Marble - Colorado Geological Survey

Marble - Colorado Geological Survey

Marble - Colorado Geological Survey

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

tiles. These are extremely capital intensive. CGS<br />

has assumed that these tiles will be fabricated<br />

at an existing off site facility. The Idaho Travertine<br />

Company custom cuts tiles but they require<br />

that the tile stock be in the form of marble planks<br />

which generally fall into the waste category.<br />

The blocks for calculation purposes are 100<br />

cubic feet and comprise 10 percent of the annual<br />

quarry production. CGS assumes that 940 tiles<br />

can be recovered from these blocks at a cost of<br />

$4.10 per tile and sold for $4.50 per tile. The<br />

low margin compared to slabs is due to the shipment<br />

for custom fabrication. The calcium carbonate<br />

product is included in the calculations<br />

because quarry costs have already been incurred<br />

against it and it is a product which has a high<br />

demand. It is a low margin material and extremely<br />

sensitive to the haul. The CaC03 generally<br />

has no deleterious factors unless contaminated<br />

with hornfels or other noncarbonates<br />

and is expected to be produced at 10 percent of<br />

production from block fragments and to a<br />

limited extent from other clean quarry waste.<br />

The ashlar strips used for exterior building<br />

facing and interior decorative walls would be<br />

also recovered from clean quarry waste. These<br />

strips are random in thickness and length but<br />

approximate the planks in size. CGS has not<br />

either seen any or heard of any gray marble<br />

ashlar veneered walls so the annual sales and<br />

margins are selected to be low. The amount of<br />

production would build eighty walls eight feet<br />

high and 50 feet long per year.<br />

The actual calculation in the $EE program<br />

requires selection of mine life, assumed to be 30<br />

years. The project start date is January, 1990,<br />

34<br />

utilizing discrete compounding. The minimum<br />

rate of return has been selected to be 18 percent<br />

as a risk adjusted rate. The inflation rate<br />

is assumed to be four percent and the escalation<br />

rate is assumed to be six percent for capital<br />

cost. There are four products; slabs, tiles,<br />

CaCOs and ashlar as discussed previously. The<br />

tax burden has been selected as forward carry<br />

against future revenues. The federal tax rate of<br />

34 percent and the state tax rate of 5.4 percent<br />

total 39.4 percent. Zero severance tax is used<br />

for quarry rock. The ad valorem rate is assumed<br />

to be 1.5 percent however that rate is high<br />

for this area of Pitkin County which has a very<br />

low mill levy.<br />

The property tax is a function of assessed<br />

value given to CGS as $257,272 by Division of<br />

Property Taxation, and the buildings, and permanent<br />

equipment including underground<br />

mining equipment, non drivable or towable surface<br />

equipment and any fixture dedicated to<br />

the mine. The non-dedicated equipment is<br />

taxed also but at a different rate. Due to the<br />

complexity of this tax situation the 1.5 percent<br />

ad valorem rate was used and no other<br />

property tax treatment was programmed.<br />

The capital costs are escalated and include<br />

land, development, buildings and equipment.<br />

The building was assumed to have a 30 year<br />

life and equipment a five year life for depreciation<br />

purposes ( See Table 2).<br />

It is assumed that loans for all costs will be<br />

available at 16 percent except the no collateral<br />

development loan which is 18 percent.<br />

The production is a function of the season<br />

lengths and costs are assumed to be incurred at<br />

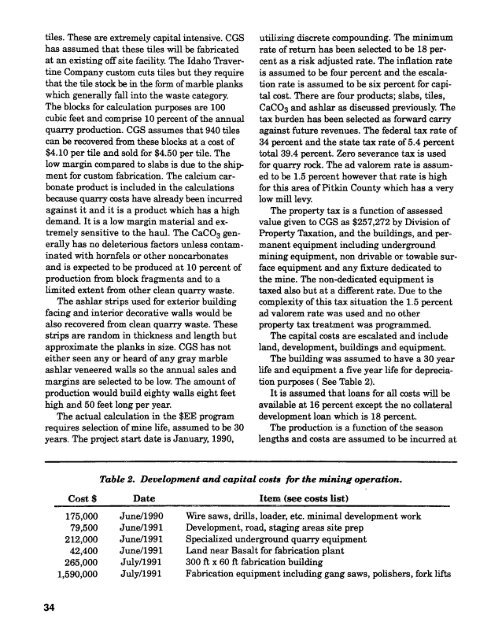

Table 2. Development and capital costs for the mining operation.<br />

Cost $ Date Item (see costs list)<br />

175,000 June/1990 Wire saws, drills, loader, etc. minimal development work<br />

79,500 June/1991 Development, road, staging areas site prep<br />

212,000 June/1991 Specialized underground quarry equipment<br />

42,400 June/1991 Land near Basalt for fabrication plant<br />

265,000 July/1991 300 ft x 60 ft fabrication building<br />

1,590,000 July/1991 Fabrication equipment including gang saws, polishers, fork lifts