October 2010 issue of HR News magazine - IPMA

October 2010 issue of HR News magazine - IPMA

October 2010 issue of HR News magazine - IPMA

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ecoNomic outlook<br />

CONTINUED FROM PAGE 17<br />

The most efficient way to <strong>of</strong>fer voluntary<br />

benefits is through a cafeteria-style<br />

program that includes both employerprovided<br />

and voluntary benefits. A coordinated<br />

menu <strong>of</strong> options will encourage<br />

employees to think about their needs and<br />

make optimal selections.<br />

Work with Vendors<br />

One <strong>of</strong> the challenges <strong>of</strong> integrating traditional<br />

and voluntary benefits is getting<br />

voluntary benefit vendors on board. As<br />

benefit <strong>of</strong>ferings have become more<br />

complex, insurance companies have<br />

narrowed their portfolio <strong>of</strong> services,<br />

<strong>of</strong>fering fewer voluntary benefit options.<br />

Similarly, broker-administrators have<br />

developed specialized expertise in education,<br />

enrollment and administration to<br />

support those limited platforms. This has<br />

made it more difficult to design and coordinate<br />

voluntary and employer-funded<br />

benefits. Also, the best way to manage<br />

education, enrollment and premium<br />

collection differs by <strong>of</strong>fering. Certain<br />

voluntary benefits are most effectively<br />

funded through payroll deduction and<br />

others through an annual fee. Some, but<br />

not all, vendors <strong>of</strong>fer help with employee<br />

communications.<br />

Employers should evaluate vendors’ <strong>of</strong>ferings<br />

and develop strategies to educate<br />

and enroll employees. They also should<br />

ensure <strong>of</strong>ferings are properly priced and<br />

underwritten, including having a renewal<br />

formula and procedures (covering such<br />

things as expenses, trend, credibility and<br />

participation) consistent with objectives.<br />

When selecting vendors for new<br />

employee-paid voluntary benefits through<br />

competitive bidding, employers need to<br />

make sure coverage is efficient, costeffective<br />

and sustainable. The process is<br />

as important for voluntary benefits as it is<br />

for employer-paid benefits.<br />

Public sector plan sponsors should keep<br />

in mind that their size, compared to most<br />

private-sector employers, usually gives<br />

them an advantage in negotiating with<br />

new vendors. Vendor selection should<br />

cover financial terms, payment methodology,<br />

administration and performance<br />

standards and renewal terms.<br />

Public sector employers should monitor<br />

the performance <strong>of</strong> existing and new<br />

vendors periodically. Among the factors to<br />

| 20 | OCTOBER <strong>2010</strong><br />

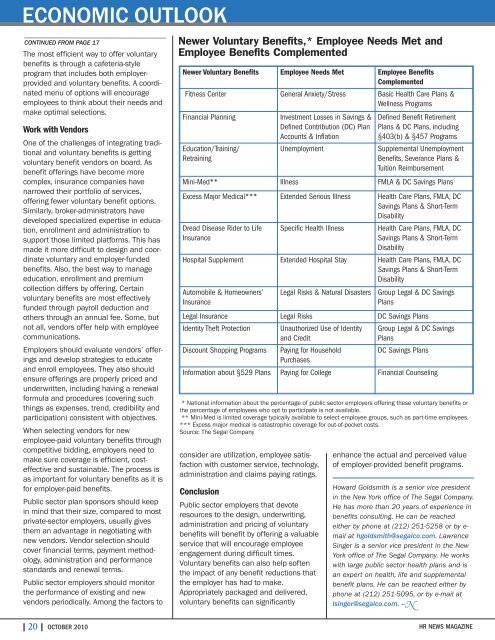

Newer Voluntary Benefits,* Employee Needs Met and<br />

Employee Benefits Complemented<br />

Newer Voluntary Benefits Employee Needs Met Employee Benefits<br />

Complemented<br />

Fitness Center General Anxiety/Stress Basic Health Care Plans &<br />

Wellness Programs<br />

Financial Planning Investment Losses in Savings &<br />

Defined Contribution (DC) Plan<br />

Accounts & Inflation<br />

Education/Training/<br />

Retraining<br />

consider are utilization, employee satisfaction<br />

with customer service, technology,<br />

administration and claims paying ratings.<br />

Conclusion<br />

Public sector employers that devote<br />

resources to the design, underwriting,<br />

administration and pricing <strong>of</strong> voluntary<br />

benefits will benefit by <strong>of</strong>fering a valuable<br />

service that will encourage employee<br />

engagement during difficult times.<br />

Voluntary benefits can also help s<strong>of</strong>ten<br />

the impact <strong>of</strong> any benefit reductions that<br />

the employer has had to make.<br />

Appropriately packaged and delivered,<br />

voluntary benefits can significantly<br />

Defined Benefit Retirement<br />

Plans & DC Plans, including<br />

§403(b) & §457 Programs<br />

Unemployment Supplemental Unemployment<br />

Benefits, Severance Plans &<br />

Tuition Reimbursement<br />

Mini-Med** Illness FMLA & DC Savings Plans<br />

Excess Major Medical*** Extended Serious Illness Health Care Plans, FMLA, DC<br />

Savings Plans & Short-Term<br />

Disability<br />

Dread Disease Rider to Life<br />

Insurance<br />

Specific Health Illness Health Care Plans, FMLA, DC<br />

Savings Plans & Short-Term<br />

Disability<br />

Hospital Supplement Extended Hospital Stay Health Care Plans, FMLA, DC<br />

Savings Plans & Short-Term<br />

Disability<br />

Automobile & Homeowners’<br />

Insurance<br />

Legal Risks & Natural Disasters Group Legal & DC Savings<br />

Plans<br />

Legal Insurance Legal Risks DC Savings Plans<br />

Identity Theft Protection Unauthorized Use <strong>of</strong> Identity<br />

and Credit<br />

Discount Shopping Programs Paying for Household<br />

Purchases<br />

Group Legal & DC Savings<br />

Plans<br />

DC Savings Plans<br />

Information about §529 Plans Paying for College Financial Counseling<br />

* National information about the percentage <strong>of</strong> public sector employers <strong>of</strong>fering these voluntary benefits or<br />

the percentage <strong>of</strong> employees who opt to participate is not available.<br />

** Mini-Med is limited coverage typically available to select employee groups, such as part-time employees.<br />

*** Excess major medical is catastrophic coverage for out-<strong>of</strong>-pocket costs.<br />

Source: The Segal Company<br />

enhance the actual and perceived value<br />

<strong>of</strong> employer-provided benefit programs.<br />

Howard Goldsmith is a senior vice president<br />

in the New York <strong>of</strong>fice <strong>of</strong> The Segal Company.<br />

He has more than 20 years <strong>of</strong> experience in<br />

benefits consulting. He can be reached<br />

either by phone at (212) 251-5258 or by email<br />

at hgoldsmith@segalco.com. Lawrence<br />

Singer is a senior vice president in the New<br />

York <strong>of</strong>fice <strong>of</strong> The Segal Company. He works<br />

with large public sector health plans and is<br />

an expert on health, life and supplemental<br />

benefit plans. He can be reached either by<br />

phone at (212) 251-5095, or by e-mail at<br />

lsinger@segalco.com. —N<br />

<strong>HR</strong> NEWS MAGAZINE