Shadow Economies and Corruption All Over the World - Index of - IZA

Shadow Economies and Corruption All Over the World - Index of - IZA

Shadow Economies and Corruption All Over the World - Index of - IZA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

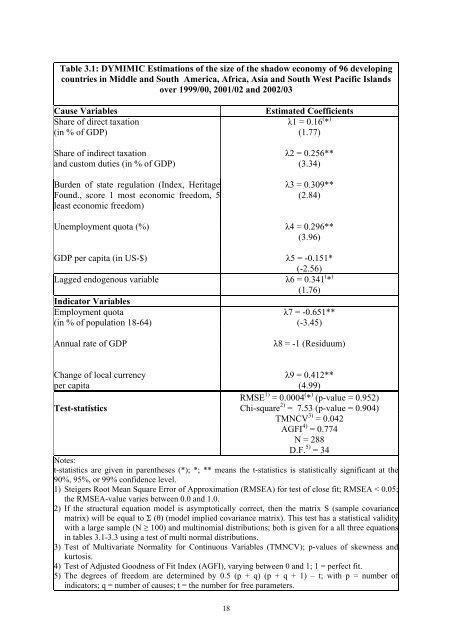

Table 3.1: DYMIMIC Estimations <strong>of</strong> <strong>the</strong> size <strong>of</strong> <strong>the</strong> shadow economy <strong>of</strong> 96 developing<br />

countries in Middle <strong>and</strong> South America, Africa, Asia <strong>and</strong> South West Pacific Isl<strong>and</strong>s<br />

over 1999/00, 2001/02 <strong>and</strong> 2002/03<br />

Cause Variables Estimated Coefficients<br />

Share <strong>of</strong> direct taxation λ1 = 0.16 ( * )<br />

(in % <strong>of</strong> GDP) (1.77)<br />

Share <strong>of</strong> indirect taxation λ2 = 0.256**<br />

<strong>and</strong> custom duties (in % <strong>of</strong> GDP) (3.34)<br />

Burden <strong>of</strong> state regulation (<strong>Index</strong>, Heritage<br />

Found., score 1 most economic freedom, 5<br />

least economic freedom)<br />

λ3 = 0.309**<br />

(2.84)<br />

Unemployment quota (%) λ4 = 0.296**<br />

(3.96)<br />

GDP per capita (in US-$) λ5 = -0.151*<br />

(-2.56)<br />

Lagged endogenous variable λ6 = 0.341 ( * )<br />

(1.76)<br />

Indicator Variables<br />

Employment quota λ7 = -0.651**<br />

(in % <strong>of</strong> population 18-64) (-3.45)<br />

Annual rate <strong>of</strong> GDP λ8 = -1 (Residuum)<br />

Change <strong>of</strong> local currency λ9 = 0.412**<br />

per capita (4.99)<br />

RMSE 1) = 0.0004 ( * ) (p-value = 0.952)<br />

Test-statistics Chi-square 2) = 7.53 (p-value = 0.904)<br />

TMNCV 3) = 0.042<br />

AGFI 4) = 0.774<br />

N = 288<br />

D.F. 5) = 34<br />

Notes:<br />

t-statistics are given in paren<strong>the</strong>ses (*); *; ** means <strong>the</strong> t-statistics is statistically significant at <strong>the</strong><br />

90%, 95%, or 99% confidence level.<br />

1) Steigers Root Mean Square Error <strong>of</strong> Approximation (RMSEA) for test <strong>of</strong> close fit; RMSEA < 0.05;<br />

<strong>the</strong> RMSEA-value varies between 0.0 <strong>and</strong> 1.0.<br />

2) If <strong>the</strong> structural equation model is asymptotically correct, <strong>the</strong>n <strong>the</strong> matrix S (sample covariance<br />

matrix) will be equal to Σ (θ) (model implied covariance matrix). This test has a statistical validity<br />

with a large sample (N ≥ 100) <strong>and</strong> multinomial distributions; both is given for a all three equations<br />

in tables 3.1-3.3 using a test <strong>of</strong> multi normal distributions.<br />

3) Test <strong>of</strong> Multivariate Normality for Continuous Variables (TMNCV); p-values <strong>of</strong> skewness <strong>and</strong><br />

kurtosis.<br />

4) Test <strong>of</strong> Adjusted Goodness <strong>of</strong> Fit <strong>Index</strong> (AGFI), varying between 0 <strong>and</strong> 1; 1 = perfect fit.<br />

5) The degrees <strong>of</strong> freedom are determined by 0.5 (p + q) (p + q + 1) – t; with p = number <strong>of</strong><br />

indicators; q = number <strong>of</strong> causes; t = <strong>the</strong> number for free parameters.<br />

18