With all customer<br />

data securely stored in a single<br />

system, it becomes significantly easier<br />

to analyse risk portfolios and ensure<br />

compliance with regulatory audits.<br />

TietoEVRY’s ESG and Climate Risk<br />

Assessment tool is a strategic enhancement<br />

for businesses looking to<br />

Kimmo Alkio,<br />

CEO<br />

incorporate ESG considerations into<br />

their financial practices. By offering a<br />

systematic and data-driven approach<br />

to evaluating ESG and climate risk,<br />

it positions UAE-based organisations<br />

on the path to more responsible and<br />

sustainable financial decisions.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 17

Fintech News<br />

Al Etihad Payments Unveils Instant Payments Platform in UAE<br />

<strong>The</strong> launch of “Aani,” an instant<br />

payments platform, represents<br />

a groundbreaking shift in the<br />

digital payment landscape<br />

within the UAE. This initiative, part of<br />

the CBUAE’s Financial Infrastructure<br />

Transformation (FIT) program, paves<br />

the way for seamless, secure, and<br />

immediate digital payments. Aligned<br />

with the UAE’s vision of becoming a<br />

global digital payment hub, Aani empowers<br />

licensed financial institutions<br />

(LFIs) and payment service providers<br />

to provide customers with an exceptional<br />

payment experience. Aani offers<br />

consumers, businesses, corporations,<br />

and government entities a unique<br />

digital payment experience, enabling<br />

24/7 secure and instant transactions.<br />

Aani boasts a range of user-friendly<br />

features, allowing users to transfer<br />

funds instantly with just the recipient’s<br />

phone number, and simplifying tasks<br />

like requesting money and splitting<br />

bills. Additionally, Aani supports QR<br />

codes, facilitating convenient, cashless<br />

payments at various merchants.<br />

Emirates NBD and DIFC Introduce Dubai’s Fintech Talent<br />

Accelerator<br />

Emirates NBD and the Dubai<br />

International Financial Centre<br />

(DIFC) have launched<br />

the “National Digital Talent<br />

Incubator” in line with their strategic<br />

partnership. Hosted by DIFC<br />

Launchpad, this custom incubator<br />

program is designed to stimulate the<br />

growth of fintech startups and foster<br />

entrepreneurship within the fintech<br />

and digital innovation sector in the<br />

UAE. Renowned industry leaders like<br />

Visa, Microsoft, and Dell Technologies<br />

will provide support to the program.<br />

Operating with two cohorts per year,<br />

each comprising three to six fintech<br />

startups led by Emirati founders, participants<br />

will benefit from an eight-week<br />

program featuring insights, hands-on<br />

experience, mentorship, and access to<br />

a network of innovators, established<br />

corporations, government entities, and<br />

capital sources in the UAE.<br />

Qatar Central Bank Issues Loan-Based Crowdfunding<br />

Regulation<br />

Qatar Central Bank is dedicated<br />

to enhancing and regulating<br />

the nation’s financial sector.<br />

In pursuit of this, it has issued<br />

instructions for the Loan-Based<br />

Crowdfunding Regulation, focusing<br />

on licensing and regulation. All entities<br />

wishing to engage in this sector<br />

must apply for a licence from QCB.<br />

Loan-based crowdfunding platforms<br />

offer innovative ways for borrowers,<br />

including SMEs, to connect with various<br />

investors and secure short-term<br />

financing. This is particularly beneficial<br />

for SMEs facing challenges in obtaining<br />

traditional bank loans, enabling them<br />

to fuel business growth. Such platforms<br />

also present an attractive opportunity<br />

for investors to diversify their investments<br />

and contribute to the growth<br />

and development of SMEs, fostering<br />

economic advancement in Qatar.<br />

Qatar: Leading Fintech<br />

and Sustainability Hub<br />

Qatar is strategically positioning<br />

itself as a prominent fintech hub<br />

in the Middle East, as highlighted<br />

in a report by PwC Middle<br />

East. Recognizing the potential of fintech,<br />

Qatar has initiated efforts to nurture a<br />

robust and sustainable fintech ecosystem.<br />

Aligned with its National Vision 2030, the<br />

country is making significant strides in<br />

digital transformation, with a focus on<br />

building a digital economy. Qatar has<br />

introduced strategic initiatives, such as<br />

the Doha cloud region by Google Cloud<br />

and the implementation of OpenAI’s GPT<br />

technology in the Azure Qatar Cloud, to<br />

empower local businesses, fostering longterm<br />

advantages. However, as banks adopt<br />

emerging technologies, they must also<br />

consider risk mitigation and regulatory<br />

policies for successful implementation.<br />

Qatari banks are embracing environmental,<br />

social, and governance (ESG) practices<br />

and incorporating sustainability measures.<br />

18 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

DIFC Launches AI and<br />

Web3 Corporate<br />

Accelerator in Dubai<br />

<strong>The</strong> Dubai International Financial<br />

Centre (DIFC) has launched its<br />

Transformation Programme, a<br />

highly customizable corporate<br />

accelerator aimed at strengthening<br />

businesses in the region by bolstering<br />

their Artificial Intelligence capabilities.<br />

This program, suitable for businesses<br />

of all sizes, offers C-level coaching on<br />

industry trends to ensure organisations<br />

remain at the forefront of technological<br />

innovation. It fosters partnerships with<br />

startups and industry leaders, expediting<br />

proof-of-concept creation and internal<br />

adoption. Leveraging Dubai’s thriving<br />

innovation ecosystem and broader<br />

technological landscape, participants<br />

will gain actionable solutions. <strong>The</strong><br />

initiative also provides access to a<br />

cutting-edge corporate innovation<br />

lab, top-tier hardware and software,<br />

and facilities for concept development<br />

and prototype testing in collaboration<br />

with tech experts.<br />

Emirates NBD Launches New Digital Wealth Offering<br />

Emirates NBD has introduced<br />

a platform offering access<br />

to securities and ETFs from<br />

both global exchanges such as<br />

Nasdaq, NYSE, and the London Stock<br />

Exchange, as well as local markets<br />

including the Dubai Financial Market,<br />

Abu Dhabi Securities Exchange, and<br />

Nasdaq Dubai. In total, the platform<br />

offers more than 11,000 global equities<br />

and 150 regional equities for trading. This<br />

platform is integrated into the bank’s<br />

newly launched mobile app, ENBD<br />

X, enabling customers to seamlessly<br />

invest and trade in complex financial<br />

instruments alongside their everyday<br />

banking transactions. Additionally,<br />

Emirates NBD is running a three-month<br />

digital wealth campaign for ENBD X<br />

users, offering zero commissions and<br />

waived custody fees for October, <strong>November</strong>,<br />

and December <strong>2023</strong> as part of<br />

the bank’s 60th-anniversary celebrations.<br />

All applicable charges will be refunded<br />

within seven working days at the end<br />

of each calendar month.<br />

25 Upcoming Fintech Events in the Middle East for<br />

Q4 <strong>2023</strong> and Q1 2024<br />

<strong>The</strong> Middle East and North<br />

Africa (MENA) region is experiencing<br />

a burgeoning fintech<br />

landscape, driven by favourable<br />

demographics and governments<br />

emphasising technology for enhanced<br />

financial access. With around 3,000<br />

fintech solutions operating in the ME-<br />

NA region, it has become a focal point<br />

for venture capital (VC) investments.<br />

Over the past three years, fintech has<br />

dominated VC funding, accounting for<br />

21% of venture funding in 2021 and<br />

increasing to 29% in 2022, as reported<br />

by Magnitt, a Middle East-focused<br />

startup data platform. With a significant<br />

portion of the population under<br />

30 and high mobile penetration, the<br />

growth potential in the fintech sector<br />

is attracting substantial investments,<br />

leading to the organisation of conferences<br />

and events across the region to<br />

showcase the latest technologies and<br />

innovations. <strong>The</strong>se gatherings provide<br />

a platform for industry stakeholders to<br />

connect and foster innovation in the<br />

thriving MENA fintech industry.<br />

Salt Edge Collaborates with<br />

SeaPay for Open Banking<br />

Solutions in Saudi Arabia<br />

SeaPay, a prominent Omni-Channel<br />

Payment Solutions provider<br />

in Saudi Arabia, has unveiled a<br />

strategic partnership with Salt<br />

Edge, a renowned financial technology<br />

firm. <strong>The</strong>ir collaboration aims to deliver<br />

innovative open banking solutions to local<br />

merchants in Saudi Arabia, aligning<br />

with the Saudi Central Bank’s vision for<br />

a thriving business environment. Open<br />

banking adoption in Saudi Arabia has<br />

gained momentum, with stakeholders like<br />

the Saudi Central Bank (SAMA) actively<br />

developing a comprehensive regulatory<br />

framework to support local businesses.<br />

This proactive approach has already attracted<br />

strong fintech players and fruitful<br />

partnerships. <strong>The</strong> partnership between<br />

Salt Edge and SeaPay exemplifies the<br />

transformative potential of financial<br />

technology. SeaPay, building on its legacy<br />

as the Arab Sea Information System,<br />

is dedicated to providing secure digital<br />

payment solutions for local merchants.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 19

Fintech Application<br />

AL MULLA EXCHANGE APP<br />

Al Mulla Exchange is a Kuwait-based<br />

application and is<br />

an integral part of the Al Mulla<br />

Group. It is recognised for its innovative<br />

approach. Back in 2018, it came<br />

forward as the first exchange company<br />

in Kuwait to launch a mobile remittance<br />

app. This app quickly gained<br />

popularity and became one of the most<br />

downloaded financial services apps in<br />

the Middle East.<br />

As of the latest available data, the<br />

application has garnered approximately<br />

340,000 downloads from app stores catering<br />

to Android, iPhone, and Huawei<br />

users. Notably, Al Mulla Exchange’s<br />

mobile Fintech service has enabled<br />

secure currency exchange transactions<br />

exceeding $1 billion.<br />

<strong>The</strong> app boasts a user-friendly interface,<br />

making it easy to use and navigate.<br />

With access to over 180 countries, it<br />

provides a global reach for sending<br />

money worldwide. Users can easily repeat<br />

previous transactions and transfer<br />

funds to multiple beneficiaries with a<br />

single payment. Transaction history and<br />

receipts can be viewed, downloaded,<br />

and shared directly from the app.<br />

<strong>The</strong> Al Mulla Exchange App offers a<br />

valuable feature: a currency exchange<br />

rate calculator. This tool empowers<br />

users to make informed decisions<br />

when sending money, ensuring that<br />

they get the best exchange rate available.<br />

Whether you’re sending money<br />

for personal or business reasons, this<br />

feature provides real-time exchange<br />

rate information, enabling users to<br />

maximise the value of their currency<br />

exchange transactions.<br />

In addition to its other features,<br />

the App offers a convenient foreign<br />

currency ordering service. This feature<br />

allows users to request specific foreign<br />

currencies and have them delivered<br />

right to their doorstep.<br />

<strong>The</strong> Al Mulla Exchange App also<br />

allows users to update their Civil ID<br />

information directly through the app. It<br />

offers live exchange rates for informed<br />

money transfers and provides an easy<br />

process for adding beneficiaries. Users<br />

can receive instant support through<br />

WhatsApp chat and calls for quick<br />

assistance.<br />

Users can also locate any of Al Mulla<br />

Exchange’s 112+ branches in Kuwait<br />

through the app. Multilingual support<br />

is available, with the app accessible<br />

in eight languages, including Arabic,<br />

English, Hindi, Tagalog, Telugu, Tamil,<br />

Malayalam, and Marathi.<br />

Furthermore, the Al Mulla Exchange<br />

App is available on both Google Play and<br />

the App Store, providing easy access<br />

for users to benefit from its wide range<br />

of features for efficient international<br />

money remittances.<br />

Availability: Google Play Store and<br />

Apple App Store<br />

Website: www.almullaexchange.com<br />

20 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

Realme 11 5G<br />

Realme, the rapidly emerging<br />

technology brand, has officially<br />

marked its entry into the UAE<br />

market with the launch of the Realme 11<br />

5G smartphone. This innovative device<br />

introduces several notable features,<br />

including a flagship-level 108MP camera<br />

equipped with 3x in-sensor zoom, a<br />

lightning-fast 67W SUPERVOOC Charge,<br />

and a capacious internal storage of up<br />

to 256GB, expandable to a massive 2TB<br />

with external memory.<br />

<strong>The</strong> Realme 11 5G boasts a Samsung<br />

ISOCELL HM6 sensor with an impressive<br />

108MP resolution and a spacious<br />

1/1.67-inch sensor size, enabling users<br />

to capture sharp and detailed images.<br />

It also offers a 3x lossless zoom-in<br />

mode, expanding creative possibilities<br />

in mobile photography.<br />

One of the standout features of the<br />

Realme 11 5G is its exceptional 67W<br />

SUPERVOOC Charge, providing rapid<br />

charging speeds and offering a 50%<br />

battery charge in just 17 minutes. <strong>The</strong><br />

smartphone excels in battery life, with<br />

impressive standby and usage times for<br />

various scenarios.<br />

<strong>The</strong> device features a 6.72-inch FHD+<br />

screen with a high refresh rate of up<br />

to 120Hz, offering a smooth viewing<br />

experience. <strong>The</strong> Dynamic Refresh Rate<br />

adjusts automatically based on usage,<br />

optimising performance and efficiency.<br />

Powering the Realme 11 5G is the<br />

MediaTek Dimensity 6100+ 5G processor,<br />

known for its efficiency and<br />

high performance. It supports dynamic<br />

RAM configurations of up to 16GB for<br />

a seamless multitasking experience.<br />

Notably, the Realme 11 5G showcases a<br />

unique camera embellishment known as<br />

the “Glory Halo,” inspired by the luxury<br />

watch industry. This design element<br />

combines meticulous craftsmanship<br />

and premium aesthetics.<br />

<strong>The</strong> smartphone runs on Google<br />

Mobile Services and Android 13.0,<br />

ensuring a feature-rich and up-to-date<br />

user experience.<br />

<strong>November</strong> <strong>2023</strong> www.thefinanceworld.com 21

Business<br />

<strong>The</strong> Future of <strong>Finance</strong>: Climate Business<br />

and Generational Security<br />

<strong>The</strong> future of finance is inextricably linked to the challenges of our time,<br />

with two major forces at the forefront - climate business and generational<br />

security. Climate change, characterised by rising temperatures, extreme<br />

weather events, and environmental degradation, has become a global<br />

concern. Simultaneously, generational security encompasses the financial<br />

well-being of current and future generations.<br />

<strong>The</strong> urgency of climate change<br />

has prompted a paradigm shift<br />

in the financial industry. Climate<br />

business refers to investments, strategies,<br />

and innovations designed to<br />

mitigate and adapt to climate-related<br />

risks. It includes renewable energy<br />

projects, sustainable agriculture, carbon<br />

markets, and green bonds. <strong>The</strong>se<br />

climate-focused investments not only<br />

align with environmental goals but<br />

also offer financial opportunities for<br />

investors.<br />

As a result of this shift in financial<br />

thinking, green finance initiatives are<br />

gaining traction globally. Governments,<br />

corporations, and individuals are<br />

increasingly investing in renewable<br />

energy, electric vehicles, and sustainable<br />

infrastructure. Green bonds, a<br />

financial instrument designed to fund<br />

environmentally friendly projects, have<br />

seen significant growth. This shift<br />

towards green finance is essential<br />

to combat climate change and foster<br />

sustainable economic growth.<br />

Moreover, Environmental, Social,<br />

and Governance (ESG) criteria are<br />

now integrated into investment decisions.<br />

Investors are scrutinising the<br />

ethical and sustainability practices of<br />

companies before allocating capital.<br />

This trend encourages businesses to<br />

22 www.thefinanceworld.com <strong>November</strong> <strong>2023</strong>

e more responsible, transparent, and<br />

accountable, while investors aim for<br />

long-term returns aligned with their<br />

values.<br />

As financial institutions worldwide<br />

respond to the urgency of climate<br />

change and embrace sustainable financial<br />

practices, they are also recognizing<br />

the interplay between climate<br />