Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Markedsrapport</strong> – <strong>Juni</strong> <strong>2013</strong> Side 30<br />

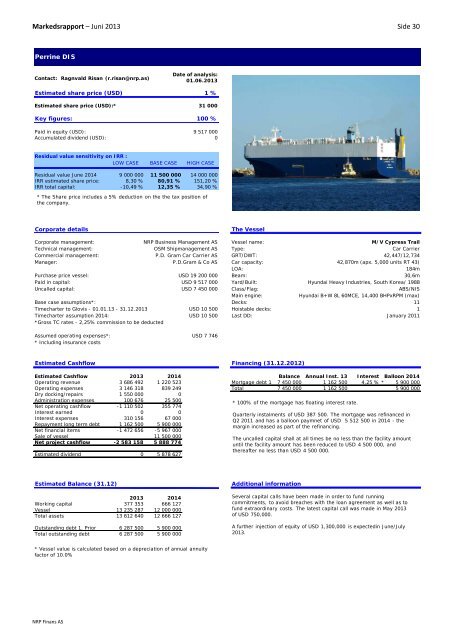

Perrine DIS<br />

Contact: Ragnvald Risan (r.risan@nrp.as)<br />

Date of analysis:<br />

01.06.<strong>2013</strong><br />

Estimated share price (USD) 1 %<br />

Estimated share price (USD):* 31 000<br />

Key figures: 100 %<br />

Paid in equity (USD): 9 517 000<br />

Accumulated dividend (USD): 0<br />

Residual value sensitivity on IRR :<br />

LOW C<strong>AS</strong>E B<strong>AS</strong>E C<strong>AS</strong>E HIGH C<strong>AS</strong>E<br />

Residual value June 2014 9 000 000 11 500 000 14 000 000<br />

IRR estimated share price: 8,30 % 80,91 % 151,20 %<br />

IRR total capital: -10,49 % 12,35 % 34,90 %<br />

* The Share price includes a 5% deduction on the the tax position of<br />

the company.<br />

Corporate details<br />

The Vessel<br />

Corporate management: <strong>NRP</strong> Business Management <strong>AS</strong> Vessel name: M/V Cypress Trail<br />

Technical management: OSM Shipmanagement <strong>AS</strong> Type: Car Carrier<br />

Commercial management: P.D. Gram Car Carrier <strong>AS</strong> GRT/DWT: 42,447/12,734<br />

Manager: P.D.Gram & Co <strong>AS</strong> Car capacity: 42,870m (apx. 5,000 units RT 43)<br />

LOA:<br />

184m<br />

Purchase price vessel: USD 19 200 000 Beam: 30,6m<br />

Paid in capital: USD 9 517 000 Yard/Built: Hyundai Heavy Industries, South Korea/ 1988<br />

Uncalled capital: USD 7 450 000 Class/Flag: ABS/NIS<br />

Main engine:<br />

Hyundai B+W 8L 60MCE, 14,400 BHPxRPM (max)<br />

Base case assumptions*: Decks: 11<br />

Timecharter to Glovis - 01.01.13 - 31.12.<strong>2013</strong> USD 10 500 Hoistable decks: 1<br />

Timecharter assumption 2014: USD 10 500 Last DD: January 2011<br />

*Gross TC rates - 2,25% commission to be deducted<br />

Assumed operating expenses*: USD 7 746<br />

* Including insurance costs<br />

Estimated Cashflow Financing (31.12.2012)<br />

Estimated Cashflow <strong>2013</strong> 2014 Balance Annual Inst. 13 Interest Balloon 2014<br />

Operating revenue 3 686 492 1 220 523 Mortgage debt 1 7 450 000 1 162 500 4,25 % * 5 900 000<br />

Operating expenses 3 146 318 839 249 Total 7 450 000 1 162 500 5 900 000<br />

Dry docking/repairs 1 550 000 0<br />

Administration expenses 100 676 25 500<br />

Net operating cashflow -1 110 502 355 774<br />

Interest earned 0 0<br />

Interest expenses 310 156 67 000<br />

Repayment long term debt 1 162 500 5 900 000<br />

Net financial items -1 472 656 -5 967 000<br />

Sale of vessel 11 500 000<br />

Net project cashflow -2 583 158 5 888 774<br />

Estimated dividend 0 5 878 627<br />

* 100% of the mortgage has floating interest rate.<br />

Quarterly instalments of USD 387 500. The mortgage was refinanced in<br />

Q2 2011 and has a balloon paymnet of USD 5 512 500 in 2014 - the<br />

margin increased as part of the refinancing.<br />

The uncalled capital shall at all times be no less than the facility amount<br />

until the facility amount has been reduced to USD 4 500 000, and<br />

thereafter no less than USD 4 500 000.<br />

Estimated Balance (31.12)<br />

<strong>2013</strong> 2014<br />

Working capital 377 353 666 127<br />

Vessel 13 235 287 12 000 000<br />

Total assets 13 612 640 12 666 127<br />

Outstanding debt 1. Prior 6 287 500 5 900 000<br />

Total outstanding debt 6 287 500 5 900 000<br />

Net asset value pre dividen #REF! 12 483 954<br />

* Vessel value is calculated based on a depreciation of annual annuity<br />

factor of 10.0%<br />

Additional information<br />

Several capital calls have been made in order to fund running<br />

commitments, to avoid breaches with the loan agreement as well as to<br />

fund extraordinary costs. The latest capital call was made in May <strong>2013</strong><br />

of USD 750,000.<br />

A further injection of equity of USD 1,300,000 is expectedin June/July<br />

<strong>2013</strong>.<br />

<strong>NRP</strong> Finans <strong>AS</strong>