Finance World Magazine| Edition: January 2024

With the beginning of the new year, this month’s edition of Finance World magazine spotlights the global position of the United Arab Emirates's commanding role as an attraction for foreign direct investments. It explores the economic landscape of the UAE, navigating through the strategic initiatives and market dynamics that have propelled the nation into the Limelight. Among the multitude of global investments, the cover story highlights the top individuals who, discerning the immense potential of the UAE market, made lucrative gains through their strategic investments, contributing significantly to the nation's economic prosperity. Furthermore, the magazine thoroughly examines the factors that position the UAE as an attractive destination for FDI in various articles, such as "Benefits of Investing in Free Zones for Foreign Investors in the UAE", "Dubai Healthcare City's Impact on Empowering Business Growth", and “The Synergistic Impact: How Foreign Investments Fuel Local Economies in the UAE”. Moreover, this edition features insightful articles curated for individuals interested in investing or establishing businesses in the UAE. Explore essential information within pieces like "Complete Guide for Investing in Dubai Real Estate from India" and "DNFBPs: Safeguarding Global Finance Against Money Laundering." These articles offer comprehensive insights, aiding readers in navigating investment opportunities and regulatory considerations within the UAE market. Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

With the beginning of the new year, this month’s edition of Finance World magazine spotlights the global position of the United Arab Emirates's commanding role as an attraction for foreign direct investments. It explores the economic landscape of the UAE, navigating through the strategic initiatives and market dynamics that have propelled the nation into the Limelight.

Among the multitude of global investments, the cover story highlights the top individuals who, discerning the immense potential of the UAE market, made lucrative gains through their strategic investments, contributing significantly to the nation's economic prosperity. Furthermore, the magazine thoroughly examines the factors that position the UAE as an attractive destination for FDI in various articles, such as "Benefits of Investing in Free Zones for Foreign Investors in the UAE", "Dubai Healthcare City's Impact on Empowering Business Growth", and “The Synergistic Impact: How Foreign Investments Fuel Local Economies in the UAE”.

Moreover, this edition features insightful articles curated for individuals interested in investing or establishing businesses in the UAE. Explore essential information within pieces like "Complete Guide for Investing in Dubai Real Estate from India" and "DNFBPs: Safeguarding Global Finance Against Money Laundering." These articles offer comprehensive insights, aiding readers in navigating investment opportunities and regulatory considerations within the UAE market.

Keep yourself up to date with all financial sector news with our current news segments. Each person can find something unique from us. We believe our readers deserve real value from what we have to offer.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Cover Story<br />

UAE’s Economic<br />

Metamorphosis:<br />

Spotlighting Foreign Investments<br />

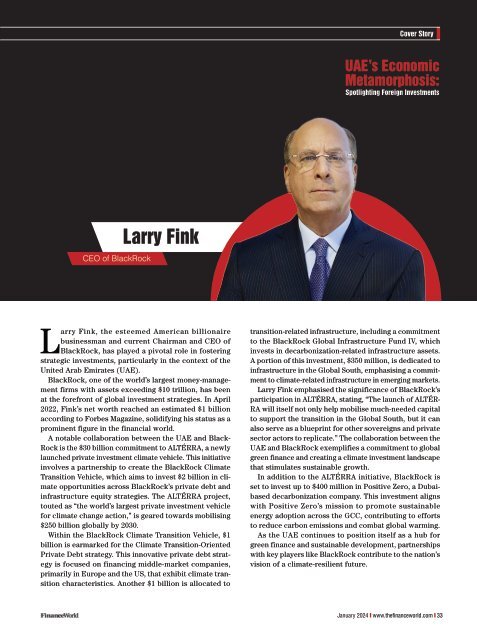

CEO of BlackRock<br />

Larry Fink<br />

Larry Fink, the esteemed American billionaire<br />

businessman and current Chairman and CEO of<br />

BlackRock, has played a pivotal role in fostering<br />

strategic investments, particularly in the context of the<br />

United Arab Emirates (UAE).<br />

BlackRock, one of the world’s largest money-management<br />

firms with assets exceeding $10 trillion, has been<br />

at the forefront of global investment strategies. In April<br />

2022, Fink’s net worth reached an estimated $1 billion<br />

according to Forbes Magazine, solidifying his status as a<br />

prominent figure in the financial world.<br />

A notable collaboration between the UAE and Black-<br />

Rock is the $30 billion commitment to ALTÉRRA, a newly<br />

launched private investment climate vehicle. This initiative<br />

involves a partnership to create the BlackRock Climate<br />

Transition Vehicle, which aims to invest $2 billion in climate<br />

opportunities across BlackRock’s private debt and<br />

infrastructure equity strategies. The ALTÉRRA project,<br />

touted as “the world’s largest private investment vehicle<br />

for climate change action,” is geared towards mobilising<br />

$250 billion globally by 2030.<br />

Within the BlackRock Climate Transition Vehicle, $1<br />

billion is earmarked for the Climate Transition-Oriented<br />

Private Debt strategy. This innovative private debt strategy<br />

is focused on financing middle-market companies,<br />

primarily in Europe and the US, that exhibit climate transition<br />

characteristics. Another $1 billion is allocated to<br />

transition-related infrastructure, including a commitment<br />

to the BlackRock Global Infrastructure Fund IV, which<br />

invests in decarbonization-related infrastructure assets.<br />

A portion of this investment, $350 million, is dedicated to<br />

infrastructure in the Global South, emphasising a commitment<br />

to climate-related infrastructure in emerging markets.<br />

Larry Fink emphasised the significance of BlackRock’s<br />

participation in ALTÉRRA, stating, “The launch of ALTÉR-<br />

RA will itself not only help mobilise much-needed capital<br />

to support the transition in the Global South, but it can<br />

also serve as a blueprint for other sovereigns and private<br />

sector actors to replicate.” The collaboration between the<br />

UAE and BlackRock exemplifies a commitment to global<br />

green finance and creating a climate investment landscape<br />

that stimulates sustainable growth.<br />

In addition to the ALTÉRRA initiative, BlackRock is<br />

set to invest up to $400 million in Positive Zero, a Dubaibased<br />

decarbonization company. This investment aligns<br />

with Positive Zero’s mission to promote sustainable<br />

energy adoption across the GCC, contributing to efforts<br />

to reduce carbon emissions and combat global warming.<br />

As the UAE continues to position itself as a hub for<br />

green finance and sustainable development, partnerships<br />

with key players like BlackRock contribute to the nation’s<br />

vision of a climate-resilient future.<br />

<strong>January</strong> <strong>2024</strong> www.thefinanceworld.com 33