Didier Duret - RTL.nl

Didier Duret - RTL.nl

Didier Duret - RTL.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

2<br />

Work in progress<br />

We may well be entering an investment phase that builds<br />

for the future and focuses less on “muddling through”.<br />

Traditional sources of safe yield are exhausted,<br />

forcing investors to look for yields on instruments<br />

that discount future economic value.<br />

Faster public-policy reforms, political and social changes and<br />

game-changing technologies can remedy the eurozone and<br />

US debt crises – despite the apparent paralysis caused by<br />

slow global growth and political “getting by”. The economic<br />

slowdown, painful and politically risky as it is, is not a slump<br />

but a healing process for more sustainable growth that is less<br />

dependent on debt, greed and trade imbalances.<br />

Policymakers have become masters of controlled fiscal<br />

austerity; below the surface, resilient and dynamic private<br />

firms store future value. Thus 2012 may yet be seen as a<br />

turning point, economically for the US and politically for the<br />

European Union.<br />

Key trends<br />

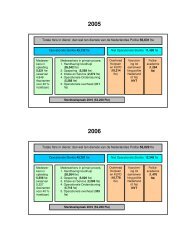

• Slow economic growth. With no clear timing for recovery,<br />

the worst risks seem covered by leading developed<br />

countries’ pragmatic and extraordinary reflationary<br />

monetary policies and emerging countries’ fiscal initiatives.<br />

These moves will ultimately lead to more sustainable<br />

growth, removing market sentiment from the thrall of the<br />

negative scenario (see graph).<br />

• Much lower systemic risks of a eurozone break-up.<br />

Deflation is now policymakers’ primary concern in the US,<br />

eurozone and some major developing countries. The “fiscal<br />

cliff” in the US, the chances of a slump in Europe and the<br />

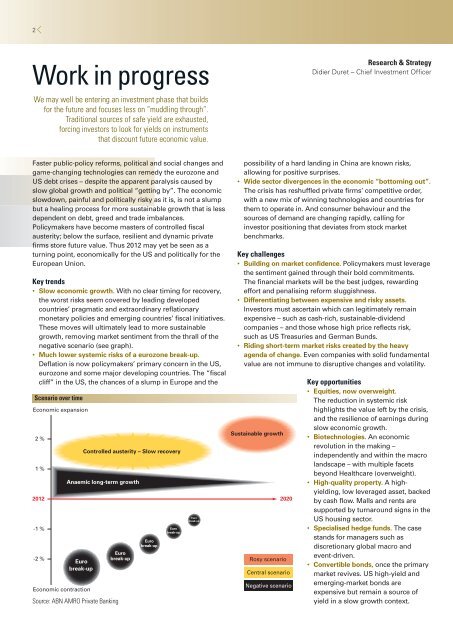

Scenario over time<br />

Economic expansion<br />

2 %<br />

1 %<br />

2012<br />

-1 %<br />

-2 %<br />

Anaemic long-term growth<br />

Euro<br />

break-up<br />

Economic contraction<br />

Source: ABN AMRO Private Banking<br />

Controlled austerity – Slow recovery<br />

Euro<br />

break -up<br />

Euro<br />

break- up<br />

Euro<br />

break- up<br />

Euro<br />

break- up<br />

Research & Strategy<br />

<strong>Didier</strong> <strong>Duret</strong> – Chief Investment Officer<br />

possibility of a hard landing in China are known risks,<br />

allowing for positive surprises.<br />

• Wide sector divergences in the economic “bottoming out”.<br />

The crisis has reshuffled private firms’ competitive order,<br />

with a new mix of winning technologies and countries for<br />

them to operate in. And consumer behaviour and the<br />

sources of demand are changing rapidly, calling for<br />

investor positioning that deviates from stock market<br />

benchmarks.<br />

Key challenges<br />

• Building on market confidence. Policymakers must leverage<br />

the sentiment gained through their bold commitments.<br />

The financial markets will be the best judges, rewarding<br />

effort and penalising reform sluggishness.<br />

• Differentiating between expensive and risky assets.<br />

Investors must ascertain which can legitimately remain<br />

expensive – such as cash-rich, sustainable-dividend<br />

companies – and those whose high price reflects risk,<br />

such as US Treasuries and German Bunds.<br />

• Riding short-term market risks created by the heavy<br />

agenda of change. Even companies with solid fundamental<br />

value are not immune to disruptive changes and volatility.<br />

Sustainable growth<br />

2020<br />

Rosy scenario<br />

Central scenario<br />

Negative scenario<br />

Key opportunities<br />

• Equities, now overweight.<br />

The reduction in systemic risk<br />

highlights the value left by the crisis,<br />

and the resilience of earnings during<br />

slow economic growth.<br />

• Biotechnologies. An economic<br />

revolution in the making –<br />

independently and within the macro<br />

landscape – with multiple facets<br />

beyond Healthcare (overweight).<br />

• High-quality property. A highyielding,<br />

low leveraged asset, backed<br />

by cash flow. Malls and rents are<br />

supported by turnaround signs in the<br />

US housing sector.<br />

• Specialised hedge funds. The case<br />

stands for managers such as<br />

discretionary global macro and<br />

event-driven.<br />

• Convertible bonds, once the primary<br />

market revives. US high-yield and<br />

emerging-market bonds are<br />

expensive but remain a source of<br />

yield in a slow growth context.