REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

- TAGS

- real

- estate

- redi-net.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WINTER 2011 | VOL 39 | NO 4<br />

© 2011 <strong>REAL</strong> <strong>ESTATE</strong> RESEARCH CORPORATION. ALL RIGHTS RESERVED.<br />

RERC © <strong>REAL</strong> <strong>ESTATE</strong> <strong>REPORT</strong> - THE NATIONAL <strong>REAL</strong> <strong>ESTATE</strong> AUTHORITY<br />

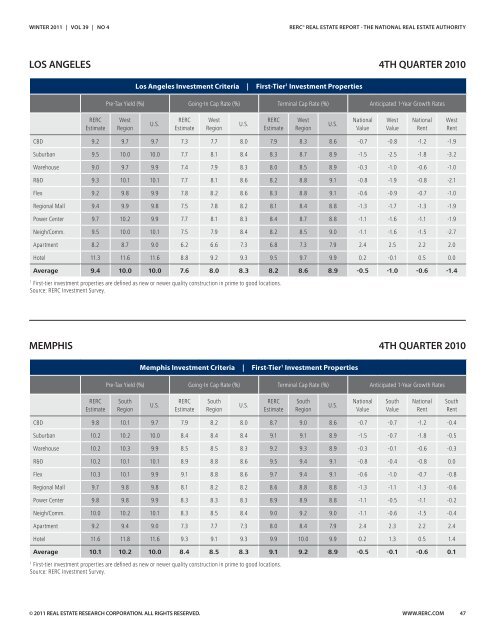

LOS ANGELES 4TH QUARTER 2010<br />

RERC<br />

Estimate<br />

Los Angeles Investment Criteria | First-Tier 1 Investment Properties<br />

Pre-Tax Yield (%) Going-In Cap Rate (%) Terminal Cap Rate (%) Anticipated 1-Year Growth Rates<br />

West<br />

Region<br />

U.S.<br />

RERC<br />

Estimate<br />

West<br />

Region<br />

U.S.<br />

RERC<br />

Estimate<br />

CBD 9.2 9.7 9.7 7.3 7.7 8.0 7.9 8.3 8.6 -0.7 -0.8 -1.2 -1.9<br />

Suburban 9.5 10.0 10.0 7.7 8.1 8.4 8.3 8.7 8.9 -1.5 -2.5 -1.8 -3.2<br />

Warehouse 9.0 9.7 9.9 7.4 7.9 8.3 8.0 8.5 8.9 -0.3 -1.0 -0.6 -1.0<br />

R&D 9.3 10.1 10.1 7.7 8.1 8.6 8.2 8.8 9.1 -0.8 -1.9 -0.8 -2.1<br />

Flex 9.2 9.8 9.9 7.8 8.2 8.6 8.3 8.8 9.1 -0.6 -0.9 -0.7 -1.0<br />

Regional Mall 9.4 9.9 9.8 7.5 7.8 8.2 8.1 8.4 8.8 -1.3 -1.7 -1.3 -1.9<br />

Power Center 9.7 10.2 9.9 7.7 8.1 8.3 8.4 8.7 8.8 -1.1 -1.6 -1.1 -1.9<br />

Neigh/Comm. 9.5 10.0 10.1 7.5 7.9 8.4 8.2 8.5 9.0 -1.1 -1.6 -1.5 -2.7<br />

Apartment 8.2 8.7 9.0 6.2 6.6 7.3 6.8 7.3 7.9 2.4 2.5 2.2 2.0<br />

Hotel 11.3 11.6 11.6 8.8 9.2 9.3 9.5 9.7 9.9 0.2 -0.1 0.5 0.0<br />

Average 9.4 10.0 10.0 7.6 8.0 8.3 8.2 8.6 8.9 -0.5 -1.0 -0.6 -1.4<br />

1 First-tier investment properties are defined as new or newer quality construction in prime to good locations.<br />

Source: RERC Investment Survey.<br />

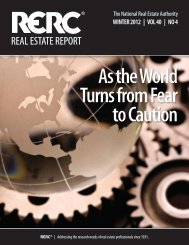

MEMPHIS 4TH QUARTER 2010<br />

RERC<br />

Estimate<br />

West<br />

Region<br />

Memphis Investment Criteria | First-Tier 1 Investment Properties<br />

U.S.<br />

National<br />

Value<br />

West<br />

Value<br />

National<br />

Rent<br />

Pre-Tax Yield (%) Going-In Cap Rate (%) Terminal Cap Rate (%) Anticipated 1-Year Growth Rates<br />

South<br />

Region<br />

U.S.<br />

RERC<br />

Estimate<br />

South<br />

Region<br />

U.S.<br />

RERC<br />

Estimate<br />

CBD 9.8 10.1 9.7 7.9 8.2 8.0 8.7 9.0 8.6 -0.7 -0.7 -1.2 -0.4<br />

Suburban 10.2 10.2 10.0 8.4 8.4 8.4 9.1 9.1 8.9 -1.5 -0.7 -1.8 -0.5<br />

Warehouse 10.2 10.3 9.9 8.5 8.5 8.3 9.2 9.3 8.9 -0.3 -0.1 -0.6 -0.3<br />

R&D 10.2 10.1 10.1 8.9 8.8 8.6 9.5 9.4 9.1 -0.8 -0.4 -0.8 0.0<br />

Flex 10.3 10.1 9.9 9.1 8.8 8.6 9.7 9.4 9.1 -0.6 -1.0 -0.7 -0.8<br />

Regional Mall 9.7 9.8 9.8 8.1 8.2 8.2 8.6 8.8 8.8 -1.3 -1.1 -1.3 -0.6<br />

Power Center 9.8 9.8 9.9 8.3 8.3 8.3 8.9 8.9 8.8 -1.1 -0.5 -1.1 -0.2<br />

Neigh/Comm. 10.0 10.2 10.1 8.3 8.5 8.4 9.0 9.2 9.0 -1.1 -0.6 -1.5 -0.4<br />

Apartment 9.2 9.4 9.0 7.3 7.7 7.3 8.0 8.4 7.9 2.4 2.3 2.2 2.4<br />

Hotel 11.6 11.8 11.6 9.3 9.1 9.3 9.9 10.0 9.9 0.2 1.3 0.5 1.4<br />

Average 10.1 10.2 10.0 8.4 8.5 8.3 9.1 9.2 8.9 -0.5 -0.1 -0.6 0.1<br />

1 First-tier investment properties are defined as new or newer quality construction in prime to good locations.<br />

Source: RERC Investment Survey.<br />

South<br />

Region<br />

U.S.<br />

National<br />

Value<br />

South<br />

Value<br />

National<br />

Rent<br />

West<br />

Rent<br />

South<br />

Rent<br />

WWW.RERC.COM 47