Opportunity Issue 108

Opportunity magazine is a niche business-to-business publication that explores various investment opportunities within Southern Africa’s economic sectors. The publication is endorsed by the South African Chamber of Commerce and Industry (SACCI).

Opportunity magazine is a niche business-to-business publication that explores various investment opportunities within Southern Africa’s economic sectors. The publication is endorsed by the South African Chamber of Commerce and Industry (SACCI).

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

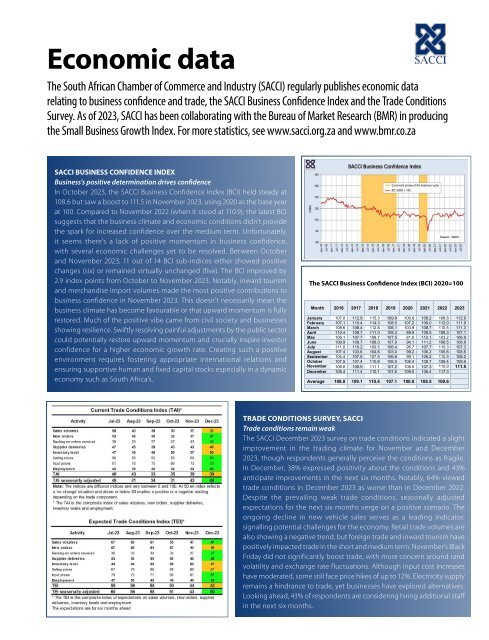

SACCI Business Confidence Index – November 2023<br />

Economic data<br />

The SACCI Business Confidence Index (BCI)<br />

2020 = 100<br />

Month 2016 2017 2018 2019 2020 2021 2022 2023<br />

January 107.0 112.9 115.3 109.9 106.6 109.2 <strong>108</strong>.8 112.9<br />

February 107.1 110.4 114.3 <strong>108</strong>.0 107.2 109.0 112.0 111.9<br />

March <strong>108</strong>.6 <strong>108</strong>.4 112.8 106.1 103.9 <strong>108</strong>.7 110.5 111.3<br />

April 110.4 109.7 111.0 <strong>108</strong>.3 89.9 109.5 <strong>108</strong>.3 107.1<br />

May 106.1 107.7 <strong>108</strong>.7 107.5 81.0 112.1 103.2 106.9<br />

The South African Chamber of Commerce and Industry (SACCI) regularly publishes economic data<br />

relating to business confidence and trade, the SACCI Business Confidence Index and the Trade Conditions<br />

Survey. As of 2023, SACCI has been collaborating with the Bureau<br />

October<br />

of Market Research (BMR) in producing<br />

November<br />

the Small Business Growth Index. For more statistics, see www.sacci.org.za and www.bmr.co.za<br />

June 109.9 109.7 <strong>108</strong>.3 107.9 94.1 111.2 <strong>108</strong>.5 <strong>108</strong>.8<br />

July 111.0 110.2 109.5 106.4 95.7 107.7 110.3 107.3<br />

August 107.4 103.6 104.6 103.0 99.2 106.2 105.6 <strong>108</strong>.6<br />

September 104.4 107.5 107.9 106.8 99.1 105.2 110.9 <strong>108</strong>.2<br />

107.5 107.4 110.8 106.0 106.4 109.7 109.4 <strong>108</strong>.6<br />

<strong>108</strong>.6 109.9 111.1 107.2 <strong>108</strong>.0 107.3 110.9 111.5<br />

December <strong>108</strong>.4 111.4 110.1 107.6 109.0 106.4 117.3<br />

Average <strong>108</strong>.0 109.1 110.4 107.1 100.0 <strong>108</strong>.5 109.6<br />

SACCI BUSINESS CONFIDENCE INDEX<br />

Business’s positive determination drives confidence<br />

In October 2023, the SACCI Business Confidence Index (BCI) held steady at<br />

<strong>108</strong>.6 but saw a boost to 111.5 in November 2023, using 2020 as the base year<br />

at 100. Compared to November 2022 (when it stood at 110.9), the latest BCI<br />

suggests that the business climate and economic conditions didn't provide<br />

the spark for increased confidence over the medium term. Unfortunately,<br />

it seems there's a lack of positive momentum in business confidence,<br />

with several economic challenges yet to be resolved. Between October<br />

and November 2023, 11 out of 14 BCI sub-indices either showed positive<br />

changes (six) or remained virtually unchanged (five). The BCI improved by<br />

2.9 index points from October to November 2023. Notably, inward tourism<br />

and merchandise import volumes made the most positive contributions to<br />

business confidence in November 2023. This doesn't necessarily mean the<br />

business climate has become favourable or that upward momentum is fully<br />

restored. Much of the positive vibe came from civil society and businesses<br />

showing resilience. Swiftly resolving painful adjustments by the public sector<br />

could potentially restore upward momentum and crucially inspire investor<br />

confidence for a higher economic growth rate. Creating such a positive<br />

environment requires fostering appropriate international relations and<br />

ensuring supportive human and fixed capital stocks especially in a dynamic<br />

economy such as South Africa’s.<br />

SACCI Business Confidence Index – November 2023<br />

The SACCI The Business SACCI Business Confidence Confidence Index (BCI) Index 2020=100 (BCI)<br />

2020 = 100<br />

Month 2016 2017 2018 2019 2020 2021 2022 2023<br />

January 107.0 112.9 115.3 109.9 106.6 109.2 <strong>108</strong>.8 112.9<br />

February 107.1 110.4 114.3 <strong>108</strong>.0 107.2 109.0 112.0 111.9<br />

March <strong>108</strong>.6 <strong>108</strong>.4 112.8 106.1 103.9 <strong>108</strong>.7 110.5 111.3<br />

April 110.4 109.7 111.0 <strong>108</strong>.3 89.9 109.5 <strong>108</strong>.3 107.1<br />

May 106.1 107.7 <strong>108</strong>.7 107.5 81.0 112.1 103.2 106.9<br />

June 109.9 109.7 <strong>108</strong>.3 107.9 94.1 111.2 <strong>108</strong>.5 <strong>108</strong>.8<br />

July 111.0 110.2 109.5 106.4 95.7 107.7 110.3 107.3<br />

August 107.4 103.6 104.6 103.0 99.2 106.2 105.6 <strong>108</strong>.6<br />

September 104.4 107.5 107.9 106.8 99.1 105.2 110.9 <strong>108</strong>.2<br />

October 107.5 107.4 110.8 106.0 106.4 109.7 109.4 <strong>108</strong>.6<br />

November <strong>108</strong>.6 109.9 111.1 107.2 <strong>108</strong>.0 107.3 110.9 111.5<br />

December <strong>108</strong>.4 111.4 110.1 107.6 109.0 106.4 117.3<br />

Average <strong>108</strong>.0 109.1 110.4 107.1 100.0 <strong>108</strong>.5 109.6<br />

2<br />

TRADE CONDITIONS SURVEY, SACCI<br />

Trade conditions remain weak<br />

The SACCI December 2023 survey on trade conditions indicated a slight<br />

improvement in the trading climate for November and December<br />

2023, though respondents generally perceive the conditions as fragile.<br />

In December, 38% expressed positivity about the conditions and 43%<br />

anticipate improvements in the next six months. Notably, 64% viewed<br />

trade conditions in December 2023 as worse than in December 2022.<br />

Despite the prevailing weak trade conditions, seasonally adjusted<br />

expectations for the next six months verge on a positive scenario. The<br />

ongoing decline in new vehicle sales serves as a leading indicator,<br />

signalling potential challenges for the economy. Retail trade volumes are<br />

also showing a negative trend, but foreign trade and inward tourism have<br />

positively impacted trade in the short and medium term. November's Black<br />

Friday did not significantly boost trade, with more concern around rand<br />

volatility and exchange rate fluctuations. Although<br />

2<br />

input cost increases<br />

have moderated, some still face price hikes of up to 12%. Electricity supply<br />

remains a hindrance to trade, yet businesses have explored alternatives.<br />

Looking ahead, 43% of respondents are considering hiring additional staff<br />

in the next six months.