Report of the Supervisory Board - tuv nord italia

Report of the Supervisory Board - tuv nord italia

Report of the Supervisory Board - tuv nord italia

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes<br />

to <strong>the</strong> consolidated balance sheet and <strong>the</strong> consolidated pr<strong>of</strong>it and loss account<br />

(1) Non-current assets<br />

The structure <strong>of</strong> and movements in <strong>the</strong> noncurrent<br />

assets <strong>of</strong> <strong>the</strong> Group are itemised in <strong>the</strong><br />

schedule <strong>of</strong> changes in non-current assets.<br />

In <strong>the</strong> consolidated schedule <strong>of</strong> changes to<br />

non-current assets <strong>the</strong> cumulative acquisition<br />

and manufacturing costs and <strong>the</strong> depreciation<br />

and amortisation <strong>of</strong> <strong>the</strong> consolidated<br />

companies are included as at 1.1.2004.<br />

Among <strong>the</strong> financial assets, claims arising<br />

from reinsurance in <strong>the</strong> amount <strong>of</strong><br />

€486,448k are recognised. These are capi-<br />

(2) Financial assets – Shareholdings<br />

The list <strong>of</strong> shareholdings and major trade<br />

investments has been filed with <strong>the</strong> Commercial<br />

Register <strong>of</strong> Hanover Local Court under<br />

registration number HRB 61566.<br />

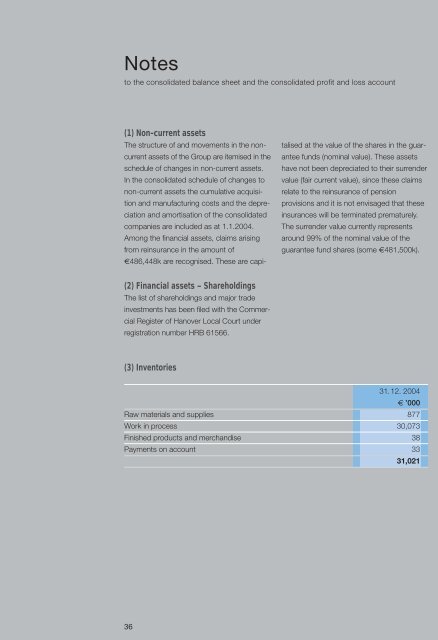

(3) Inventories<br />

36<br />

talised at <strong>the</strong> value <strong>of</strong> <strong>the</strong> shares in <strong>the</strong> guarantee<br />

funds (nominal value). These assets<br />

have not been depreciated to <strong>the</strong>ir surrender<br />

value (fair current value), since <strong>the</strong>se claims<br />

relate to <strong>the</strong> reinsurance <strong>of</strong> pension<br />

provisions and it is not envisaged that <strong>the</strong>se<br />

insurances will be terminated prematurely.<br />

The surrender value currently represents<br />

around 99% <strong>of</strong> <strong>the</strong> nominal value <strong>of</strong> <strong>the</strong><br />

guarantee fund shares (some €481,500k).<br />

31. 12. 2004<br />

€ ’000<br />

Raw materials and supplies 877<br />

Work in process 30,073<br />

Finished products and merchandise 38<br />

Payments on account 33<br />

31,021