You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Markedsrapport</strong> – <strong>Juni</strong> <strong>2013</strong> Side 22<br />

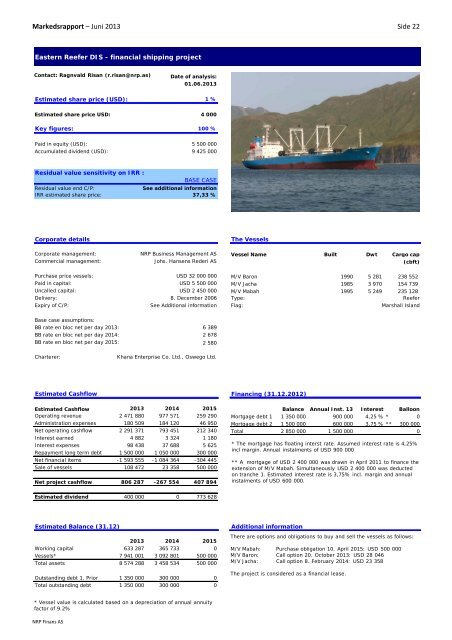

Eastern Reefer DIS - financial shipping project<br />

Contact: Ragnvald Risan (r.risan@nrp.as)<br />

Date of analysis:<br />

01.06.<strong>2013</strong><br />

Estimated share price (USD): 1 %<br />

Estimated share price USD: 4 000<br />

Key figures: 100 %<br />

Paid in equity (USD): 5 500 000<br />

Accumulated dividend (USD): 9 425 000<br />

Residual value sensitivity on IRR :<br />

B<strong>AS</strong>E C<strong>AS</strong>E<br />

Residual value end C/P:<br />

See additional information<br />

IRR estimated share price: 37,33 %<br />

Corporate details<br />

The Vessels<br />

Corporate management: <strong>NRP</strong> Business Management <strong>AS</strong> Vessel Name Built Dwt Cargo cap<br />

Commercial management: Johs. Hansens Rederi <strong>AS</strong> (cbft)<br />

Purchase price vessels: USD 32 000 000 M/V Baron 1990 5 281 238 552<br />

Paid in capital: USD 5 500 000 M/V Jacha 1985 3 970 154 739<br />

Uncalled capital: USD 2 450 000 M/V Mabah 1995 5 249 235 128<br />

Delivery: 8. December 2006 Type: Reefer<br />

Expiry of C/P: See Additional information Flag: Marshall Island<br />

Base case assumptions:<br />

BB rate en bloc net per day <strong>2013</strong>: 6 389<br />

BB rate en bloc net per day 2014: 2 678<br />

BB rate en bloc net per day 2015: 2 580<br />

Charterer:<br />

Khana Enterprise Co. Ltd., Oswego Ltd.<br />

Estimated Cashflow Financing (31.12.2012)<br />

Estimated Cashflow <strong>2013</strong> 2014 2015 Balance Annual Inst. 13 Interest Balloon<br />

Operating revenue 2 471 880 977 571 259 290 Mortgage debt 1 1 350 000 900 000 4,25 % * 0<br />

Administration expenses 180 509 184 120 46 950 Mortgage debt 2 1 500 000 600 000 3,75 % ** 300 000<br />

Net operating cashflow 2 291 371 793 451 212 340 Total 2 850 000 1 500 000 0<br />

Interest earned 4 882 3 324 1 180<br />

Interest expenses 98 438 37 688 5 625<br />

Repayment long term debt 1 500 000 1 050 000 300 000<br />

Net financial items -1 593 555 -1 084 364 -304 445<br />

Sale of vessels 108 472 23 358 500 000<br />

Net project cashflow 806 287 -267 554 407 894<br />

* The mortgage has floating interst rate. Assumed interest rate is 4,25%<br />

incl margin. Annual instalments of USD 900 000<br />

** A mortgage of USD 2 400 000 was drawn in April 2011 to finance the<br />

extension of M/V Mabah. Simultaneously USD 2 400 000 was deducted<br />

on tranche 1. Estimated interest rate is 3,75% incl. margin and annual<br />

instalments of USD 600 000.<br />

Estimated dividend 400 000 0 773 628<br />

Estimated Balance (31.12)<br />

<strong>2013</strong> 2014 2015<br />

Working capital 633 287 365 733 0<br />

Vessels* 7 941 001 3 092 801 500 000<br />

Total assets 8 574 288 3 458 534 500 000<br />

Outstanding debt 1. Prior 1 350 000 300 000 0<br />

Total outstanding debt 1 350 000 300 000 0<br />

Additional information<br />

There are options and obligations to buy and sell the vessels as follows:<br />

M/V Mabah: Purchase obligation 10. April 2015: USD 500 000<br />

M/V Baron: Call option 20. October <strong>2013</strong>: USD 28 046<br />

M/V Jacha: Call option 8. February 2014: USD 23 358<br />

The project is considered as a financial lease.<br />

* Vessel value is calculated based on a depreciation of annual annuity<br />

factor of 9.2%<br />

<strong>NRP</strong> Finans <strong>AS</strong>