Semi-Annual Report and Accounts - chartbook.fid-intl.com

Semi-Annual Report and Accounts - chartbook.fid-intl.com

Semi-Annual Report and Accounts - chartbook.fid-intl.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Fidelity<br />

Funds<br />

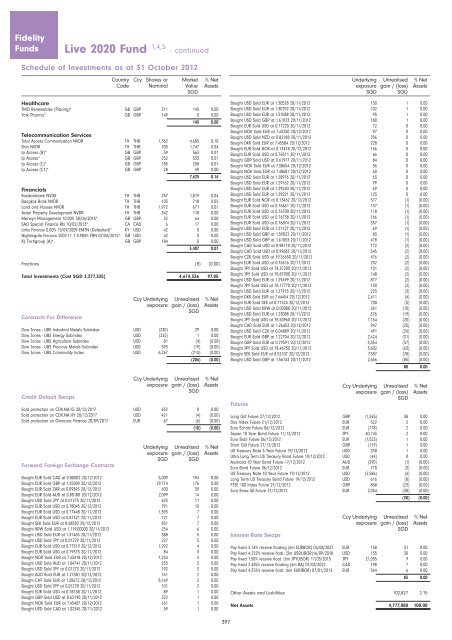

Healthcare<br />

TMO Renewables (Placing)* GB GBP 311 145 0.00<br />

York Pharma* GB GBP 149 0 0.00<br />

145 0.00<br />

Tele<strong>com</strong>munication Services<br />

Total Access Communication NVDR TH THB 1,362 4,685 0.10<br />

Shin NVDR TH THB 703 1,747 0.04<br />

Ip Access (B)* GB GBP 39 563 0.01<br />

Ip Access* GB GBP 252 333 0.01<br />

Ip Access (C)* GB GBP 185 258 0.01<br />

Ip Access (C1)* GB GBP 28 39 0.00<br />

7,625 0.16<br />

Financials<br />

Kasikornbank NVDR TH THB 257 1,819 0.04<br />

Bangkok Bank NVDR TH THB 103 718 0.02<br />

L<strong>and</strong> <strong>and</strong> Houses NVDR TH THB 1,972 671 0.01<br />

Asian Property Development NVDR TH THB 342 118 0.00<br />

Marwyn Management 10.00% 30/04/2015* GB GBP 32 64 0.00<br />

SAO Special Finance Rts 10/02/2013* CA CAD 6 17 0.00<br />

Links Finance 0.00% 15/09/2009 EMTN (Defaulted)* KY USD 42 0 0.00<br />

Nightingale Finance 2007-11 1 0.983% FRN 07/06/2015* GB USD 42 0 0.00<br />

XL Techgroup (A)* GB GBP 184 0 0.00<br />

3,407 0.07<br />

Fractions (8) (0.00)<br />

Total Investments (Cost SGD 3,277,325) 4,674,336 97.85<br />

Contracts For Difference<br />

Ccy Underlying Unrealised % Net<br />

exposure gain / (loss) Assets<br />

SGD<br />

Dow Jones - UBS Industrial Metals Subindex USD (230) 29 0.00<br />

Dow Jones - UBS Energy Subindex USD (232) 1 0.00<br />

Dow Jones - UBS Agriculture Subindex USD 81 (4) (0.00)<br />

Dow Jones - UBS Precious Metals Subindex USD 393 (19) (0.00)<br />

Dow Jones - UBS Commodity Index USD 6,267 (213) (0.00)<br />

(206) (0.00)<br />

Credit Default Swaps<br />

Live 2020 Fund 1,4,5 - continued<br />

Schedule of Investments as at 31 October 2012<br />

Ccy Underlying Unrealised % Net<br />

exposure gain / (loss) Assets<br />

SGD<br />

Sold protection on CDX.NA.IG 20/12/2017 USD 632 0 0.00<br />

Sold protection on CDX.NA.HY 20/12/2017 USD 421 (4) (0.00)<br />

Sold protection on Glencore Finance 20/09/2017 EUR 67 (6) (0.00)<br />

(10) (0.00)<br />

Forward Foreign Exchange Contracts<br />

Country Ccy Shares or Market % Net<br />

Code Nominal Value Assets<br />

SGD<br />

Underlying Unrealised % Net<br />

exposure gain / (loss) Assets<br />

SGD SGD<br />

Bought EUR Sold CAD at 0.80002 20/12/2012 5,009 194 0.00<br />

Bought EUR Sold GBP at 1.25009 20/12/2012 29,774 176 0.00<br />

Bought EUR Sold ZAR at 0.09393 20/12/2012 600 39 0.00<br />

Bought EUR Sold AUD at 0.80180 20/12/2012 2,099 14 0.00<br />

Bought USD Sold JPY at 0.01275 20/11/2012 623 11 0.00<br />

Bought EUR Sold USD at 0.78045 20/12/2012 791 10 0.00<br />

Bought EUR Sold USD at 0.77448 20/11/2012 1,393 7 0.00<br />

Bought EUR Sold USD at 0.81321 20/11/2012 121 7 0.00<br />

Bought SEK Sold EUR at 8.68530 20/12/2012 851 7 0.00<br />

Bought KRW Sold USD at 1,119.00000 20/11/2012 234 6 0.00<br />

Bought USD Sold EUR at 1.31465 20/11/2012 388 5 0.00<br />

Bought USD Sold JPY at 0.01279 20/11/2012 227 5 0.00<br />

Bought EUR Sold USD at 0.77319 20/12/2012 1,292 4 0.00<br />

Bought EUR Sold USD at 0.79375 20/11/2012 84 3 0.00<br />

Bought NOK Sold EUR at 7.43418 20/12/2012 1,234 3 0.00<br />

Bought USD Sold AUD at 1.04741 20/11/2012 255 3 0.00<br />

Bought USD Sold JPY at 0.01273 20/11/2012 192 3 0.00<br />

Bought AUD Sold EUR at 1.27381 20/12/2012 161 2 0.00<br />

Bought CHF Sold EUR at 1.20672 20/12/2012 8,169 2 0.00<br />

Bought USD Sold JPY at 0.01278 20/11/2012 101 2 0.00<br />

Bought EUR Sold USD at 0.78158 20/11/2012 89 1 0.00<br />

Bought GBP Sold USD at 0.62190 20/11/2012 322 1 0.00<br />

Bought NOK Sold EUR at 7.45407 20/12/2012 161 1 0.00<br />

Bought USD Sold CAD at 1.02345 20/11/2012 59 1 0.00<br />

397<br />

Bought USD Sold EUR at 1.30528 20/11/2012 150 1 0.00<br />

Bought USD Sold EUR at 1.30792 20/11/2012 102 1 0.00<br />

Bought USD Sold EUR at 1.31088 20/11/2012 95 1 0.00<br />

Bought USD Sold GBP at 1.61923 20/11/2012 180 1 0.00<br />

Bought EUR Sold USD at 0.77220 20/11/2012 72 0 0.00<br />

Bought NOK Sold EUR at 7.43250 20/12/2012 97 0 0.00<br />

Bought USD Sold NZD at 0.82188 20/11/2012 256 0 0.00<br />

Bought DKK Sold EUR at 7.45584 20/12/2012 228 0 0.00<br />

Bought EUR Sold NOK at 0.13478 20/12/2012 166 0 0.00<br />

Bought EUR Sold USD at 0.76511 20/11/2012 66 0 0.00<br />

Bought GBP Sold USD at 0.61977 20/11/2012 84 0 0.00<br />

Bought NOK Sold EUR at 7.38654 20/12/2012 56 0 0.00<br />

Bought NOK Sold EUR at 7.40681 20/12/2012 60 0 0.00<br />

Bought USD Sold EUR at 1.28976 20/11/2012 63 0 0.00<br />

Bought USD Sold EUR at 1.29162 20/11/2012 99 0 0.00<br />

Bought USD Sold EUR at 1.29260 20/11/2012 69 0 0.00<br />

Bought USD Sold EUR at 1.29521 20/11/2012 123 0 0.00<br />

Bought EUR Sold NOK at 0.13462 20/12/2012 577 (1) (0.00)<br />

Bought EUR Sold USD at 0.76661 20/11/2012 137 (1) (0.00)<br />

Bought EUR Sold USD at 0.76700 20/11/2012 118 (1) (0.00)<br />

Bought EUR Sold USD at 0.76738 20/11/2012 166 (1) (0.00)<br />

Bought EUR Sold USD at 0.76874 20/11/2012 357 (1) (0.00)<br />

Bought USD Sold EUR at 1.27127 20/11/2012 69 (1) (0.00)<br />

Bought USD Sold GBP at 1.59022 20/11/2012 83 (1) (0.00)<br />

Bought USD Sold GBP at 1.61053 20/11/2012 418 (1) (0.00)<br />

Bought CAD Sold USD at 0.98718 20/11/2012 172 (2) (0.00)<br />

Bought CAD Sold USD at 0.99633 20/11/2012 545 (2) (0.00)<br />

Bought CZK Sold USD at 19.26650 20/11/2012 476 (2) (0.00)<br />

Bought EUR Sold USD at 0.76616 20/11/2012 252 (2) (0.00)<br />

Bought JPY Sold USD at 78.37200 20/11/2012 101 (2) (0.00)<br />

Bought JPY Sold USD at 78.87900 20/11/2012 140 (2) (0.00)<br />

Bought USD Sold EUR at 1.29499 20/11/2012 877 (2) (0.00)<br />

Bought JPY Sold USD at 78.17770 20/11/2012 130 (3) (0.00)<br />

Bought USD Sold EUR at 1.27915 20/11/2012 223 (3) (0.00)<br />

Bought DKK Sold EUR at 7.44454 20/12/2012 2,411 (4) (0.00)<br />

Bought EUR Sold SEK at 0.11524 20/12/2012 700 (5) (0.00)<br />

Bought USD Sold KRW at 0.00088 20/11/2012 261 (10) (0.00)<br />

Bought USD Sold EUR at 1.23088 20/11/2012 376 (19) (0.00)<br />

Bought JPY Sold USD at 78.50960 20/11/2012 1,164 (20) (0.00)<br />

Bought CAD Sold EUR at 1.26453 20/12/2012 947 (25) (0.00)<br />

Bought USD Sold CZK at 0.04889 20/11/2012 491 (26) (0.00)<br />

Bought EUR Sold GBP at 1.22704 20/12/2012 2,424 (31) (0.00)<br />

Bought GBP Sold EUR at 0.79591 20/12/2012 3,354 (37) (0.00)<br />

Bought JPY Sold USD at 78.46750 20/11/2012 3,602 (63) (0.00)<br />

Bought SEK Sold EUR at 8.52107 20/12/2012 7,387 (78) (0.00)<br />

Bought USD Sold GBP at 1.56133 20/11/2012 2,656 (85) (0.00)<br />

80 0.00<br />

Futures<br />

Ccy Underlying Unrealised % Net<br />

exposure gain / (loss) Assets<br />

SGD<br />

Long Gilt Future 27/12/2012 GBP (1,545) 38 0.00<br />

Dax Index Future 21/12/2012 EUR 522 2 0.00<br />

Euro Schatz Future 06/12/2012 EUR (778) 2 0.00<br />

Japan 10 Year Bond Future 11/12/2012 JPY 60,743 2 0.00<br />

Euro Bobl Future 06/12/2012 EUR (1,023) 1 0.00<br />

Short Gilt Future 27/12/2012 GBP (119) 1 0.00<br />

US Treasury Note 5 Year Future 19/12/2012 USD 230 1 0.00<br />

Ultra Long Term US Treasury Bond Future 19/12/2012 USD (44) 0 0.00<br />

Australia 10 Year Bond Future 17/12/2012 AUD (290) (1) (0.00)<br />

Euro Bund Future 06/12/2012 EUR 770 (3) (0.00)<br />

US Treasury Note 10 Year Future 19/12/2012 USD (2,586) (4) (0.00)<br />

Long Term US Treasury Bond Future 19/12/2012 USD 616 (8) (0.00)<br />

FTSE 100 Index Future 21/12/2012 GBP 868 (23) (0.00)<br />

Euro Stoxx 50 Future 21/12/2012 EUR 2,054 (38) (0.00)<br />

(30) (0.00)<br />

Interest Rate Swaps<br />

Underlying Unrealised % Net<br />

exposure gain / (loss) Assets<br />

SGD SGD<br />

Ccy Underlying Unrealised % Net<br />

exposure gain / (loss) Assets<br />

SGD<br />

Pay fixed 3.14% receive floating (6m EURBOR) 04/08/2021 EUR 158 31 0.00<br />

Pay fixed 4.222% receive float. (3m USDLIBOR)16/09/2018 USD 135 30 0.00<br />

Pay fixed 1.50% receive float. (6m JPYLIBOR) 17/03/2015 JPY 21,055 9 0.00<br />

Pay fixed 2.435% receive floating (6m BA) 01/03/2022 CAD 198 7 0.00<br />

Pay fixed 4.376% receive float. (6m EURIBOR) 07/01/2013 EUR 564 6 0.00<br />

83 0.00<br />

Other Assets <strong>and</strong> Liabilities 102,827 2.15<br />

Net Assets 4,777,080 100.00