- Page 1 and 2:

DARDEN CONSULTING CASE BOOK 2012- 2

- Page 3 and 4:

TABLE OF CONTENTS (CONT’D) 8. E-c

- Page 5 and 6:

STRUCTURE OF THE CASE INTERVIEW The

- Page 7 and 8:

STRUCTURE OF THE CASE INTERVIEW Str

- Page 9 and 10:

Frameworks FRAMEWORKS The most impo

- Page 11 and 12:

FRAMEWORKS Common Frameworks Bucket

- Page 13 and 14:

THE MATH So What? One of the most i

- Page 15 and 16:

ACCENTURE Firm Overview “Drawing

- Page 17 and 18:

BAIN AND COMPANY Firm Overview “B

- Page 19 and 20:

BOSTON CONSULTING GROUP Firm Overvi

- Page 21 and 22:

IBM GLOBAL BUSINESS SERVICES Firm O

- Page 23 and 24:

ZS ASSOCIATES Firm Overview A mid-s

- Page 25 and 26:

CASE 1: BIKE DVD RENTAL SERVICE IN

- Page 27 and 28:

BIKE DVD RENTAL SERVICE IN NYC Prof

- Page 29 and 30:

BIKE DVD RENTAL SERVICE IN NYC Calc

- Page 31 and 32:

CASE 2: DRYWALL COMPETITIVE THREAT

- Page 33 and 34:

DRYWALL COMPETITIVE THREAT Question

- Page 35 and 36:

DRYWALL COMPETITIVE THREAT Question

- Page 37 and 38:

DRYWALL COMPETITIVE THREAT Question

- Page 39 and 40:

DRYWALL COMPETITIVE THREAT Key Expe

- Page 41 and 42:

DRYWALL COMPETITIVE THREAT Exhibit

- Page 43 and 44:

ORGAN DONATION CASE Sample answer:

- Page 45 and 46:

ORGAN DONATION CASE Question 2: The

- Page 47 and 48:

ORGAN DONATION CASE Question 3: Wha

- Page 49 and 50:

ORGAN DONATION CASE Question 4: The

- Page 51 and 52:

ORGAN DONATION CASE Question 5: The

- Page 53 and 54:

ORGAN DONATION CASE Recommendation

- Page 55 and 56:

Exhibit 1 ORGAN DONATION CASE Cauca

- Page 57 and 58:

CENTRAL POWER Clarifying Questions

- Page 59 and 60:

CENTRAL POWER Note: Strong plans wi

- Page 61 and 62:

CENTRAL POWER Industrial Commercial

- Page 63 and 64:

Phase 2 CENTRAL POWER Generation of

- Page 65 and 66:

CENTRAL POWER Here are some ideas t

- Page 67 and 68:

CENTRAL POWER There are two other m

- Page 69 and 70:

CENTRAL POWER Questions to Further

- Page 71 and 72:

CASE 5: CHEMICALS, INC. Firm Style

- Page 73 and 74:

CHEMICALS, INC. Framework / Structu

- Page 75 and 76:

CHEMICALS, INC. Strong Plan Since s

- Page 77 and 78:

CHEMICALS, INC. Strong Recommendati

- Page 79 and 80:

CASE 6: HOSPITAL PROFITABILITY Case

- Page 81 and 82:

HOSPITAL PROFITABILITY Explore the

- Page 83 and 84:

HOSPITAL PROFITABILITY • Direct t

- Page 85 and 86:

Calculations Revenue Profit HOSPITA

- Page 87 and 88:

HOSPITAL PROFITABILITY Recommendati

- Page 89 and 90:

Exhibit 2 HOSPITAL PROFITABILITY

- Page 91 and 92:

CONTACT LENS MANUFACTURER GROWTH Fr

- Page 93 and 94:

CONTACT LENS MANUFACTURER GROWTH

- Page 95 and 96:

CONTACT LENS MANUFACTURER GROWTH Re

- Page 97 and 98:

Exhibit 2 CONTACT LENS MANUFACTURER

- Page 99 and 100:

Exhibit 4 CONTACT LENS MANUFACTURER

- Page 101 and 102:

Exhibit 6 CONTACT LENS MANUFACTURER

- Page 103 and 104:

Exhibit 8 CONTACT LENS MANUFACTURER

- Page 105 and 106:

E-COMMERCE IN AIRLINE INDUSTRY Clar

- Page 107 and 108:

E-COMMERCE IN AIRLINE INDUSTRY Fram

- Page 109 and 110:

E-COMMERCE IN AIRLINE INDUSTRY Calc

- Page 111 and 112:

E-COMMERCE IN AIRLINE INDUSTRY 2. C

- Page 113 and 114:

E-COMMERCE IN AIRLINE INDUSTRY Ques

- Page 115 and 116:

BIG GREEN BIOFUELS Clarifying Quest

- Page 117 and 118:

BIG GREEN BIOFUELS Strong Plan Incl

- Page 119 and 120:

BIG GREEN BIOFUELS Interviewer: Goo

- Page 121 and 122:

CASE 10: NEW RUBBER PLANT INVESTMEN

- Page 123 and 124:

NEW RUBBER PLANT INVESTMENT Structu

- Page 125 and 126:

NEW RUBBER PLANT INVESTMENT Incomin

- Page 127 and 128:

NEW RUBBER PLANT INVESTMENT Income

- Page 129 and 130:

NEW RUBBER PLANT INVESTMENT • Hig

- Page 131 and 132:

CASE 11: ASIAN MOBILE SERVICE PROVI

- Page 133 and 134:

ASIAN MOBILE SERVICE PROVIDER Inter

- Page 135 and 136:

CASE 12: RADIATOR FINS FOR DEFENSE

- Page 137 and 138: RADIATOR FINS FOR DEFENSE AIRCRAFT

- Page 139 and 140: RADIATOR FINS FOR DEFENSE AIRCRAFT

- Page 141 and 142: CAPITAL INVESTMENT FOR UTILITY Clar

- Page 143 and 144: CAPITAL INVESTMENT FOR UTILITY Fram

- Page 145 and 146: CAPITAL INVESTMENT FOR UTILITY Phas

- Page 147 and 148: CAPITAL INVESTMENT FOR UTILITY Stro

- Page 149 and 150: ELECTRIC CAR MANUFACTURER GROWTH Cl

- Page 151 and 152: ELECTRIC CAR MANUFACTURER GROWTH We

- Page 153 and 154: Question 5 ELECTRIC CAR MANUFACTURE

- Page 155 and 156: Framework / Structure MINER’S DIL

- Page 157 and 158: MINER’S DILEMMA Strong Plan The c

- Page 159 and 160: Recommendation MINER’S DILEMMA Th

- Page 161 and 162: BIG TRUCK COMPANY Framework / Struc

- Page 163 and 164: Calculations BIG TRUCK COMPANY Ques

- Page 165 and 166: Question 2 (cont’d): BIG TRUCK CO

- Page 167 and 168: Question 3 (cont’d): BIG TRUCK CO

- Page 169 and 170: Question 4 (cont’d): BIG TRUCK CO

- Page 171 and 172: THE BIG TRUCK COMPANY Question 5 (c

- Page 173 and 174: THE BIG TRUCK COMPANY Question 6 (c

- Page 175 and 176: THE BIG TRUCK COMPANY

- Page 177 and 178: Framework / Structure AUTO SPARE PA

- Page 179 and 180: AUTO SPARE PARTS Calculations Size

- Page 181 and 182: CASE 18: MACHINE COMPANY Firm Style

- Page 183 and 184: MACHINE COMPANY Framework / Structu

- Page 185 and 186: MACHINE COMPANY Recommendation My r

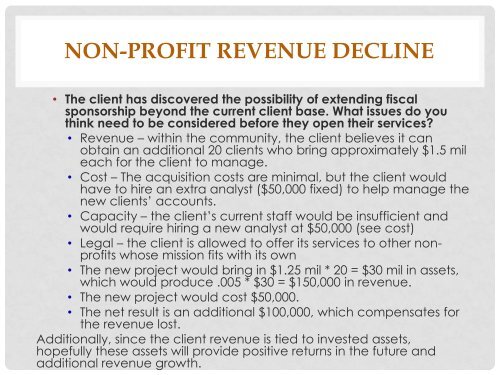

- Page 187: NON-PROFIT REVENUE DECLINE Framewor

- Page 191 and 192: CASE 20: GAS LIQUEFACTION Firm Styl

- Page 193 and 194: GAS LIQUEFACTION Recommendation •

- Page 195: ACKNOWLEDGEMENTS The following indi