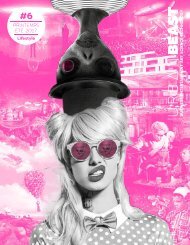

Magazine BEAST #4 2016

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

8<br />

#Business | PrivateBanking<br />

THE RISE<br />

OF DIGITAL<br />

PRIVATE<br />

BANKING<br />

OR THE BEST<br />

WAY TO<br />

EMPOWER<br />

CUSTOMERS<br />

BY ALEXANDRE KEILMANN<br />

Banks have been using computers and therefore<br />

ICT services for ages, notably to register<br />

transactions. If during the last five years,<br />

technology has been revolutionizing retail<br />

banking through the use of new communication<br />

channels, but also allowing clients to pay without<br />

any contact, FinTech has not yet completely<br />

transformed the Private Banking and Wealth<br />

Management branches of financial services,<br />

where human relationship still plays a big part.<br />

But more and more opportunities are emerging,<br />

and private banks all over the world are diving<br />

right into it… for the benefits of their clients.<br />

Answering the new generations’ needs<br />

Nowadays, people are increasingly using digital<br />

channels to contact their banks and purchase financial<br />

products. In Asia Pacific, one of the fastest growing<br />

regions for consumer adoption of digital financial<br />

services solutions, 82% of high-net worth individuals<br />

expect, according to a 2014 Capgemini study, their<br />

wealth management relationship to be conducted<br />

entirely or mostly through digital channels. Also, for<br />

38% of HNWIs in Asia, digital contact with their wealth<br />

manager is more important than direct contact. These<br />

figures actually bring down the myth that many still<br />

believe in: «private banking clients prefer and expect<br />

face-to-face interaction».<br />

Today, more than 70% of HNWIs use social media websites such<br />

as Facebook: communication and interaction though these new<br />

media channels have therefore become crucial when it comes<br />

to developing a lasting trust relation with clients. «Private banks<br />

need to be aware of the fact that the new generation was raised<br />

with technology. Therefore, technology will eventually replace<br />

schmoozing» according to Serge Krancenblum, President of LAFO<br />

(Luxembourg Family Office Association).<br />

Moreover, digital significantly helps with client knowledge and<br />

private banks are notably starting to segment client by life stages,<br />

rather than current assets. As a matter of fact, the needs and<br />

expectations of young entrepreneurs are quintessentially different<br />

from the ones of seniors and retirees. Intimate knowledge actually<br />

provides a new value to private banking, and a customer centric<br />

approach is therefore essential.<br />

More autonomy on the one hand…<br />

Clients are in the driving seat. To answers their new needs, Credit<br />

Suisse Private Banking Asia Pacific launched an app in March 2015,<br />

which allows clients to receive personalized intelligence depending<br />

on their portfolios, and have access to tools to analyze their risk<br />

exposure and even trading tools. Actually, it can be considered as<br />

a new private banking service delivery model, putting emphasis<br />

on mobile: ATAWAD. Benjamin Collette, Deloitte EMEA Wealth<br />

Management and Private Banking Co-Leader can only agree:<br />

«Players should take digital maturity and client perception of<br />

personal relationships into account when going forward with their<br />

business models. A new generation is emerging that places a high<br />

importance on web platforms and accessing information from<br />

wherever they are located at any time of the day».<br />

With online channels now being one of the most important sources<br />

for investment decisions, customers, especially in Asia and the<br />

US, are increasingly willing to make decisions themselves. Europe<br />

is still a bit behind, relying a bit more on their asset managers<br />

and private bankers…a change that might actually be more cultural<br />

than anything else, but things are moving exponentially in this<br />

direction. Digital apps such as the one developed by Credit Suisse<br />

Private Banking give the clients more flexibility and grant them a<br />

decision-making feeling through one single click or tap. In Europe,<br />

BNP Paribas Wealth Management has been recognized many times<br />

for its digital network app «Next Generation Program <strong>2016</strong>», which<br />

aims at sharing expertise and developing knowledge of finance<br />

and wealth management online, but also through workshops,<br />

therefore combining digital and physical encounters. «BNP Paribas<br />

is determined to respond to the specific needs of its clients in<br />

innovative ways» underlined BNP Paribas Wealth Management Co-<br />

CEO Sofia Merlo.<br />

Just like a diversified portfolio, customers now expect multiple<br />

channels not only to communicate with their private banker, but<br />

also to be their own actor when it comes to market opportunities.<br />

Les entrepreneurs doivent savoir bien<br />

s’entourer. Si mon entreprise se développe tant<br />

aujourd’hui, c’est aussi parce que ma banque<br />

croit en mon projet.<br />

ING m’accompagne,<br />

mon coeur me guide.<br />

ING Luxembourg SA, 52 route d’Esch, L-2965 Luxembourg - R.C.S. Luxembourg B.6041 - TVA LU 11082217 - ing.lu<br />

<strong>BEAST</strong> MAGAZINE <strong>#4</strong><br />

Tous les projets méritent d’être réalisés.<br />

Rendez-vous sur followyourheart.lu<br />

Follow your heart