Didier Duret - RTL.nl

Didier Duret - RTL.nl

Didier Duret - RTL.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

16<br />

Property<br />

Capturing dividends<br />

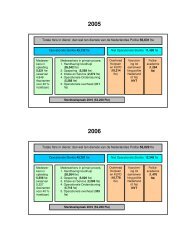

Listed real estate is overweight in our asset allocation and<br />

offers opportunities, as risk–return expectations for listed<br />

property stand between those of bonds and equity. Real<br />

estate in our focus areas – mai<strong>nl</strong>y retail, renting and to a<br />

lesser extend residential – generates quite stable income, as<br />

tenants usually have long-term contracts and rents are linked<br />

to inflation, which is expected to come down o<strong>nl</strong>y slightly.<br />

On top of that, the deleveraging process that started after the<br />

onset of the global crisis continues, with loan-to-value ratios<br />

declining and balance sheet quality improving.<br />

We focus on top-tier companies that can generate dividend<br />

yields of 3-4% in the current slow-growth and low-interest<br />

rate environment, which could imply paying a premium for<br />

investments in the best locations, regions and categories.<br />

These companies maintain their competitive advantage in the<br />

current low sovereign yield environment as they can<br />

refinance at lower rates. We avoid the lower-quality real<br />

estate companies that offer double-digit yields as these<br />

dividends could be at risk. This is especially important for<br />

Europe, where vacancy rates are low in prime locations and<br />

limited new supply is coming to the market, while rents are<br />

falling in secondary locations on increasing vacancies and<br />

hardly any demand from occupiers.<br />

We recognise the opportunities globally offered by the sector.<br />

Regionally we prefer the United States (overweight) to Asia<br />

(neutral) and Europe (underweight). Economic headwinds<br />

and banking refinancing will make it hard for European<br />

property stocks (investments in real estate were down by<br />

27% year-on-year in Q1 2012). In contrast, US real estate<br />

investment trusts (REITs) offer positive earnings momentum<br />

as regulators require them to increase their dividend<br />

payments by 10–15% in the coming year. The US market<br />

Research & Strategy<br />

Manuel Hernandez – Property Specialist<br />

showed a solid start in 2012, but volume growth is levelling<br />

off, indicating a mature phase in the recovery. This is mostly<br />

in the retail sector, with vacancy rates at 6.9% and rental<br />

levels stable.<br />

In Asia, the average debt ratio for property companies is<br />

around 20%, much lower than in Europe and the US. China<br />

and Hong Kong drive Asia ex-Australia and ex-Japan. With<br />

two rounds of rate cuts since June by China’s central bank,<br />

the chances of a soft landing for that housing market have<br />

increased.<br />

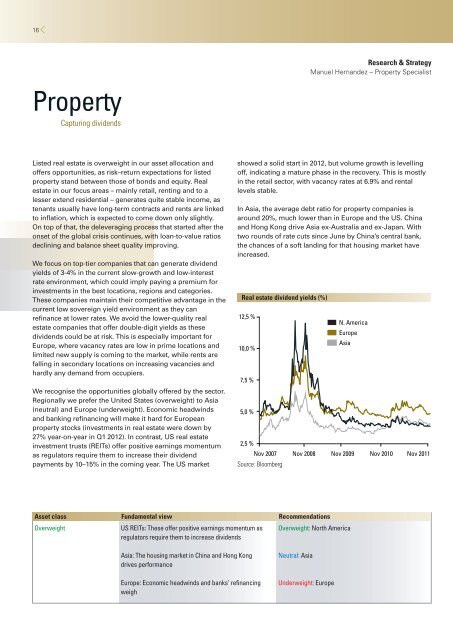

Real estate dividend yields (%)<br />

12,5 %<br />

10,0 %<br />

7,5 %<br />

5,0 %<br />

N. America<br />

Europe<br />

Asia<br />

2,5 %<br />

Nov 2007 Nov 2008 Nov 2009 Nov 2010 Nov 2011<br />

Source: Bloomberg<br />

Asset class Fundamental view Recommendations<br />

Overweight<br />

US REITs: These offer positive earnings momentum as<br />

regulators require them to increase dividends<br />

Overweight: North America<br />

Asia: The housing market in China and Hong Kong<br />

drives performance<br />

Europe: Economic headwinds and banks’ re financing<br />

weigh<br />

Neutral: Asia<br />

Underweight: Europe