REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

REAL ESTATE REPORT - REDI-net.com

- TAGS

- real

- estate

- redi-net.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

WINTER 2011 | VOL 39 | NO 4<br />

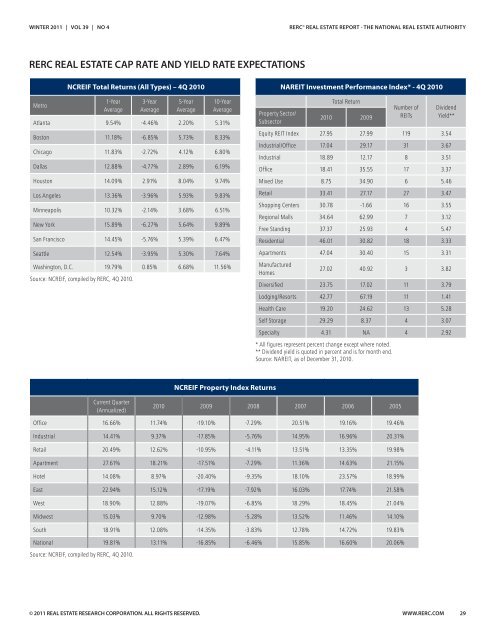

RERC <strong>REAL</strong> <strong>ESTATE</strong> CAP RATE AND YIELD RATE EXPECTATIONS<br />

Metro<br />

NCREIF Total Returns (All Types) – 4Q 2010<br />

1-Year<br />

Average<br />

3-Year<br />

Average<br />

5-Year<br />

Average<br />

© 2011 <strong>REAL</strong> <strong>ESTATE</strong> RESEARCH CORPORATION. ALL RIGHTS RESERVED.<br />

10-Year<br />

Average<br />

Atlanta 9.54% -4.46% 2.20% 5.31%<br />

Boston 11.18% -6.85% 5.73% 8.33%<br />

Chicago 11.83% -2.72% 4.12% 6.80%<br />

Dallas 12.88% -4.77% 2.89% 6.19%<br />

Houston 14.09% 2.91% 8.04% 9.74%<br />

Los Angeles 13.36% -3.96% 5.93% 9.83%<br />

Minneapolis 10.32% -2.14% 3.68% 6.51%<br />

New York 15.89% -6.27% 5.64% 9.89%<br />

San Francisco 14.45% -5.76% 5.39% 6.47%<br />

Seattle 12.54% -3.95% 5.30% 7.64%<br />

Washington, D.C. 19.79% 0.85% 6.68% 11.56%<br />

Source: NCREIF, <strong>com</strong>piled by RERC, 4Q 2010.<br />

Current Quarter<br />

(Annualized)<br />

Property Sector/<br />

Subsector<br />

RERC © <strong>REAL</strong> <strong>ESTATE</strong> <strong>REPORT</strong> - THE NATIONAL <strong>REAL</strong> <strong>ESTATE</strong> AUTHORITY<br />

NAREIT Investment Performance Index* - 4Q 2010<br />

Total Return<br />

2010 2009<br />

Number of<br />

REITs<br />

Dividend<br />

Yield**<br />

Equity REIT Index 27.95 27.99 119 3.54<br />

Industrial/Office 17.04 29.17 31 3.67<br />

Industrial 18.89 12.17 8 3.51<br />

Office 18.41 35.55 17 3.37<br />

Mixed Use 8.75 34.90 6 5.46<br />

Retail 33.41 27.17 27 3.47<br />

Shopping Centers 30.78 -1.66 16 3.55<br />

Regional Malls 34.64 62.99 7 3.12<br />

Free Standing 37.37 25.93 4 5.47<br />

Residential 46.01 30.82 18 3.33<br />

Apartments 47.04 30.40 15 3.31<br />

Manufactured<br />

Homes<br />

NCREIF Property Index Returns<br />

27.02 40.92 3 3.82<br />

Diversified 23.75 17.02 11 3.79<br />

Lodging/Resorts 42.77 67.19 11 1.41<br />

Health Care 19.20 24.62 13 5.28<br />

Self Storage 29.29 8.37 4 3.07<br />

Specialty 4.31 NA 4 2.92<br />

* All figures represent percent change except where noted.<br />

** Dividend yield is quoted in percent and is for month end.<br />

Source: NAREIT, as of December 31, 2010.<br />

2010 2009 2008 2007 2006 2005<br />

Office 16.66% 11.74% -19.10% -7.29% 20.51% 19.16% 19.46%<br />

Industrial 14.41% 9.37% -17.85% -5.76% 14.95% 16.96% 20.31%<br />

Retail 20.49% 12.62% -10.95% -4.11% 13.51% 13.35% 19.98%<br />

Apartment 27.61% 18.21% -17.51% -7.29% 11.36% 14.63% 21.15%<br />

Hotel 14.08% 8.97% -20.40% -9.35% 18.10% 23.57% 18.99%<br />

East 22.94% 15.12% -17.19% -7.92% 16.03% 17.74% 21.58%<br />

West 18.90% 12.88% -19.07% -6.85% 18.29% 18.45% 21.04%<br />

Midwest 15.03% 9.70% -12.98% -5.28% 13.52% 11.46% 14.10%<br />

South 18.91% 12.08% -14.35% -3.83% 12.78% 14.72% 19.83%<br />

National 19.81% 13.11% -16.85% -6.46% 15.85% 16.60% 20.06%<br />

Source: NCREIF, <strong>com</strong>piled by RERC, 4Q 2010.<br />

WWW.RERC.COM 29