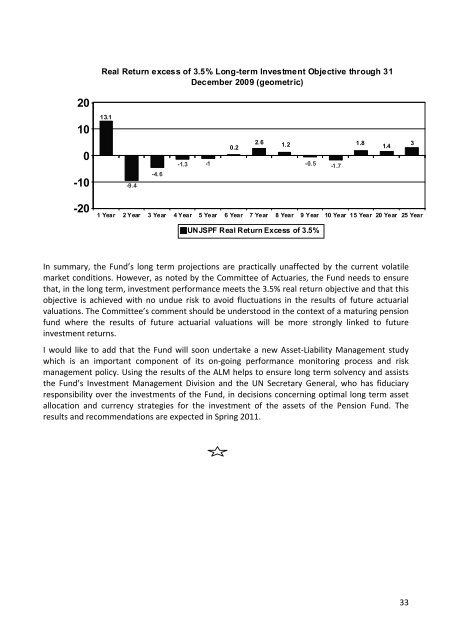

Real Return excess of 3.5% Long-term Investment Objective through 31December 2009 (geometric)201013.10-10-9.4-4.6-1.3 -10.22.6 1.2-0.5 -1.71.81.43-201 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Year 15 Year 20 Year 25 YearUNJSPF Real Return Excess of 3.5%In summary, the Fund’s long term projections are practically unaffected by the current volatilemarket conditions. However, as noted by the Committee of Actuaries, the Fund needs to ensurethat, in the long term, investment performance meets the 3.5% real return objective and that thisobjective is achieved with no undue risk to avoid fluctuations in the results of future actuarialvaluations. The Committee’s comment should be understood in the context of a maturing pensionfund where the results of future actuarial valuations will be more strongly linked to futureinvestment returns.I would like to add that the Fund will soon undertake a new Asset-Liability Management studywhich is an important component of its on-going performance monitoring process and riskmanagement policy. Using the results of the ALM helps to ensure long term solvency and assiststhe Fund’s Investment Management Division and the UN Secretary General, who has fiduciaryresponsibility over the investments of the Fund, in decisions concerning optimal long term assetallocation and currency strategies for the investment of the assets of the Pension Fund. Theresults and recommendations are expected in Spring <strong>2011</strong>.33

SPIRIT OF GENEVAIn his article “Celebrating <strong>70</strong> years of <strong>AAFI</strong>-<strong>AFICS</strong>” our friend Aamir Ali refers to the triumph of theEsprit de Genève in the spirit of conciliation and constructive compromise that paved the relationsbetween <strong>AAFI</strong>-<strong>AFICS</strong> and the associations of former officials of ILO, WHO and other UN agencies.In an article published in the HCR Refugee Survey Quarterly (2007, Vol 26, Issue 4) Prof P.H.Dembinski and the journalist M. Farroh, attribute the term “Spirit of <strong>Geneva</strong>” to the Swiss writerRobert de Traz who published a book under this title in 1929, after the First World War and thecreation in 1919 of the League of Nations (and the ILO), which had at the time raised both faithand hope such as few organizations have enjoyed since.Based in <strong>Geneva</strong>, thanks to President Woodrow Wilson, the League of Nations symbolized the alasutopian hope of putting an end to all wars by subjecting international relations to a set of juridicalregulations that would limit, if not abolish, the need to resort to violence between sovereignstates : a new religion for peace by Law. Support for the League of Nations was at its strongest inGreat Britain and in France the movement was acclaimed by a political and intellectual elite,amongst whom Aristide Briand and René Cassin.For de Traz, the spirit of <strong>Geneva</strong> was inspired by both a democratic and a prophetic legitimacyfirmly rooted in a universal moral law based on a Christian aspiration for universality and aProtestant individualization of morality.The spirit of <strong>Geneva</strong> is now almost forgotten but international <strong>Geneva</strong>, seat of the United NationsOffice at <strong>Geneva</strong>, the International Red Cross and many specialized agencies, has become theworld capital of soft governance, i.e. international cooperation in social, economic and moreespecially humanitarian action, with the support of the NGOs, in contrast to the hard politics ofthe UN Headquarters in New York. We have progressed from the pacifist utopia of 1920 to 1930 toa more realistic conception of the potentials and limits of internationalism.An association named the “Esprit de Genève” was set up in 2004 to give a fresh impulse to theimage of <strong>Geneva</strong> and relations between civil society and the state. The association groupsmembers from economic, associative, political and administrative circles.Also set up in 2004 but with no relation to the former, is a group of <strong>Geneva</strong> wine growers whoproduce a red wine baptized “L’Esprit de Genève” intended to embody open-mindedness,spirituality, humanism, diversity, innovation and quality.Yves BEIGBEDER34