REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

- TAGS

- real

- estate

- redi-net.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WINTER 2011 | VOL 39 | NO 4<br />

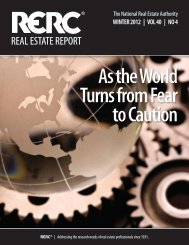

Consumer Confidence<br />

Index<br />

After decreasing slightly in December, consumer confidence rose 7.2 points to 60.6<br />

in January 2011. This is only the second time the index exceeded 60 since 2008.<br />

This improvement might have been caused by tax cuts and improving labor market<br />

conditions. While moods are looking up, there is evidence that consumers believe<br />

the recession has not ended.<br />

S&P 500<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

Dec-01<br />

May-02<br />

Oct-02<br />

Mar-03<br />

Aug-03<br />

Source: The Conference Board.<br />

Beginning of Month Adjusted Closing Price<br />

1600<br />

1500<br />

1400<br />

1300<br />

1200<br />

1100<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

Source: S&P.<br />

Dec-02<br />

Apr-03<br />

Aug-03<br />

Dec-03<br />

Apr-04<br />

Index of Leading Indicators<br />

Jan-04<br />

Jun-04<br />

Nov-04<br />

Apr-05<br />

Sep-05<br />

Feb-06<br />

Jul-06<br />

Dec-06<br />

May-07<br />

Oct-07<br />

Mar-08<br />

Aug-08<br />

Jan-09<br />

Jun-09<br />

Nov-09<br />

Apr-10<br />

Sep-10<br />

Jan-11<br />

Aug-04<br />

Dec-04<br />

Apr-05<br />

Aug-05<br />

Dec-05<br />

Apr-06<br />

Aug-06<br />

Dec-06<br />

Apr-07<br />

Aug-07<br />

Dec-07<br />

Apr-08<br />

Aug-08<br />

Dec-08<br />

Apr-09<br />

Aug-09<br />

Dec-09<br />

Apr-10<br />

Aug-10<br />

Dec-10<br />

The S&P 500 ended December 2010 at 1,257.64, up 0.07 percent from November.<br />

Overall, the S&P 500 was less volatile during fourth quarter as it gradually<br />

increased. Stocks in general are be<strong>com</strong>ing more popular, though they are still considered<br />

to be more risky than <strong>com</strong>mercial real estate.<br />

Percent Change Month Ago<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

-0.2<br />

-0.4<br />

Source: The Conference Board.<br />

Jan-10<br />

Feb-10<br />

Mar-10<br />

Apr-10<br />

May-10<br />

Jun-10<br />

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Nov-10<br />

Dec-10<br />

The Conference Board’s Index of Leading Indicators rose 1 percent in December<br />

2010, indicating that the pace of recovery should increase in 2011. Compared to<br />

a year ago, the index grew 5 percent, and is more broad-based than previously.<br />

Economic growth has accelerated in recent months, and consumer spending is<br />

expected to strengthen with help from reductions in payroll taxes.<br />

© 2011 <strong>REAL</strong> <strong>ESTATE</strong> RESEARCH CORPORATION. ALL RIGHTS RESERVED.<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

1600<br />

1500<br />

1400<br />

1300<br />

1200<br />

1100<br />

1000<br />

900<br />

800<br />

700<br />

600<br />

1.6<br />

1.4<br />

1.2<br />

1.0<br />

0.8<br />

0.6<br />

0.4<br />

0.2<br />

0.0<br />

-0.2<br />

-0.4<br />

Existing Home Sales<br />

RERC © <strong>REAL</strong> <strong>ESTATE</strong> <strong>REPORT</strong> - THE NATIONAL <strong>REAL</strong> <strong>ESTATE</strong> AUTHORITY<br />

Housing Affordability<br />

Index<br />

Source: NAR.<br />

190<br />

180<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

Oct-07<br />

Dec-07<br />

Feb-08<br />

Apr-08<br />

The National Association of <strong>REAL</strong>TORS® (NAR) Housing Affordability Index measures<br />

whether or not a typical family could qualify for a mortgage on a typical home.<br />

During fourth quarter 2010, the index increased until December, when it fell slightly<br />

to 185.3. However this still indicates that a typical family is more than able to afford<br />

a median-priced home.<br />

Millions<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

Single Family Home Supply<br />

Jun-08<br />

Aug-08<br />

Oct-08<br />

Dec-08<br />

Feb-09<br />

Apr-09<br />

Jun-09<br />

Aug-09<br />

Oct-09<br />

Dec-09<br />

Feb-10<br />

Apr-10<br />

Jun-10<br />

Aug-10<br />

Oct-10<br />

Dec-10<br />

Dec-01<br />

Mar-02<br />

Jul-02<br />

Nov-02<br />

Mar-03<br />

Jul-03<br />

Nov-03<br />

Mar-04<br />

Jul-04<br />

Nov-04<br />

Mar-05<br />

Jul-05<br />

Nov-05<br />

Mar-06<br />

Jul-06<br />

Nov-06<br />

Mar-07<br />

Jul-07<br />

Nov-07<br />

Mar-08<br />

Jul-08<br />

Nov-08<br />

Mar-09<br />

Jul-09<br />

Nov-09<br />

Mar-10<br />

Jul-10<br />

Dec-10<br />

Source: NAR.<br />

Existing home sales jumped 12.3 percent in December 2010, at an annualized rate<br />

of 5.28 million units. This is the strongest monthly gain since 1999. However, <strong>com</strong>pared<br />

to a year ago, sales are down 2.9 percent. Foreclosure processsing issues<br />

persist, threatening demand and creating uncertainty. Home prices are expected to<br />

decline further, before stabilizing in the second half of the year.<br />

Months<br />

13<br />

12<br />

11<br />

10<br />

Source: NAR.<br />

9<br />

8<br />

7<br />

6<br />

Nov-09<br />

Dec-09<br />

Jan-10<br />

Feb-10<br />

Mar-10<br />

Apr-10<br />

May-10<br />

Jun-10<br />

Jul-10<br />

Aug-10<br />

Sep-10<br />

Oct-10<br />

Nov-10<br />

Dec-10<br />

During fourth quarter, the monthly home supply continued to steadily decrease,<br />

with the December 2010 single-family home supply declining to 8.1 from the previous<br />

month. This remains considerably higher than the normal rate of around 6.0<br />

months, but demand for housing is expected to increase as job growth increases.<br />

190<br />

180<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

8.0<br />

7.0<br />

6.0<br />

5.0<br />

4.0<br />

3.0<br />

13<br />

12<br />

11<br />

10<br />

WWW.RERC.COM 17<br />

9<br />

8<br />

7<br />

6