Didier Duret - RTL.nl

Didier Duret - RTL.nl

Didier Duret - RTL.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Work in progress<br />

Quarterly Outlook Q4 2012<br />

Investment<br />

Strategy

Quarterly Outlook Q4 2012<br />

<strong>Didier</strong> <strong>Duret</strong><br />

Chief Investment Officer,<br />

ABN AMRO Private Banking<br />

September 2012<br />

Work in progress<br />

The enormous efforts in progress since the start of the<br />

global financial crisis in 2008 seem finally to be showing<br />

some results, though there is still more to be done.<br />

However, the end of “muddling through” may be in sight.<br />

The European Central Bank has recently taken some<br />

uncharacteristically bold steps to protect the single currency,<br />

and certain indicators in the United States are starting to<br />

surprise on the upside.<br />

The global economy now faces political uncertainties:<br />

leadership change in China and possibly in the US, the US<br />

“fiscal cliff” at year-end, and the stringent measures<br />

required to ensure the euro’s survival. Investors should<br />

remain aware of these while pursuing progress on the value<br />

of their portfolios.<br />

The time is therefore ripe to abandon anxieties and with<br />

them, safe havens, and government bonds in particular.<br />

These have become especially expensive and should be<br />

avoided in favour of lower-rated investment-grade bonds,<br />

European equities and high-quality listed US property,<br />

among other asset classes. Selected hedge funds can also<br />

offer opportunities.<br />

Through these and other investment views, the ABN AMRO<br />

Private Banking Research & Strategy team aims to assist<br />

you in investing prudently and successfully. Your<br />

Relationship Manager or nearest Investment Advisory<br />

Centre (see back cover) is also ready to work with you on<br />

selecting the asset classes reflecting the risk/return strategy<br />

that best meets your investment needs, continuing the work<br />

in progress on your investment portfolio.

Contents<br />

Quarterly Outlook Q4 September 2012 1<br />

Introduction – “Work in progress” 2<br />

Economics – “Finding a cyclical bottom; headwinds remain” 3<br />

Economics –“Pragmatic progress in the euro crisis” 4<br />

Economics –“Splitting the work to fix the euro” 5<br />

Equity market outlook 6<br />

Equity market – Sector outlook 7<br />

Equity market – Megatrend theme update 8<br />

New equity theme – “Biological solutions” 9<br />

Bond market outlook 10<br />

Bond portfolio allocation 11<br />

Currency outlook 12<br />

Forecasts 13<br />

Hedge funds 14<br />

Commodity outlook 15<br />

Property 16<br />

Private equity 17<br />

Asset allocation 18<br />

Contributors 20<br />

This is an international ABN AMRO publication.<br />

Risk profiles and availability of investment products may differ by country.<br />

Your local Advisor will be able to inform you.

2<br />

Work in progress<br />

We may well be entering an investment phase that builds<br />

for the future and focuses less on “muddling through”.<br />

Traditional sources of safe yield are exhausted,<br />

forcing investors to look for yields on instruments<br />

that discount future economic value.<br />

Faster public-policy reforms, political and social changes and<br />

game-changing technologies can remedy the eurozone and<br />

US debt crises – despite the apparent paralysis caused by<br />

slow global growth and political “getting by”. The economic<br />

slowdown, painful and politically risky as it is, is not a slump<br />

but a healing process for more sustainable growth that is less<br />

dependent on debt, greed and trade imbalances.<br />

Policymakers have become masters of controlled fiscal<br />

austerity; below the surface, resilient and dynamic private<br />

firms store future value. Thus 2012 may yet be seen as a<br />

turning point, economically for the US and politically for the<br />

European Union.<br />

Key trends<br />

• Slow economic growth. With no clear timing for recovery,<br />

the worst risks seem covered by leading developed<br />

countries’ pragmatic and extraordinary reflationary<br />

monetary policies and emerging countries’ fiscal initiatives.<br />

These moves will ultimately lead to more sustainable<br />

growth, removing market sentiment from the thrall of the<br />

negative scenario (see graph).<br />

• Much lower systemic risks of a eurozone break-up.<br />

Deflation is now policymakers’ primary concern in the US,<br />

eurozone and some major developing countries. The “fiscal<br />

cliff” in the US, the chances of a slump in Europe and the<br />

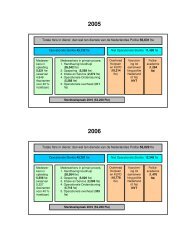

Scenario over time<br />

Economic expansion<br />

2 %<br />

1 %<br />

2012<br />

-1 %<br />

-2 %<br />

Anaemic long-term growth<br />

Euro<br />

break-up<br />

Economic contraction<br />

Source: ABN AMRO Private Banking<br />

Controlled austerity – Slow recovery<br />

Euro<br />

break -up<br />

Euro<br />

break- up<br />

Euro<br />

break- up<br />

Euro<br />

break- up<br />

Research & Strategy<br />

<strong>Didier</strong> <strong>Duret</strong> – Chief Investment Officer<br />

possibility of a hard landing in China are known risks,<br />

allowing for positive surprises.<br />

• Wide sector divergences in the economic “bottoming out”.<br />

The crisis has reshuffled private firms’ competitive order,<br />

with a new mix of winning technologies and countries for<br />

them to operate in. And consumer behaviour and the<br />

sources of demand are changing rapidly, calling for<br />

investor positioning that deviates from stock market<br />

benchmarks.<br />

Key challenges<br />

• Building on market confidence. Policymakers must leverage<br />

the sentiment gained through their bold commitments.<br />

The financial markets will be the best judges, rewarding<br />

effort and penalising reform sluggishness.<br />

• Differentiating between expensive and risky assets.<br />

Investors must ascertain which can legitimately remain<br />

expensive – such as cash-rich, sustainable-dividend<br />

companies – and those whose high price reflects risk,<br />

such as US Treasuries and German Bunds.<br />

• Riding short-term market risks created by the heavy<br />

agenda of change. Even companies with solid fundamental<br />

value are not immune to disruptive changes and volatility.<br />

Sustainable growth<br />

2020<br />

Rosy scenario<br />

Central scenario<br />

Negative scenario<br />

Key opportunities<br />

• Equities, now overweight.<br />

The reduction in systemic risk<br />

highlights the value left by the crisis,<br />

and the resilience of earnings during<br />

slow economic growth.<br />

• Biotechnologies. An economic<br />

revolution in the making –<br />

independently and within the macro<br />

landscape – with multiple facets<br />

beyond Healthcare (overweight).<br />

• High-quality property. A highyielding,<br />

low leveraged asset, backed<br />

by cash flow. Malls and rents are<br />

supported by turnaround signs in the<br />

US housing sector.<br />

• Specialised hedge funds. The case<br />

stands for managers such as<br />

discretionary global macro and<br />

event-driven.<br />

• Convertible bonds, once the primary<br />

market revives. US high-yield and<br />

emerging-market bonds are<br />

expensive but remain a source of<br />

yield in a slow growth context.

Finding a cyclical bottom;<br />

headwinds remain<br />

Sustained below-trend growth<br />

The global business cycle has weakened this year. We believe<br />

a modest growth acceleration is in store for the next couple<br />

of quarters as the manufacturing cycle bottoms out and<br />

improving financing conditions, slower inflation and policy<br />

stimulus provide some support for economic activity.<br />

Above-trend growth is u<strong>nl</strong>ikely, however, as fiscal policy<br />

remains restrictive in many advanced economies and<br />

deleveraging continues both in the financial sector and<br />

among households. A sustained period of meagre growth<br />

will create an environment for inflation to retreat further,<br />

barring commodity price shocks. It will also leave the global<br />

economy vulnerable to any negative fall-out from the euro<br />

crisis. We expect Chinese policymakers to take further action<br />

to bolster activity, so as to save the new leadership from<br />

facing a sharply slowing economy.<br />

Recent economic indicators confirm that the global economy<br />

has slowed, but some encouraging signs have also appeared<br />

– with the most promising in the US, among major<br />

economies. Its labour market is continuing to improve,<br />

though sluggishly. The housing market there has apparently<br />

started a recovery (see graph), which could continue for a<br />

long time: house prices are rising again in almost all regions,<br />

the number of unsold homes is declining and residential<br />

construction is picking up. (Construction fell sharply during<br />

the downturn, leaving the sector very small, and so it will take<br />

a while before greater construction spending boosts GDP<br />

growth).<br />

US corporations remain cautious, however, possibly because<br />

of the upcoming presidential elections and consequent fiscalpolicy<br />

uncertainty. If Congress does not change current<br />

legislation, the economy will be over the “fiscal cliff” from<br />

year-end – hitting significant fiscal tightening. We assume<br />

that Congress will soften the tightening but not remove it<br />

entirely. Thus we expect the US economy to continue<br />

growing modestly before gaining further momentum in 2013.<br />

Business confidence is improving<br />

Most countries’ confidence indicators have weakened this<br />

year, yet in the US and Europe purchasing managers' indices<br />

have stopped declining – and some are rising modestly –<br />

most probably stemming from a range of factors such as<br />

falling inflation, a rapid inventory reduction and easier<br />

financing conditions. We think that these elements will<br />

continue supporting economic activity, at least for now.<br />

Quarterly Outlook Q4 September 2012 3<br />

Research & Strategy<br />

and Group Economics<br />

Han de Jong – Chief Economist<br />

A new pace of growth for China<br />

China is now the world’s second-largest economy,<br />

responsible for a significant share of global growth since the<br />

onset of the crisis. But growth has slowed markedly this year.<br />

Although some deceleration was intended under the current<br />

five-year plan, which aims to focus more on consumption<br />

and less on investment and exports, that target has been<br />

overshot. A downturn in the housing market has also hit<br />

overall activity. But policymakers, u<strong>nl</strong>ike many in the West,<br />

can use a host of fiscal and monetary policies to buttress<br />

activity, especially as they have taken o<strong>nl</strong>y small steps<br />

recently. And as the leadership will change later this year,<br />

those currently in power will doubtless want to ensure that<br />

their successors do not face a hard landing, and will probably<br />

step up stimulus efforts as necessary. Finally, as the business<br />

cycle in advanced economies is bottoming out, an improved<br />

external environment may also be in store.<br />

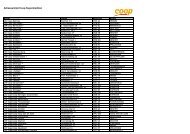

US House prices year-on-year (%)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

-10<br />

-15<br />

-20<br />

2005 2006 2007 2008 2009 2010 2011 2012<br />

Source: US Case Shiller home price index, Bloomberg

4<br />

Pragmatic progress<br />

in the euro crisis<br />

Keeping united in a crisis<br />

The euro crisis remains the greatest risk to the global<br />

economy. A break-up of the common currency would be<br />

extremely costly, pushing Europe into a sharp downturn and<br />

pulling the global economy down as well. So far, European<br />

policymakers have managed to keep things together, but it<br />

has been difficult. Crisis situations have been met with<br />

emergency measures from governments and the European<br />

Central Bank (ECB), while politicians are engaged in a<br />

complicated process of improving the monetary union’s<br />

institutional arrangements.<br />

The resolve it takes<br />

The strategy seems relatively clear. Single-currency<br />

success requires fiscal, banking and, possibly, political union.<br />

Most involved agree on this, but it is unclear that there is a<br />

uniform understanding of what this all means. Still, a number<br />

of important and encouraging steps have been taken on this<br />

long road. Commentators outside the eurozone tend to<br />

underestimate the ultimate desire of all involved for the<br />

process to succeed, but they should bear in mind, however,<br />

that progress is necessarily slow as it entails complex<br />

negotiations.<br />

A pragmatic ECB<br />

The role of the ECB in all this – apart from taking on<br />

responsibility for supervising banks – is to keep the financial<br />

system functioning and to create an environment conducive<br />

to economic growth. These non-conventional measures have<br />

led the ECB to double its balance sheet (see graph) in the<br />

wake of the Fed. Although some of its measures have been<br />

controversial, the ECB appears to fully understand what it is<br />

meant to achieve and, under the leadership of Mario Draghi,<br />

seems determined to deliver.<br />

The most likely scenario is that the eurozone pulls through.<br />

As financial markets accept this, tension and financing<br />

conditions will ease over the next couple of quarters,<br />

restoring business confidence and supporting economic<br />

growth.<br />

Central Bank balance sheets: ECB/Fed on index basis<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

Research & Strategy<br />

and Group Economics<br />

Han de Jong – Chief Economist<br />

FED ECB<br />

50<br />

Jan 2008 Jan 2009 Jan 2010 Jan 2011 Jan 2012<br />

Source: Thomson Reuters

Splitting the work<br />

to fix the euro<br />

EFSF<br />

ECB<br />

ECOFIN<br />

ECB to the rescue<br />

Financial market worries about the future of the singlecurrency<br />

area have eased notably over recent weeks. The<br />

eurozone authorities desperately needed to increase their<br />

short-term financial firepower, and the increase in the new<br />

lending capacity of the European Financial Stabilisation<br />

Mechanism/European Stability Mechanism to €500 billion<br />

was a step in this direction, while the ECB’s new bond<br />

purchase programme, which will be u<strong>nl</strong>imited, has finally<br />

provided the eurozone with a credible sovereign back-stop,<br />

as long as countries sign up to structural reform<br />

programmes. Indeed, the ECB’s actions have reduced the<br />

big systemic risks to the euro related to financing problems<br />

in big member states.<br />

The real solution to the crisis is, of course, in governments’<br />

hands and the ECB's contribution is merely to keep the<br />

financial system working as well as it can and to create an<br />

interest-rate environment that most supports economic<br />

growth.<br />

ESM<br />

OMT<br />

SMP<br />

Quarterly Outlook Q4 September 2012 5<br />

Group Economics<br />

Nick Kounis – Head Macro Research<br />

Politicians now have the tools<br />

What do politicians have to do? The authorities in vulnerable<br />

countries need to stay on track with the adjustments<br />

necessary to bring public finances to order and restore<br />

competitiveness. This will be economically and socially<br />

painful and will take years, rather than months. Deeper<br />

economic integration is also crucial. A move towards a<br />

banking union to break the vicious circle between banks and<br />

sovereigns is on the cards. The aim is to put a single<br />

supervisory mechanism in place by the middle of next year,<br />

which will allow the eurozone’s rescue funds to directly<br />

re-capitalise banks.<br />

A fiscal union, requiring a bigger pooling of sovereignty,<br />

is another challenge. This will be a long process, but the<br />

fiscal compact, ensuring tougher budgetary discipline,<br />

should come into force at the start of next year. Improved<br />

public finances and more powerful fiscal rules should<br />

eventually open the way to a single eurozone bond.<br />

IMF<br />

EU<br />

QE

6<br />

Equity market outlook<br />

Recognising progress<br />

The current political muddling through on the eurozone and<br />

US debt crisis entails a new economic reality of slower global<br />

growth that is dampening global equity market sentiment.<br />

This reality can also be viewed as a new “wall of worry” for<br />

equity investors. However, this state of the world economy is<br />

not necessarily negative for equities. At least, there is<br />

movement and no political nor economic paralysis. And we<br />

believe that the movement is in the right direction, with active<br />

support from the central banks to reduce systemic risk and to<br />

move towards more sustainable and more balanced global<br />

economic growth with a new competitive order for firms in<br />

the global marketplace.<br />

Gaining exposure in the ebb and flow<br />

September’s politically momentous decisions by the ECB and<br />

EU leaders will lead either to an acceleration of work in<br />

progress or to a temporary setback. A positive outcome<br />

would give further support to the equity rally in Europe and,<br />

in particular, to emerging countries. It could also potentially<br />

fuel a renewed focus on more cyclical (as well as financial)<br />

stocks. A negative outcome would hamper equities, but not<br />

necessarily be a disaster in term of earnings trends. As long<br />

as steps go in the direction of the sustainability of public debt,<br />

there is progress, and any setbacks in Q4 could then be entry<br />

opportunities. Despite the recent rally, valuations are in<br />

historically attractive territory, for both developed and<br />

emerging markets.<br />

Re-entering Europe<br />

The geographical preference is tilted towards Europe (now<br />

overweight) at the expense of the US market (underweight)<br />

considering the valuation gap (see graph) and potential catchup<br />

due to lower systemic risk. The US has served as a safe<br />

haven for almost two years and is therefore trading at above<br />

Asset class Fundamental view Recommendations<br />

Equities<br />

Overweight<br />

Abating systemic risk unveils the value of equities when<br />

bonds yield little<br />

Strong earnings on broad indices mask a huge<br />

divergence. The short-term downside risks present<br />

opportunities<br />

Earnings sustainability is a safe haven<br />

in equity markets<br />

Research & Strategy<br />

Sybren Brouwer – Global Head Equity Research<br />

average historic multiples (see graph). In the next few<br />

months, tables could gradually turn in Europe’s favour both<br />

from valuation and earnings momentum perspectives.<br />

Emerging markets (overweight) should regain ground,<br />

as they are also modestly valued. Even though short-term<br />

earnings are suffering in the global economic slowdown,<br />

we believe that mid- to longer-term earnings growth potential<br />

is attractive.<br />

We keep an emphasis on high-quality companies that<br />

generate sustainable growth and solid cash flows. These<br />

stocks have become more expensive on a preference for<br />

low-risk stocks. But, in a low interest-rate environment, solid<br />

cash flows become more valuable, so these stocks might<br />

keep an upside potential.<br />

Valuation gap (trailing price/earnings ) between the US and Europe<br />

30<br />

24<br />

18<br />

11<br />

5<br />

Aug 05 May 06 Feb 07 Nov 07 Aug 08 May 09 Feb 10 Nov 10 Aug 11 May 12<br />

Source: Bloomberg<br />

MSCI USA - price/earnings<br />

MSCI Europe - price/earnings<br />

Sustainable earnings growth stocks to stay expensive:<br />

they are driven by long term competitiveness trends,<br />

independent of economic growth<br />

Investors are prepared to pay a premium for solid cash<br />

flows in a low-interest rate environment<br />

This can be found in Industrials and Healthcare sectors,<br />

in emerging markets exposure and through a thematic<br />

approach

Equity market –<br />

Sector outlook<br />

Digging for sustainable earnings growth<br />

Repositioning for the equities overweight can be done by<br />

adding exposure to (sub-) sectors and companies with<br />

sustainable cash flows. We favour Healthcare, mai<strong>nl</strong>y<br />

biotechnologies (see the next two pages). For Industrials<br />

(overweight), we prefer the most stable Commercial Services<br />

& Supplies as well as Capital Goods, which benefits from<br />

infrastructure investments, green energy and lower gas<br />

Overweight - Neutral - Underweight<br />

Quarterly Outlook Q4 September 2012 7<br />

Research & Strategy<br />

Sybren Brouwer – Global Head Equity Research<br />

prices. Consumer-related top picks are Luxury Goods,<br />

Consumer Services and Household & Personal Care.<br />

Integrated Oils, Chemicals and Software & Services also have<br />

stable cash flows and sustainable growth. Financials are<br />

upgraded to neutral on reduced systemic risk and expected<br />

clarification on eurozone banking union and supervision.<br />

Sector Sub-sector Top picks Comments<br />

Energy<br />

Oil Services<br />

Haliburton, Saipem<br />

Should rally from low valuations when sentiment up<br />

Integrated Oils<br />

Royal Dutch Shell, Chevron<br />

High dividend yield protects against volatility<br />

Exploration & Production<br />

CNOOC, Whiting Petroleum<br />

Prices: limited potential for oil; struct. weak natgas<br />

Refining<br />

Valero<br />

US: strong refining margins; Europe: overcapacity<br />

Materials<br />

Chemicals<br />

BASF, Agrium, Lanxess, Incitec Pivot<br />

Low US gas prices favourable<br />

Metals & Mining<br />

Rio Tinto, Freeport, Barrick Gold<br />

Prefer miners, scarce metals, bulk commodities.<br />

Construction Materials<br />

Heidelberg Cement<br />

Austerity is coming its way<br />

Paper & Forest<br />

International Paper<br />

Demand & pulp spot more stable; weak seasonality<br />

Industrials<br />

Commercial Services & Supplies Intertek, Bureau Veritas<br />

Rising regulation & continuing outsourcing<br />

Capital Goods<br />

ABB, EADS, Schneider, Caterpillar, Emerson,<br />

Deere, GE, H. Whampoa, MTR, China Comm Constr,<br />

Mitsui & Co, Keppel Corp.<br />

Short-cycle business pressured; 2013 could improve<br />

Transportation<br />

Growth in passenger traffic; fuel prices an issue<br />

Cons. Discretionary Consumer Durables<br />

LVMH, Richemont, adidas, Lennar, LG Electronics Housebuilders on profit threshold as sector turns<br />

Consumer Services<br />

Compass<br />

Shareholder return as a share price driver<br />

Retailing<br />

PPR, Target<br />

Sales trends strong but profits uncertain<br />

Automobiles & Components<br />

BMW, Volkswagen, Hyundai Motors, Michelin Slowing growth priced in, with upside on growth<br />

Media<br />

CBS, Walt Disney, WPP, Wolters Kluwer<br />

Higher content prices negative for big networks<br />

Consumer Staples Household & Personal Care<br />

Henkel, L'Oréal, Reckitt Benckiser, Estée Lauder,<br />

Procter & Gamble<br />

Preference for personal care on buoyant demand<br />

Food & Drug Retailing<br />

Tesco, CVS Caremark<br />

Structural & cyclical challenges remain<br />

Food, Beverages & Tobacco<br />

Nestlé, Nutreco, Pernod Ricard, Coca-Cola,<br />

MJN, Kraft Foods<br />

Solid earnings, stretched valuations; margin pressure<br />

Healthcare Healthcare Equipment & Services DaVita, Thermo Fisher, Fresenius SE<br />

Spending on essential care not in danger in US<br />

Pharmaceuticals, Biotech & Life Sciences Gilead Sciences, Celgene, Actelion, Pfizer, Roche M&A, cash generation very high, nice valuations<br />

Financials<br />

Diversified Financials<br />

American Express, JP Morgan, Wells Fargo Quality, defensive & diversified names = winners<br />

Insurance<br />

Allianz, Zurich FS, AXA, Prudential UK, AIA group Technical side improving a little<br />

Commercial Banks<br />

HSBC, Standard Chartered, ICBC, CCB<br />

Exposure to growth regions instead of Europe<br />

Real Estate<br />

Simon Property Group, Cheung Kong,<br />

Keppel Land, Unibail Rodamco<br />

Top quality names with assets in prime locations<br />

Information Tech Technology Hardware & Equipment EMC<br />

Cloud computing<br />

Software & Services<br />

Google, Nuance Communications, IBM<br />

Defensive characteristics, generally<br />

Semicond. & Semicond. Equipment Samsung Electronics<br />

Strong in smartphones & tablets; growth trends<br />

Telecom<br />

Telecommunication Services Vodafone, France Telecom, KPN,<br />

China Telecom, China Unicom<br />

Challenging environment, especially in Europe<br />

Utilities<br />

Renewable Utilities<br />

EDP Renovaveis, Enel Green Power<br />

Uncertainty over subsidies weighs<br />

Regulated/Multi-Utilities<br />

GDF Suez, Veolia Environment, NextEra Energy Muted fundamentals, recession in EU burdens

8<br />

Equity theme –<br />

Megatrend theme update<br />

Our new theme, Biological solutions, fits well with our current<br />

portfolio of themes. One of our main base assumptions for<br />

this portfolio is the growing demand for goods and services<br />

from the more affluent middle classes, especially in fast-<br />

Research & Strategy<br />

Edith Thouin - Head Theme Research<br />

growing markets. Alternative supplies are needed and these<br />

have to be sufficient, renewable and environmentally friendly.<br />

A new wave of technologies will change the way we<br />

consume and produce in the years to come.<br />

Theme Launch Investment case Key components Current theme<br />

recommendation<br />

New age of<br />

services<br />

No nonsense<br />

consumer<br />

Green<br />

infrastructure<br />

Big is beautiful<br />

Filling the<br />

factory<br />

Taking care<br />

European gems<br />

Quality counts<br />

The return of<br />

the consumer<br />

Mergers and<br />

Acquisitions for<br />

a reason<br />

Pricing power<br />

High-quality<br />

dividends<br />

The care<br />

industry<br />

Step<br />

on the gas<br />

3Q08<br />

2Q09<br />

3Q09<br />

4Q09<br />

1Q10<br />

2Q10<br />

3Q10<br />

4Q10<br />

1Q11<br />

2Q11<br />

3Q11<br />

4Q11<br />

1Q12<br />

2Q12<br />

As global trade expands, the need for transport,<br />

storage and inspection of goods is accelerating.<br />

Consumers are debt laden and are working at ways<br />

to maintain their living standards but “at a discount”.<br />

Long-term elements (environment friendliness and<br />

energy savings) and short-term reasons (stimulus<br />

programmes) benefit “green” infrastructure<br />

Investors focus on large companies that can expand in<br />

emerging markets (EM) to become real global players.<br />

As demand picked up again and inventories were at<br />

historical lows, it was time to get production going.<br />

The rising and changing needs of consumers in EM<br />

as they move up Maslow’s triangle of needs.<br />

Large European expertise and brand names are in<br />

demand with the rising middle classes worldwide,<br />

helped by a weakening euro.<br />

As production in EM moves up the value chain and<br />

global trade keeps on growing, the need for global<br />

quality standards, including environmental and<br />

safety regulations, is on the rise.<br />

With the recovery (in the US and Asia) gaining<br />

pace, consumer spending is leading.<br />

Companies are cash rich. Vertical integration and<br />

scarcity issues lead to more acquisitions.<br />

In an age of austerity, pricing power is proving<br />

paramount for companies to maintain margins and<br />

secure long-term earnings growth.<br />

In an uncertain and low interest rate environment,<br />

investors focus on dividend-paying stocks as a<br />

stable source of yield.<br />

Focus on health and wellness trends, relaxing<br />

in a high-stress environment.<br />

Shale gas revolution in the US will have profound<br />

impact on different companies.<br />

Vopak, SGS, Intertek, Burlington Northern<br />

(taken over by Berkshire Hathaway)<br />

Amazon, Fielmann, Ryanair, Tesco,<br />

Walmart, McDonalds, H&M<br />

Nalco, Syngenta, DSM, Arcadis, Veolia,<br />

Flour<br />

Samsung Electr., HSBC, Roche, Oracle,<br />

Coca-Cola, LVMH, Caterpillar, Walmart<br />

ASML, Caterpillar, Siemens, Imtech,<br />

Arcelor Mittal, ABB, Aalberts<br />

Samsung Electr., Adidas, Genting B., Mead<br />

Johnson, Heineken, Prudential, Intertek<br />

BASF, DSM, Daimler, Fresenius, L’Oréal,<br />

Intertek, Sanofi, Siemens<br />

Mead Johnson, Bureau Veritas, Thermo<br />

Fischer, Symrise, Vopak, Fresenius,<br />

DSM, Keppel Corp.<br />

Adidas, Apple, Daimler, Fedex, Randstad,<br />

Simon Property, Swatch, Wereldhave<br />

Mead Johnson, Mosaic, Gea, Symrise,<br />

Starbucks, Actelion, Macarthur Coal, Qiagen<br />

Apple, Philip Morris, Allergan, Lanxess,<br />

Coca-Cola, Nestle, Reckitt Benckiser,<br />

Starbucks<br />

BASF, DSM, Philp Morris Intl., Royal Dutch,<br />

Roche, AT&T, Nestle, Bristol Myers,<br />

SingTel, Vodafone<br />

Allergan, Estee Lauder, DSM,<br />

WeightWatchers, Starbucks, L’Oréal, DaVita<br />

Dow Chemical, BASF, LyondellBasell,<br />

Intl. Paper, Kinder Morgan<br />

Strong buy<br />

Closed<br />

Feb. 2010<br />

Buy<br />

Buy<br />

Closed<br />

May 2011<br />

Strong buy<br />

Buy<br />

Strong buy<br />

Hold<br />

Buy<br />

Buy<br />

Strong buy<br />

Strong buy<br />

Strong buy

New equity theme –<br />

Biological solutions<br />

The world’s resources are being depleted faster than ever by<br />

a rapidly rising global population.<br />

Solutions to increase or find alternatives to these supplies<br />

have to be found. Dependence on non-renewable and often<br />

environmentally damaging material from fossil organisms<br />

has to be replaced by living and replaceable resources.<br />

And that is just what science has been doing over the last<br />

decade, although most people are unaware of this.<br />

New discoveries on how biological organisms can be used<br />

as alternatives to goods like oil and oil-based products,<br />

chemical-based pharmaceuticals and a new source of<br />

productivity in agriculture are now making a real difference.<br />

Though this overview may seem very diverse, the R&D<br />

efforts and findings of these very different industries are<br />

being integrated (also through acquisitions) into a new breed<br />

of biotechnology corporate giant, active in most of the<br />

emerging biotechnology industries listed below. They are<br />

moving from the polluting chemicals industry to green and<br />

sustainable solutions. Examples of the best in class in this<br />

Amgen<br />

Celgene<br />

Gilead<br />

Roche<br />

DuPont<br />

DSM<br />

Quarterly Outlook Q4 September 2012 9<br />

Research & Strategy<br />

Edith Thouin - Head Theme Research<br />

trend are Ecolabs, DuPont, Amgen, Celgene and Gilead<br />

Sciences of the US, DSM in the Netherlands, Roche and<br />

Syngenta of Switzerland, and BASF of Germany.<br />

Such biotechnology can be grouped into four “colours”.<br />

Red biotechnology is the discovery and introduction of new,<br />

biological drugs and diagnosis techniques based on the<br />

many new insights into human DNA.<br />

White biotechnology stands for industrial applications using<br />

organic raw materials to make biodegradable plastics<br />

replacing oil-based products made with highly polluting<br />

chemicals.<br />

Green biotechnology enables the farmer, through modifying<br />

plant seeds, to achieve much larger and more predictable<br />

harvests.<br />

Blue biotechnology uses enzymes to clean much needed water<br />

supplies.<br />

Monsanto<br />

Syngenta<br />

DuPont<br />

Ecolab<br />

DSM

10<br />

Bond market outlook<br />

The euro is irreversible<br />

(Mario Draghi, London, 26 July 2012)<br />

Strong push from the ECB<br />

Against the backdrop of the eurozone debt crisis, EU<br />

policymakers – determined to avoid disaster – will make<br />

huge efforts to avoid unwelcome jumps in yield, given<br />

that the path to recovery remains critical.<br />

Having recently put forward a conditional government bond<br />

purchasing program, the ECB has in effect increased<br />

eurozone rescue facilities and bought more time for dealing<br />

with the sovereign debt crisis. This promise to intervene to<br />

tame the European peripheral bond market is under strict<br />

policy conditions and does not rule out the possibility of<br />

Spain and Italy asking for external support. Rating agencies<br />

could interpret this positively and politicians have more time<br />

for reforms. The effectiveness of these policy actions will<br />

remain under the vigilant scrutiny of capital markets but<br />

reduces the risk of excessively high yields in peripheral<br />

bonds.<br />

As capital markets reduce speculation against countries<br />

dropping out of the single currency, potential flows from<br />

safe havens are a risk for long-term Bund holders.<br />

United States: Spellbound by quantitative easing<br />

For the US, the dual threats of European financial turmoil and<br />

the end of tax breaks at the start of 2013 (the “fiscal cliff”) will<br />

keep the Fed focused on preventive easing. This will keep<br />

yields low in the coming months and maintain the quest for<br />

yield across fixed-income markets. Fed policymakers will o<strong>nl</strong>y<br />

strongly act if the cost outweighs the benefits, balancing risks<br />

of being too accommodative. This does not make the yield<br />

curve attractive (see graph).<br />

Governments:<br />

Underweight<br />

Corporates:<br />

Overweight<br />

Core government bond yields are<br />

risky at current levels<br />

ECB bond purchases aim to reduce<br />

excessive yields on peripheral<br />

government bonds<br />

Cash-rich firms are stronger than<br />

many governments. The search for<br />

yield supports tighter credit-yield<br />

spreads<br />

Market liquidity remains limited<br />

Research & Strategy<br />

Roel Barnhoorn – Global Head Bond Strategy<br />

Asia<br />

Asian policy makers are trying to maintain growth<br />

momentum and to avoid a boom-bust cycle in real estate.<br />

As Asia has no debt crisis, average credit quality for both<br />

corporates and states remains strong with limited debt<br />

leverage, notably in Korea.<br />

Negative US and German real yield curves<br />

Asset class: Underweight Fundamental view Drivers Recommendations<br />

0%<br />

-0,8%<br />

-1,5%<br />

-2,3%<br />

-3,0%<br />

2Y 3Y 5Y 7Y 10Y<br />

Source: ABN AMRO Private Banking and Bloomberg<br />

Low risk appetite<br />

Investors looking for yield<br />

Low default rates supported<br />

by balance sheets<br />

US Germany<br />

Neutral duration<br />

Preference for Belgian and French; take<br />

profits on core government bonds<br />

Take profits on expensive investment grade<br />

Recommendations are in our Credit<br />

Handbook, Covered Bond Handbook and<br />

Monthly Bond Opportunities<br />

US high-yield hedge in EUR<br />

Asian corporate bonds for<br />

emerging-market allocation

Bond portfolio allocation<br />

Real yield 5 year reference<br />

+3.52% US high yield<br />

+1.39% Emerging markets<br />

+0.92% Average investment grade<br />

-1.48% US Treasury<br />

-1.72% Germany<br />

Repositioning<br />

Quarterly Outlook Q4 September 2012 11<br />

Research & Strategy<br />

Roel Barnhoorn – Global Head Bond Strategy<br />

Point of low return<br />

Conditions in capital markets have generally improved, with<br />

government bond yields at (or near) post-crisis lows. Credits,<br />

particularly high-yield bonds, are expensive (absolutely and<br />

against investment-grade bonds). With global monetary easing,<br />

we expect continued performance for lower grade corporate<br />

credits. Low, core government yields and even negative real<br />

yields (see graph) make these bonds very sensitive to interest<br />

rate variations, and so incompatible with most bond investors’<br />

low risk expectations.<br />

Repositioning into lower credit quality names<br />

We have shifted our focus from high quality into yield<br />

enhancement, reducing the shares of core government<br />

and high-quality corporate bonds.<br />

Lower investment-grade and non-investment grade bonds offer<br />

opportunities, and we may diversify into convertible bonds this<br />

quarter. Risks of US corporate defaults should stay tame, although<br />

peripheral EU corporate investment-grade bonds could suffer in<br />

the debt crisis, with some falling below investment grade,<br />

presenting selective value in non-financial European high yield.<br />

Emerging market bonds are a key source of yield enhancement<br />

and issuer diversification. With currency competition, we prefer<br />

US and EUR bonds. At equivalent ratings, emerging market<br />

corporate bonds are more attractive than developed countries’.<br />

Finally, money flows are attracted by yield pick-up,<br />

favouring our asset allocation in lower investment-grade,<br />

US non-investment grade and emerging market bonds<br />

(with a tilt to Asian credits).<br />

Recommended bond portfolio duration: Neutral<br />

12,5 %<br />

12,5 %<br />

25,0 %<br />

50,0 %<br />

High-grade government and supranational<br />

Investment-grade credits<br />

Emerging-markets debt (funds)<br />

US high-yield credits (funds)

12<br />

Currency outlook<br />

USD appreciation delayed till US political uncertainty lifts<br />

We have been constructive on the USD for several quarters<br />

on the improvement in the longer-term fundamental outlook<br />

and the attractive valuation of the currency. According to<br />

purchasing power parities of the G11 currencies, o<strong>nl</strong>y the SEK<br />

is more undervalued than the USD. Although the longer-term<br />

picture remains one of USD strength, for instance, the USD<br />

presents good value on a trade-weighted basis (see the graph),<br />

some short-term headwinds may have an important bearing<br />

on USD market sentiment.<br />

First, the Federal Reserve is committed to prolonging its<br />

exceptionally loose monetary policy. Its dual mandate of full<br />

employment and price stability is biased to decisively<br />

supporting the economy. Official interest rates are not<br />

expected to rise in the next two years, barring any substantial<br />

improvement of the US job market. With that in mind, real<br />

interest rates will remain negative or at ultra low levels along<br />

the yield curve for the foreseeable future and represent a<br />

drag on the USD. Second, despite the risk of a resurgence of<br />

the eurozone debt crisis, the market in Q4 will be more<br />

sensitive to US political uncertainty created by the<br />

presidential election, the end-of-year US fiscal cliff (a possible<br />

fiscal consolidation of some 4% of GDP) and the debt ceiling.<br />

We are therefore more cautious on the USD and see less<br />

upside in Q4 across the board.<br />

For the EUR, variables to watch are political developments<br />

and economic data. On the latter, expectations are very low,<br />

laying the ground for the market to be more sensitive to<br />

positive than negative news, resulting in EUR crosses<br />

performing well.<br />

Research & Strategy<br />

Georgette Boele – Coordinator FX and Commodity Strategy<br />

Commodity-based and emerging market currencies will be<br />

highly correlated with the fate of the Chinese economy.<br />

Originally, we thought that the economy would bottom out in<br />

Q3 on the back of the global recovery and policy stimulus, but<br />

we will probably have to wait until end-2012, prolonging the<br />

uncertainty around China’s economic growth path, capping<br />

the upside for this quarter in these currencies.<br />

US Real effective exchange rate<br />

135<br />

130<br />

125<br />

120<br />

115<br />

110<br />

105<br />

100<br />

95<br />

90<br />

1994 1996 1998 2000 2002 2004 2006 2008 2010 2012<br />

Source: Bank of International Settlements, Bloomberg<br />

Asset class Group Economics fundamental view Recommendations ABN AMRO Private Banking<br />

Currency<br />

Short-term drivers to be a headwind for the USD<br />

Slightly positive EUR view against European crosses<br />

Volatility is below historical norms<br />

Accumulate USD in the 1.25–1.30 range<br />

Uncertainty on China to be a headwind for commoditybased<br />

and emerging market currencies in the first half of Q4<br />

Neutral<br />

2006 2007 2008 2009 2010

Forecasts<br />

Knowing what is possible is the<br />

beginning of happiness<br />

George Santayana<br />

Our central scenario is that the world economy will slowly<br />

regain momentum in 2013. The sum of higher than unusual<br />

uncertainties will keep central banks united in maintaining<br />

historically low interest rate environments.<br />

Macro (%) Equities<br />

5 Sep 2012<br />

Real GDP Growth 2013 Inflation 2013<br />

ABN Market ABN Market<br />

AMRO view AMRO view<br />

US 2.0 2.1 1.7 2.0<br />

Eurozone 0.2 0.3 1.4 1.7<br />

UK 1.3 1.4 1.8 1.9<br />

Japan 1.4 1.4 0.1 0.0<br />

Other countries* 2.5 2.3 1.9 1.8<br />

Em Asia 6.9 7.0 5.3 4.4<br />

Latin America 4.3 3.8 6.1 6.5<br />

EEMEA** 3.1 3.3 4.9 5.9<br />

World 3.5 3.5 3.8 3.4<br />

All forecasts are annual averages of quarterly year-on-year changes.<br />

* Australia, Canada, Denmark, New Zealand, Norway, Sweden and Switzerland<br />

** Emerging Europe, Middle East and Africa<br />

Source: ABN AMRO Group Economics, Consensus Economics, EIU<br />

Interest rates and bond yields (%)<br />

Sep 2012<br />

United States<br />

Dec 2012 Mar 2013 Jun 2013 Sep 2013<br />

US Fed 0.25 0.0–0.25 0.0–0.25 0.0–0.25 0.0–0.25<br />

3- month 0.41 0.30 0.30 0.30 0.30<br />

2- year 0.07 0.05 0.05 0.10 0.20<br />

10- year 1.57 1.60 1.60 1.90 2.20<br />

Germany<br />

ECB Refi 0.75 0.75 0.75 0.75 0.75<br />

3- month 0.27 0.30 0.30 0.40 0.50<br />

2- year -0.04 0.00 0.10 0.20 0.35<br />

10- year 1.40 1.40 1.50 1.70 2.00<br />

Quarterly Outlook Q4 September 2012 13<br />

Research & Strategy<br />

and Group Economics<br />

Alternative scenarios, such as a major euro crisis and<br />

anaemic long-term growth, are envisaged but are attributed<br />

low probabilities that will likely decline as long as EU<br />

reshaping keeps going and the US economy picks up pace.<br />

Spot Direction Forward<br />

5 Sep 2012 3 months P/E 2013<br />

S&P 500 1405.2 ▼ 12.2<br />

Euro Stoxx 50 2450.0 ▲ 9.4<br />

FTSE-100 5692.0 ▲ 9.9<br />

Nikkei 225 8775.5 ▼ 12.3<br />

DAX 6937.5 ▲ 9.6<br />

CAC 40 3421.1 ▲ 9.6<br />

AEX 330.1 ▲ 9.7<br />

Hang Seng Index 19429.9 ► 9.5<br />

Shanghai SE Comp. 2043.6 ▲ 8.0<br />

Straits Times Index 3011.6 ► 12.8<br />

Currencies<br />

FX pair 4 Sep 2012 Dec 2012 Mar 2013 Jun 2013 Sep 2013<br />

EUR/USD 1.26 1.25 1.25 1.20 1.15<br />

GBP/USD 1.59 1.56 1.56 1.50 1.42<br />

EUR/GBP 0.79 0.80 0.80 0.80 0.81<br />

USD/CHF 0.95 0.98 0.98 1.04 1.09<br />

EUR/CHF 1.20 1.22 1.23 1.25 1.25<br />

USD/JPY 79.39 80.00 82.00 82.00 85.00<br />

EUR/JPY 98.90 100.00 102.50 98.40 97.75<br />

USD/CAD 0.99 0.98 0.98 1.00 1.00<br />

AUD/USD 1.03 1.05 1.05 1.03 1.00<br />

NZD/USD 0.80 0.82 0.82 0.80 0.78<br />

EUR/NOK 7.31 7.50 7.50 7.25 7.00<br />

EUR/SEK 8.42 8.50 8.50 8.25 8.00

14<br />

Hedge funds<br />

Looking for arbitrage opportunities<br />

while managing risk<br />

Hedge funds have brought down their risk exposures and<br />

increased cash holdings as they expect a range-bound but<br />

choppy market environment ahead, as macro policy and<br />

politics dominate. This cautious positioning has moderated<br />

the risk–return profile of hedge funds, as illustrated by the<br />

volatility of the HFRX Global Hedge Fund Index. It has come<br />

down in recent months and is now comparable to the bond<br />

risk profile (see graph).<br />

6-month rolling volatility HFRX<br />

Volatility (%)<br />

9<br />

8<br />

7<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

Jul 2004 Jul 2006 Jul 2008 Jul 2010 Jul 2012<br />

Source: BIS, Bloomberg<br />

The higher cash holdings should enable hedge funds to<br />

re-enter markets quickly if major opportunities arise.<br />

The expected market environment favours hedge funds<br />

pursuing pure arbitrage strategies rather than those which<br />

rely heavily on directional exposure. The emphasis is on<br />

alpha generation, not market beta. Hedge funds pursuing<br />

fixed-income, credit and merger arbitrage strategies should<br />

generate a steady stream of returns with low volatility.<br />

Although range-bound markets are rarely beneficial for CTA<br />

and global macro funds, we think that these strategies should<br />

be part of a hedge fund portfolio as they can offer true decorrelation<br />

and portfolio protection in case the eurozone debt<br />

crisis flares up again. But the reverse is also true – if we see a<br />

favourable outcome in Europe and the US, then CTA and<br />

global macro funds are best positioned to profit from the<br />

resulting positive market momentum.<br />

Research & Strategy<br />

Olivier Couvreur – CIO Multimanager<br />

Erik Keller – Senior Hedge Fund Analyst<br />

We maintain our overweight recommendation for hedge<br />

funds, as managers have the flexibility and skills to take<br />

advantage of unpredictable and sideways-moving markets.<br />

A portfolio of hedge funds blending fixed-income and merger<br />

arbitrage strategies with tactical trading strategies, like CTA<br />

and global macro funds, is the best mix for the months<br />

ahead. Fund of hedge funds primarily investing in fixedincome<br />

and credit arbitrage strategies are also a good<br />

alternative to traditional bond investments in the current<br />

low-yield environment.<br />

Hedge fund strategies:<br />

Positive on global macro, CTA, relative value and eventdriven;<br />

Negative on long/short equity.<br />

Global macro: Global macro and CTA hedge funds are the<br />

o<strong>nl</strong>y strategies that can provide true de-correlation in times<br />

of market stress or a prolonged rebound in risk assets.<br />

Relative value: A slow growth environment strongly favours<br />

credit. From a long-o<strong>nl</strong>y perspective, the credit trade might<br />

seem crowded but for long/short managers ample arbitrage<br />

opportunities remain.<br />

Event-driven: We prefer multi-strategy event-driven funds<br />

that have the flexibility to take advantage of the various substrategies:<br />

merger arbitrage, special situations and distressed<br />

securities.<br />

Long/short equity: Many long/short equity hedge funds are<br />

struggling in the current environment. O<strong>nl</strong>y (sector)<br />

specialised equity markets’ neutral hedge funds can generate<br />

decent returns.

Commodity outlook<br />

Balancing forces<br />

The holiday season in much of the industrialized world –<br />

which leads to reduced liquidity – proved supportive for<br />

commodity markets. The Commodity Research Bureau index<br />

rallied by 18% between mid-June and mid-September (CRB),<br />

as overall sentiment in financial markets improved; oil prices<br />

rallied on renewed tensions in the Middle East (Iran and<br />

Syria) and supply-related concerns; grain prices showed an<br />

impressive rally on drought in crop-growing areas; and<br />

precious metal prices moved higher on expectations of more<br />

quantitative easing by the Federal Reserve. One headwind<br />

was a downward adjustment in expectations for Chinese<br />

growth, hurting base, ferrous and some precious metals.<br />

The rally in commodity markets will u<strong>nl</strong>ikely turn into another<br />

massive bull run for several reasons: events in the fourth<br />

quarter, such as central bank policy announcements, the<br />

evolving EU crisis, US elections and the US fiscal cliff could<br />

introduce uncertainty into the market; oil prices may be<br />

supported near term by increased demand, supply and geopolitical<br />

concerns but most of these drivers will peter out<br />

during the quarter; and crop-supportive weather prospects<br />

and higher inventories should put downward pressure on<br />

agricultural prices. Loose monetary policy is targeted and<br />

should have limited impact on commodity prices. But China’s<br />

economic outlook will likely pick up in Q4 and this should<br />

support base and ferrous metals.<br />

The commodity market is typically a relatively small asset<br />

class with its own dynamics. Nevertheless, overall risk<br />

appetite on financial markets also plays a crucial role and<br />

could lead to bursts of volatility in the fourth quarter (see<br />

graph). More monetary stimulus might result in a moderate<br />

Quarterly Outlook Q4 September 2012 15<br />

Research & Strategy<br />

Georgette Boele – Coordinator FX and Commodity Strategy<br />

pick-up of economic growth, while commodity-specific<br />

dynamics may cap the upside. This could lead to erratic<br />

moves towards the end of the year. The fundamental case<br />

and central bank policy are not supportive enough to become<br />

positive while risks to the downside remain.<br />

CRB (lhs) and CRB (rhs) volatility<br />

Asset class Fundamental view Recommendations<br />

Commodities<br />

Group Economics has a neutral view on price<br />

Keep commodity index exposure<br />

Underweight<br />

development, as the supply–demand factors balance out<br />

Underweight commodities in portfolios because of riskreturn<br />

preference for other asset classes<br />

500<br />

400<br />

300<br />

200<br />

100<br />

Jan 2007 Jan 2008 Jan 2009 Jan 2010 Jan 2011 Jan 2012<br />

Source: Bloomberg<br />

CRB Index<br />

6-month Rolling Volatility (annualised)<br />

50%<br />

40%<br />

30%<br />

20%<br />

10%<br />

Be careful on commodities, as the recent run-up in prices<br />

and potential jumps in volatility make them risky

16<br />

Property<br />

Capturing dividends<br />

Listed real estate is overweight in our asset allocation and<br />

offers opportunities, as risk–return expectations for listed<br />

property stand between those of bonds and equity. Real<br />

estate in our focus areas – mai<strong>nl</strong>y retail, renting and to a<br />

lesser extend residential – generates quite stable income, as<br />

tenants usually have long-term contracts and rents are linked<br />

to inflation, which is expected to come down o<strong>nl</strong>y slightly.<br />

On top of that, the deleveraging process that started after the<br />

onset of the global crisis continues, with loan-to-value ratios<br />

declining and balance sheet quality improving.<br />

We focus on top-tier companies that can generate dividend<br />

yields of 3-4% in the current slow-growth and low-interest<br />

rate environment, which could imply paying a premium for<br />

investments in the best locations, regions and categories.<br />

These companies maintain their competitive advantage in the<br />

current low sovereign yield environment as they can<br />

refinance at lower rates. We avoid the lower-quality real<br />

estate companies that offer double-digit yields as these<br />

dividends could be at risk. This is especially important for<br />

Europe, where vacancy rates are low in prime locations and<br />

limited new supply is coming to the market, while rents are<br />

falling in secondary locations on increasing vacancies and<br />

hardly any demand from occupiers.<br />

We recognise the opportunities globally offered by the sector.<br />

Regionally we prefer the United States (overweight) to Asia<br />

(neutral) and Europe (underweight). Economic headwinds<br />

and banking refinancing will make it hard for European<br />

property stocks (investments in real estate were down by<br />

27% year-on-year in Q1 2012). In contrast, US real estate<br />

investment trusts (REITs) offer positive earnings momentum<br />

as regulators require them to increase their dividend<br />

payments by 10–15% in the coming year. The US market<br />

Research & Strategy<br />

Manuel Hernandez – Property Specialist<br />

showed a solid start in 2012, but volume growth is levelling<br />

off, indicating a mature phase in the recovery. This is mostly<br />

in the retail sector, with vacancy rates at 6.9% and rental<br />

levels stable.<br />

In Asia, the average debt ratio for property companies is<br />

around 20%, much lower than in Europe and the US. China<br />

and Hong Kong drive Asia ex-Australia and ex-Japan. With<br />

two rounds of rate cuts since June by China’s central bank,<br />

the chances of a soft landing for that housing market have<br />

increased.<br />

Real estate dividend yields (%)<br />

12,5 %<br />

10,0 %<br />

7,5 %<br />

5,0 %<br />

N. America<br />

Europe<br />

Asia<br />

2,5 %<br />

Nov 2007 Nov 2008 Nov 2009 Nov 2010 Nov 2011<br />

Source: Bloomberg<br />

Asset class Fundamental view Recommendations<br />

Overweight<br />

US REITs: These offer positive earnings momentum as<br />

regulators require them to increase dividends<br />

Overweight: North America<br />

Asia: The housing market in China and Hong Kong<br />

drives performance<br />

Europe: Economic headwinds and banks’ re financing<br />

weigh<br />

Neutral: Asia<br />

Underweight: Europe

Private equity<br />

A momentum of its own<br />

Five years into the financial crisis, private equity continues<br />

growing steadily, and has total managed assets of more than<br />

$3 trillion. When mark-to-market became the practice for<br />

valuing investments in 2009, it hit the market values of<br />

investment companies, but their valuations have since<br />

improved. This is partly because private equity has a long<br />

investment horizon, and expectations of short-term gains are<br />

out of tune with the process of adding value over the entire<br />

holding period. Political uncertainties and regulatory<br />

requirements may affect returns across regions, hence the<br />

need to build a well-balanced portfolio. Europe continues to<br />

face uncertainties and we favour private equity funds<br />

targeting resilient companies in downturns, regardless of<br />

location worldwide.<br />

Distressed<br />

Economic stresses continue to create opportunities. Much<br />

debt has also been refinanced over the past two years and<br />

maturities extended with risk of default in 2013–2017.<br />

Buyouts<br />

Smaller companies could be early beneficiaries in an<br />

economic upturn, while operational and strategic<br />

improvements have a larger impact in the mid-cap segment.<br />

Transaction volume is recovering from 2009 with average<br />

quarterly transactions of more than 25, but volumes less in<br />

aggregate. We are now in a similar phase to 2004 (a good<br />

year). Economic value to gross earnings multiples for 2012<br />

are just under 8x (they were 7.2x in 2004) – entry valuations<br />

should ideally stay at 7.5x. Many high-quality buyout<br />

managers are expected to raise new funds in the next two or<br />

three years after a relatively slow fund-raising environment.<br />

Quarterly Outlook Q4 September 2012 17<br />

Research & Strategy<br />

Olivier Palasi – Head Private Equity<br />

Mezzanine<br />

Mezzanine is a debt instrument that can offer equity-like<br />

gross returns with debt-like risks. High cash coupons<br />

generate near-term cash income and equity co-investment<br />

allows mezzanine investors to experience an upside. There<br />

are many opportunities for mezzanine, as these private<br />

placements are competing with traditional public financing in<br />

the large and mid-cap space. This strategy is suitable for riskaverse<br />

clients looking for a first entry into private equity.<br />

Secondary market<br />

Public market corrections and the slowdown in exit activity<br />

have kept downward pressure on prices. Sellers may be<br />

reluctant to sell portfolio companies but public market<br />

volatility could spark additional sales from banks and<br />

investors with a weak hand.<br />

Venture<br />

We favour growth equity relative to early stage capital. Longterm<br />

technology and healthcare trends bring opportunities –<br />

reforms in US healthcare will boost investments in related<br />

services.

18<br />

Asset allocation<br />

New positioning to benefit from the<br />

change of market dynamics<br />

Take advantage of supportive actions<br />

The Global Investment Committee of ABN AMRO Bank has<br />

increased its exposure to risk assets, mai<strong>nl</strong>y with an<br />

overweight in equities and real estate. This is because the<br />

reduction of systemic risk, central banks’ strong reflationary<br />

policies, and resilience of corporate earnings can lift equities<br />

in anticipation of a more sustainable economic path on a<br />

12-month horizon. Hyper-stimulative policies have made<br />

core government yields unattractive, justifying disinvestment<br />

from core government bonds.<br />

Among equities, we added a preference for Europe at the<br />

expense of the US and remain overweight in emerging<br />

markets and negative Japan. In bond markets, we decided to<br />

take profits on the most expensive part in our current bond<br />

allocation by selling half of our current allocation in core<br />

government bonds in the eurozone and to reallocate the<br />

proceeds in line with our overweight in corporates, high-yield<br />

and emerging market debt. On the alternative investment<br />

side, beside the overweight in real estate, we maintain a<br />

positive view on hedge funds both for exposure to skilled<br />

managers and as insurance against adverse market<br />

gyrations.<br />

Audited performance of our Tactical asset allocation vs. its Strategic asset allocation<br />

Performance: Adding to absolute return<br />

All our risk profile model portfolios benefited from recovery<br />

in asset prices during Q3. They were rewarded for their active<br />

exposure to global equities – in Europe particularly – and to<br />

credit markets at a time when the general opinion was<br />

unfavourable, given Europe’s risks. But being underweight<br />

commodities, we did not benefit from the recovery there.<br />

To take one example, a balanced portfolio (profile 3) gained<br />

6.78% in USD from the start of the year to early September<br />

over-performing the benchmark by 90 basis points, and<br />

gained 8.75% in EUR, almost the same as the benchmark.<br />

Risks: First signs that economic disappointments may diminish<br />

Based on separate calculations, these changes have<br />

increased the total risk exposure of risk profile 3 from 7% to<br />

8% (compared with 6.5% for its benchmark). The benefit of<br />

multiple sources of diversification in the various segments of<br />

the bond and equities markets mitigates the overall equity<br />

market risk (19%). Also, reduced market volatility in equity<br />

assets and the improvement in the grassroot businesses<br />

(small businesses and residential sector) in the US are<br />

creating less uncertain conditions.<br />

EUR USD<br />

22 May 2003 to 7 Sep 2012* 2012 YTD (7 Sep) 22 May 2003 to 7 Sep 2012* 2012 YTD (7 Sep)<br />

Strategic Tactical Excess Return Strategic Tactical Excess Return Strategic Tactical Excess Return Strategic Tactical Excess Return<br />

Profile 1 50.50 62.23 11.72 6.05 6.70 0.65 53.57 65.81 12.23 1.65 4.23 2.58<br />

Profile 2 52.87 64.00 11.14 7.71 7.87 0.15 57.29 68.20 10.91 4.11 5.74 1.63<br />

Profile 3 66.88 87.36 20.48 8.91 8.75 -0.16 75.31 91.55 16.24 5.89 6.78 0.90<br />

Profile 4 69.29 89.25 19.96 10.48 9.85 -0.64 79.12 93.96 14.84 8.19 8.13 -0.06<br />

Profile 5 76.88 100.52 23.64 12.04 10.94 -1.09 87.13 105.42 18.29 10.41 9.48 -0.93<br />

Profile 6 78.69 101.79 23.11 13.18 11.65 -1.53 89.86 107.18 17.32 12.02 10.42 -1.60<br />

* Profiles 1 and 2 are linked to the "old" Conservative profile, profiles 3 and 4 to the "old" Balanced profile and profiles 5 and 6 to the "old" Growth profile.

– continued<br />

*Recommended duration; Neutral. Benchmark: Bank of America, Merrill Lynch Government Bonds 1-10 years.<br />

**Foreign exchange exposure; o<strong>nl</strong>y equity markets and a small portion of alternative investments are exposed to foreign currencies.<br />

Quarterly Outlook Q4 September 2012 19<br />

Research & Strategy<br />

Gerardo Amo – Global Head Quantitative and Risk Analysis<br />

Asset allocation of model portfolios showing EUR/USD risk profiles in %,<br />

starting with our most conservative Profile and ending with Profile 6, which is most exposed to market risks.<br />

Asset allocation Profile 1 Profile 2<br />

Asset class Strategic Tactical Deviation Strategic Tactical Deviation<br />

Neutral Min. Max. Neutral Min. Max.<br />

Money markets 5 0 60 18 +13 5 0 70 11 +6<br />

Bonds* 90 40 100 74 -16 70 30 85 58 -12<br />

Equities 0 0 10 0 15 0 30 18 +3<br />

Alternative investments 5 0 10 8 +3 10 0 20 13 +3<br />

Funds of hedge funds 5 8 +3 5 8 +3<br />

Real estate 0 0 3 5 +2<br />

Commodities 0 0 2 0 -2<br />

Total Exposure** 100 100 100 100<br />

Asset allocation Profile 3 Profile 4<br />

Asset class Strategic Tactical Deviation Strategic Tactical Deviation<br />

Neutral Min. Max. Neutral Min. Max.<br />

Money markets 5 0 70 6 +1 5 0 70 6 +1<br />

Bonds* 55 20 70 46 -9 35 10 55 25 -10<br />

Equities 30 10 50 35 +5 50 20 70 56 +6<br />

Alternative investments 10 0 20 13 +3 10 0 30 13 +3<br />

Funds of hedge funds 5 8 +3 5 8 +3<br />

Real estate 3 5 +2 3 5 +2<br />

Commodities 2 0 -2 2 0 -2<br />

Total Exposure** 100 100 100 100<br />

Asset allocation Profile 5 Profile 6<br />

Asset class Strategic Tactical Deviation Strategic Tactical Deviation<br />

Neutral Min. Max. Neutral Min. Max.<br />

Money markets 5 0 70 2 -3 5 0 60 0 -5<br />

Bonds* 15 0 40 11 -4 0 0 25 0<br />

Equities 70 30 90 77 +7 85 40 100 90 +5<br />

Alternative investments 10 0 30 10 10 0 30 10<br />

Funds of hedge funds 5 5 5 5<br />

Real estate 3 5 +2 3 5 +2<br />

Commodities 2 0 -2 2 0 -2<br />

Total Exposure** 100 100 100 100

20<br />

Contributors<br />

Members of the ABN AMRO Bank Global Investment Committee<br />

<strong>Didier</strong> <strong>Duret</strong> didier.duret@ch.abnamro.com Chief Investment Officer Private Banking<br />

Gerben Jorritsma gerben.jorritsma@<strong>nl</strong>.abnamro.com Head Discretionary Portfolio Management Strategy<br />

Han de Jong han.de.jong@<strong>nl</strong>.abnamro.com Chief Economist<br />

Arnaud de Dumast arnaud.de.dumast@fr.abnamro.com Head Investments Private Clients France<br />

Wim Fonteine wim.fonteine@<strong>nl</strong>.abnamro.com Senior Investment Specialist and Advisory Delegate<br />

Economic Bureau<br />

Nick Kounis nick.kounis@<strong>nl</strong>.abnamro.com Head Macro Research<br />

Georgette Boele georgette.boele@<strong>nl</strong>.abnamro.com Coordinator FX and Commodity Strategy<br />

Roy Wellington Teo roy.teo@sg.abnamro.com FX Strategist Asia<br />

Bond Research & Strategy Team<br />

Roel Barnhoorn roel.barnhoorn@<strong>nl</strong>.abnamro.com Global Head Bond Strategy<br />

Agnes Pellé-Charron agnes.pelle.charron@ch.abnamro.com Credit Analyst<br />

Carman Wong carman.wong@hk.abnamro.com Head of Emerging Bond markets<br />

Grace M.K. Lim grace.m.k.lim@sg.abnamro.com Emerging market Bond Analyst<br />

Jeroen van Herwaarden jeroen.van.herwaarden@<strong>nl</strong>.abnamro.com Credit Analyst<br />

Equity Research & Strategy Team<br />

Sybren Brouwer sybren.brouwer@<strong>nl</strong>.abnamro.com Global Head Equity Research<br />

Thomas Helfer thomas.helfer@ch.abnamro.com Head Equity Research US market, Materials<br />

Daphne Roth daphne.roth@sg.abnamro.com Head Asia Equity Research, Australia, EM Asia<br />

Edith Thouin edith.thouin@ch.abnamro.com Head Theme Research, Materials, Healthcare<br />

Markus Glockenmeier markus.glockenmeier@bethmannbank.de Equity Analyst Telco & Utilities, Europe<br />

Yunpu Li yunpu.li@bethmannbank.de Equity Analyst Consumer Staples, Latin America<br />

Alfred Schoengraf alfred.schoengraf@bethmannbank.de Equity Analyst Industrials<br />

Beat Lang beat.lang@ch.abnamro.com Equity Analyst Consumer Discretionary<br />

Jens Zimmermann jens.zimmermann@ch.abnamro.com Equity Analyst Energy, CEE, Middle East & North Africa<br />

Margareta Jonker margareta.jonker@<strong>nl</strong>.abnamro.com Equity Analyst Netherlands<br />

Françoise Cespedes francoise.cespedes@fr.abnamro.com Equity Analyst Neuflize OBC Inv. French Banks<br />

Emilie Bruneau emilie.bruneau@fr.abnamro.com Equity Analyst Neuflize OBC Inv. European IT<br />

Gustavo Guimaraes gustavo.guimaraes@fr.abnamro.com Equity Analyst Neuflize OBC Inv. US Technology<br />

Chiu Yen Neo chiu.yen.neo@sg.abnamro.com Equity Analyst Japan, Singapore<br />

Carol Chau carol.chau@hk.abnamro.com Equity Analyst Korea, Hong Kong, Taiwan<br />

Ralph Wessels ralph.wessels@<strong>nl</strong>.abnamro.com Equity Analyst Financials<br />

Ivy Pan ivy.pan@hk.abnamro.com Equity Analyst China<br />

Alternative Investments<br />

Olivier Couvreur olivier.couvreur@fr.abnamro.com CIO Multimanager, Hedge Funds<br />

Olivier Palasi olivier.palasi@fr.abnamro.com Head Private Equity<br />

Manuel Hernandez Fernandez manuel.hernandez@<strong>nl</strong>.abnamro.com Property Specialist<br />

Erik Keller eric.keller@<strong>nl</strong>.abnamro.com Senior Hedge Fund Analyst<br />

Technical Analysis<br />

Aad Hoogervorst aad.hoogervorst @<strong>nl</strong>.abnamro.com Senior Technical Analyst<br />

Demis Bril demis.bril@<strong>nl</strong>.abnamro.com Senior Technical Analyst<br />

Quantitative Analysis and Risk Management<br />

Gerardo Amo gerardo.amo@ch.abnamro.com Global Quantitative and Risk Analysis<br />

Paul Groenewoud paul.groenewoud@<strong>nl</strong>.abnamro.com Quantitative and Risk Analyst<br />

Andrew Trythall andrew.trythall@<strong>nl</strong>.abnamro.com Quantitative and Risk Analyst<br />

Production Team<br />

Barbara Schiphorst barbara.schiphorst@<strong>nl</strong>.abnamro.com Global Coordination<br />

Jonathan Aspin j@j.aspin.name Editor Quarterly Outlook<br />

Christina Santore christina.santore@yahoo.com Editorial and Communication Support<br />

Christina Cain cgkcain@gmail.com Editor Supporting Documents<br />

André Heemstra andre.heemstra@<strong>nl</strong>.abnamro.com Editorial Support<br />

Kai A. Smith kai.smith@ch.abnamro.com IAC Project Manager<br />

Special thanks to Marijke Zewuster, Serdar Kucukakin, Arjen van Dijkhuizen, Casper Burgering,<br />

Aline Schuiling, Thijs Pons and Sien Tennekes

Disclaimers<br />

© Copyright 2012 ABN AMRO Bank N.V. and affiliated companies ("ABN AMRO"), Gustav Mahlerlaan 10, 1082 PP Amsterdam / P.O. box 283,<br />

1000 EA Amsterdam, The Netherlands. All rights reserved. This material was prepared by the Investment Advisory Centre (IAC) of ABN AMRO. It<br />

is provided for informational purposes o<strong>nl</strong>y and does not constitute an offer to sell or a solicitation to buy any security or other financial<br />

instrument. While based on information believed to be reliable, no guarantee is given that it is accurate or complete. While we endeavour to<br />

update on a reasonable basis the information and opinions contained herein, there may be regulatory, compliance or other reasons that prevent<br />

us from doing so. The opinions, forecasts, assumptions, estimates, derived valuations and target price(s) contained in this material are as of the<br />

date indicated and are subject to change at any time without prior notice. The investments referred to in this material may not be appropriate or<br />

suitable for the specific investment objectives, financial situation, knowledge, experience, or individual needs of recipients and should not be<br />

relied upon in substitution for the exercise of independent judgement. ABN AMRO or its officers, directors, employee benefit programs or coworkers,<br />

including persons which were involved in preparing or issuing this material, may from time to time hold long- or short-positions in<br />

securities, warrants, futures, options, derivatives or other financial instruments referred to in this material. ABN AMRO may offer and render at<br />

any time investment banking-, commercial banking-, credit-, advice-, and other services to the issuer of any security referred to in this material.<br />

Pursuant to offering and rendering such services, ABN AMRO may come into possession of information not included in this material and<br />

ABN AMRO may prior or immediately after publication thereof have acted based on such information. In the past year,<br />

ABN AMRO may have acted as lead manager or co-lead manager with regard to a public offering of securities from issuers as mentioned in this<br />

material. The stated price of any securities mentioned herein is as of the date indicated and is not a representation that any transaction can be<br />

effected at this price. Neither ABN AMRO nor other persons shall be liable for any direct, indirect, special, incidental, consequential, punitive or<br />

exemplary damages, including lost profits arising in any way from the information contained in this material. This material is for the use of<br />

intended recipients o<strong>nl</strong>y and the contents may not be reproduced, redistributed, or copied in whole or in part for any purpose without<br />

ABN AMRO's prior express consent. This document is solely intended for dissemination amongst private/retail customers in a PC country.<br />

Distribution to private/retail customers in any jurisdiction that would require registration or licensing of the distributor which the distributor does<br />

not currently have, is not permitted. Material means all research information contained in any form including but not limited to hard copy,<br />

electronic form, presentations, e-mail, SMS or WAP.<br />

US Securities Law<br />

ABN AMRO Bank N.V. is not a registered broker-dealer under the U.S. Securities Exchange Act of 1934, as amended (the "1934 Act") and under<br />

applicable state laws in the United States. In addition, ABN AMRO Bank N.V. is not a registered investment adviser under the U.S. Investment<br />

Advisers Act of 1940, as amended (the "Advisers Act" and together with the 1934 Act, the "Acts), and under applicable state laws in the United<br />

States. Accordingly, absent specific exemption under the Acts, any brokerage and investment advisory services provided by<br />