RA BRS 2003 GB >pdf

RA BRS 2003 GB >pdf

RA BRS 2003 GB >pdf

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

10<br />

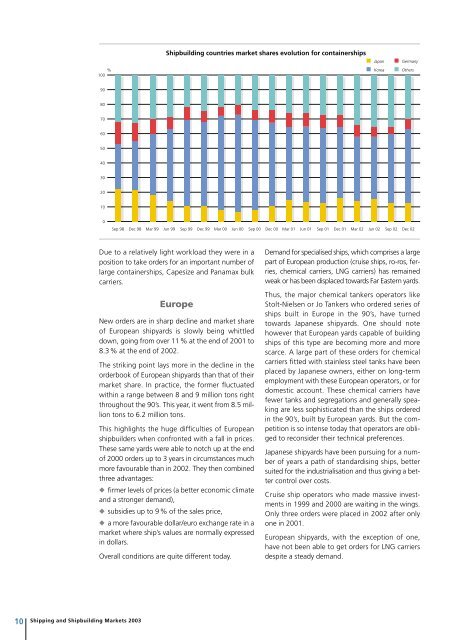

%<br />

100<br />

Shipping and Shipbuilding Markets <strong>2003</strong><br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

Due to a relatively light workload they were in a<br />

position to take orders for an important number of<br />

large containerships, Capesize and Panamax bulk<br />

carriers.<br />

Europe<br />

New orders are in sharp decline and market share<br />

of European shipyards is slowly being whittled<br />

down, going from over 11 % at the end of 2001 to<br />

8.3 % at the end of 2002.<br />

The striking point lays more in the decline in the<br />

orderbook of European shipyards than that of their<br />

market share. In practice, the former fluctuated<br />

within a range between 8 and 9 million tons right<br />

throughout the 90’s. This year, it went from 8.5 million<br />

tons to 6.2 million tons.<br />

This highlights the huge difficulties of European<br />

shipbuilders when confronted with a fall in prices.<br />

These same yards were able to notch up at the end<br />

of 2000 orders up to 3 years in circumstances much<br />

more favourable than in 2002. They then combined<br />

three advantages:<br />

◆ firmer levels of prices (a better economic climate<br />

and a stronger demand),<br />

◆ subsidies up to 9 % of the sales price,<br />

◆ a more favourable dollar/euro exchange rate in a<br />

market where ship’s values are normally expressed<br />

in dollars.<br />

Overall conditions are quite different today.<br />

Shipbuilding countries market shares evolution for containerships<br />

Japan<br />

Korea<br />

Germany<br />

Others<br />

Sep 98 Dec 98 Mar 99 Jun 99 Sep 99 Dec 99 Mar 00 Jun 00 Sep 00 Dec 00 Mar 01 Jun 01 Sep 01<br />

Dec 01 Mar 02 Jun 02 Sep 02 Dec 02<br />

Demand for specialised ships, which comprises a large<br />

part of European production (cruise ships, ro-ros, ferries,<br />

chemical carriers, LNG carriers) has remained<br />

weak or has been displaced towards Far Eastern yards.<br />

Thus, the major chemical tankers operators like<br />

Stolt-Nielsen or Jo Tankers who ordered series of<br />

ships built in Europe in the 90’s, have turned<br />

towards Japanese shipyards. One should note<br />

however that European yards capable of building<br />

ships of this type are becoming more and more<br />

scarce. A large part of these orders for chemical<br />

carriers fitted with stainless steel tanks have been<br />

placed by Japanese owners, either on long-term<br />

employment with these European operators, or for<br />

domestic account. These chemical carriers have<br />

fewer tanks and segregations and generally speaking<br />

are less sophisticated than the ships ordered<br />

in the 90’s, built by European yards. But the competition<br />

is so intense today that operators are obliged<br />

to reconsider their technical preferences.<br />

Japanese shipyards have been pursuing for a number<br />

of years a path of standardising ships, better<br />

suited for the industrialisation and thus giving a better<br />

control over costs.<br />

Cruise ship operators who made massive investments<br />

in 1999 and 2000 are waiting in the wings.<br />

Only three orders were placed in 2002 after only<br />

one in 2001.<br />

European shipyards, with the exception of one,<br />

have not been able to get orders for LNG carriers<br />

despite a steady demand.