RA BRS 2003 GB >pdf

RA BRS 2003 GB >pdf

RA BRS 2003 GB >pdf

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

46<br />

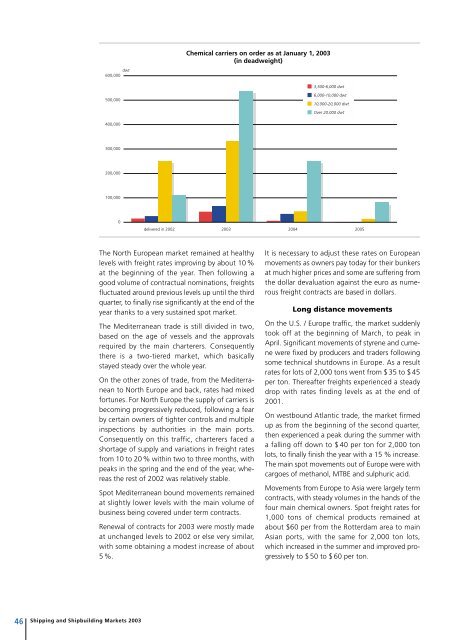

dwt<br />

600,000<br />

500,000<br />

400,000<br />

300,000<br />

200,000<br />

100,000<br />

Shipping and Shipbuilding Markets <strong>2003</strong><br />

0<br />

delivered in 2002<br />

The North European market remained at healthy<br />

levels with freight rates improving by about 10 %<br />

at the beginning of the year. Then following a<br />

good volume of contractual nominations, freights<br />

fluctuated around previous levels up until the third<br />

quarter, to finally rise significantly at the end of the<br />

year thanks to a very sustained spot market.<br />

The Mediterranean trade is still divided in two,<br />

based on the age of vessels and the approvals<br />

required by the main charterers. Consequently<br />

there is a two-tiered market, which basically<br />

stayed steady over the whole year.<br />

On the other zones of trade, from the Mediterranean<br />

to North Europe and back, rates had mixed<br />

fortunes. For North Europe the supply of carriers is<br />

becoming progressively reduced, following a fear<br />

by certain owners of tighter controls and multiple<br />

inspections by authorities in the main ports.<br />

Consequently on this traffic, charterers faced a<br />

shortage of supply and variations in freight rates<br />

from 10 to 20 % within two to three months, with<br />

peaks in the spring and the end of the year, whereas<br />

the rest of 2002 was relatively stable.<br />

Spot Mediterranean bound movements remained<br />

at slightly lower levels with the main volume of<br />

business being covered under term contracts.<br />

Renewal of contracts for <strong>2003</strong> were mostly made<br />

at unchanged levels to 2002 or else very similar,<br />

with some obtaining a modest increase of about<br />

5%.<br />

Chemical carriers on order as at January 1, <strong>2003</strong><br />

(in deadweight)<br />

<strong>2003</strong><br />

2004<br />

3,500-6,000 dwt<br />

6,000-10,000 dwt<br />

10,000-20,000 dwt<br />

Over 20,000 dwt<br />

2005<br />

It is necessary to adjust these rates on European<br />

movements as owners pay today for their bunkers<br />

at much higher prices and some are suffering from<br />

the dollar devaluation against the euro as numerous<br />

freight contracts are based in dollars.<br />

Long distance movements<br />

On the U.S. / Europe traffic, the market suddenly<br />

took off at the beginning of March, to peak in<br />

April. Significant movements of styrene and cumene<br />

were fixed by producers and traders following<br />

some technical shutdowns in Europe. As a result<br />

rates for lots of 2,000 tons went from $ 35 to $ 45<br />

per ton. Thereafter freights experienced a steady<br />

drop with rates finding levels as at the end of<br />

2001.<br />

On westbound Atlantic trade, the market firmed<br />

up as from the beginning of the second quarter,<br />

then experienced a peak during the summer with<br />

a falling off down to $ 40 per ton for 2,000 ton<br />

lots, to finally finish the year with a 15 % increase.<br />

The main spot movements out of Europe were with<br />

cargoes of methanol, MTBE and sulphuric acid.<br />

Movements from Europe to Asia were largely term<br />

contracts, with steady volumes in the hands of the<br />

four main chemical owners. Spot freight rates for<br />

1,000 tons of chemical products remained at<br />

about $60 per from the Rotterdam area to main<br />

Asian ports, with the same for 2,000 ton lots,<br />

which increased in the summer and improved progressively<br />

to $ 50 to $ 60 per ton.