REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

- TAGS

- real

- estate

- redi-net.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WINTER 2011 | VOL 39 | NO 4<br />

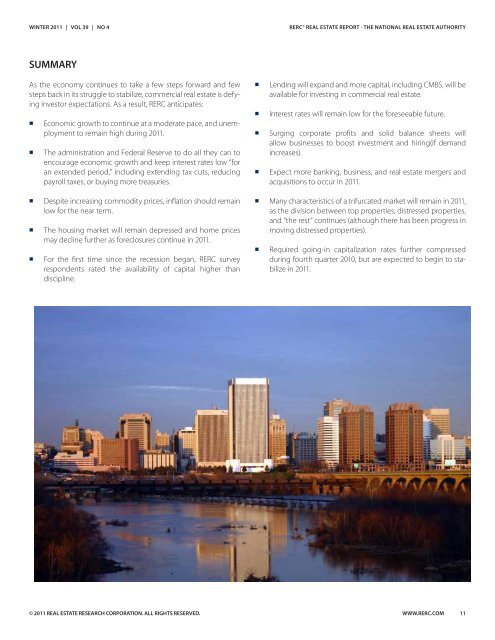

SUMMARY<br />

As the economy continues to take a few steps forward and few<br />

steps back in its struggle to stabilize, <strong>com</strong>mercial real estate is defying<br />

investor expectations. As a result, RERC anticipates:<br />

n Economic growth to continue at a moderate pace, and unemployment<br />

to remain high during 2011.<br />

n The administration and Federal Reserve to do all they can to<br />

encourage economic growth and keep interest rates low “for<br />

an extended period,” including extending tax cuts, reducing<br />

payroll taxes, or buying more treasuries.<br />

n Despite increasing <strong>com</strong>modity prices, inflation should remain<br />

low for the near term.<br />

n The housing market will remain depressed and home prices<br />

may decline further as foreclosures continue in 2011.<br />

n For the first time since the recession began, RERC survey<br />

respondents rated the availability of capital higher than<br />

discipline.<br />

© 2011 <strong>REAL</strong> <strong>ESTATE</strong> RESEARCH CORPORATION. ALL RIGHTS RESERVED.<br />

RERC © <strong>REAL</strong> <strong>ESTATE</strong> <strong>REPORT</strong> - THE NATIONAL <strong>REAL</strong> <strong>ESTATE</strong> AUTHORITY<br />

n Lending will expand and more capital, including CMBS, will be<br />

available for investing in <strong>com</strong>mercial real estate.<br />

n Interest rates will remain low for the foreseeable future.<br />

n Surging corporate profits and solid balance sheets will<br />

allow businesses to boost investment and hiring(if demand<br />

increases).<br />

n Expect more banking, business, and real estate mergers and<br />

acquisitions to occur in 2011.<br />

n Many characteristics of a trifurcated market will remain in 2011,<br />

as the division between top properties, distressed properties,<br />

and “the rest” continues (although there has been progress in<br />

moving distressed properties).<br />

n Required going-in capitalization rates further <strong>com</strong>pressed<br />

during fourth quarter 2010, but are expected to begin to stabilize<br />

in 2011.<br />

WWW.RERC.COM 11