Didier Duret - RTL.nl

Didier Duret - RTL.nl

Didier Duret - RTL.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

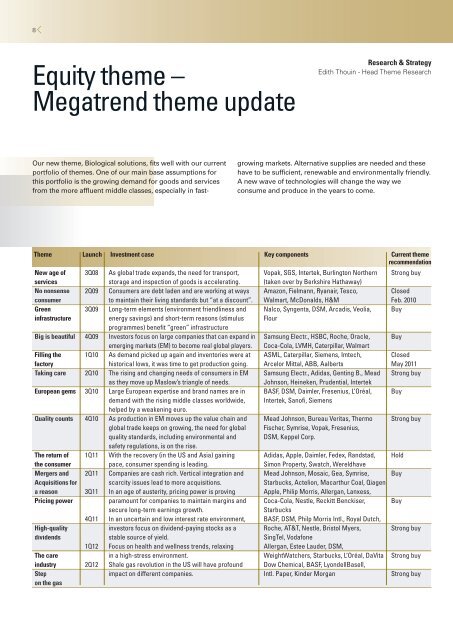

Equity theme –<br />

Megatrend theme update<br />

Our new theme, Biological solutions, fits well with our current<br />

portfolio of themes. One of our main base assumptions for<br />

this portfolio is the growing demand for goods and services<br />

from the more affluent middle classes, especially in fast-<br />

Research & Strategy<br />

Edith Thouin - Head Theme Research<br />

growing markets. Alternative supplies are needed and these<br />

have to be sufficient, renewable and environmentally friendly.<br />

A new wave of technologies will change the way we<br />

consume and produce in the years to come.<br />

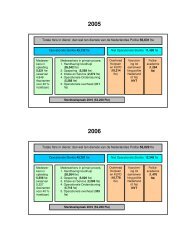

Theme Launch Investment case Key components Current theme<br />

recommendation<br />

New age of<br />

services<br />

No nonsense<br />

consumer<br />

Green<br />

infrastructure<br />

Big is beautiful<br />

Filling the<br />

factory<br />

Taking care<br />

European gems<br />

Quality counts<br />

The return of<br />

the consumer<br />

Mergers and<br />

Acquisitions for<br />

a reason<br />

Pricing power<br />

High-quality<br />

dividends<br />

The care<br />

industry<br />

Step<br />

on the gas<br />

3Q08<br />

2Q09<br />

3Q09<br />

4Q09<br />

1Q10<br />

2Q10<br />

3Q10<br />

4Q10<br />

1Q11<br />

2Q11<br />

3Q11<br />

4Q11<br />

1Q12<br />

2Q12<br />

As global trade expands, the need for transport,<br />

storage and inspection of goods is accelerating.<br />

Consumers are debt laden and are working at ways<br />

to maintain their living standards but “at a discount”.<br />

Long-term elements (environment friendliness and<br />

energy savings) and short-term reasons (stimulus<br />

programmes) benefit “green” infrastructure<br />

Investors focus on large companies that can expand in<br />

emerging markets (EM) to become real global players.<br />

As demand picked up again and inventories were at<br />

historical lows, it was time to get production going.<br />

The rising and changing needs of consumers in EM<br />

as they move up Maslow’s triangle of needs.<br />

Large European expertise and brand names are in<br />

demand with the rising middle classes worldwide,<br />

helped by a weakening euro.<br />

As production in EM moves up the value chain and<br />

global trade keeps on growing, the need for global<br />

quality standards, including environmental and<br />

safety regulations, is on the rise.<br />

With the recovery (in the US and Asia) gaining<br />

pace, consumer spending is leading.<br />

Companies are cash rich. Vertical integration and<br />

scarcity issues lead to more acquisitions.<br />

In an age of austerity, pricing power is proving<br />

paramount for companies to maintain margins and<br />

secure long-term earnings growth.<br />

In an uncertain and low interest rate environment,<br />

investors focus on dividend-paying stocks as a<br />

stable source of yield.<br />

Focus on health and wellness trends, relaxing<br />

in a high-stress environment.<br />

Shale gas revolution in the US will have profound<br />

impact on different companies.<br />

Vopak, SGS, Intertek, Burlington Northern<br />

(taken over by Berkshire Hathaway)<br />

Amazon, Fielmann, Ryanair, Tesco,<br />

Walmart, McDonalds, H&M<br />

Nalco, Syngenta, DSM, Arcadis, Veolia,<br />

Flour<br />

Samsung Electr., HSBC, Roche, Oracle,<br />

Coca-Cola, LVMH, Caterpillar, Walmart<br />

ASML, Caterpillar, Siemens, Imtech,<br />

Arcelor Mittal, ABB, Aalberts<br />

Samsung Electr., Adidas, Genting B., Mead<br />

Johnson, Heineken, Prudential, Intertek<br />

BASF, DSM, Daimler, Fresenius, L’Oréal,<br />

Intertek, Sanofi, Siemens<br />

Mead Johnson, Bureau Veritas, Thermo<br />

Fischer, Symrise, Vopak, Fresenius,<br />

DSM, Keppel Corp.<br />

Adidas, Apple, Daimler, Fedex, Randstad,<br />

Simon Property, Swatch, Wereldhave<br />

Mead Johnson, Mosaic, Gea, Symrise,<br />

Starbucks, Actelion, Macarthur Coal, Qiagen<br />

Apple, Philip Morris, Allergan, Lanxess,<br />

Coca-Cola, Nestle, Reckitt Benckiser,<br />

Starbucks<br />

BASF, DSM, Philp Morris Intl., Royal Dutch,<br />

Roche, AT&T, Nestle, Bristol Myers,<br />

SingTel, Vodafone<br />

Allergan, Estee Lauder, DSM,<br />

WeightWatchers, Starbucks, L’Oréal, DaVita<br />

Dow Chemical, BASF, LyondellBasell,<br />

Intl. Paper, Kinder Morgan<br />

Strong buy<br />

Closed<br />

Feb. 2010<br />

Buy<br />

Buy<br />

Closed<br />

May 2011<br />

Strong buy<br />

Buy<br />

Strong buy<br />

Hold<br />

Buy<br />

Buy<br />

Strong buy<br />

Strong buy<br />

Strong buy