Sirtex Cover.proof 11 - School of Educators

Sirtex Cover.proof 11 - School of Educators

Sirtex Cover.proof 11 - School of Educators

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

3Section<br />

6<br />

Information Summary<br />

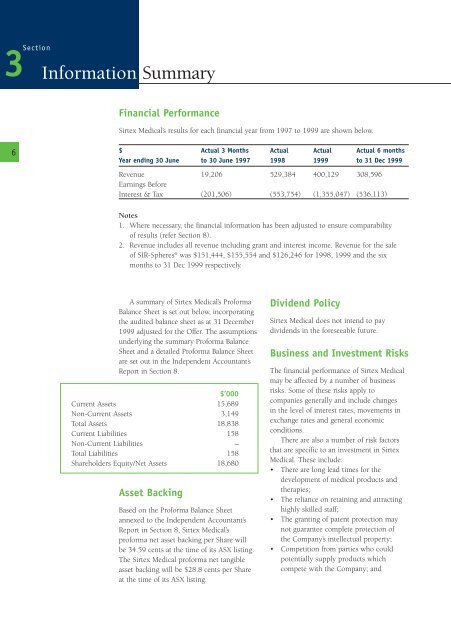

Financial Performance<br />

<strong>Sirtex</strong> Medical’s results for each financial year from 1997 to 1999 are shown below.<br />

$ Actual 3 Months Actual Actual Actual 6 months<br />

Year ending 30 June to 30 June 1997 1998 1999 to 31 Dec 1999<br />

Revenue 19,206 529,384 400,129 308,596<br />

Earnings Before<br />

Interest & Tax (201,506) (553,754) (1,355,047) (536,<strong>11</strong>3)<br />

Notes<br />

1. Where necessary, the financial information has been adjusted to ensure comparability<br />

<strong>of</strong> results (refer Section 8).<br />

2. Revenue includes all revenue including grant and interest income. Revenue for the sale<br />

<strong>of</strong> SIR-Spheres ® was $151,444, $155,554 and $126,246 for 1998, 1999 and the six<br />

months to 31 Dec 1999 respectively.<br />

A summary <strong>of</strong> <strong>Sirtex</strong> Medical’s Pr<strong>of</strong>orma<br />

Balance Sheet is set out below, incorporating<br />

the audited balance sheet as at 31 December<br />

1999 adjusted for the Offer. The assumptions<br />

underlying the summary Pr<strong>of</strong>orma Balance<br />

Sheet and a detailed Pr<strong>of</strong>orma Balance Sheet<br />

are set out in the Independent Accountant’s<br />

Report in Section 8.<br />

$’000<br />

Current Assets 15,689<br />

Non-Current Assets 3,149<br />

Total Assets 18,838<br />

Current Liabilities 158<br />

Non-Current Liabilities –<br />

Total Liabilities 158<br />

Shareholders Equity/Net Assets 18,680<br />

Asset Backing<br />

Based on the Pr<strong>of</strong>orma Balance Sheet<br />

annexed to the Independent Accountant’s<br />

Report in Section 8, <strong>Sirtex</strong> Medical’s<br />

pr<strong>of</strong>orma net asset backing per Share will<br />

be 34.59 cents at the time <strong>of</strong> its ASX listing.<br />

The <strong>Sirtex</strong> Medical pr<strong>of</strong>orma net tangible<br />

asset backing will be $28.8 cents per Share<br />

at the time <strong>of</strong> its ASX listing.<br />

Dividend Policy<br />

<strong>Sirtex</strong> Medical does not intend to pay<br />

dividends in the foreseeable future.<br />

Business and Investment Risks<br />

The financial performance <strong>of</strong> <strong>Sirtex</strong> Medical<br />

may be affected by a number <strong>of</strong> business<br />

risks. Some <strong>of</strong> these risks apply to<br />

companies generally and include changes<br />

in the level <strong>of</strong> interest rates, movements in<br />

exchange rates and general economic<br />

conditions.<br />

There are also a number <strong>of</strong> risk factors<br />

that are specific to an investment in <strong>Sirtex</strong><br />

Medical. These include:<br />

• There are long lead times for the<br />

development <strong>of</strong> medical products and<br />

therapies;<br />

• The reliance on retaining and attracting<br />

highly skilled staff;<br />

• The granting <strong>of</strong> patent protection may<br />

not guarantee complete protection <strong>of</strong><br />

the Company’s intellectual property;<br />

• Competition from parties who could<br />

potentially supply products which<br />

compete with the Company; and