Green Economy Journal Issue 63

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FINANCE<br />

South Africa’s carbon market<br />

STARVING,<br />

with an<br />

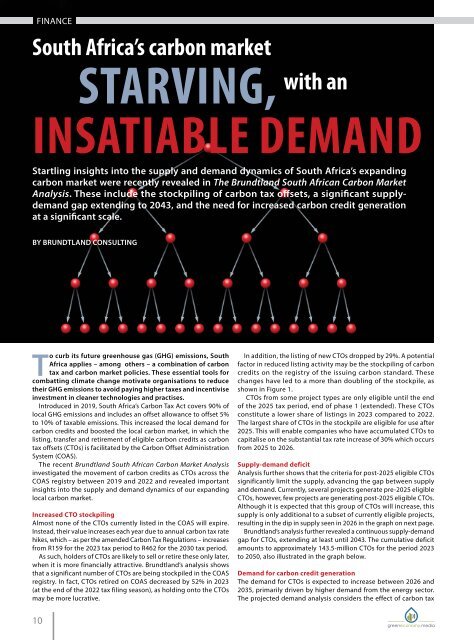

COAS listings<br />

(million CTOs/year)<br />

COAS stockpile<br />

(million CTOs/year)<br />

COAS retirements<br />

(million CTOs/year)<br />

FINANCE<br />

INSATIABLE DEMAND<br />

Figure 1. The flow of CTOs through COAS over time.<br />

Startling insights into the supply and demand dynamics of South Africa’s expanding<br />

carbon market were recently revealed in The Brundtland South African Carbon Market<br />

Analysis. These include the stockpiling of carbon tax offsets, a significant supplydemand<br />

gap extending to 2043, and the need for increased carbon credit generation<br />

at a significant scale.<br />

BY BRUNDTLAND CONSULTING<br />

on the energy and industrial sectors, as they will aim to reduce<br />

their emissions by 5% to 10% through using CTOs. The demand<br />

projection also considers the implication of South Africa’s Nationally<br />

Determined Contribution (NDC) and assumes a linear trajectory to<br />

net-zero emissions in 2050.<br />

This illustrates that there is a need for increased carbon credit<br />

generation at a significant scale. It is crucial to acknowledge that<br />

engaging in projects that generate carbon credits can be challenging,<br />

considering the expertise required for project implementation,<br />

the complexity to measure and verify emission reductions and the<br />

regulatory compliance requirements. Further, the eligibility criteria<br />

for carbon credits under the South African Carbon Tax is restrictive, for<br />

example, excluding activities that had received an energy efficiency<br />

allowance under section 12L of the Income Tax Act.<br />

At the leading edge<br />

The supply and demand dynamics of South Africa’s expanding carbon<br />

market will affect many local companies as they face increasing<br />

carbon taxes and tougher competition for the already-tight supply<br />

of CTOs that will be in ever-greater demand.<br />

CTO supply-demand gap (million CTOs/year)<br />

To curb its future greenhouse gas (GHG) emissions, South<br />

Africa applies – among others – a combination of carbon<br />

tax and carbon market policies. These essential tools for<br />

combatting climate change motivate organisations to reduce<br />

their GHG emissions to avoid paying higher taxes and incentivise<br />

investment in cleaner technologies and practises.<br />

Introduced in 2019, South Africa’s Carbon Tax Act covers 90% of<br />

local GHG emissions and includes an offset allowance to offset 5%<br />

to 10% of taxable emissions. This increased the local demand for<br />

carbon credits and boosted the local carbon market, in which the<br />

listing, transfer and retirement of eligible carbon credits as carbon<br />

tax offsets (CTOs) is facilitated by the Carbon Offset Administration<br />

System (COAS).<br />

The recent Brundtland South African Carbon Market Analysis<br />

investigated the movement of carbon credits as CTOs across the<br />

COAS registry between 2019 and 2022 and revealed important<br />

insights into the supply and demand dynamics of our expanding<br />

local carbon market.<br />

Increased CTO stockpiling<br />

Almost none of the CTOs currently listed in the COAS will expire.<br />

Instead, their value increases each year due to annual carbon tax rate<br />

hikes, which – as per the amended Carbon Tax Regulations – increases<br />

from R159 for the 2023 tax period to R462 for the 2030 tax period.<br />

As such, holders of CTOs are likely to sell or retire these only later,<br />

when it is more financially attractive. Brundtland’s analysis shows<br />

that a significant number of CTOs are being stockpiled in the COAS<br />

registry. In fact, CTOs retired on COAS decreased by 52% in 2023<br />

(at the end of the 2022 tax filing season), as holding onto the CTOs<br />

may be more lucrative.<br />

In addition, the listing of new CTOs dropped by 29%. A potential<br />

factor in reduced listing activity may be the stockpiling of carbon<br />

credits on the registry of the issuing carbon standard. These<br />

changes have led to a more than doubling of the stockpile, as<br />

shown in Figure 1.<br />

CTOs from some project types are only eligible until the end<br />

of the 2025 tax period, end of phase 1 (extended). These CTOs<br />

constitute a lower share of listings in 2023 compared to 2022.<br />

The largest share of CTOs in the stockpile are eligible for use after<br />

2025. This will enable companies who have accumulated CTOs to<br />

capitalise on the substantial tax rate increase of 30% which occurs<br />

from 2025 to 2026.<br />

Supply-demand deficit<br />

Analysis further shows that the criteria for post-2025 eligible CTOs<br />

significantly limit the supply, advancing the gap between supply<br />

and demand. Currently, several projects generate pre-2025 eligible<br />

CTOs, however, few projects are generating post-2025 eligible CTOs.<br />

Although it is expected that this group of CTOs will increase, this<br />

supply is only additional to a subset of currently eligible projects,<br />

resulting in the dip in supply seen in 2026 in the graph on next page.<br />

Brundtland’s analysis further revealed a continuous supply-demand<br />

gap for CTOs, extending at least until 2043. The cumulative deficit<br />

amounts to approximately 143.5-million CTOs for the period 2023<br />

to 2050, also illustrated in the graph below.<br />

Demand for carbon credit generation<br />

The demand for CTOs is expected to increase between 2026 and<br />

2035, primarily driven by higher demand from the energy sector.<br />

The projected demand analysis considers the effect of carbon tax<br />

WATCH VIDEO<br />

Mind the Gap, a deficit of 143.5-million CTOs across the various tax phases.<br />

THOUGHT [ECO]NOMY<br />

greeneconomy/report recycle<br />

THE SOUTH AFRICAN CARBON TAX EXPLAINED |<br />

Brundtland Consulting<br />

10 11