Business Guide to Romania* - Bayern - Europa

Business Guide to Romania* - Bayern - Europa

Business Guide to Romania* - Bayern - Europa

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

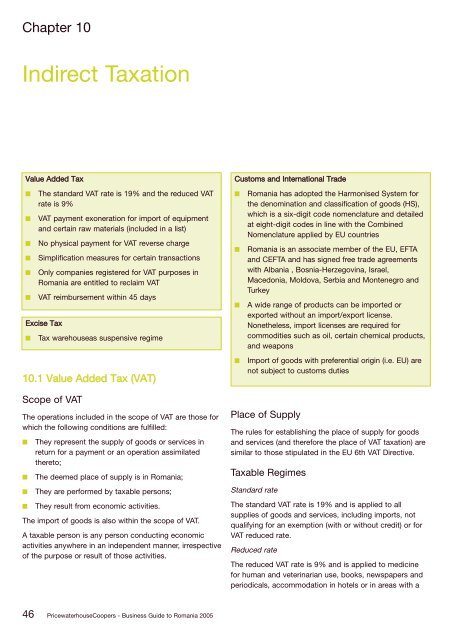

Chapter 10<br />

Indirect Taxation<br />

Value Added Tax<br />

■ The standard VAT rate is 19% and the reduced VAT<br />

rate is 9%<br />

■ VAT payment exoneration for import of equipment<br />

and certain raw materials (included in a list)<br />

■ No physical payment for VAT reverse charge<br />

■ Simplification measures for certain transactions<br />

■ Only companies registered for VAT purposes in<br />

Romania are entitled <strong>to</strong> reclaim VAT<br />

■ VAT reimbursement within 45 days<br />

Excise Tax<br />

■ Tax warehouseas suspensive regime<br />

10.1 Value Added Tax (VAT)<br />

Scope of VAT<br />

The operations included in the scope of VAT are those for<br />

which the following conditions are fulfilled:<br />

■ They represent the supply of goods or services in<br />

return for a payment or an operation assimilated<br />

there<strong>to</strong>;<br />

■ The deemed place of supply is in Romania;<br />

■ They are performed by taxable persons;<br />

■ They result from economic activities.<br />

The import of goods is also within the scope of VAT.<br />

A taxable person is any person conducting economic<br />

activities anywhere in an independent manner, irrespective<br />

of the purpose or result of those activities.<br />

46 PricewaterhouseCoopers - <strong>Business</strong> <strong>Guide</strong> <strong>to</strong> Romania 2005<br />

Cus<strong>to</strong>ms and International Trade<br />

■ Romania has adopted the Harmonised System for<br />

the denomination and classification of goods (HS),<br />

which is a six-digit code nomenclature and detailed<br />

at eight-digit codes in line with the Combined<br />

Nomenclature applied by EU countries<br />

■ Romania is an associate member of the EU, EFTA<br />

and CEFTA and has signed free trade agreements<br />

with Albania , Bosnia-Herzegovina, Israel,<br />

Macedonia, Moldova, Serbia and Montenegro and<br />

Turkey<br />

■ A wide range of products can be imported or<br />

exported without an import/export license.<br />

Nonetheless, import licenses are required for<br />

commodities such as oil, certain chemical products,<br />

and weapons<br />

■ Import of goods with preferential origin (i.e. EU) are<br />

not subject <strong>to</strong> cus<strong>to</strong>ms duties<br />

Place of Supply<br />

The rules for establishing the place of supply for goods<br />

and services (and therefore the place of VAT taxation) are<br />

similar <strong>to</strong> those stipulated in the EU 6th VAT Directive.<br />

Taxable Regimes<br />

Standard rate<br />

The standard VAT rate is 19% and is applied <strong>to</strong> all<br />

supplies of goods and services, including imports, not<br />

qualifying for an exemption (with or without credit) or for<br />

VAT reduced rate.<br />

Reduced rate<br />

The reduced VAT rate is 9% and is applied <strong>to</strong> medicine<br />

for human and veterinarian use, books, newspapers and<br />

periodicals, accommodation in hotels or in areas with a