CROIssANCE dURAbLE - Euronav.com

CROIssANCE dURAbLE - Euronav.com

CROIssANCE dURAbLE - Euronav.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

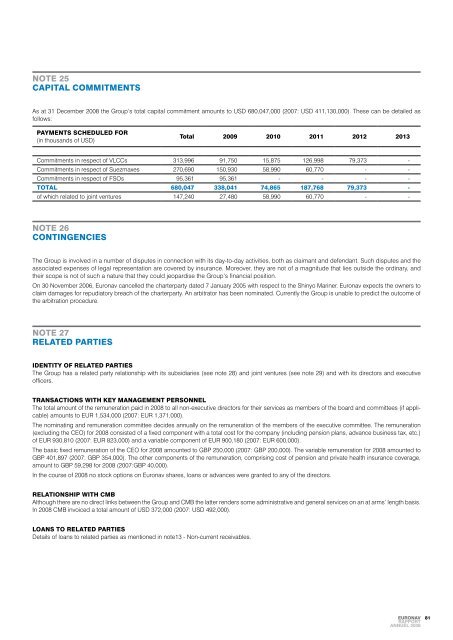

note 25<br />

capital <strong>com</strong>mitments<br />

As at 31 December 2008 the Group’s total capital <strong>com</strong>mitment amounts to USD 680,047,000 (2007: USD 411,130,000). These can be detailed as<br />

follows:<br />

payments scheduled for<br />

(in thousands of USD)<br />

total 2009 2010 2011 2012 2013<br />

Commitments in respect of VLCCs 313,996 91,750 15,875 126,998 79,373 -<br />

Commitments in respect of Suezmaxes 270,690 150,930 58,990 60,770 - -<br />

Commitments in respect of FSOs 95,361 95,361 - - - -<br />

total 680,047 338,041 74,865 187,768 79,373 -<br />

of which related to joint ventures 147,240 27,480 58,990 60,770 - -<br />

note 26<br />

contingencies<br />

The Group is involved in a number of disputes in connection with its day-to-day activities, both as claimant and defendant. Such disputes and the<br />

associated expenses of legal representation are covered by insurance. Moreover, they are not of a magnitude that lies outside the ordinary, and<br />

their scope is not of such a nature that they could jeopardise the Group’s financial position.<br />

On 30 November 2006, <strong>Euronav</strong> cancelled the charterparty dated 7 January 2005 with respect to the Shinyo Mariner. <strong>Euronav</strong> expects the owners to<br />

claim damages for repudiatory breach of the charterparty. An arbitrator has been nominated. Currently the Group is unable to predict the out<strong>com</strong>e of<br />

the arbitration procedure.<br />

note 27<br />

related parties<br />

identity of related parties<br />

The Group has a related party relationship with its subsidiaries (see note 28) and joint ventures (see note 29) and with its directors and executive<br />

officers.<br />

transactions with key management personnel<br />

The total amount of the remuneration paid in 2008 to all non-executive directors for their services as members of the board and <strong>com</strong>mittees (if applicable)<br />

amounts to EUR 1,534,000 (2007: EUR 1,371,000).<br />

The nominating and remuneration <strong>com</strong>mittee decides annually on the remuneration of the members of the executive <strong>com</strong>mittee. The remuneration<br />

(excluding the CEO) for 2008 consisted of a fixed <strong>com</strong>ponent with a total cost for the <strong>com</strong>pany (including pension plans, advance business tax, etc.)<br />

of EUR 930,810 (2007: EUR 823,000) and a variable <strong>com</strong>ponent of EUR 900,180 (2007: EUR 600,000).<br />

The basic fixed remuneration of the CEO for 2008 amounted to GBP 250,000 (2007: GBP 200,000). The variable remuneration for 2008 amounted to<br />

GBP 401,897 (2007: GBP 354,000). The other <strong>com</strong>ponents of the remuneration, <strong>com</strong>prising cost of pension and private health insurance coverage,<br />

amount to GBP 59,298 for 2008 (2007:GBP 40,000).<br />

In the course of 2008 no stock options on <strong>Euronav</strong> shares, loans or advances were granted to any of the directors.<br />

relationship with cmb<br />

Although there are no direct links between the Group and CMB the latter renders some administrative and general services on an at arms’ length basis.<br />

In 2008 CMB invoiced a total amount of USD 372,000 (2007: USD 492,000).<br />

loans to related parties<br />

Details of loans to related parties as mentioned in note13 - Non-current receivables.<br />

euronav<br />

rapport<br />

annuel 2008<br />

81