Didier Duret - RTL.nl

Didier Duret - RTL.nl

Didier Duret - RTL.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

6<br />

Equity market outlook<br />

Recognising progress<br />

The current political muddling through on the eurozone and<br />

US debt crisis entails a new economic reality of slower global<br />

growth that is dampening global equity market sentiment.<br />

This reality can also be viewed as a new “wall of worry” for<br />

equity investors. However, this state of the world economy is<br />

not necessarily negative for equities. At least, there is<br />

movement and no political nor economic paralysis. And we<br />

believe that the movement is in the right direction, with active<br />

support from the central banks to reduce systemic risk and to<br />

move towards more sustainable and more balanced global<br />

economic growth with a new competitive order for firms in<br />

the global marketplace.<br />

Gaining exposure in the ebb and flow<br />

September’s politically momentous decisions by the ECB and<br />

EU leaders will lead either to an acceleration of work in<br />

progress or to a temporary setback. A positive outcome<br />

would give further support to the equity rally in Europe and,<br />

in particular, to emerging countries. It could also potentially<br />

fuel a renewed focus on more cyclical (as well as financial)<br />

stocks. A negative outcome would hamper equities, but not<br />

necessarily be a disaster in term of earnings trends. As long<br />

as steps go in the direction of the sustainability of public debt,<br />

there is progress, and any setbacks in Q4 could then be entry<br />

opportunities. Despite the recent rally, valuations are in<br />

historically attractive territory, for both developed and<br />

emerging markets.<br />

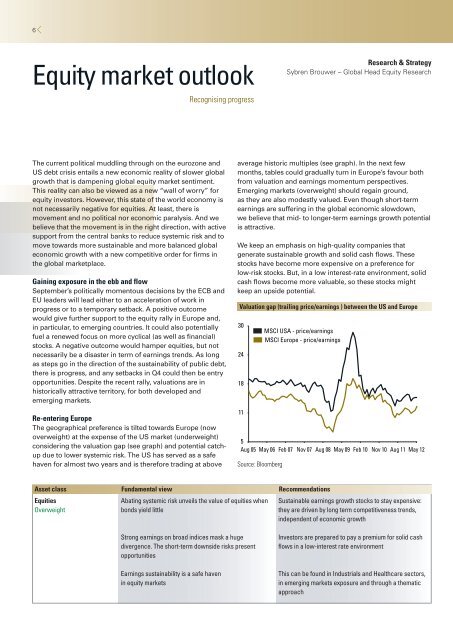

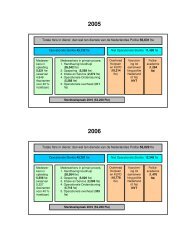

Re-entering Europe<br />

The geographical preference is tilted towards Europe (now<br />

overweight) at the expense of the US market (underweight)<br />

considering the valuation gap (see graph) and potential catchup<br />

due to lower systemic risk. The US has served as a safe<br />

haven for almost two years and is therefore trading at above<br />

Asset class Fundamental view Recommendations<br />

Equities<br />

Overweight<br />

Abating systemic risk unveils the value of equities when<br />

bonds yield little<br />

Strong earnings on broad indices mask a huge<br />

divergence. The short-term downside risks present<br />

opportunities<br />

Earnings sustainability is a safe haven<br />

in equity markets<br />

Research & Strategy<br />

Sybren Brouwer – Global Head Equity Research<br />

average historic multiples (see graph). In the next few<br />

months, tables could gradually turn in Europe’s favour both<br />

from valuation and earnings momentum perspectives.<br />

Emerging markets (overweight) should regain ground,<br />

as they are also modestly valued. Even though short-term<br />

earnings are suffering in the global economic slowdown,<br />

we believe that mid- to longer-term earnings growth potential<br />

is attractive.<br />

We keep an emphasis on high-quality companies that<br />

generate sustainable growth and solid cash flows. These<br />

stocks have become more expensive on a preference for<br />

low-risk stocks. But, in a low interest-rate environment, solid<br />

cash flows become more valuable, so these stocks might<br />

keep an upside potential.<br />

Valuation gap (trailing price/earnings ) between the US and Europe<br />

30<br />

24<br />

18<br />

11<br />

5<br />

Aug 05 May 06 Feb 07 Nov 07 Aug 08 May 09 Feb 10 Nov 10 Aug 11 May 12<br />

Source: Bloomberg<br />

MSCI USA - price/earnings<br />

MSCI Europe - price/earnings<br />

Sustainable earnings growth stocks to stay expensive:<br />

they are driven by long term competitiveness trends,<br />

independent of economic growth<br />

Investors are prepared to pay a premium for solid cash<br />

flows in a low-interest rate environment<br />

This can be found in Industrials and Healthcare sectors,<br />

in emerging markets exposure and through a thematic<br />

approach