Description Page - Doosan Power Systems

Description Page - Doosan Power Systems

Description Page - Doosan Power Systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

DOOSAN BABCOCK ENERGY<br />

Annual Report and Financial Statements 2007<br />

Notes to the financial statements continued<br />

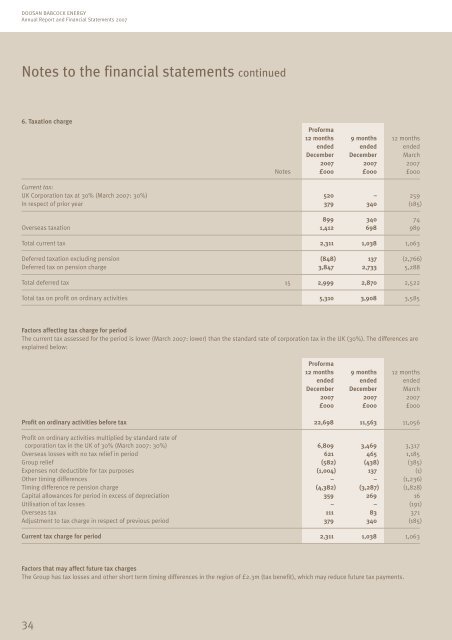

6. Taxation charge<br />

34<br />

Proforma<br />

12 months 9 months 12 months<br />

ended ended ended<br />

December December March<br />

2007 2007 2007<br />

Notes £000 £000 £000<br />

Current tax:<br />

UK Corporation tax at 30% (March 2007: 30%) 520 – 259<br />

In respect of prior year 379 340 (185)<br />

899 340 74<br />

Overseas taxation 1,412 698 989<br />

Total current tax 2,311 1,038 1,063<br />

Deferred taxation excluding pension (848) 137 (2,766)<br />

Deferred tax on pension charge 3,847 2,733 5,288<br />

Total deferred tax 15 2,999 2,870 2,522<br />

Total tax on profit on ordinary activities 5,310 3,908 3,585<br />

Factors affecting tax charge for period<br />

The current tax assessed for the period is lower (March 2007: lower) than the standard rate of corporation tax in the UK (30%). The differences are<br />

explained below:<br />

Proforma<br />

12 months 9 months 12 months<br />

ended ended ended<br />

December December March<br />

2007 2007 2007<br />

£000 £000 £000<br />

Profit on ordinary activities before tax 22,698 11,563 11,056<br />

Profit on ordinary activities multiplied by standard rate of<br />

corporation tax in the UK of 30% (March 2007: 30%) 6,809 3,469 3,317<br />

Overseas losses with no tax relief in period 621 465 1,185<br />

Group relief (582) (438) (385)<br />

Expenses not deductible for tax purposes (1,004) 137 (1)<br />

Other timing differences – – (1,236)<br />

Timing difference re pension charge (4,382) (3,287) (1,828)<br />

Capital allowances for period in excess of depreciation 359 269 16<br />

Utilisation of tax losses – – (191)<br />

Overseas tax 111 83 371<br />

Adjustment to tax charge in respect of previous period 379 340 (185)<br />

Current tax charge for period 2,311 1,038 1,063<br />

Factors that may affect future tax charges<br />

The Group has tax losses and other short term timing differences in the region of £2.3m (tax benefit), which may reduce future tax payments.